Chennai Petroleum Corporation Shows Strong Trading Activity Amid Declining Investor Participation

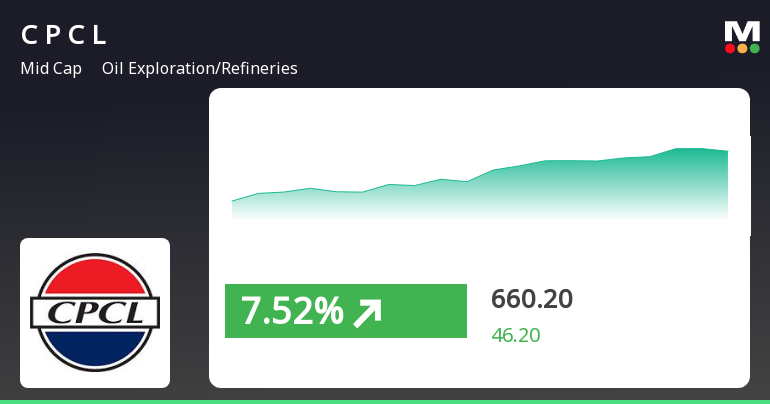

2025-03-26 10:00:03Chennai Petroleum Corporation Ltd (symbol: CHENNPETRO) has emerged as one of the most active equities today, reflecting significant trading activity in the oil exploration and refinery sector. The stock recorded a total traded volume of 4,266,301 shares, with a total traded value of approximately Rs 27,762.53 lakhs. Opening at Rs 614.25, the stock reached a day high of Rs 664.5, marking a notable intraday increase of 6.8%. The last traded price stands at Rs 647.0, representing a 5.56% return for the day, significantly outperforming its sector, which saw a mere 0.23% increase. Despite this positive performance, there has been a decline in investor participation, with delivery volume dropping by 31.77% compared to the five-day average. The stock's liquidity remains robust, with a trading capacity sufficient for transactions up to Rs 5.2 crore. Additionally, Chennai Petroleum boasts a high dividend yield of 8...

Read More

Chennai Petroleum Corporation's Stock Surges Amid High Volatility and Strong Dividend Yield

2025-03-26 09:30:13Chennai Petroleum Corporation's stock has experienced notable activity, outperforming its sector and reaching an intraday high. The stock is above several moving averages and features a high dividend yield. Meanwhile, the broader market shows positive trends, with the Sensex and BSE Mid Cap index both gaining.

Read More

Chennai Petroleum Faces Profit Decline Amid Increased Leverage and Investor Concerns

2025-03-25 08:00:50Chennai Petroleum Corporation has recently experienced a change in its evaluation, reflecting a shift in its technical outlook. The company faces challenges, including declining profitability and a high debt-to-equity ratio. Institutional investor participation has decreased, raising concerns about its financial health, despite a high dividend yield and long-term growth potential.

Read MoreChennai Petroleum Corporation Shows Mixed Technical Trends Amid Market Evaluation Revision

2025-03-25 08:00:14Chennai Petroleum Corporation (CPCL), a midcap player in the oil exploration and refinery sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 637.25, showing a slight increase from the previous close of 632.50. Over the past week, CPCL has demonstrated a notable performance, achieving a return of 13.50%, significantly outpacing the Sensex, which returned 5.14% in the same period. In terms of technical indicators, the weekly MACD suggests a mildly bullish trend, while the monthly perspective leans towards a mildly bearish outlook. The Bollinger Bands indicate a bullish stance on a weekly basis, contrasting with a mildly bearish monthly trend. Moving averages on a daily basis also reflect a mildly bearish sentiment. When examining the company's performance over various time frames, CPCL has shown impressive returns over the long ter...

Read More

Chennai Petroleum Corporation's Evaluation Adjustment Signals Market Stabilization Amid Mixed Financial Indicators

2025-03-24 08:00:13Chennai Petroleum Corporation has recently experienced an evaluation adjustment reflecting current market dynamics, indicating a stabilization in its stock performance. While the company shows strong management efficiency and long-term profit growth, it faces challenges such as a significant profit decline and reduced institutional investor participation.

