Chamanlal Setia Exports Adjusts Valuation Grade Amid Mixed Performance Metrics

2025-03-26 08:00:35Chamanlal Setia Exports, a small-cap player in the Rice & Rice Processing industry, has recently undergone a valuation adjustment. The company's current price stands at 309.75, with a notable 52-week range between 185.00 and 446.55. Key financial metrics reveal a PE ratio of 15.78 and an EV to EBITDA ratio of 10.11, indicating a competitive position within its sector. The company's return metrics show a mixed performance against the Sensex. Over the past year, Chamanlal Setia has delivered a return of 46.98%, significantly outperforming the Sensex's 7.12%. However, year-to-date, the stock has seen a decline of 27.72%, contrasting with the Sensex's slight decrease of 0.16%. Over longer periods, the company has demonstrated robust growth, with a remarkable 969.95% return over the past five years. In comparison to peers, Chamanlal Setia's valuation metrics appear more favorable, particularly when contrasted ...

Read MoreChamanlal Setia Exports Adjusts Valuation Amid Strong Performance and Peer Comparison

2025-03-20 08:00:44Chamanlal Setia Exports, a small-cap player in the Rice & Rice Processing industry, has recently undergone a valuation adjustment. The company's current price stands at 320.60, reflecting a slight increase from the previous close of 314.20. Over the past year, Chamanlal Setia has demonstrated a robust performance with a return of 55.86%, significantly outpacing the Sensex, which returned 4.77% in the same period. Key financial metrics for Chamanlal Setia include a PE ratio of 16.33 and an EV to EBITDA ratio of 10.50, indicating its market positioning relative to peers. Notably, GRM Overseas, a competitor in the same sector, is currently valued at a higher PE ratio of 27.36 and an EV to EBITDA of 27.51, highlighting a distinct valuation gap between the two companies. Chamanlal Setia's return on capital employed (ROCE) is reported at 28.49%, while its return on equity (ROE) stands at 15.04%. These figures s...

Read More

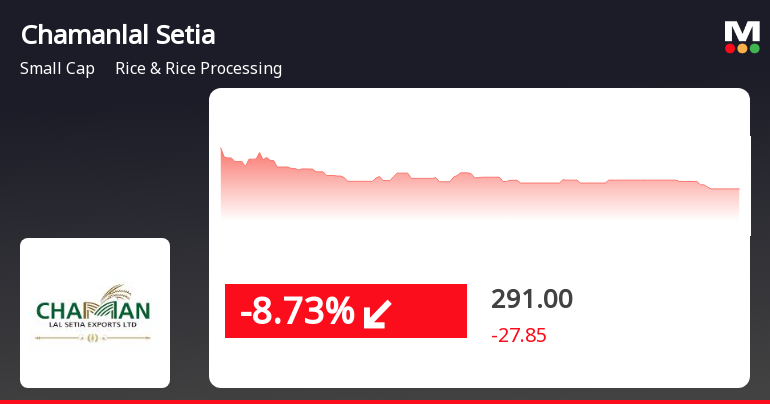

Chamanlal Setia Exports Shows Resilience Amid Market Volatility and Small-Cap Gains

2025-03-06 14:35:18Chamanlal Setia Exports, a small-cap company in the Rice & Rice Processing sector, has experienced notable stock performance, outperforming its sector significantly. The stock has shown high volatility and is currently above several moving averages. Despite a challenging year, it has achieved substantial growth over the past three years.

Read More

Chamanlal Setia Exports Faces Significant Stock Decline Amid Broader Market Challenges

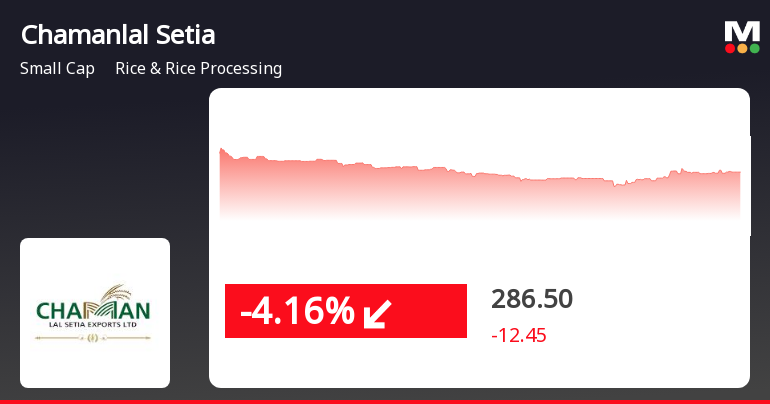

2025-02-14 14:15:33Chamanlal Setia Exports, a small-cap company in the Rice & Rice Processing sector, has seen its shares decline significantly, underperforming against the sector and broader market indices. The stock has consistently fallen over the past two days and is trading below multiple moving averages, indicating ongoing bearish trends.

Read More

Chamanlal Setia Exports Faces Continued Stock Volatility Amid Broader Market Stability

2025-02-11 10:05:21Chamanlal Setia Exports, a small-cap company in the Rice & Rice Processing sector, faced significant stock volatility, declining 7.92% on February 11, 2025. This continues a downward trend, with a cumulative drop of 11.96% over three days, contrasting sharply with the broader market performance.

