CMS Info Systems Shows Mixed Technical Trends Amid Strong Yearly Performance

2025-04-02 08:10:04CMS Info Systems, a midcap player in the IT software industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 479.05, showing a notable increase from the previous close of 458.25. Over the past year, CMS Info Systems has demonstrated a robust performance with a return of 23.07%, significantly outperforming the Sensex, which recorded a return of 2.72% in the same period. In terms of technical indicators, the weekly MACD suggests a mildly bullish sentiment, while the monthly MACD indicates a mildly bearish outlook. The Bollinger Bands are signaling bullish trends on both weekly and monthly bases, indicating potential volatility in price movements. However, the daily moving averages reflect a mildly bearish stance, suggesting mixed signals in the short term. The company's performance over various time frames highlights its resilience, pa...

Read More

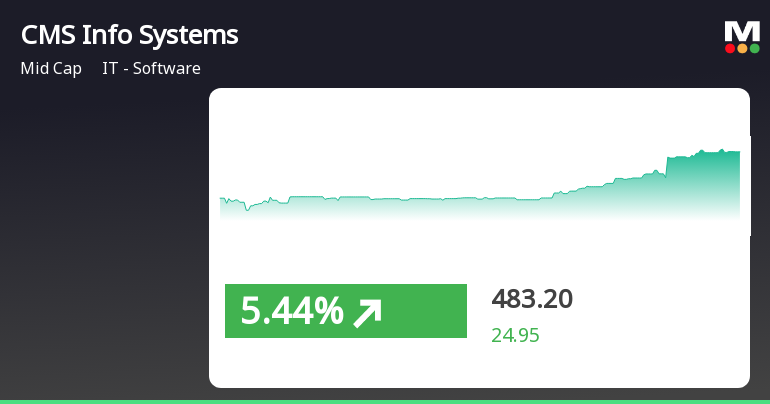

CMS Info Systems Shows Resilience Amid Broader Market Decline, Signaling Potential Trend Reversal

2025-04-01 14:35:26CMS Info Systems has demonstrated notable resilience, gaining 5.36% on April 1, 2025, after five days of decline. The stock outperformed the broader market, with a significant annual performance of 24.17%, contrasting with the Sensex's 2.71%. It remains positioned above several short to medium-term moving averages.

Read More

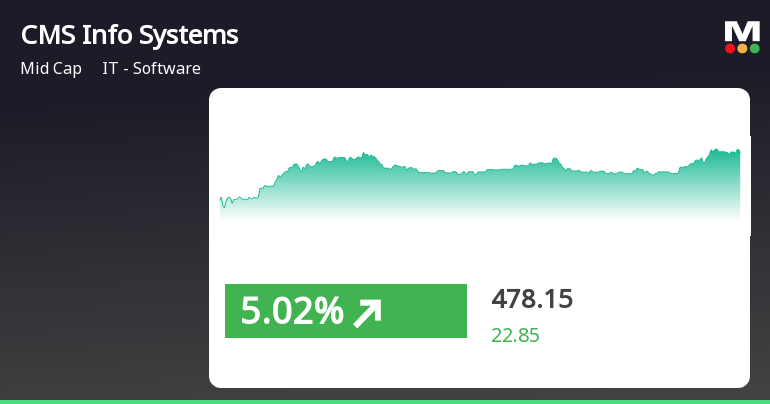

CMS Info Systems Shows Strong Performance Amid Broader Market Recovery Trends

2025-03-21 14:50:28CMS Info Systems has demonstrated notable performance, gaining 5.06% on March 21, 2025, and outperforming its sector. The stock has seen consecutive gains over four days, totaling 9.9%. It is currently above several moving averages, while the broader market, led by small caps, has also rebounded.

Read More

CMS Info Systems Adjusts Evaluation Score Amid Mixed Technical Indicators and Strong Fundamentals

2025-03-21 08:04:01CMS Info Systems has recently adjusted its evaluation score, reflecting changes in the technical landscape. The company's mixed technical indicators show varying trends, while its strong management efficiency is underscored by an 18.09% return on equity and a low debt-to-equity ratio, contributing to its market outperformance.

