Crest Ventures Opens Strong with 13.16% Gain, Outpacing Sector Performance

2025-03-27 15:25:04Crest Ventures, a small-cap player in the construction and real estate sector, has shown significant activity today, opening with a notable gain of 13.16%. The stock's performance has outpaced its sector by 3.65%, reflecting a strong intraday movement. Crest Ventures reached an intraday high of Rs 413.95, indicating high volatility with an intraday fluctuation of 8.33%. In terms of performance metrics, Crest Ventures has delivered a 2.93% increase over the past day, compared to a modest 0.45% rise in the Sensex. Over the past month, the stock has risen by 9.13%, while the Sensex has gained 4.05%. Technical indicators present a mixed picture; while the stock is currently above its 20-day moving average, it remains below the 5-day, 50-day, 100-day, and 200-day moving averages. The MACD and Bollinger Bands suggest bearish trends on a weekly basis, while the Dow Theory indicates a mildly bullish outlook. Wit...

Read More

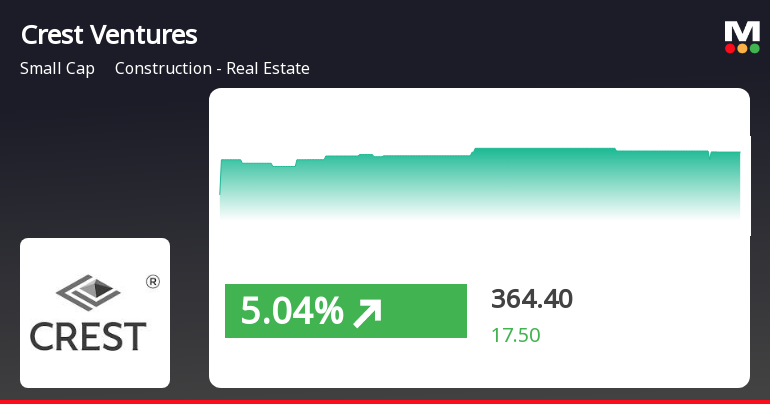

Crest Ventures Experiences Significant Stock Volatility Amid Broader Market Recovery

2025-03-27 09:30:15Crest Ventures, a small-cap construction and real estate company, experienced notable trading activity, with significant intraday volatility. The stock has shown mixed performance over various time frames, outperforming its sector today while facing declines over the past three months and year-to-date. It remains above several short-term moving averages.

Read MoreCrest Ventures Faces Bearish Technical Trends Amid Market Dynamics Shift

2025-03-27 08:00:28Crest Ventures, a small-cap player in the construction and real estate sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 365.80, down from a previous close of 409.00, with a notable 52-week high of 621.20 and a low of 304.55. Today's trading saw a high of 393.00 and a low matching the current price. The technical summary indicates a bearish sentiment across various indicators. The MACD shows a bearish trend on a weekly basis, while the monthly perspective is mildly bearish. Similarly, the Bollinger Bands and KST also reflect bearish conditions, with moving averages signaling a bearish outlook on a daily basis. The On-Balance Volume (OBV) presents a mildly bearish trend, suggesting a cautious market sentiment. In terms of performance, Crest Ventures has faced challenges compared to the Sensex. Over the past week, the stock returne...

Read More

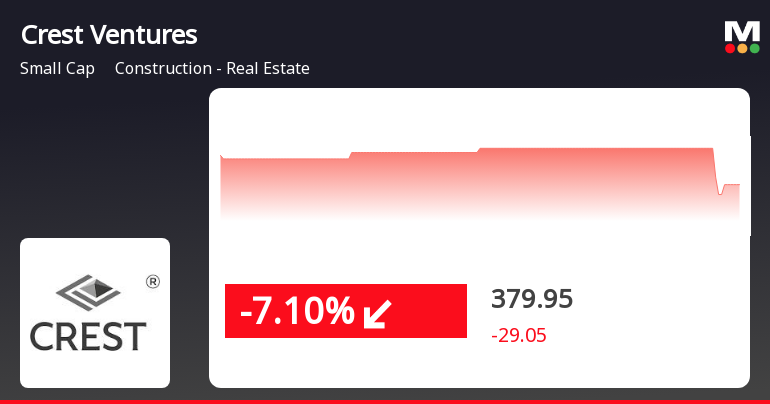

Crest Ventures Faces Significant Stock Decline Amid Broader Market Stability

2025-03-26 13:30:16Crest Ventures, a small-cap construction and real estate firm, saw a notable decline in its shares today, underperforming against the broader market. While the stock has shown significant long-term growth, it has faced recent challenges, including a year-to-date decrease, contrasting with the stability of the Sensex.

