Concord Biotech Adjusts Evaluation Score Amid Strong Long-Term Fundamentals and Market Outperformance

2025-04-03 08:14:22Concord Biotech has recently adjusted its evaluation score, reflecting a change in technical trends. The company maintains strong long-term fundamentals, with a notable average Return on Equity of 20.62% and healthy growth. Despite a flat quarterly performance, it has outperformed the broader market over the past year.

Read MoreConcord Biotech Shows Mixed Technical Trends Amidst Market Evaluation Revision

2025-04-03 08:06:38Concord Biotech, a midcap player in the Pharmaceuticals & Drugs industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1,695.00, showing a notable increase from the previous close of 1,656.30. Over the past week, the stock has demonstrated a return of 2.24%, contrasting with a decline of 0.87% in the Sensex, indicating a positive short-term performance relative to the broader market. In terms of technical indicators, the weekly MACD remains bearish, while the moving averages on a daily basis also reflect a bearish sentiment. The Bollinger Bands indicate a mildly bearish trend on a weekly basis, with a sideways movement observed monthly. The On-Balance Volume (OBV) shows a mildly bullish trend weekly, suggesting some accumulation despite the overall bearish indicators. Looking at the company's performance over different time frames, ...

Read More

Concord Biotech Faces Market Sentiment Shift Amid Declining Sales and Profits

2025-03-28 08:08:03Concord Biotech has recently experienced a change in its evaluation, influenced by shifts in technical indicators and market sentiment. The company reported net sales of Rs 244.22 crore for the quarter, alongside declines in profit metrics. Despite these challenges, it maintains strong long-term fundamentals and a solid annual growth rate.

Read MoreConcord Biotech Faces Technical Trend Challenges Amid Market Dynamics Shift

2025-03-28 08:04:13Concord Biotech, a midcap player in the Pharmaceuticals & Drugs industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1719.35, showing a notable increase from the previous close of 1657.85. Over the past week, the stock has demonstrated a return of 5.1%, outperforming the Sensex, which returned 1.65% during the same period. In terms of technical indicators, the MACD is signaling bearish momentum on a weekly basis, while the daily moving averages also reflect a bearish stance. The Bollinger Bands indicate a mildly bearish trend on a weekly basis, with a sideways movement observed monthly. The KST and Dow Theory metrics further support the bearish sentiment on a weekly basis, although the RSI shows no significant signals. Looking at the company's performance over various time frames, it has returned 9.09% over the past month and 14....

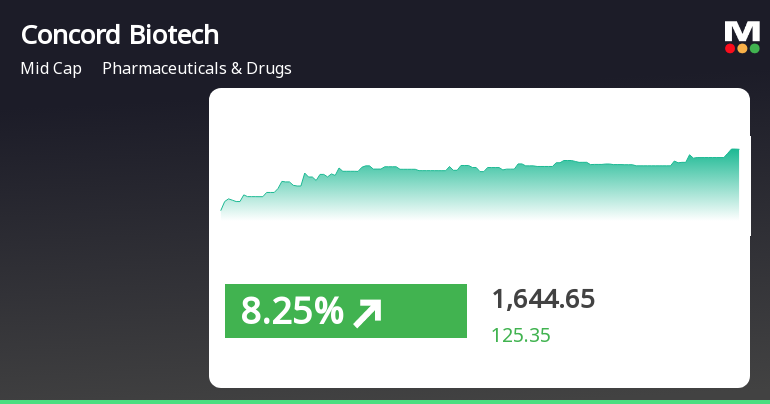

Read MoreConcord Biotech's Stock Activity Highlights Divergence from Broader Market Trends

2025-03-27 18:00:45Concord Biotech, a mid-cap player in the Pharmaceuticals & Drugs industry, has shown significant activity today, with its stock rising by 3.71%. This performance stands in contrast to the Sensex, which increased by only 0.41%. Over the past week, Concord Biotech's stock has gained 5.10%, again outperforming the Sensex's 1.65% rise. Despite these recent gains, the company's year-to-date performance reflects a decline of 22.20%, while the Sensex has remained relatively stable with a decrease of just 0.68%. Over the past year, Concord Biotech has achieved a return of 14.96%, significantly higher than the Sensex's 6.32% performance. The stock currently has a market capitalization of Rs 17,295.00 crore and a price-to-earnings (P/E) ratio of 55.13, which is notably higher than the industry average P/E of 37.39. Technical indicators suggest a bearish trend in the weekly MACD and moving averages, while the Bollin...

