Chartered Capital & Investment Adjusts Valuation Metrics Amid Market Challenges

2025-04-02 08:09:30Chartered Capital & Investment has recently adjusted its valuation metrics, reflecting a more favorable position within the finance/NBFC sector. Key indicators include a PE ratio of 11.02 and a price-to-book value of 0.40, highlighting its competitive stance despite broader market challenges.

Read MoreChartered Capital & Investment Adjusts Valuation Grade Amid Competitive Market Position

2025-04-02 08:00:10Chartered Capital & Investment has recently undergone a valuation adjustment, reflecting its financial metrics and market position within the finance and non-banking financial company (NBFC) sector. The company's price-to-earnings (PE) ratio stands at 11.02, while its price-to-book value is notably low at 0.40. Additionally, the enterprise value to EBITDA ratio is recorded at 8.85, indicating a competitive valuation relative to its peers. In terms of performance indicators, Chartered Capital's return on capital employed (ROCE) is 4.07%, and its return on equity (ROE) is 3.60%. These figures provide insight into the company's operational efficiency and profitability. When compared to its peers, Chartered Capital demonstrates a more favorable valuation profile, particularly in terms of its PE and PEG ratios, which are significantly lower than those of companies like Colab Platforms and Oswal Green Tech, bot...

Read More

Chartered Capital & Investment Faces Market Sentiment Shift Amid Technical Adjustments

2025-03-25 08:06:39Chartered Capital & Investment has recently experienced a change in evaluation, influenced by shifts in technical indicators and market sentiment. Despite a modest Return on Equity and attractive valuation metrics, the stock's performance reflects complexities in the current market environment, with recent trends indicating a bearish outlook.

Read More

Chartered Capital's Evaluation Adjustment Raises Questions on Long-Term Financial Strength

2025-03-18 08:04:52Chartered Capital & Investment, a microcap in the finance and NBFC sector, has recently adjusted its evaluation following a comprehensive analysis of its financial metrics. The company reported flat performance in Q3 FY24-25, raising concerns about its long-term strength, despite a significant profit increase over the past year.

Read More

Chartered Capital Adjusts Valuation Amid Flat Performance and Strong Profit Growth

2025-03-13 08:02:19Chartered Capital & Investment, a microcap in the finance sector, has recently experienced an evaluation adjustment based on its financial metrics and market position. The company reported flat performance in Q3 FY24-25, with a notable ROE of 1.35% and a significant profit increase of 79.5% over the past year.

Read More

Chartered Capital's Financial Metrics Raise Questions About Long-Term Viability

2025-03-10 08:02:35Chartered Capital & Investment, a microcap in the finance and NBFC sector, has recently adjusted its evaluation based on financial metrics and market position. The company reported flat performance in Q3 FY24-25, raising concerns about its long-term strength, despite a significant profit increase and attractive valuation ratios.

Read More

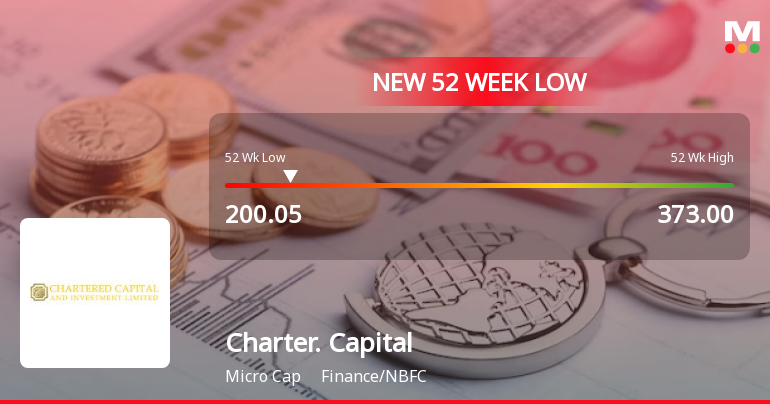

Chartered Capital & Investment Faces High Volatility Amidst Weak Long-Term Fundamentals

2025-03-05 10:05:13Chartered Capital & Investment, a microcap in the finance sector, hit a new 52-week low today but also reached a notable intraday high. Over the past year, the stock has declined, contrasting with the broader market. Its return on equity is low, but it has an attractive valuation.

Read More

Chartered Capital Faces Market Scrutiny Amid Flat Performance and Low ROE Concerns

2025-02-27 18:47:59Chartered Capital & Investment has recently adjusted its evaluation, reflecting its current market position amid flat financial performance for the quarter ending December 2024. The company faces challenges in generating shareholder returns, despite an attractive valuation and significant profit growth over the past year. Technical indicators suggest a bearish trend.

Read More

Chartered Capital Faces Evaluation Adjustment Amid Flat Performance and Low ROE Concerns

2025-02-25 18:17:01Chartered Capital & Investment, a microcap finance company, has recently adjusted its evaluation amid flat financial performance in Q3 FY24-25. The company faces challenges with a low Return on Equity and a mildly bearish stock trend, despite a significant profit increase over the past year and an attractive valuation.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

08-Apr-2025 | Source : BSECertificate under Regulation 74(5) of SEBI (DP) Regulations 2018 for the quarter ended March 31 2025.

Closure of Trading Window

25-Mar-2025 | Source : BSEIntimation of closure of trading window for the quarter and year ended March 31 2025.

Board Meeting Outcome for Outcome Of Meeting Of Board Of Directors Held On March 10 2025

10-Mar-2025 | Source : BSEOutcome Of Meeting Of Board Of Directors held on March 10 2025 for Appointment of Secretarial Auditor of the company.

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available