Cybele Industries Sees Strong Buying Momentum Amid Market Challenges and Price Gains

2025-04-03 09:40:08Cybele Industries Ltd is currently witnessing strong buying activity, marking a notable performance in the market. Today, the stock has gained 0.76%, outperforming the Sensex, which has declined by 0.38%. Over the past week, Cybele Industries has shown a positive trend with a total increase of 2.08%, while the Sensex has dropped by 1.64%. Notably, the stock has experienced consecutive gains over the last three days, accumulating a total return of 14.29%. Despite these recent gains, Cybele Industries has faced challenges over longer time frames, with a significant decline of 25.51% over the past month and 45.58% over the past year, contrasting sharply with the Sensex's 3.32% increase during the same period. The stock is currently trading below its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, indicating a bearish trend in the longer term. The buying pressure may be attributed to various fact...

Read MoreCybele Industries Surges Nearly 10% Amid Market Correction and Buying Pressure

2025-04-01 14:15:06Cybele Industries Ltd is witnessing significant buying activity today, with the stock surging by 9.96%. This performance starkly contrasts with the Sensex, which has declined by 1.78%. Notably, this marks a trend reversal for Cybele Industries after four consecutive days of decline, indicating a potential shift in market sentiment. The stock reached an intraday high of Rs 20.31, reflecting a robust recovery amid high volatility, with an intraday fluctuation of 5.18%. Despite this positive movement, the stock has faced challenges over the past week, down 19.63%, and has seen a substantial decline of 28.36% over the past month. In terms of longer-term performance, Cybele Industries has shown resilience, with a remarkable 302.18% increase over the past five years, compared to the Sensex's 169.01% rise during the same period. However, the stock is currently trading below its 5-day, 20-day, 50-day, 100-day, a...

Read More

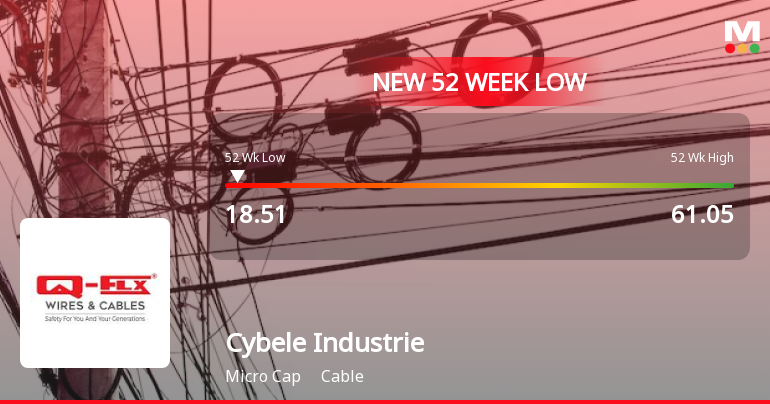

Cybele Industries Faces Financial Struggles Amid Significant Stock Volatility and Decline

