Chemplast Sanmar Faces Technical Bearish Indicators Amid Market Challenges

2025-04-01 08:01:09Chemplast Sanmar, a midcap player in the chemicals industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 431.00, showing a slight increase from the previous close of 428.45. Over the past year, Chemplast Sanmar has experienced a decline of 3.42%, contrasting with a 5.11% gain in the Sensex, highlighting a challenging performance relative to the broader market. The technical summary indicates a bearish sentiment in several key indicators. The MACD and Bollinger Bands on a weekly basis are both bearish, while the moving averages also reflect a bearish trend. The KST shows a similar bearish outlook, although the monthly indicators present a mildly bullish stance in some areas. Notably, the Relative Strength Index (RSI) shows no signal, suggesting a lack of momentum in either direction. In terms of stock performance, Chemplast Sanmar h...

Read More

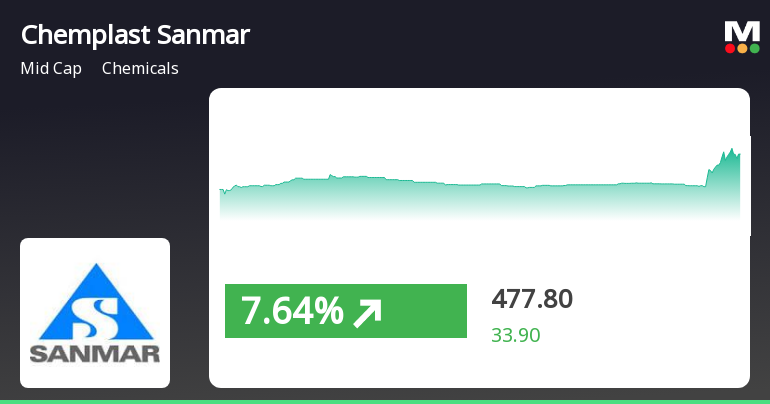

Chemplast Sanmar Shows Resilience with Notable Stock Rebound Amid Market Recovery

2025-03-27 14:30:27Chemplast Sanmar, a midcap chemicals company, experienced a notable rebound on March 27, 2025, after two days of decline. The stock reached an intraday high of Rs 460.25, outperforming its sector. Meanwhile, the broader market saw the Sensex recover significantly, reflecting overall positive momentum.

Read More

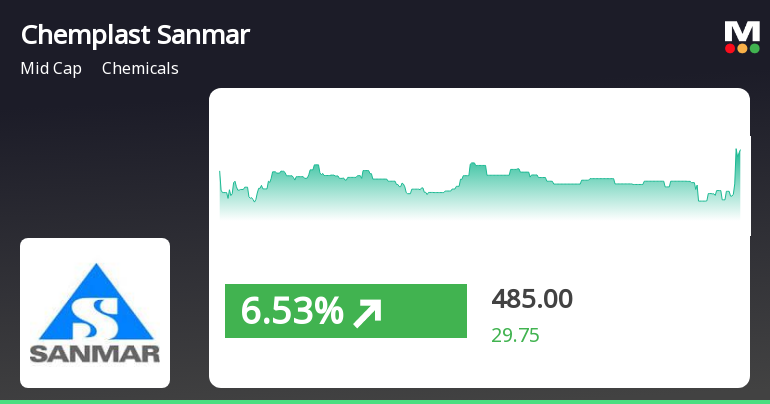

Chemplast Sanmar Shows Strong Short-Term Gains Amid Mixed Long-Term Signals

2025-03-24 15:30:25Chemplast Sanmar, a midcap chemicals company, experienced notable gains on March 24, 2025, outperforming the broader market. The stock has shown a strong upward trend over the past week, although its three-month performance indicates a decline. Over the past year, it has outperformed the Sensex.

Read More

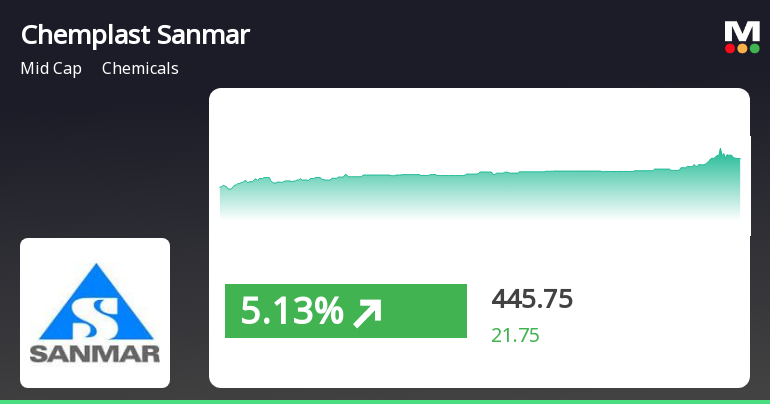

Chemplast Sanmar's Stock Surge Highlights Broader Market Recovery and Small-Cap Strength

2025-03-21 15:15:34Chemplast Sanmar has experienced notable stock activity, rising significantly today and outperforming its sector. The stock has shown a consistent upward trend over the past four days, with a substantial total return. In the broader market, small-cap stocks are leading gains, while the Sensex has rebounded after a negative start.

