Centum Electronics Faces Technical Trend Shifts Amid Market Volatility and Performance Variability

2025-03-25 08:01:05Centum Electronics, a small-cap player in the electronics components industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock, which is currently priced at 1,636.00, has shown notable fluctuations, with a 52-week high of 2,400.00 and a low of 1,140.15. Today's trading saw a high of 1,702.70 and a low of 1,471.05, indicating a volatile market environment. In terms of technical indicators, the MACD and KST suggest a bearish sentiment on both weekly and monthly scales, while the Bollinger Bands and moving averages also reflect a mildly bearish outlook. The Dow Theory presents a contrasting view with a mildly bullish signal on the weekly chart, although it aligns with a mildly bearish stance on the monthly chart. When examining the company's performance against the Sensex, Centum Electronics has demonstrated significant returns over various periods. Over the pa...

Read More

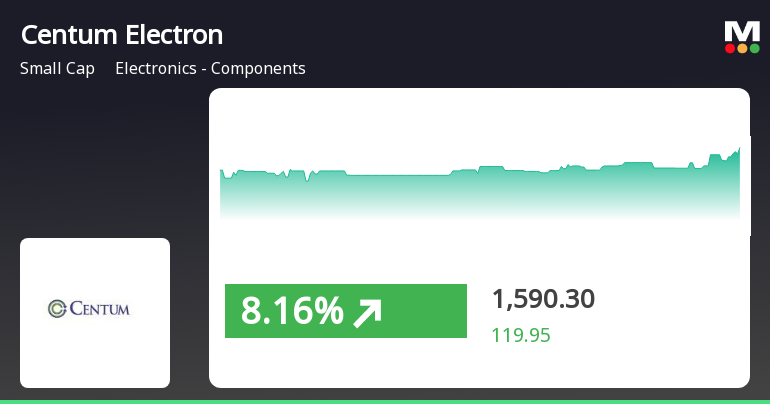

Centum Electronics Shows Strong Short-Term Gains Amid Mixed Long-Term Trends

2025-03-24 13:30:17Centum Electronics experienced notable trading activity on March 24, 2025, outperforming the broader market. The stock reached an intraday high and has shown a positive trend over the past two days. Despite recent gains, its year-to-date performance remains down, while longer-term results are strong.

Read More

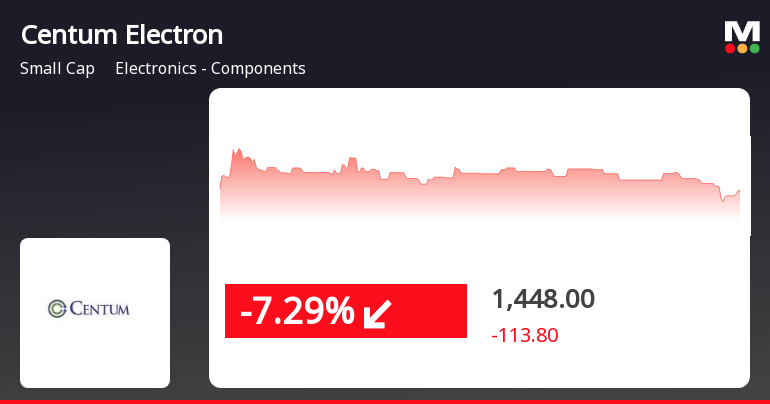

Centum Electronics Faces Significant Decline Amid Mixed Market Signals and Sector Gains

2025-03-19 13:45:48Centum Electronics has faced a notable decline today, following two days of gains. The stock opened lower and reached an intraday low, indicating potential trend reversal. While the broader electronics sector has performed well, Centum's longer-term performance shows significant declines over the past three months and year-to-date.

Read More

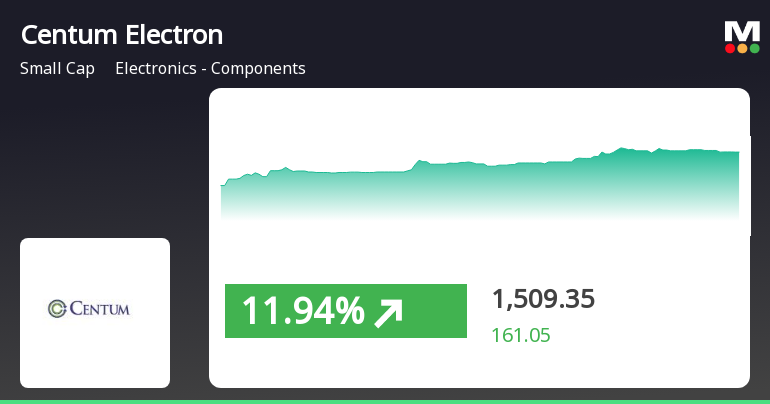

Centum Electronics Shows Strong Short-Term Gains Amid Broader Market Uptrend

2025-03-18 10:15:16Centum Electronics has experienced notable gains, outperforming its sector and achieving a total return of 11.37% over two days. The stock is currently above its short-term moving averages but below longer-term ones. Despite recent challenges, it has shown significant growth over the past five years.

