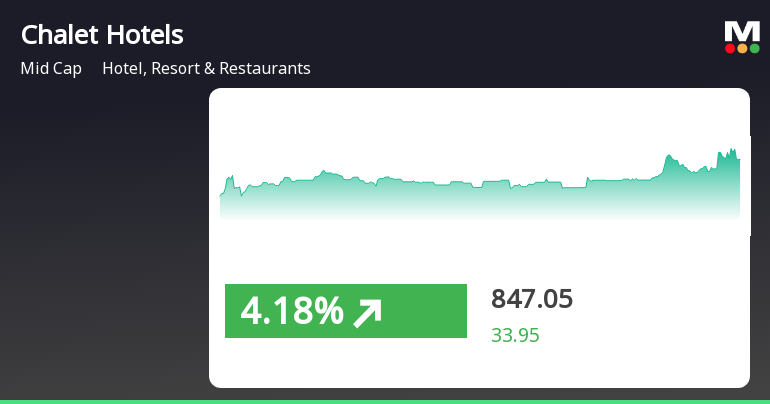

Chalet Hotels Shows Resilience Amid Broader Market Turbulence and Declining Sensex

2025-04-01 15:35:28Chalet Hotels experienced notable trading activity, outperforming its sector amid broader market declines. The stock is currently above key moving averages, indicating a positive short-term trend. Over the past month, it has shown resilience, while its three-year performance significantly surpasses that of the Sensex.

Read More

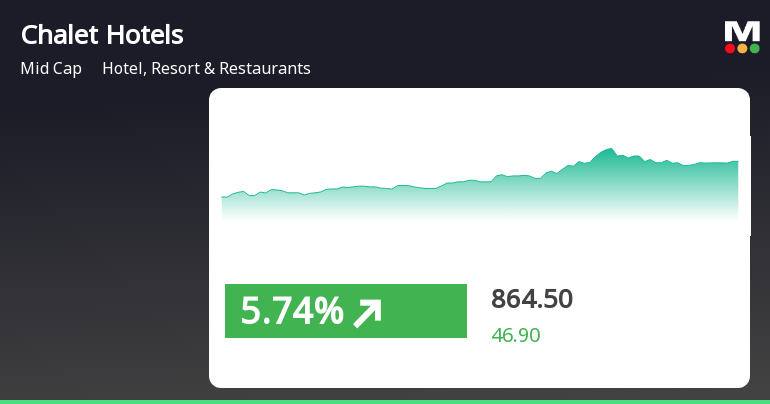

Chalet Hotels Shows Strong Performance Amid Broader Market Gains and Trends

2025-03-24 10:35:26Chalet Hotels has shown impressive performance, gaining 6.55% on March 24, 2025, and outperforming its sector significantly. The stock has risen consistently over four days, achieving a total return of 13.34%. It is currently trading above key moving averages, highlighting its strong market position.

Read MoreChalet Hotels Faces Mixed Technical Trends Amidst Strong Long-Term Performance

2025-03-18 08:04:23Chalet Hotels, a midcap player in the Hotel, Resort & Restaurants industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 770.00, showing a slight increase from the previous close of 762.30. Over the past year, Chalet Hotels has experienced a stock return of 4.88%, outperforming the Sensex, which recorded a return of 2.10% in the same period. In terms of technical indicators, the MACD shows a bearish trend on a weekly basis, while the monthly perspective leans towards a mildly bearish stance. The Relative Strength Index (RSI) indicates bullish momentum weekly, but no significant signal on a monthly basis. Bollinger Bands reflect a mildly bearish trend weekly, with a sideways movement monthly. Moving averages indicate a bearish trend on a daily basis, while the KST shows a bearish trend weekly and mildly bearish monthly. Chalet Hotels...

Read MoreChalet Hotels Faces Technical Trend Shifts Amid Mixed Market Signals

2025-03-12 08:03:18Chalet Hotels, a midcap player in the Hotel, Resort & Restaurants industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 770.10, down from a previous close of 792.95, with a 52-week high of 1,051.15 and a low of 643.65. Today's trading saw a high of 791.65 and a low of 758.20. The technical summary indicates a bearish sentiment in various indicators, including the MACD and Bollinger Bands on a weekly basis. The moving averages also reflect a bearish trend, while the KST shows a mildly bearish outlook on a monthly basis. Notably, the Dow Theory presents a mildly bullish signal on a weekly basis, suggesting some mixed signals in the short term. In terms of performance, Chalet Hotels has shown resilience compared to the Sensex. Over the past week, the stock returned 3.52%, outperforming the Sensex's 1.52%. In the last month, it achieve...

Read MoreChalet Hotels Faces Mixed Technical Trends Amidst Market Evaluation Revision

2025-03-06 08:02:59Chalet Hotels, a midcap player in the Hotel, Resort & Restaurants industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 769.40, showing a notable increase from the previous close of 743.95. Over the past year, Chalet Hotels has experienced a stock return of -3.34%, contrasting with a slight gain of 0.07% in the Sensex during the same period. In terms of technical indicators, the weekly MACD remains bearish, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) indicates a bullish trend on a weekly basis, but shows no signal for the monthly period. Bollinger Bands suggest a mildly bearish trend weekly, with a sideways movement monthly. Daily moving averages are bearish, and the KST reflects a bearish stance weekly, transitioning to mildly bearish monthly. Chalet Hotels has shown resilience over longer period...

