CIE Automotive India Faces Bearish Technical Trends Amid Market Challenges

2025-04-02 08:02:43CIE Automotive India, a midcap player in the castings and forgings industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 399.05, slightly down from the previous close of 400.00. Over the past year, CIE Automotive has faced challenges, with a notable decline of 15.51%, contrasting with a modest gain of 2.72% in the Sensex during the same period. The technical summary indicates a bearish sentiment across various indicators. The MACD shows a bearish trend on a weekly basis, while the monthly outlook is mildly bearish. Bollinger Bands and moving averages also reflect bearish conditions, suggesting a cautious market environment. Notably, the stock's performance over different time frames reveals a significant return of 125.77% over three years and an impressive 456.94% over five years, highlighting its long-term growth potential despite ...

Read MoreCIE Automotive India Faces Mixed Technical Trends Amid Market Challenges

2025-04-01 08:00:56CIE Automotive India, a midcap player in the castings and forgings industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 400.00, slightly down from the previous close of 401.25. Over the past year, CIE Automotive has faced challenges, with a return of -13.24%, contrasting with a 5.11% gain in the Sensex during the same period. In terms of technical indicators, the MACD and Bollinger Bands suggest a bearish sentiment on a weekly basis, while the monthly outlook shows a mildly bearish trend. The KST also aligns with this assessment, indicating a cautious market stance. However, the On-Balance Volume (OBV) signals a bullish trend on both weekly and monthly charts, suggesting some underlying strength in trading volume. Despite recent fluctuations, CIE Automotive has demonstrated resilience over longer periods, with a remarkable 523.05...

Read More

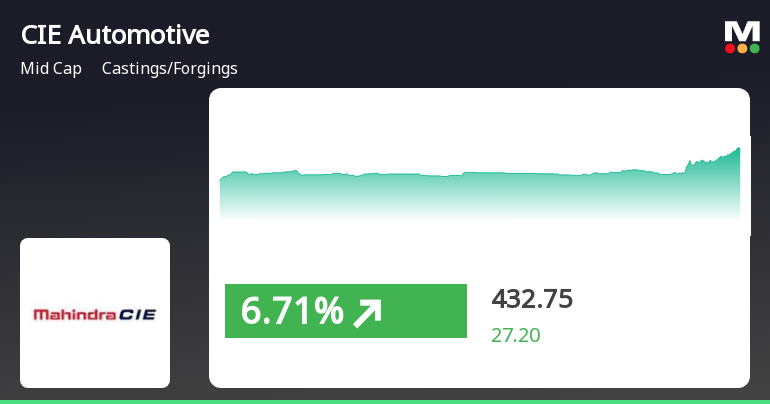

CIE Automotive India Shows Positive Short-Term Momentum Amid Broader Market Recovery

2025-03-27 14:45:15CIE Automotive India has experienced notable trading activity, outperforming its sector and achieving a positive return over the last two days. The stock's performance reflects a mixed trend in moving averages, while the broader market, led by small-cap stocks, has shown a rebound after a negative opening.

Read More

CIE Automotive India Faces Evaluation Shift Amid Declining Sales and Profitability Concerns

2025-03-26 08:02:11CIE Automotive India has recently experienced a change in its evaluation, influenced by its latest quarterly results, which showed a decline in net sales and operating profit. The company's performance indicators suggest a cautious outlook, reflecting its position within a bearish technical range and underperformance compared to the broader market.

Read MoreCIE Automotive Faces Bearish Technical Trends Amidst Long-Term Resilience in Market Performance

2025-03-26 08:01:13CIE Automotive India, a midcap player in the castings and forgings industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 405.00, slightly down from its previous close of 409.70. Over the past year, CIE Automotive has faced challenges, with a return of -8.89%, contrasting with a 7.12% gain in the Sensex during the same period. In terms of technical indicators, the stock's performance shows a bearish sentiment in various metrics. The MACD and Bollinger Bands indicate bearish trends on a weekly basis, while the moving averages also reflect a bearish outlook. The KST aligns with this sentiment, showing bearish tendencies on a weekly basis, although it is mildly bearish on a monthly scale. Despite these technical challenges, CIE Automotive has demonstrated resilience over longer periods, with a remarkable 545.93% return over the past ...