Read MoreCrest Ventures Faces Mixed Technical Trends Amid Market Evaluation Revision

2025-03-26 08:00:43Crest Ventures, a small-cap player in the construction and real estate sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 409.00, showing a notable increase from the previous close of 396.00. Over the past year, Crest Ventures has experienced a stock return of 3.75%, while the Sensex has returned 7.12%, indicating a relative underperformance in the broader market context. The technical summary for Crest Ventures reveals a mixed outlook. The MACD indicates bearish trends on a weekly basis, while the monthly perspective shows a mildly bearish stance. The Bollinger Bands present a mildly bearish signal weekly but are bullish on a monthly scale. Moving averages also reflect a mildly bearish trend, suggesting caution in the short term. In terms of returns, Crest Ventures has demonstrated significant resilience over longer periods, with...

Read MoreCrest Ventures Faces Technical Challenges Amid Mixed Market Sentiment and Long-Term Resilience

2025-03-25 08:01:03Crest Ventures, a small-cap player in the construction and real estate sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 396.00, slightly down from its previous close of 401.00. Over the past year, Crest Ventures has experienced a stock return of 0.46%, which contrasts with a 7.07% return from the Sensex, indicating a lag in performance relative to the broader market. In terms of technical indicators, the weekly MACD and Bollinger Bands suggest a bearish sentiment, while the monthly indicators show a mix of mildly bearish and bullish signals. The moving averages and KST also reflect a bearish trend, highlighting potential challenges in the stock's performance. Despite these technical trends, Crest Ventures has shown resilience over longer periods, with a remarkable 676.47% return over the past five years, significantly outperform...

Read MoreCrest Ventures Faces Mixed Technical Trends Amid Market Evaluation Revision

2025-03-21 08:00:20Crest Ventures, a small-cap player in the construction and real estate sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 403.50, showing a slight increase from the previous close of 401.30. Over the past year, Crest Ventures has experienced a stock return of 2.11%, while the Sensex has returned 5.89% in the same period. The technical summary indicates a mixed outlook, with various indicators suggesting a mildly bearish trend. The MACD shows bearish signals on a weekly basis and mildly bearish on a monthly basis, while the Bollinger Bands reflect a mildly bearish stance weekly and bullish monthly. Moving averages also indicate a mildly bearish trend, and the KST aligns with this sentiment. In terms of performance, Crest Ventures has demonstrated notable resilience over longer periods, with a remarkable 643.09% return over the past...

Read More

Crest Ventures Faces Continued Stock Volatility Amid Broader Market Challenges

2025-03-12 15:45:15Crest Ventures, a small-cap construction and real estate firm, has faced notable stock volatility, marking its fourth consecutive day of losses. Despite a significant long-term growth of 631.87% over the past decade, the stock has underperformed in the short term, reflecting broader market challenges.

Read MoreCrest Ventures Faces Technical Trend Shifts Amid Market Evaluation Adjustments

2025-03-10 08:00:24Crest Ventures, a small-cap player in the construction and real estate sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 408.45, slightly down from the previous close of 414.90. Over the past year, Crest Ventures has experienced a decline of 6.11%, contrasting with a modest gain of 0.29% in the Sensex during the same period. The technical summary indicates a bearish sentiment in the weekly MACD and moving averages, while the monthly indicators show a mix of mildly bearish and bullish trends. Notably, the stock's performance over the last three years has been impressive, with a return of 141.40%, significantly outpacing the Sensex's 40.67% return. Over five years, Crest Ventures has delivered a remarkable 348.85% return compared to the Sensex's 97.82%. In the short term, the stock has shown a strong weekly return of 19.55%, while ...

Read MoreClosure of Trading Window

27-Mar-2025 | Source : BSEPlease refer the attached intimation.

Announcement under Regulation 30 (LODR)-Code of Conduct under SEBI (PIT) Regulations 2015

21-Mar-2025 | Source : BSEPlease refer the attached intimation.

Identification And Designation Of Senior Management Personnel

21-Mar-2025 | Source : BSEPlease refer the attached intimation.

Corporate Actions

No Upcoming Board Meetings

Crest Ventures Ltd has declared 10% dividend, ex-date: 23 Aug 24

No Splits history available

No Bonus history available

Crest Ventures Ltd has announced 1:2 rights issue, ex-date: 15 Sep 16