Craftsman Automation Adjusts Valuation Grade Amid Mixed Market Performance and Competitive Metrics

2025-03-20 08:01:06Craftsman Automation, a midcap player in the engineering sector, has recently undergone a valuation adjustment reflecting its current market standing. The company's price-to-earnings ratio stands at 57.40, while its price-to-book value is noted at 4.05. Other key metrics include an EV to EBIT ratio of 26.90 and an EV to EBITDA ratio of 15.94, indicating its operational efficiency relative to its enterprise value. In terms of returns, Craftsman Automation has shown a mixed performance against the Sensex. Over the past week, the stock has declined by 3.18%, contrasting with a 1.92% gain in the Sensex. However, on a monthly basis, Craftsman has outperformed the index with a return of 15.27%, compared to a slight decline in the Sensex. Over the past year, the stock has delivered a return of 22.96%, significantly higher than the Sensex's 4.77%. When compared to its peers, Craftsman Automation's valuation metri...

Read More

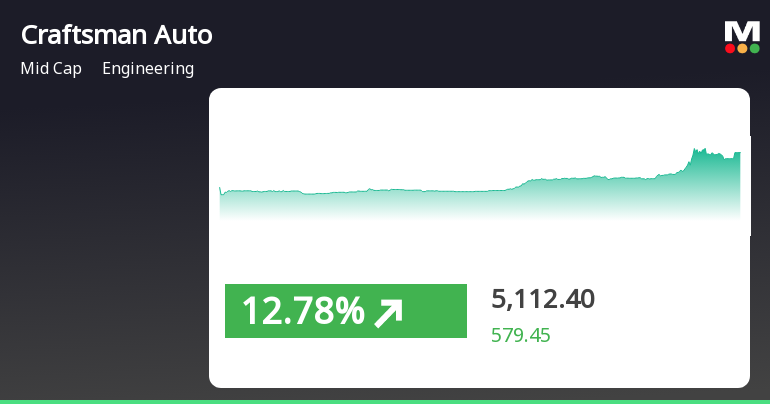

Craftsman Automation Surges Amid Broader Market Gains and Sector Outperformance

2025-03-05 15:50:45Craftsman Automation has experienced notable trading activity, achieving significant gains and outperforming its sector. The stock reached an intraday high amid high volatility, while also showing strong performance over the past week. The broader engineering sector and the Sensex have also seen positive movement, albeit with different trends.

Read MoreCraftsman Automation Shows Technical Trend Shifts Amid Market Volatility

2025-03-03 08:00:44Craftsman Automation, a midcap player in the engineering sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 4,471.65, showing a notable increase from the previous close of 4,185.35. Over the past week, the stock has reached a high of 4,705.65 and a low of 4,133.00, indicating some volatility in its trading range. In terms of technical indicators, the MACD shows a bearish trend on a weekly basis, while the monthly perspective leans towards a mildly bearish outlook. The Relative Strength Index (RSI) remains neutral for both weekly and monthly assessments. Bollinger Bands indicate a mildly bearish trend weekly, with a sideways movement monthly. The daily moving averages reflect a bearish sentiment, while the KST presents a contrasting bullish view on a monthly basis. When comparing the stock's performance to the Sensex, Craftsman Aut...

Read MoreCraftsman Automation Shows Mixed Technical Trends Amid Market Volatility

2025-03-02 08:00:44Craftsman Automation, a midcap player in the engineering sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 4,471.65, showing a notable increase from the previous close of 4,185.35. Over the past year, Craftsman Automation has reached a high of 7,107.15 and a low of 3,782.05, indicating significant volatility. In terms of technical indicators, the MACD shows a bearish trend on a weekly basis while presenting a mildly bearish outlook monthly. The Relative Strength Index (RSI) remains neutral, with no signals detected in both weekly and monthly assessments. Bollinger Bands indicate a mildly bearish trend weekly, while the monthly perspective is sideways. Moving averages reflect a bearish sentiment on a daily basis, and the KST shows a mixed picture with a bearish weekly trend and a bullish monthly outlook. When comparing the company...

Read MoreCraftsman Automation Shows Mixed Technical Trends Amid Market Volatility

2025-03-01 08:00:43Craftsman Automation, a midcap player in the engineering sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 4,471.65, showing a notable increase from the previous close of 4,185.35. Over the past week, the stock reached a high of 4,705.65 and a low of 4,133.00, indicating some volatility in its trading range. In terms of technical indicators, the MACD suggests a bearish trend on a weekly basis, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) shows no significant signals for both weekly and monthly assessments. Bollinger Bands indicate a mildly bearish trend weekly, with a sideways movement monthly. Daily moving averages also reflect a bearish sentiment, while the KST presents a contrasting bullish view on a monthly basis. When comparing the stock's performance to the Sensex, Craftsman Automation has ...

