CIAN Agro Industries Faces Intense Selling Pressure Amid Significant Price Declines

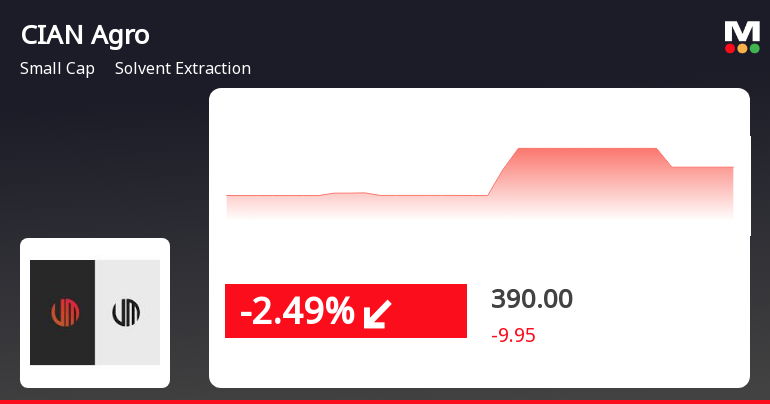

2025-04-03 09:40:07CIAN Agro Industries & Infrastructure Ltd is currently facing significant selling pressure, with the stock showing only sellers today. The stock has experienced consecutive days of losses, reflecting a challenging market environment. In the latest trading session, CIAN Agro Industries reported a decline of 5.00%, contrasting sharply with the Sensex, which fell by only 0.38%. Over the past week, CIAN Agro Industries has shown a positive performance of 6.04%, but this is overshadowed by its one-month performance, which is down 1.07%, while the Sensex has gained 4.44% in the same period. The three-month performance reveals a substantial decline of 29.87% for CIAN Agro Industries, compared to a modest 3.65% drop in the Sensex. Year-to-date, the stock is down 31.29%, while the Sensex has only decreased by 2.32%. Factors contributing to the selling pressure may include market volatility and sector-specific cha...

Read MoreCIAN Agro Industries Surges 4.99% Amid Strong Buying Activity and Sector Momentum

2025-04-02 09:35:19CIAN Agro Industries & Infrastructure Ltd is witnessing significant buying activity, with the stock rising by 4.99% today, outperforming the Sensex, which increased by only 0.54%. Over the past three days, CIAN Agro has shown consecutive gains, accumulating a total return of 11.61%. The stock opened with a gap up of 4.76% and reached an intraday high of Rs 375.35. In terms of performance relative to the Sensex, CIAN Agro has demonstrated strong results over the past year, with an impressive increase of 878.75%, compared to the Sensex's modest 3.42% rise. However, the stock has faced challenges in the shorter term, with a decline of 27.68% year-to-date, while the Sensex has decreased by only 2.18%. The solvent extraction sector, in which CIAN Agro operates, has also seen positive momentum, gaining 2.84%. This sector-wide performance may be contributing to the heightened buying pressure observed in CIAN Agr...

Read MoreCIAN Agro Industries Adjusts Valuation Grade Amidst Mixed Performance Indicators

2025-04-02 08:00:39CIAN Agro Industries & Infrastructure has recently undergone a valuation adjustment, reflecting its current standing within the solvent extraction industry. The company, categorized as a small-cap entity, showcases a price-to-earnings (PE) ratio of 26.93 and a price-to-book value of 0.51, indicating a unique position in the market. Its enterprise value to EBITDA stands at 23.78, while the EV to EBIT ratio is noted at 34.66, suggesting a nuanced financial profile. In terms of performance, CIAN Agro has demonstrated significant returns over the past year, with an impressive 840.79% increase, contrasting sharply with the Sensex's modest 2.72% gain during the same period. However, the company has faced challenges in the shorter term, with a year-to-date return of -31.12%, while the Sensex has only declined by 2.71%. When compared to its peers, CIAN Agro's metrics reveal a competitive edge, particularly in its...

Read MoreCIAN Agro Industries Surges Amid Strong Buying Activity Despite Broader Market Decline

2025-04-01 14:15:11CIAN Agro Industries & Infrastructure Ltd is witnessing significant buying activity, with the stock rising by 4.99% today, contrasting sharply with the Sensex, which declined by 1.78%. This marks a notable performance over the past week, where CIAN Agro gained 2.30%, while the Sensex fell by 2.54%. However, the stock has faced challenges over the longer term, with a 29.72% decline over the past three months and a year-to-date drop of 31.12%. Today's trading saw the stock open with a gap up of 4.83%, reaching an intraday high of Rs 356.95. Despite this positive movement, it also experienced a low of Rs 324.15, indicating some volatility during the session. Over the past year, CIAN Agro has shown remarkable growth of 840.79%, significantly outperforming the Sensex's 2.73% increase. The strong buying pressure could be attributed to various factors, including market sentiment and potential developments within...