Read More

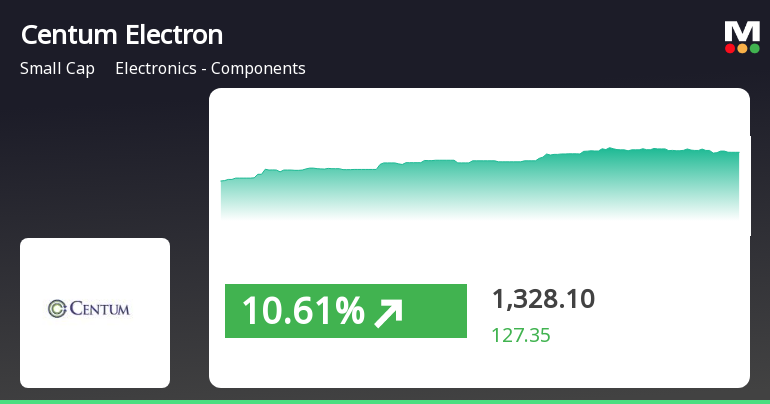

Centum Electronics Outperforms Sector Amid Broader Market Decline and Volatility

2025-03-11 10:15:19Centum Electronics experienced notable trading activity, achieving a significant gain today and outperforming the broader sector. The stock reached an intraday high after initially opening lower, while its moving averages indicate mixed positioning. Meanwhile, the broader market, represented by the Sensex, is showing a bearish trend.

Read MoreCentum Electronics Faces Technical Trend Challenges Amid Market Volatility

2025-03-07 08:01:08Centum Electronics, a small-cap player in the electronics components industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1,240.00, showing a notable fluctuation with a previous close of 1,189.10. Over the past week, the stock has experienced a high of 1,284.95 and a low of 1,205.00, indicating volatility in its trading activity. In terms of technical indicators, the weekly MACD and KST are both signaling bearish trends, while the monthly indicators show a mildly bearish stance. The moving averages also reflect a bearish sentiment, contributing to the overall technical summary. The Bollinger Bands and On-Balance Volume (OBV) metrics further support this assessment, with both weekly and monthly readings indicating a mildly bearish outlook. When comparing Centum Electronics' performance to the Sensex, the stock has faced significant...

Read MoreCentum Electronics Faces Ongoing Challenges Despite Recent Stock Uptick

2025-03-06 18:00:48Centum Electronics, a small-cap player in the Electronics - Components industry, has shown notable activity today, with its stock rising by 4.28%. This uptick comes amid a challenging performance landscape, as the company has experienced a significant decline of 31.86% over the past year, contrasting sharply with the Sensex's modest gain of 0.34% during the same period. Despite today's positive movement, Centum Electronics has faced headwinds in recent weeks, with a 1.23% drop over the last week and a staggering 41.53% decline year-to-date. The company's market capitalization stands at Rs 1,554.00 crore, and it currently has a price-to-earnings ratio of -259.61, which is notably lower than the industry average of 64.43. In terms of technical indicators, the stock is showing bearish trends across various time frames, including MACD and moving averages. The overall performance metrics indicate a challenging...

Read MoreCentum Electronics Opens Strong with 8.06% Gain Amidst Market Volatility

2025-03-06 09:40:11Centum Electronics, a small-cap player in the electronics components industry, has shown significant activity today, opening with a notable gain of 8.06%. The stock's performance has outpaced its sector by 1.06%, marking a positive trend over the past three days with a cumulative return of 5.82%. Today, Centum Electronics reached an intraday high of Rs 1284.95, reflecting high volatility with an intraday fluctuation of 5.04%. Despite this day's gains, the stock has faced challenges over the past month, declining by 33.66%, compared to a 5.62% drop in the Sensex. In terms of technical indicators, the stock's moving averages are currently higher than the 5-day average but fall below the 20-day, 50-day, 100-day, and 200-day averages. The MACD and RSI indicators suggest a bearish trend on a weekly basis, while the daily moving averages indicate a mildly bullish sentiment. With a beta of 1.35, Centum Electron...

Read More

Centum Electronics Hits 52-Week Low Amid Ongoing Small-Cap Struggles and High Debt Concerns

2025-03-04 09:43:33Centum Electronics has reached a new 52-week low, reflecting a significant year-over-year decline. The stock is trading below multiple moving averages, indicating a bearish trend. Financial concerns include a high debt-to-EBITDA ratio and disappointing quarterly results, highlighting ongoing challenges in the small-cap segment.

Read MoreClosure of Trading Window

25-Mar-2025 | Source : BSEClosure of Trading Window

Intimation Under Regulation 30 Of The Securities And Exchange Board Of India (Listing Obligations And Disclosure Requirements) Regulations 2015

19-Mar-2025 | Source : BSEPlease refer enclosed

Disclosures under Reg. 29(1) of SEBI (SAST) Regulations 2011

17-Mar-2025 | Source : BSEThe Exchange has received the disclosure under Regulation 29(1) of SEBI (Substantial Acquisition of Shares & Takeovers) Regulations 2011 for 3P India Equity Fund

Corporate Actions

No Upcoming Board Meetings

Centum Electronics Ltd has declared 30% dividend, ex-date: 31 Jul 24

No Splits history available

No Bonus history available

No Rights history available