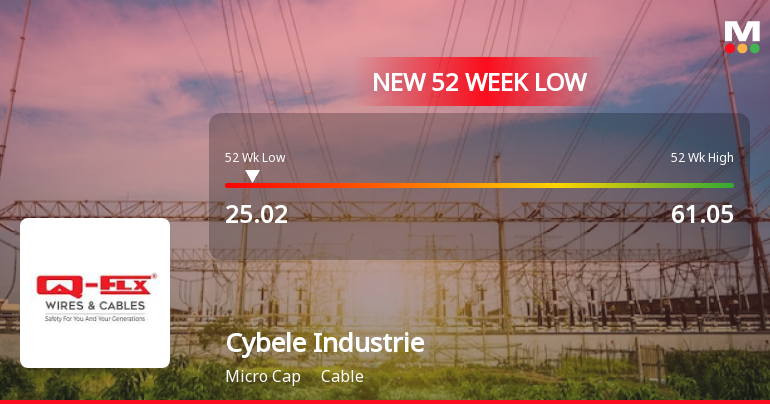

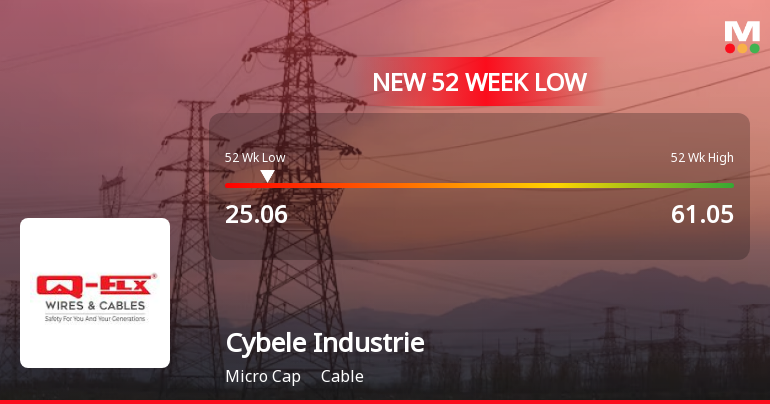

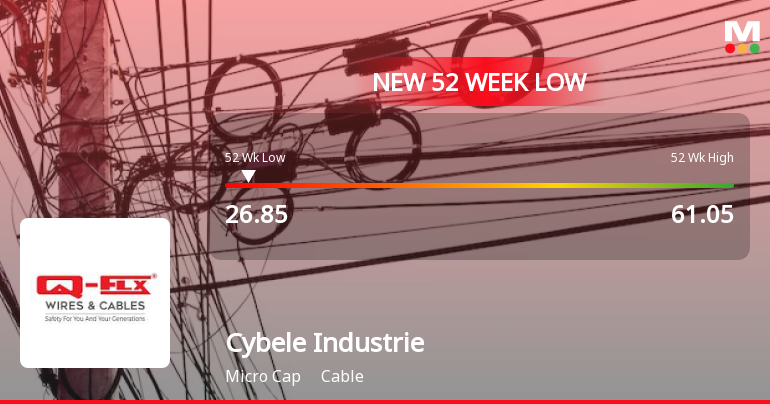

2025-03-28 13:05:31Cybele Industries, a microcap in the cable sector, has faced significant volatility, reaching a new 52-week low. The company has reported consecutive operating losses, a declining ability to service debt, and a substantial drop in net sales and profit. Its stock has underperformed compared to broader market trends.

Read More

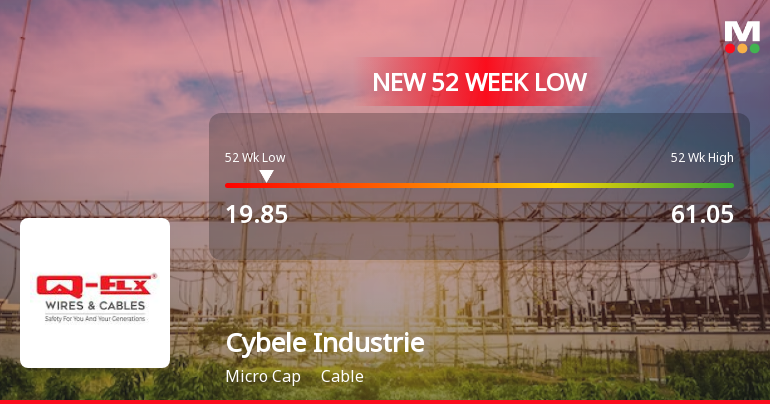

Cybele Industries Faces Severe Decline Amidst Heightened Market Volatility and Weak Financials

2025-03-27 10:07:18Cybele Industries, a microcap in the cable sector, has faced significant volatility, reaching a new 52-week low. The stock has underperformed its sector and reported consecutive declines, with negative financial metrics including operating losses and a substantial drop in net sales and profit. Concerns about its long-term viability persist.

Read More

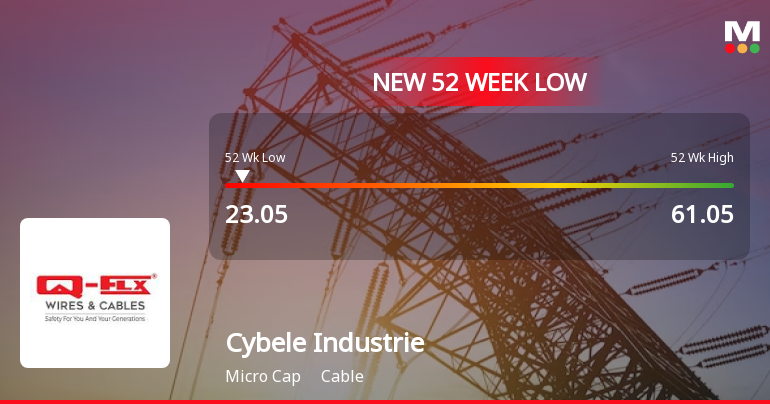

Cybele Industries Faces Significant Challenges Amid Broader Market Decline and Poor Financial Performance

2025-03-26 14:35:15Cybele Industries, a microcap in the cable sector, has faced notable volatility, reaching a new 52-week low. The stock has underperformed its sector and is trading below key moving averages. The company reported operating losses, declining net sales, and negative results for three consecutive quarters, indicating a challenging financial position.