Read MoreCMS Info Systems Shows Mixed Technical Trends Amid Strong Yearly Performance

2025-03-21 08:03:16CMS Info Systems, a midcap player in the IT software industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 455.30, showing a notable increase from the previous close of 442.00. Over the past week, CMS Info Systems has demonstrated a stock return of 4.53%, outperforming the Sensex, which recorded a return of 3.41% in the same period. In terms of technical indicators, the MACD shows a bearish trend on a weekly basis, while the monthly perspective indicates a mildly bearish stance. The Relative Strength Index (RSI) remains neutral for both weekly and monthly assessments. Bollinger Bands present a mildly bearish outlook weekly, contrasting with a mildly bullish view on a monthly basis. Daily moving averages also reflect a mildly bearish trend. When examining the company's performance over various time frames, CMS Info Systems has deliv...

Read More

CMS Info Systems Faces Growth Challenges Amidst Stable Financial Performance and High Management Efficiency

2025-03-13 08:09:03CMS Info Systems has recently experienced a change in its evaluation, reflecting various performance indicators. In Q3 FY24-25, the company reported flat net sales of Rs 581.49 crore, with modest growth in operating profit. Key metrics indicate challenges, yet management efficiency remains high, supported by a low Debt to Equity ratio.

Read More

CMS Info Systems Faces Growth Challenges Amidst Stable Financial Performance and High Management Efficiency

2025-03-13 08:09:03CMS Info Systems has recently experienced a change in its evaluation, reflecting various performance indicators. In Q3 FY24-25, the company reported flat net sales of Rs 581.49 crore, with modest growth in operating profit. Key metrics indicate challenges, yet management efficiency remains high, supported by a low Debt to Equity ratio.

Read MoreCMS Info Systems Faces Technical Trend Shifts Amid Market Sentiment Changes

2025-03-13 08:02:50CMS Info Systems, a midcap player in the IT software industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 446.55, down from a previous close of 455.75. Over the past year, CMS Info Systems has shown a return of 11.64%, significantly outperforming the Sensex, which recorded a return of 0.49% in the same period. However, year-to-date performance indicates a decline of 9.04%, while the Sensex has decreased by 5.26%. In terms of technical indicators, the weekly MACD is bearish, while the monthly MACD shows a mildly bearish trend. The Bollinger Bands indicate a bearish stance on a weekly basis, with a sideways trend observed monthly. Daily moving averages also reflect a bearish sentiment. The KST shows a bullish trend weekly, contrasting with other indicators. The company's performance over various time frames highlights its resilience...

Read MoreCMS Info Systems Faces Technical Trend Shifts Amid Market Sentiment Changes

2025-03-13 08:02:50CMS Info Systems, a midcap player in the IT software industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 446.55, down from a previous close of 455.75. Over the past year, CMS Info Systems has shown a return of 11.64%, significantly outperforming the Sensex, which recorded a return of 0.49% in the same period. However, year-to-date performance indicates a decline of 9.04%, while the Sensex has decreased by 5.26%. In terms of technical indicators, the weekly MACD is bearish, while the monthly MACD shows a mildly bearish trend. The Bollinger Bands indicate a bearish stance on a weekly basis, with a sideways trend observed monthly. Daily moving averages also reflect a bearish sentiment. The KST shows a bullish trend weekly, contrasting with other indicators. The company's performance over various time frames highlights its resilience...

Read MoreAnnouncement under Regulation 30 (LODR)-Change in Directorate

04-Apr-2025 | Source : BSEThe Board of Directors have appointed Mr. Vishnu Jerome (DIN 05325285) as an Additional Director of the Company designated as an Independent Director for 3 years w.e.f. 4th April 2025 subject to approval of the Shareholders within stipulated period.

Intimation - Receipt Of No Objection Letter From Stock Exchanges For De-Classification Of SION Investment Holdings Pte. Limited As A Promoter Of The Company

02-Apr-2025 | Source : BSEReceipt of No Objection letter from stock exchanges for de-classification of SION Investment Holdings Pte. Limited as a Promoter of the Company

Intimation Under Regulation 30 Of SEBI (Listing Obligations And Disclosure Requirements) Regulations 2015

01-Apr-2025 | Source : BSEPlease find enclosed herewith the Cautionary Letters received by the Company from the Stock Exchanges which are self-explanatory.

Corporate Actions

No Upcoming Board Meetings

CMS Info Systems Ltd has declared 32% dividend, ex-date: 11 Feb 25

No Splits history available

No Bonus history available

No Rights history available