Cosmo First Shows Mixed Technical Trends Amid Strong Long-Term Performance

2025-04-03 08:01:37Cosmo First, a small-cap player in the packaging industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 645.00, showing a notable increase from the previous close of 631.35. Over the past year, Cosmo First has demonstrated a return of 19.68%, significantly outperforming the Sensex, which recorded a return of 3.67% in the same period. In terms of technical indicators, the MACD shows a bearish trend on a weekly basis while indicating a mildly bearish stance monthly. The Bollinger Bands also reflect a mildly bearish trend for both weekly and monthly assessments. The stock's moving averages present a bearish outlook on a daily basis, while the KST indicates a bullish trend on a monthly scale. Despite the mixed signals from various technical metrics, the company's performance over longer periods remains noteworthy. For instance, over fiv...

Read MoreCosmo First's Recent Gains Highlight Short-Term Trading Opportunities Amid Long-Term Challenges

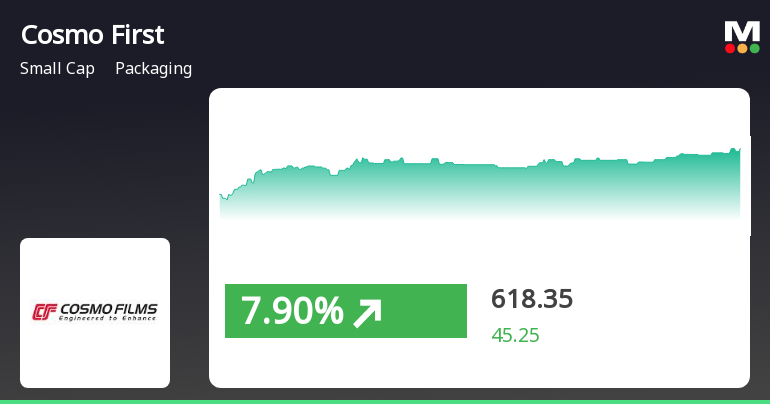

2025-03-05 09:50:02Cosmo First, a small-cap player in the packaging industry, has shown notable activity today, opening with a gain of 5.94%. The stock has outperformed its sector by 0.27%, reflecting a positive trend in the short term. Over the past two days, Cosmo First has recorded a total return of 7.92%, indicating a consecutive gain that has captured market attention. Today, the stock reached an intraday high of Rs 639.95, showcasing its volatility and potential for short-term trading opportunities. However, it is important to note that Cosmo First is currently trading below its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, suggesting a longer-term trend that may not be as favorable. In comparison to the broader market, Cosmo First's one-day performance of 2.92% stands out against the Sensex's 0.79%. However, the stock has faced challenges over the past month, with a decline of 16.16%, while the Sensex ...

Read MoreCosmo First Experiences Technical Trend Shifts Amid Market Volatility and Mixed Indicators

2025-03-05 08:00:47Cosmo First, a small-cap player in the packaging industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 604.05, showing a notable shift from its previous close of 573.10. Over the past year, Cosmo First has experienced a high of 1,084.10 and a low of 451.45, indicating significant volatility. In terms of technical indicators, the weekly MACD and moving averages suggest a bearish sentiment, while the monthly KST presents a contrasting bullish outlook. The Bollinger Bands and Dow Theory metrics also indicate a mildly bearish trend on a weekly and monthly basis. The On-Balance Volume (OBV) shows a mildly bullish stance weekly, but no clear trend on a monthly basis. When comparing the stock's performance to the Sensex, Cosmo First has faced challenges, particularly in the short term. Over the past week, the stock returned -8.48%, while ...

Read MoreCosmo First Ltd Shows Resilience Amid Market Volatility and Long-Term Growth Potential

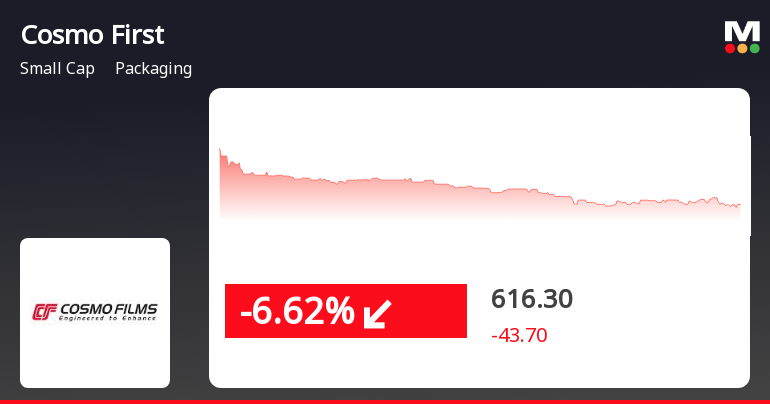

2025-03-04 18:00:19Cosmo First Ltd, a small-cap player in the packaging industry, has shown significant activity today, with its stock rising by 5.40%. This uptick comes amid a broader market context where the Sensex has experienced a slight decline of 0.13%. Over the past year, Cosmo First has outperformed the Sensex, achieving a return of 15.57% compared to the index's -1.19%. Despite today's positive movement, the stock has faced challenges in the short term, with a 1-week decline of 8.48% and a 1-month drop of 17.68%. Year-to-date, the stock is down 33.98%, reflecting a broader trend of volatility. However, over a longer horizon, Cosmo First has demonstrated resilience, with a remarkable 202.15% increase over the past five years and an impressive 964.84% rise over the last decade. Key financial metrics indicate a P/E ratio of 13.04, significantly lower than the industry average of 20.14, suggesting potential value withi...

