Choksi Imaging Adjusts Valuation Grade Amid Competitive Industry Landscape

2025-04-02 08:00:16Choksi Imaging has recently undergone a valuation adjustment, reflecting its current financial metrics and market position. The company's price-to-earnings ratio stands at 16.78, while its price-to-book value is recorded at 1.75. Additionally, the enterprise value to EBITDA ratio is noted at 28.69, indicating a specific valuation context within the industry. In terms of performance indicators, Choksi Imaging has a return on equity (ROE) of 10.44% and a return on capital employed (ROCE) of 1.31%. The PEG ratio is particularly noteworthy at 0.05, suggesting a favorable growth outlook relative to its earnings. When compared to its peers, Choksi Imaging's valuation metrics present a competitive landscape. For instance, Sh. Pushkar Chem. and Taneja Aerospace are positioned at higher valuation levels, with PE ratios of 15.65 and 56.54, respectively. In contrast, Mallcom (India) shows a PE ratio of 19.07, while ...

Read MoreChoksi Imaging Ltd Sees Strong Buying Activity Amid Broader Market Decline

2025-03-28 09:55:04Choksi Imaging Ltd is currently witnessing significant buying activity, with the stock rising by 4.55% today, in stark contrast to the Sensex, which has declined by 0.21%. This performance marks a notable outperformance against the broader market, particularly as the stock opened with a gap up of 4.53% and reached an intraday high of Rs 68.99. Over the past week, Choksi Imaging has gained 2.53%, while the Sensex has increased by 0.70%. However, the stock's performance over the last month shows a decline of 5.48%, compared to the Sensex's rise of 5.81%. Despite this recent volatility, Choksi Imaging has demonstrated resilience over the longer term, with a remarkable 82.30% increase over the past three years and a staggering 662.43% rise over the last five years. The current buying pressure may be attributed to various factors, including market sentiment and potential developments within the company or its ...

Read MoreChoksi Imaging Ltd Sees Significant Buying Activity Amidst Notable Price Gains

2025-03-17 10:25:04Choksi Imaging Ltd is currently witnessing significant buying activity, marking a notable performance in the market. The stock has experienced consecutive gains over the last four days, accumulating a total return of 10.07%. Today, it rose by 4.99%, significantly outperforming the Sensex, which recorded a modest increase of 0.49%. Despite a challenging month where the stock declined by 7.35%, its year-to-date performance shows a decrease of 19.07%, compared to the Sensex's decline of 5.05%. However, over the past year, Choksi Imaging has delivered a robust return of 24.58%, far exceeding the Sensex's 2.13% gain. Today's trading session opened with a gap down of 4.91%, but the stock rebounded to reach an intraday high of Rs 75.95, reflecting a 4.96% increase from the previous close. The intraday low was recorded at Rs 68.8. Notably, the stock's performance today outpaced its sector by 4.07%. Choksi Imag...

Read More

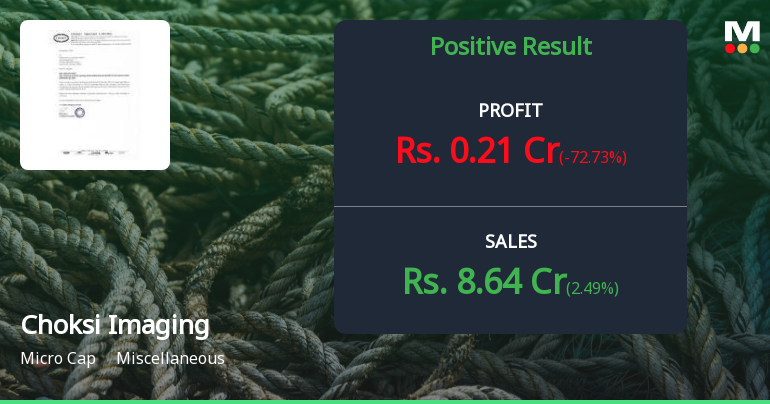

Choksi Imaging Reports Profit Growth Amidst Operational Challenges and Debt Concerns

2025-02-28 18:26:06Choksi Imaging has recently adjusted its evaluation following a positive third-quarter performance, reporting a profit after tax of Rs 0.98 crore. Despite modest sales growth and increased operating profit, the company faces challenges such as operating losses and a negative EBIT to interest ratio, raising concerns about its long-term financial stability.

Read More

Choksi Imaging Adjusts Valuation Amidst Positive Profit Trends and Debt Concerns

2025-02-18 18:32:09Choksi Imaging, a microcap company, has recently adjusted its evaluation based on its third-quarter financial results for FY24-25. The company has reported three consecutive quarters of positive outcomes, including a profit after tax of Rs 0.98 crore, despite facing operating losses and challenges in long-term debt servicing.

Read More

Choksi Imaging Reports Profit Turnaround, Reflects Shift in Market Evaluation February 2025

2025-02-17 19:01:34Choksi Imaging has announced its financial results for the quarter ending December 2024, revealing a profit after tax of Rs 0.98 crore for the half-year, a recovery from a loss in the previous year. The company's evaluation score has adjusted, reflecting its operational performance and market standing.

Read MoreAnnouncement under Regulation 30 (LODR)-Change of Company Name

03-Apr-2025 | Source : BSEChange of name of the Company from Choksi Imaging Limited to Choksi Asia Limited pursuant to Scheme of Amalgamation.

Closure of Trading Window

31-Mar-2025 | Source : BSEIntimation of closure of trading window.

Announcement under Regulation 30 (LODR)-Newspaper Publication

15-Feb-2025 | Source : BSEIntimation of newspaper publication of unaudited financial results for the quarter and nine month ended December 31 2024.

Corporate Actions

No Upcoming Board Meetings

Choksi Imaging Ltd has declared 25% dividend, ex-date: 16 Sep 21

No Splits history available

No Bonus history available

No Rights history available