Read MoreChemplast Sanmar Faces Technical Trend Adjustments Amidst Market Challenges

2025-03-18 08:01:18Chemplast Sanmar, a midcap player in the chemicals industry, has recently undergone a technical trend adjustment, reflecting shifts in its market performance. The company's current stock price stands at 414.25, down from a previous close of 425.50. Over the past year, Chemplast Sanmar has faced challenges, with a stock return of -4.32%, contrasting with a positive return of 2.10% for the Sensex during the same period. The technical summary indicates a mixed outlook, with the MACD showing bearish signals on a weekly basis while presenting a mildly bullish stance monthly. The Bollinger Bands and KST also reflect bearish trends weekly, although they are mildly bearish on a monthly basis. The moving averages indicate a bearish trend daily, while the Dow Theory suggests a mildly bullish position weekly. In terms of stock performance, Chemplast Sanmar has experienced a notable decline of 16.98% year-to-date, co...

Read MoreChemplast Sanmar Faces Mixed Technical Trends Amid Market Volatility

2025-03-11 08:01:38Chemplast Sanmar, a midcap player in the chemicals industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 432.50, down from a previous close of 441.65, with a 52-week high of 633.00 and a low of 380.00. Today's trading saw a high of 444.00 and a low of 432.50, indicating some volatility within the session. The technical summary reveals a bearish sentiment in the weekly MACD and Bollinger Bands, while the monthly indicators show a mildly bullish trend in MACD and a mildly bearish stance in Bollinger Bands. The daily moving averages also reflect a bearish trend, suggesting a cautious outlook in the short term. Notably, the KST and OBV indicators present a mixed picture, with the former indicating bearishness on a weekly basis and the latter showing a mildly bullish trend monthly. In terms of performance, Chemplast Sanmar's returns hav...

Read MoreChemplast Sanmar Faces Mixed Technical Trends Amid Market Volatility and Declining Performance

2025-03-10 08:00:45Chemplast Sanmar, a midcap player in the chemicals industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 441.65, slightly down from the previous close of 445.85. Over the past year, Chemplast Sanmar has experienced a stock return of -2.2%, contrasting with a modest gain of 0.29% in the Sensex during the same period. The technical summary indicates a mixed performance across various indicators. The MACD shows a bearish trend on a weekly basis, while the monthly perspective leans mildly bullish. The Relative Strength Index (RSI) presents no significant signals for both weekly and monthly assessments. Bollinger Bands and KST reflect a mildly bearish stance, suggesting some caution in the short term. Additionally, the On-Balance Volume (OBV) indicates a mildly bullish trend on both weekly and monthly scales. In terms of price movement,...

Read More

Chemplast Sanmar's Recent Gains Reflect Volatility Amid Broader Market Trends

2025-03-06 14:45:25Chemplast Sanmar, a midcap chemicals company, experienced significant gains on March 6, 2025, outperforming its sector. The stock has shown consecutive gains over two days and reached an intraday high. Its moving averages indicate mixed momentum, while the broader market reflects a positive opening with small-cap stocks leading.

Read MoreChemplast Sanmar Experiences Valuation Grade Change Amidst Profitability Challenges

2025-03-04 08:00:08Chemplast Sanmar, a midcap player in the chemicals industry, has recently undergone a valuation adjustment, reflecting its current financial metrics and market position. The company's price-to-earnings (PE) ratio stands at -75.34, indicating significant challenges in profitability. Additionally, its price-to-book value is reported at 3.78, while the enterprise value to EBITDA ratio is notably high at 36.63, suggesting a premium valuation relative to earnings before interest, taxes, depreciation, and amortization. In terms of return on capital employed (ROCE) and return on equity (ROE), Chemplast Sanmar is facing hurdles, with figures of -0.36% and -7.35%, respectively. These metrics highlight the company's struggle to generate returns for its shareholders. When compared to its peers, Chemplast Sanmar's valuation appears elevated. Competitors like Himadri Special and Navin Fluorine International also exhib...

Read MoreClosure of Trading Window

27-Mar-2025 | Source : BSEIntimation regarding closure of Trading window

Announcement under Regulation 30 (LODR)-Acquisition

27-Feb-2025 | Source : BSEIntimation regarding Proposed investment in /Acquistion of Equity shares of JSW Green energy nine limited under Group captive power scheme to source green energy.

Announcement under Regulation 30 (LODR)-Earnings Call Transcript

17-Feb-2025 | Source : BSETranscripts of earnings call.

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

Chemplast Sanmar Ltd has announced 1:10 stock split, ex-date: 08 Mar 06

No Bonus history available

Chemplast Sanmar Ltd has announced 2:3 rights issue, ex-date: 17 Mar 09