Read More

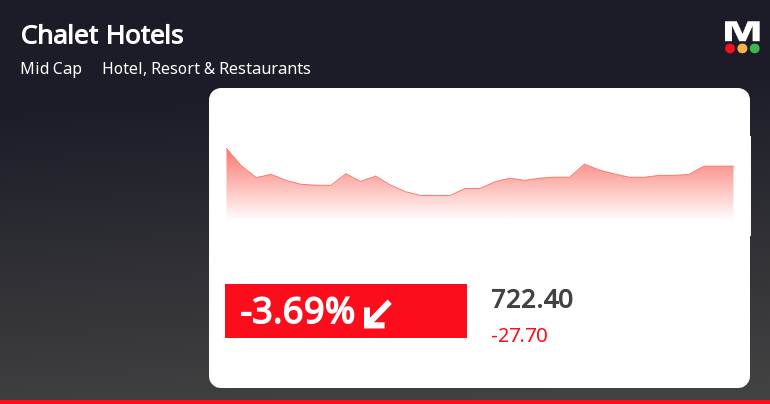

Chalet Hotels Faces Significant Market Challenges Amid Declining Share Performance

2025-03-03 09:35:27Chalet Hotels has faced a significant decline in its stock performance, dropping notably today and underperforming against its sector. The stock is currently trading below key moving averages, indicating a bearish trend. Over the past month, it has experienced a substantial decrease compared to the broader market.

Read MoreChalet Hotels Faces Short-Term Challenges Amidst Broader Market Trends and Historical Gains

2025-02-24 10:44:42Chalet Hotels, a mid-cap player in the Hotel, Resort & Restaurants industry, has experienced notable stock activity today, reflecting broader market trends. The company's market capitalization stands at Rs 15,384.72 crore, with a price-to-earnings (P/E) ratio of 154.28, significantly higher than the industry average of 68.06. Over the past year, Chalet Hotels has seen a decline of 18.40%, contrasting with the Sensex's modest gain of 1.92%. In today's trading, the stock has dipped by 1.94%, while the Sensex has decreased by 1.02%. Despite this, Chalet Hotels has shown resilience over the past week, gaining 3.76%, compared to a 1.91% drop in the Sensex. However, the longer-term performance indicates challenges, with a year-to-date decline of 28.27% against the Sensex's 4.60% drop. In contrast, the stock has performed well over three and five years, with gains of 186.63% and 107.77%, respectively, outpacing ...

Read More

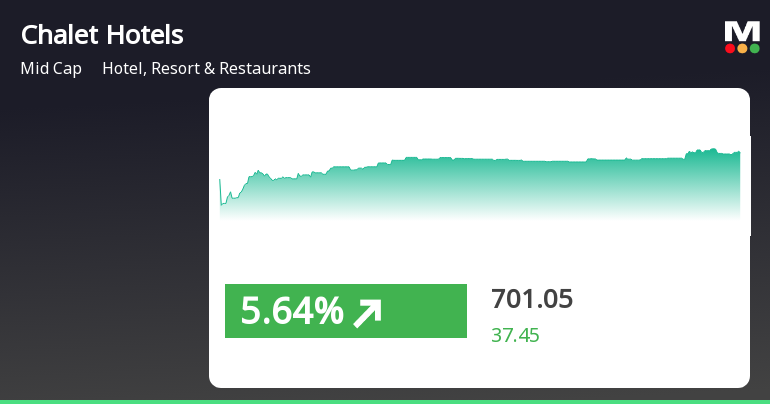

Chalet Hotels Shows Recovery Amid Mixed Performance in Hospitality Sector

2025-02-19 14:50:24Chalet Hotels saw a significant increase on February 19, 2025, reversing two days of decline. The stock outperformed its sector, which includes hotels and restaurants, despite facing a 14.09% decline over the past month. Its moving averages reflect recent volatility in the midcap hotel industry.

Read More

Chalet Hotels Hits 52-Week Low Amid Sustained Downward Trend in Stock Performance

2025-02-18 11:57:17Chalet Hotels has reached a new 52-week low, continuing a two-day decline totaling 3.98%. Despite this, it outperformed its sector slightly today. Over the past year, the stock has faced challenges, dropping 22.37%, while the broader market has seen positive growth. Moving averages indicate a sustained downward trend.

Read MoreClosure of Trading Window

28-Mar-2025 | Source : BSEThis is to inform you that as per the SEBI (Prohibition of Insider Trading) Regulations 2015 and Companys Code of Conduct the Trading Window for dealing in the Companys securities by all Designated Persons and their Immediate Relatives will be closed for the purpose of declaration of Audited Financial Results for the quarter and Financial Year ended March 31 2025 with effect from Tuesday April 1 2025 upto the expiry of 48 hours after the declaration of the said Financial Results.

Disclosures of reasons for encumbrance by promoter of listed companies under Reg. 31(1) read with Regulation 28(3) of SEBI (SAST) Regulations 2011.

25-Mar-2025 | Source : BSEThe Exchange has received the Disclosures of reasons for encumbrance by promoter of listed companies under Reg. 31(1) read with Regulation 28(3) of SEBI (SAST) Regulations 2011 on March 24 2025 for Cape Trading LLP

Disclosures of reasons for encumbrance by promoter of listed companies under Reg. 31(1) read with Regulation 28(3) of SEBI (SAST) Regulations 2011.

25-Mar-2025 | Source : BSEThe Exchange has received the Disclosures of reasons for encumbrance by promoter of listed companies under Reg. 31(1) read with Regulation 28(3) of SEBI (SAST) Regulations 2011 on March 24 2025 for Raghukool Estate Developement LLP

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available