Read MoreCIAN Agro Industries Faces Intense Selling Pressure Amid Consecutive Losses

2025-03-11 15:20:07CIAN Agro Industries & Infrastructure Ltd is currently facing significant selling pressure, with the stock showing only sellers today. The company has experienced consecutive losses, with a decline of 6.82% in today's trading session alone. Over the past two days, the stock has fallen by 6.44%, indicating a troubling trend for investors. In terms of performance relative to the Sensex, CIAN Agro has underperformed across various time frames. Today, while the Sensex remained flat at 0.00%, CIAN Agro's performance lagged significantly. Over the past week, the stock is down 1.91%, compared to a 1.54% gain in the Sensex. The one-month performance shows a decline of 12.22%, while the Sensex has only dipped by 2.86%. Several factors may be contributing to this selling pressure, including the stock's recent opening gap down of 3.88% and an intraday low of Rs 354.1. Additionally, while the stock remains above its...

Read MoreCIAN Agro Industries Surges 2.66% Amid Strong Buying Activity and Milestone Gains

2025-03-07 18:00:09CIAN Agro Industries & Infrastructure Ltd is currently witnessing significant buying activity, with the stock gaining 2.66% today, contrasting sharply with the Sensex, which has seen a slight decline of 0.01%. Over the past week, CIAN Agro has recorded a total increase of 2.58%, while the Sensex rose by 1.55%. Notably, the stock has been on a positive trajectory for the last four consecutive days, accumulating an impressive 8.14% in returns during this period. In terms of price performance, CIAN Agro reached an intraday high of Rs 389.8, reflecting today's gains, while the intraday low was Rs 371, marking a decrease of 2.29%. The stock's performance over the past year has been remarkable, with an increase of 859.86%, significantly outperforming the Sensex's modest gain of 0.29%. Factors contributing to the current buying pressure may include the stock's recent positive momentum and its strong historical p...

Read MoreCIAN Agro Industries Faces Intense Selling Pressure Amid Consecutive Losses

2025-03-04 14:45:06CIAN Agro Industries & Infrastructure Ltd is currently facing significant selling pressure, with the stock showing only sellers today. The company has experienced a consecutive decline over the past six days, resulting in a total loss of 14.25% during this period. Today, the stock is down by 0.35%, underperforming the Sensex, which has decreased by 0.14%. Over the past week, CIAN Agro has seen a substantial drop of 12.18%, compared to the Sensex's decline of 2.17%. The stock's performance over the last month is particularly concerning, with a decrease of 18.76%, while the Sensex has only fallen by 7.12%. Year-to-date, CIAN Agro has declined by 30.79%, significantly underperforming the Sensex's 6.60% drop. The stock touched an intraday low of Rs 345.55, reflecting a 4.13% decrease. While it remains above its 200-day moving average, it is currently below its 5-day, 20-day, 50-day, and 100-day moving average...

Read More

CIAN Agro Industries Faces Significant Volatility Amid Broader Market Trends

2025-02-28 09:50:21CIAN Agro Industries & Infrastructure has faced notable volatility, with a significant decline observed today. The stock has experienced consecutive losses over the past four days and has underperformed its sector and the broader market. Its trading metrics indicate mixed performance amid current market challenges.

Read MoreCIAN Agro Industries Faces Significant Volatility Amid Broader Sector Challenges

2025-02-28 09:50:13CIAN Agro Industries & Infrastructure, a small-cap player in the solvent extraction industry, has experienced significant volatility today. The stock opened with a notable loss of 7.24%, reflecting a broader trend as it underperformed its sector by 2.39%. Over the past four days, CIAN has faced consecutive declines, accumulating a total drop of 11.94% during this period. Today's trading saw the stock reach an intraday low of Rs 368.9, marking a decrease of 7.76%. The stock has been trading within a narrow range of Rs 2.1, indicating limited price movement. In terms of moving averages, CIAN's current price is above its 200-day moving average but falls below the 5-day, 20-day, 50-day, and 100-day averages, suggesting mixed signals regarding its short-term performance. In the broader context, the solvent extraction sector has also faced challenges, declining by 5.37%. Over the past month, CIAN Agro Industrie...

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

05-Apr-2025 | Source : BSECompliance Certificate under Reg 74(5) of SEBI DP Regulation 018 for the quarter ended 31st March 2025

Closure of Trading Window

24-Mar-2025 | Source : BSEClosure of Trading Window for declaration of audited financial results of the company for the quarter and year ended 31st March 2025

Announcement under Regulation 30 (LODR)-Newspaper Publication

14-Feb-2025 | Source : BSENewspaper Publication for the Financial Results of the third Quarter & nine months ended 31st December 2024.

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available