Read MoreChennai Petroleum Corporation Shows Mixed Technical Trends Amid Market Volatility

2025-03-24 08:00:09Chennai Petroleum Corporation (CPCL), a midcap player in the oil exploration and refinery sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 632.50, showing a notable increase from the previous close of 574.25. Over the past week, CPCL has reached a high of 644.40 and a low of 571.00, indicating some volatility in trading. In terms of technical indicators, the weekly MACD suggests a mildly bullish sentiment, while the monthly perspective leans towards a mildly bearish outlook. The Relative Strength Index (RSI) shows no significant signals for both weekly and monthly assessments. Bollinger Bands indicate a bullish trend on a weekly basis, contrasting with a mildly bearish stance monthly. Moving averages reflect a mildly bearish trend on a daily basis, while the On-Balance Volume (OBV) remains bullish across both weekly and monthly e...

Read More

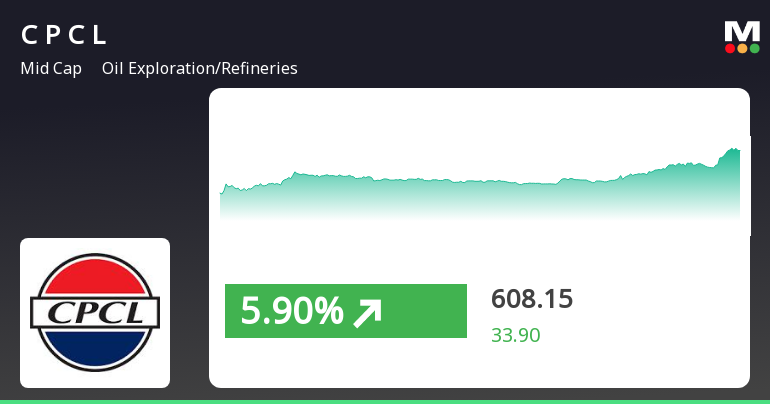

Chennai Petroleum Corporation Shows Strong Performance Amid Broader Market Rebound

2025-03-21 13:30:14Chennai Petroleum Corporation has experienced notable gains, marking its third consecutive day of increases and outperforming its sector. The stock is currently above several moving averages and offers a high dividend yield. In the broader market, small-cap stocks are leading, with the Sensex also showing positive movement.

Read MoreChennai Petroleum Corporation Sees Surge in Trading Activity and Investor Interest

2025-03-12 10:00:04Chennai Petroleum Corporation Ltd (CHENNPETRO) has emerged as one of the most active equities today, reflecting significant trading activity in the oil exploration and refinery sector. With a total traded volume of 22,934,476 shares and a total traded value of approximately Rs 12,631.39 million, the stock has captured considerable market attention. The stock opened at Rs 503.5 and reached a day high of Rs 564.0, while the day low was recorded at Rs 500.05. As of the latest update, the last traded price stands at Rs 551.0, marking a slight increase of 0.02% for the day, which is an outperformance compared to the sector's return of 0.47%. Chennai Petroleum Corporation's performance metrics indicate that it is currently above its 5-day, 20-day, and 50-day moving averages, although it remains below the 100-day and 200-day moving averages. Notably, the stock has seen a significant rise in investor participatio...

Read MoreChennai Petroleum Corporation Shows High Trading Activity Amid Oil Sector Volatility

2025-03-11 14:00:04Chennai Petroleum Corporation Ltd (CHENNPETRO) has emerged as one of the most active stocks today, reflecting significant trading activity in the oil exploration and refinery sector. The company reported a total traded volume of 13,675,307 shares, with a total traded value of approximately Rs 748.29 crore. The stock opened at Rs 503.50 and reached an intraday high of Rs 561.00, marking a notable increase of 9.35%. However, it also experienced a low of Rs 500.05 during the trading session. Chennai Petroleum's performance today outpaced its sector by 7.22%, showcasing its resilience in a competitive market. The stock's wide trading range of Rs 60.95 indicates substantial volatility, while the weighted average price suggests that more volume was traded closer to the lower end of this range. Additionally, the stock is currently yielding a high dividend of 10.74%, which may attract attention from income-focused...

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

03-Apr-2025 | Source : BSEIntimation of Compliance with Regulation 74(5) of SEBI (Depositories & Participants) Regulations2018

Announcement under Regulation 30 (LODR)-Change in Directorate

02-Apr-2025 | Source : BSEAppointment of Shri H. Shankar (DIN: 08845247) as Managing DirectorCPCL

Closure of Trading Window

25-Mar-2025 | Source : BSEIntimation of Closure of Trading Window for the Fourth Quarter and Year ended 31.03.2025

Corporate Actions

No Upcoming Board Meetings

Chennai Petroleum Corporation Ltd has declared 550% dividend, ex-date: 19 Jul 24

No Splits history available

No Bonus history available

No Rights history available