Read MoreConcord Biotech's Technical Indicators Reflect Mixed Market Sentiment and Trends

2025-03-05 08:03:47Concord Biotech, a midcap player in the Pharmaceuticals & Drugs industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1744.35, showing a notable increase from the previous close of 1519.30. Over the past year, Concord Biotech has demonstrated resilience with a return of 19.93%, significantly outperforming the Sensex, which recorded a return of just -1.19% during the same period. In terms of technical indicators, the weekly MACD is bearish, while the monthly indicators show no clear signal. The Relative Strength Index (RSI) remains neutral on both weekly and monthly charts, indicating a lack of momentum in either direction. The Bollinger Bands suggest a mildly bearish trend on a weekly basis, while the daily moving averages reflect a mildly bullish sentiment. The company's performance over various time frames reveals a mixed picture...

Read More

Concord Biotech Outperforms Sector Amid Broader Market Challenges and Small-Cap Gains

2025-03-04 10:26:18Concord Biotech has demonstrated significant stock performance, gaining 5.41% on March 4, 2025, and outperforming its sector. The stock reached an intraday high of Rs 1621, while the broader market, represented by the Sensex, opened lower and is nearing its 52-week low amid a bearish trend.

Read More

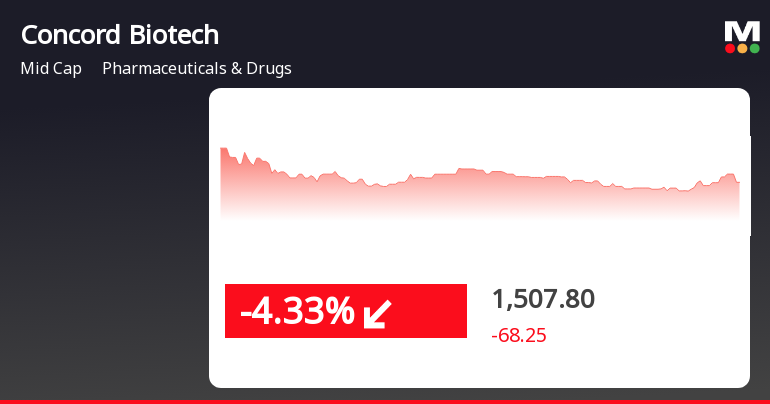

Concord Biotech Faces Significant Stock Decline Amid Broader Market Challenges

2025-02-28 11:50:30Concord Biotech's stock has declined significantly, dropping 5.13% on February 28, 2025, and accumulating an 11.2% loss over three days. The stock is trading below its moving averages and has experienced a 25.05% decline over the past month, contrasting with the broader market's performance.

Read More

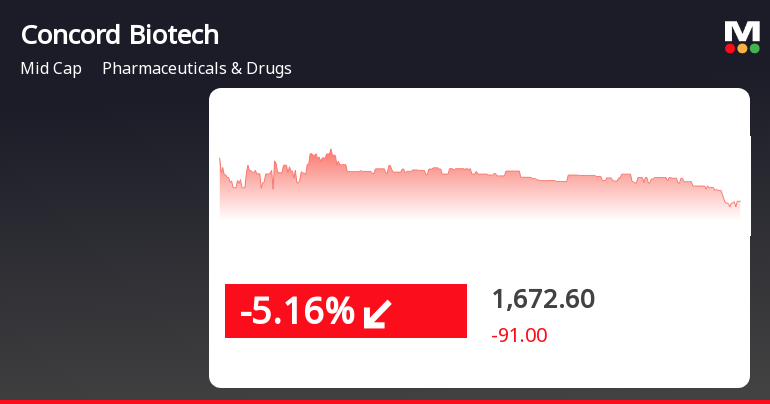

Concord Biotech Faces Significant Stock Decline Amid Sector Volatility and Underperformance

2025-02-19 15:35:32Concord Biotech's stock has faced significant challenges, declining 5.53% on February 19, 2025. The stock is trading below key moving averages and has dropped 23.19% over the past month, contrasting with the minor decline of the Sensex, highlighting ongoing volatility in the Pharmaceuticals & Drugs sector.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

09-Apr-2025 | Source : BSEEnclosed herewith the certificate under regulation 74(5) of the SEBI(DP) Regulation2018 for the quarter ended 31.03.2025.

Disclosure Under Of SEBI (LODR) Regulations 2015 Concord Biotech Secures Abbreviated New Drug Application (ANDA) Approval To Market Teriflunomide Tablets 7 Mg And 14 Mg In The US

08-Apr-2025 | Source : BSEThe company has been granted final approval from the USFDA for marketing its Teriflunomide tablets 7mg and 14mg

Commencement Of Commercial Production At Unit-4 Valthera

25-Mar-2025 | Source : BSEEnclosed herewith announcement about successfully commissioned and commenced production of Injectable at our Manufacturing facility situated at Valthera.

Corporate Actions

No Upcoming Board Meetings

Concord Biotech Ltd has declared 875% dividend, ex-date: 21 Jun 24

No Splits history available

No Bonus history available

No Rights history available