Read More

Cosmo First Shows Potential Trend Reversal Amid Broader Market Challenges

2025-03-04 15:05:13Cosmo First, a small-cap packaging company, experienced a notable increase in stock price today, breaking a six-day decline. Despite this uptick, the stock remains below key moving averages and has faced challenges over the past month. In contrast, small-cap stocks are performing well against a bearish broader market.

Read More

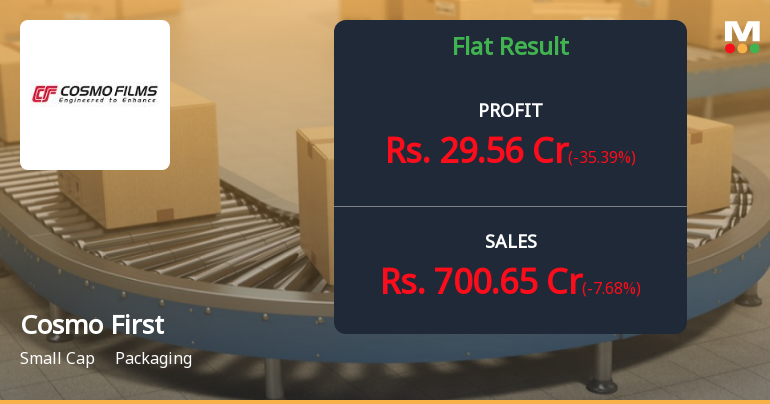

Cosmo First Faces Growth Challenges Amid Declining Operating Profit and Non-Operating Income Reliance

2025-03-03 18:01:25Cosmo First, a small-cap packaging company, has experienced a recent evaluation adjustment amid flat Q3 FY24-25 performance and a slight decline in operating profit over five years. Concerns arise from high reliance on non-operating income and reduced promoter stake, despite a favorable debt-to-equity ratio and strong market returns.

Read MoreCosmo First Adjusts Valuation Grade, Highlighting Competitive Positioning in Packaging Sector

2025-03-01 08:00:30Cosmo First, a small-cap player in the packaging industry, has recently undergone a valuation adjustment, reflecting its financial metrics and market positioning. The company's price-to-earnings ratio stands at 12.94, while its price-to-book value is recorded at 1.10. Additionally, Cosmo First shows a robust EV to EBITDA ratio of 8.95 and an EV to sales ratio of 0.84, indicating a competitive edge in operational efficiency. The company also boasts a PEG ratio of 0.24, suggesting favorable growth prospects relative to its valuation. With a dividend yield of 0.50%, it provides a modest return to shareholders. The latest return on capital employed (ROCE) is 6.66%, and the return on equity (ROE) is 7.24%, reflecting effective management of resources. In comparison to its peers, Cosmo First's valuation metrics are notably attractive. For instance, AGI Greenpac and Uflex have higher PE ratios, while TCPL Packag...

Read More

Cosmo First Faces Increased Volatility Amid Significant Stock Decline and Sector Underperformance

2025-02-27 15:35:12Cosmo First, a small-cap packaging company, has faced notable declines, losing 7.08% on February 27, 2025. The stock has underperformed its sector and experienced a four-day consecutive drop of 9.42%. It is currently trading below multiple moving averages, indicating ongoing challenges in its price performance.

Read More

Cosmo First Reports Flat Q3 FY24-25 Results Amid Strong PAT Growth and Income Concerns

2025-02-11 20:02:28Cosmo First has released its financial results for Q3 FY24-25, showing a flat performance. The company's Profit After Tax for the half-year reached Rs 75.31 crore, reflecting significant year-on-year growth. However, concerns arise from its heavy reliance on non-operating income, which poses risks to its business sustainability.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

07-Apr-2025 | Source : BSECompliance under Regulation 74(5) of SEBI (DP) Regulations 2018

Announcement Under Regulation 30 Of SEBI (LODR) Regulations 2015

01-Apr-2025 | Source : BSEAnnouncement under Regulation 30 of SEBI (LODR) Regulations 2015- Support Service Agreement with Cosmo Ferrites Limited

Intimation Under Regulation 30 Of SEBI (Listing Obligations And Disclosure Requirements) Regulations 2015

31-Mar-2025 | Source : BSEIntimation under Regulation 30 of SEBI (LODR) Regulations 2015-Update on Material Litigation

Corporate Actions

No Upcoming Board Meetings

Cosmo First Ltd has declared 30% dividend, ex-date: 26 Jul 24

No Splits history available

Cosmo First Ltd has announced 1:2 bonus issue, ex-date: 16 Jun 22

No Rights history available