Read More

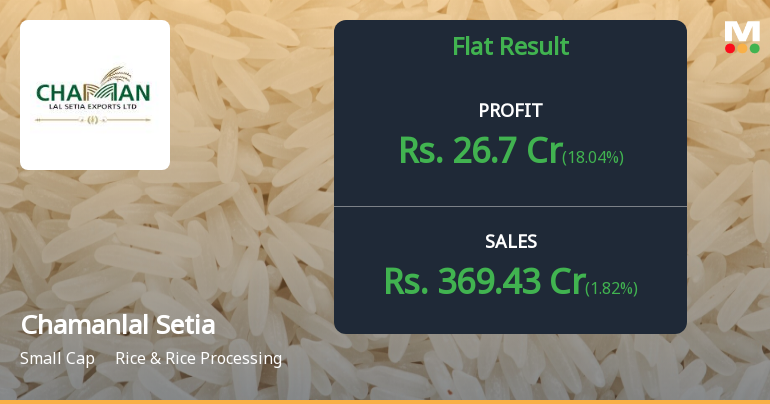

Chamanlal Setia Exports Reports Steady Q3 FY24-25 Results Amid Score Adjustment

2025-02-10 19:51:09Chamanlal Setia Exports has announced its financial results for the quarter ending February 2025, showing stable performance in Q3 FY24-25 without significant fluctuations in key metrics. However, the company's stock evaluation has seen a notable adjustment, reflecting changes in its financial standing over the past three months.

Read MoreChamanlal Setia Exports Shows Mixed Performance Amid Market Volatility and Sector Outperformance

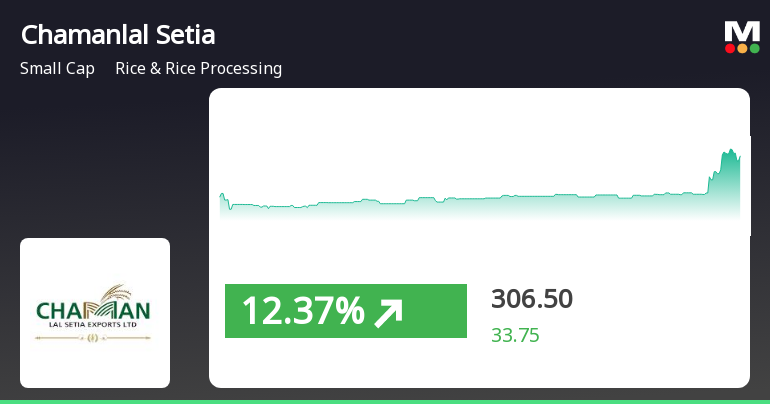

2025-01-31 10:35:08Chamanlal Setia Exports, a small-cap player in the Rice & Rice Processing industry, has shown significant activity in today's trading session. The stock opened with a notable gain of 5.48%, reaching an intraday high of Rs 333. This performance allowed it to outperform its sector by 1.43%, highlighting its relative strength in the market. In terms of moving averages, Chamanlal Setia Exports is currently positioned higher than its 200-day moving average, yet it remains below the 5-day, 20-day, 50-day, and 100-day moving averages. This indicates a mixed trend in the short to medium term. Over the past day, the stock has recorded a performance increase of 2.79%, contrasting with the Sensex's modest gain of 0.57%. However, the one-month performance reveals a decline of 24.28% for Chamanlal Setia Exports, while the Sensex has only decreased by 1.20%. These metrics reflect the stock's recent volatility and its c...

Read MoreChamanlal Setia Exports Faces Significant Volatility Amid Broader Rice Sector Challenges

2025-01-28 10:05:06Chamanlal Setia Exports, a small-cap player in the Rice & Rice Processing industry, has experienced significant volatility in today's trading session. The stock opened with a notable loss of 7.41%, reflecting a broader trend of underperformance, as it has fallen 3.81% in comparison to the Sensex, which gained 0.55%. Over the past three days, Chamanlal Setia Exports has seen a cumulative decline of 11.26%, contributing to a monthly performance drop of 24.05%, while the Sensex has decreased by just 3.71% during the same period. The stock's performance metrics indicate that it is currently trading above its 200-day moving average but below its 5-day, 20-day, 50-day, and 100-day moving averages. This suggests a mixed technical outlook. Additionally, the Rice & Rice Processing sector as a whole has also faced challenges, with a decline of 3.15%. As the market continues to react to these trends, Chamanlal Setia ...

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

05-Apr-2025 | Source : BSECompliance-Certificate under Reg.74(5) of SEBI(DP)Regulations2018 for the quarter ended 31.03.2025.

Closure of Trading Window

25-Mar-2025 | Source : BSEINTIMATION OF CLOSURE OF TRADING WINDOW

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Intimation

20-Mar-2025 | Source : BSEIntimation of Investor meet.

Corporate Actions

No Upcoming Board Meetings

Chamanlal Setia Exports Ltd has declared 112% dividend, ex-date: 20 Sep 24

Chamanlal Setia Exports Ltd has announced 2:10 stock split, ex-date: 28 Dec 15

Chamanlal Setia Exports Ltd has announced 1:10 bonus issue, ex-date: 14 Oct 16

No Rights history available