D-Link India Faces Mixed Technical Trends Amid Market Evaluation Revision

2025-04-02 08:04:32D-Link India, a small-cap player in the trading industry, has recently undergone an evaluation revision reflecting its current market dynamics. The company's technical indicators present a mixed picture, with the MACD signaling bearish trends on a weekly basis and mildly bearish on a monthly basis. The Relative Strength Index (RSI) shows no signals for both weekly and monthly periods, indicating a lack of momentum in price movements. Additionally, Bollinger Bands and KST metrics also reflect mildly bearish trends on a monthly basis, while daily moving averages indicate a bearish stance. In terms of performance, D-Link India has shown varied returns compared to the Sensex. Over the past week, the stock returned -1.45%, while the Sensex experienced a decline of 2.55%. Notably, in the one-month period, D-Link India outperformed the Sensex with a return of 12.35% against the Sensex's 3.86%. However, year-to-da...

Read MoreD-Link India Shows Mixed Technical Trends Amid Strong Long-Term Performance

2025-03-20 08:01:30D-Link India, a small-cap player in the trading industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 428.50, showing a notable increase from the previous close of 414.50. Over the past year, D-Link India has demonstrated a robust performance with a return of 56.93%, significantly outpacing the Sensex's return of 4.77% during the same period. In terms of technical indicators, the MACD shows a bearish trend on a weekly basis while indicating a mildly bearish stance monthly. The Bollinger Bands reflect a mildly bearish trend weekly, contrasting with a bullish outlook monthly. The stock's moving averages indicate a bearish trend on a daily basis, while the KST presents a mixed picture with a bearish weekly trend and a bullish monthly trend. D-Link India's performance over various time frames highlights its resilience, particularly ov...

Read More

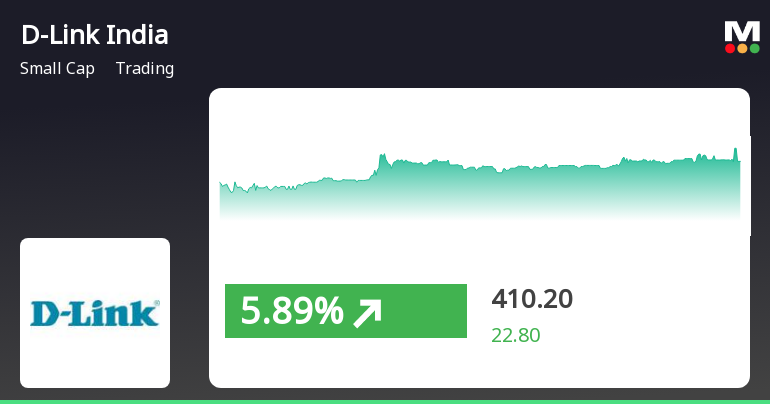

D-Link India's Recent Gains Highlight Diverging Short-Term and Long-Term Performance Trends

2025-03-06 15:35:20D-Link India experienced notable gains on March 6, 2025, marking its fourth consecutive day of increases. The stock is currently above its 5-day moving average but below longer-term averages. The broader market also showed positive momentum, with small-cap stocks leading the way.

Read More

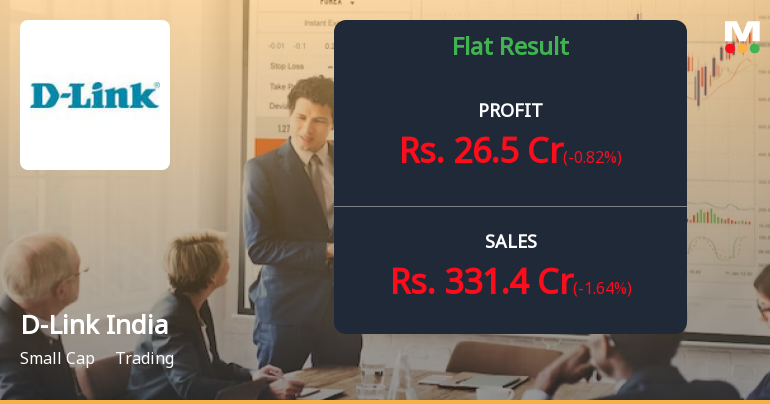

D-Link India Reports Strong Q3 FY24-25 Results Amid Evaluation Adjustments

2025-02-07 18:50:50D-Link India has announced its financial results for Q3 FY24-25, showcasing a strong performance with the highest operating profit in five quarters at Rs 33.39 crore. The operating profit margin reached 10.08%, and the profit before tax also peaked at Rs 31.50 crore, highlighting improved operational efficiency.

Read More

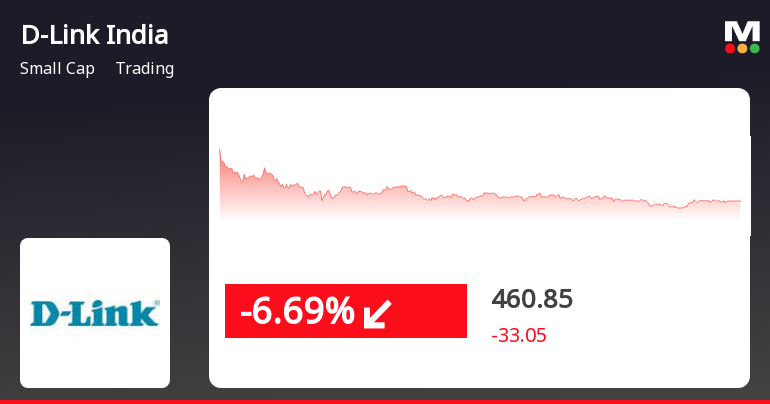

D-Link India Faces Ongoing Stock Decline Amid Broader Market Challenges

2025-01-27 15:00:18D-Link India has faced a notable decline in stock performance, losing 7.31% on January 27, 2025, and experiencing a cumulative loss of 8.84% over two days. The stock is trading below key moving averages, reflecting a challenging period amid broader sector declines, despite a high dividend yield.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

04-Apr-2025 | Source : BSECertificate under Reg.74(5) of SEBI (DP) Regulations 2018

Board Meeting Intimation for The Quarter And Year Ending March 31 2025

25-Mar-2025 | Source : BSED-Link (India) Ltdhas informed BSE that the meeting of the Board of Directors of the Company is scheduled on 03/05/2025 inter alia to consider and approve Financial Results for the quarter and year ending March 31 2025

Closure of Trading Window

25-Mar-2025 | Source : BSEIntimation of Closure of Trading Window

Corporate Actions

03 May 2025

D-Link India Ltd has declared 250% dividend, ex-date: 12 Nov 24

No Splits history available

No Bonus history available

No Rights history available