Read MoreCraftsman Automation Adjusts Valuation Grade Amid Competitive Engineering Sector Landscape

2025-03-01 08:00:14Craftsman Automation has recently undergone a valuation adjustment, reflecting its current standing in the engineering sector. The company's price-to-earnings ratio stands at 54.36, while its price-to-book value is recorded at 3.83. Other key financial metrics include an EV to EBIT ratio of 25.63 and an EV to EBITDA ratio of 15.18, indicating its operational efficiency. The company also shows a return on capital employed (ROCE) of 12.51% and a return on equity (ROE) of 8.99%, which are essential indicators of its profitability. In comparison to its peers, Craftsman Automation's valuation metrics present a mixed picture. For instance, Triveni Turbine is noted for its higher valuation, while Ircon International and Shriram Pistons maintain attractive valuations as well. Meanwhile, companies like Engineers India and Sansera Engineering are positioned differently within the market. Craftsman Automation's recen...

Read More

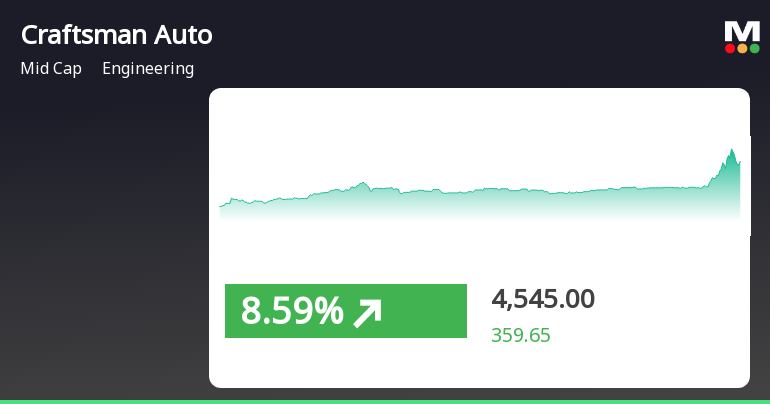

Craftsman Automation Outperforms Sector Amid Broader Engineering Industry Decline

2025-02-28 15:05:24Craftsman Automation has demonstrated strong performance, gaining 6.91% on February 28, 2025, and outperforming its sector amid a broader industry decline. The stock has consistently risen over four days, accumulating a total return of 9.76%, contrasting sharply with the declining Sensex.

Read More

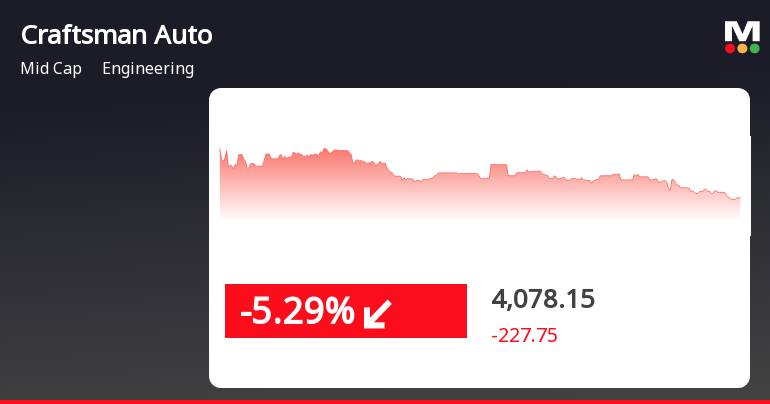

Craftsman Automation Faces Continued Stock Volatility Amid Broader Market Trends

2025-01-30 14:20:25Craftsman Automation has faced notable stock volatility, declining for five consecutive days and experiencing a significant drop over the past month. The company's performance has lagged behind its sector, with its stock trading below multiple moving averages, reflecting ongoing challenges in the market.

Read More

Craftsman Automation Reports Mixed Financial Results Amid Rising Interest Costs

2025-01-29 17:50:37Craftsman Automation's financial results for the quarter ending December 2024 show net sales reaching Rs 1,576.09 crore, the highest in five quarters. However, profitability metrics reveal challenges, with Profit Before Tax and Profit After Tax declining significantly, alongside rising interest costs impacting financial stability.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

09-Apr-2025 | Source : BSEPlease find enclosed the Certificate under Regulation 74(5) of the Securities and Exchange Board of India (Depositories and Participants) Regulations 2018 for the quarter ended 31st March 2025 received from MUFG Intime India Private Limited Registrar and Share Transfer Agent (RTA) of the Company.

Closure of Trading Window

24-Mar-2025 | Source : BSEWe wish to inform you that pursuant to the Companys Code of Conduct to regulate monitor and report trading by insider and the Securities and Exchange Board of India (Prohibition of Insider Trading) Regulations 2015 the trading Window for dealing in shares of the Company will remain closed from Tuesday 1st April 2025 till the expiry of 48 hours after the declaration of the Audited Financial Result of the Company for the quarter and financial year ending 31st March 2025

Reply To The Clarification Sought By BSE Limited On Price Movement Of The CompanyS Security

07-Mar-2025 | Source : BSEPlease find the enclosed reply to the clarification sought by BSE Limited on price movement of the Companys security.

Corporate Actions

No Upcoming Board Meetings

Craftsman Automation Ltd has declared 225% dividend, ex-date: 17 May 24

No Splits history available

No Bonus history available

No Rights history available