Read More

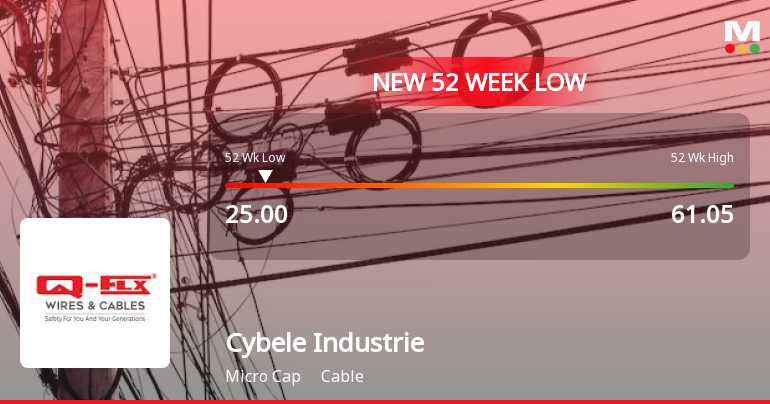

Cybele Industries Faces Financial Struggles Amid Broader Market Rally Challenges

2025-03-25 14:35:44Cybele Industries, a microcap in the cable sector, has hit a new 52-week low after a brief gain period. The company has faced significant challenges, including a 29.26% decline over the past year, disappointing financial results, and concerns over its ability to service debt, reflecting ongoing volatility.

Read More

Cybele Industries Faces Heightened Volatility Amid Significant Financial Challenges

2025-03-12 13:05:41Cybele Industries, a microcap in the cable sector, has hit a new 52-week low amid significant volatility. The company has faced a 33.13% decline in stock price over the past year, reporting consecutive quarterly losses and a troubling EBIT to interest ratio, indicating financial distress and challenges in debt servicing.

Read More

Cybele Industries Faces Financial Struggles Amid Broader Market Volatility

2025-03-11 14:35:14Cybele Industries, a microcap in the cable sector, has faced notable volatility, reaching a new 52-week low. The company has reported significant operating losses, a low return on equity, and declining net sales over the past year, raising concerns about its financial stability and investment viability.

Read More

Cybele Industries Faces Continued Decline Amid Broader Market Volatility

2025-03-03 15:10:53Cybele Industries, a microcap in the cable sector, has reached a new 52-week low, continuing a downward trend with a cumulative drop of 7.69% over four days. The stock is trading below key moving averages, reflecting ongoing market challenges, while the broader Sensex index has also turned negative.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

08-Apr-2025 | Source : BSEIntimation to BSE for submission of Quarterly Certificate from RTA under SEBI DP Regulations 74(5) 2018 for the Quarter ended March 2025

Format of the Initial Disclosure to be made by an entity identified as a Large Corporate : Annexure A

05-Apr-2025 | Source : BSEFormat of Initial Disclosure to be made by an entity identified as a Large Corporate.

| Sr. No. | Particulars | Details |

| 1 | Name of Company | Cybele Industries Ltd |

| 2 | CIN NO. | L31300TN1993PLC025063 |

| 3 | Outstanding borrowing of company as on 31st March / 31st December as applicable (in Rs cr) | 182079580.00 |

| 4 | Highest Credit Rating during the previous FY | 0 |

| 4a | Name of the Credit Rating Agency issuing the Credit Rating mentioned in (4) | Not Applicable |

| 5 | Name of Stock Exchange# in which the fine shall be paid in case of shortfall in the required borrowing under the framework | BSE |

Designation: COMPANY SECRETARY AND COMPLIANCE OFFICER

EmailId: corporate@qflexcable.com

Designation: CHIEF FINANCIAL OFFICER

EmailId: corporate@qlfexcable.com

Date: 05/04/2025

Note: In terms para of 3.2(ii) of the circular beginning F.Y 2022 in the event of shortfall in the mandatory borrowing through debt securities a fine of 0.2% of the shortfall shall be levied by Stock Exchanges at the end of the two-year block period. Therefore an entity identified as LC shall provide in its initial disclosure for a financial year the name of Stock Exchange to which it would pay the fine in case of shortfall in the mandatory borrowing through debt markets.

Closure of Trading Window

29-Mar-2025 | Source : BSEClosing Trading window for Declaration of audited financial results for the Quarter and Year ended March 31 2025

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available