Read MoreCIE Automotive India Shows Mixed Technical Trends Amidst Market Challenges

2025-03-19 08:01:17CIE Automotive India, a midcap player in the castings and forgings industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 387.50, showing a slight increase from the previous close of 380.45. Over the past year, CIE Automotive has faced challenges, with a return of -11.51%, contrasting with a positive return of 3.51% from the Sensex during the same period. The technical summary indicates a mixed performance across various indicators. The MACD shows bearish tendencies on a weekly basis, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) presents a bullish signal weekly, but no clear signal monthly. Bollinger Bands and KST also reflect a mildly bearish trend on both weekly and monthly scales. Notably, the On-Balance Volume (OBV) suggests a mildly bullish sentiment in the short term. In terms of stock perform...

Read More

CIE Automotive India Faces Financial Challenges Amidst Low Sales and Profit Growth

2025-03-19 08:01:12CIE Automotive India has recently adjusted its evaluation, reflecting its financial performance and market position. In Q3 FY24-25, the company reported net sales of Rs 2,109.95 crore and an operating profit of Rs 299.27 crore, indicating challenges in growth despite a low debt-to-equity ratio and high institutional holdings.

Read More

CIE Automotive India Faces Financial Challenges Amidst Modest Growth and Market Underperformance

2025-03-13 08:01:16CIE Automotive India has recently adjusted its evaluation amid challenging financial results for Q3 FY24-25, reporting net sales of Rs 2,109.95 crore and an operating profit of Rs 299.27 crore. Despite modest growth over five years, the stock has underperformed compared to the broader market, though it maintains a low debt-to-equity ratio and significant institutional holdings.

Read MoreCIE Automotive India Faces Technical Trend Shifts Amid Market Evaluation Revision

2025-03-11 08:01:18CIE Automotive India, a midcap player in the castings and forgings industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 392.85, down from a previous close of 401.40, with a notable 52-week high of 628.45 and a low of 370.05. Today's trading saw a high of 406.90 and a low of 388.05. The technical summary indicates a bearish sentiment in the weekly MACD and moving averages, while the monthly indicators show a mildly bearish trend. The Relative Strength Index (RSI) presents a bullish signal on a weekly basis, but no significant signal is noted for the monthly period. The Bollinger Bands and KST also reflect bearish tendencies in the weekly timeframe, with the On-Balance Volume (OBV) showing a mildly bullish stance monthly. In terms of performance, CIE Automotive's stock return over the past week stands at 2.17%, outperforming the Sen...

Read MoreCommunication To Shareholders - Intimation On Tax Deduction At Source (TDS)/ Withholding Tax On Dividend

08-Apr-2025 | Source : BSEThe Company has sent an email communication to all the shareholders whose email addresses are registered with the Company/Depositories for Intimation on Tax Deduction at source TDS/Withholding Tax on Dividend. A Copy of the same is enclosed herewith. The same is also being uploaded on the website of the Company i.e www.cie-india.com.

Announcement under Regulation 30 (LODR)-Newspaper Publication

05-Apr-2025 | Source : BSENotice published by way of advertisement in respect of Notice of 26th AGM Facility of remote e-voting and e-voting during the AGM.

Business Responsibility and Sustainability Reporting (BRSR)

04-Apr-2025 | Source : BSEBusiness Responsibility and Sustainability Report (BRSR) for the Financial Year ended 31st December 2024.

Corporate Actions

29 Apr 2025

CIE Automotive India Ltd has declared 70% dividend, ex-date: 23 Apr 25

No Splits history available

No Bonus history available

No Rights history available