D P Wires Adjusts Valuation Amidst Financial Metric Changes and Market Challenges

2025-04-03 08:11:22D P Wires, a microcap company in the Steel/Sponge Iron/Pig Iron sector, has recently adjusted its evaluation based on financial metrics and market position. The company shows operational efficiency with a PE ratio of 11.27 and a ROCE of 21.56%, despite facing recent challenges and a mildly bearish technical trend.

Read MoreD P Wires Adjusts Valuation Grade Amid Competitive Steel Industry Landscape

2025-04-02 08:02:50D P Wires, a microcap player in the Steel/Sponge Iron/Pig Iron industry, has recently undergone a valuation adjustment, reflecting its current market standing. The company reports a price-to-earnings (P/E) ratio of 11.36 and an enterprise value to EBITDA ratio of 6.89, indicating its financial metrics are competitive within the sector. The return on capital employed (ROCE) stands at 21.56%, while the return on equity (ROE) is recorded at 11.69%, showcasing its operational efficiency. In comparison to its peers, D P Wires maintains a relatively attractive valuation, although some competitors exhibit stronger metrics. For instance, Beekay Steel Industries holds a lower P/E ratio of 7.6, while Gandhi Special Tube presents a higher P/E at 13.23. The enterprise value to EBITDA ratios also vary, with Ratnaveer Precision at 10.53 and Suraj at 18.16, highlighting a diverse range of valuations across the industry. ...

Read MoreD P Wires Adjusts Valuation Grade Amid Competitive Industry Landscape and Financial Metrics

2025-03-27 08:00:53D P Wires, a microcap player in the Steel/Sponge Iron/Pig Iron industry, has recently undergone a valuation adjustment, reflecting a reassessment of its financial metrics. The company currently boasts a price-to-earnings (P/E) ratio of 11.08 and an enterprise value to EBITDA ratio of 6.66, indicating a competitive position within its sector. Additionally, its return on capital employed (ROCE) stands at 21.56%, while return on equity (ROE) is recorded at 11.69%. In comparison to its peers, D P Wires demonstrates a favorable valuation profile. For instance, Beekay Steel Industries has a P/E ratio of 7.36, while Gandhi Special Tube shows a higher P/E at 13.93. Notably, Suraj's P/E ratio is significantly higher at 28.89, suggesting that D P Wires may offer a more attractive valuation relative to some competitors. Despite recent stock performance showing declines over various periods, including a 54% drop ove...

Read More

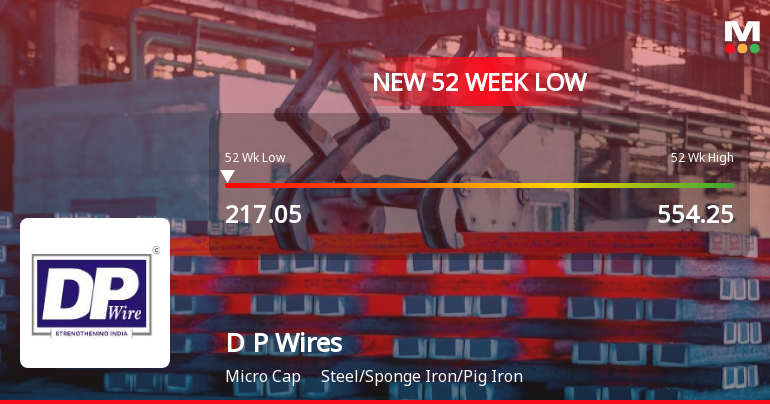

D P Wires Faces Ongoing Challenges Amid Significant Stock Volatility and Declining Financial Metrics

2025-03-18 16:05:46D P Wires, a microcap in the Steel/Sponge Iron/Pig Iron sector, has hit a new 52-week low, continuing a seven-day decline of 16.55%. The company reported a 54.02% drop in stock value over the past year, alongside significant decreases in net sales and profit after tax, indicating ongoing financial challenges.

Read More

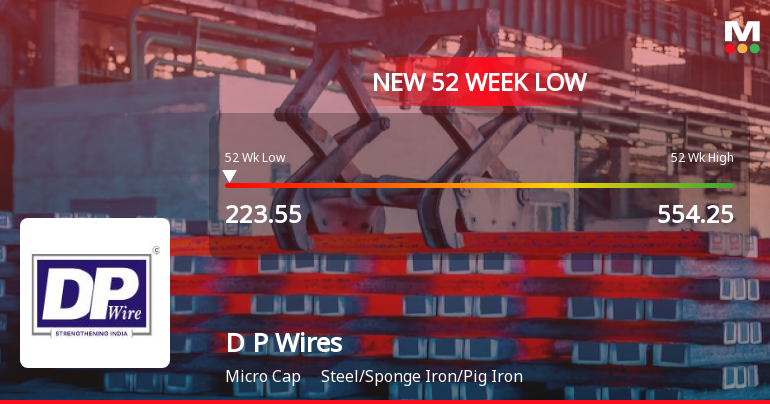

D P Wires Faces Significant Financial Challenges Amidst Market Volatility

2025-03-17 16:06:01D P Wires, a microcap in the Steel/Sponge Iron/Pig Iron sector, has faced notable volatility, reaching a 52-week low. The company reported a significant decline in net sales and profit after tax, alongside a bearish trading trend. Over the past year, the stock has dropped substantially, contrasting with broader market gains.

Read More

D P Wires Faces Continued Decline Amidst Significant Sales and Profit Reductions

2025-03-13 16:05:47D P Wires, a microcap in the Steel/Sponge Iron/Pig Iron sector, has faced significant volatility, reaching a new 52-week low. The company reported a 39.10% decline in net sales and a 21.5% drop in profit after tax, continuing a trend of negative results over five quarters.

Read More

D P Wires Faces Significant Financial Challenges Amidst Market Volatility and Declining Performance

2025-03-12 16:05:48D P Wires, a microcap in the Steel/Sponge Iron/Pig Iron sector, has faced significant volatility, reaching a new 52-week low. The company reported a 19.55% decline in operating profit and a 52.13% drop in value over the past year, amid falling net sales and profit after tax.

Read MoreD P Wires Adjusts Valuation Amidst Challenging Market Performance in Steel Sector

2025-03-11 08:00:46D P Wires, a microcap player in the Steel/Sponge Iron/Pig Iron industry, has recently undergone a valuation adjustment, reflecting a shift in its financial standing. The company's current price is 230.00, with a previous close of 241.50. Over the past year, D P Wires has experienced a significant decline in stock performance, with a return of -54.14%, contrasting sharply with a negligible change in the Sensex during the same period. Key financial metrics for D P Wires include a PE ratio of 12.74 and an EV to EBITDA ratio of 8.00, which positions it competitively within its sector. The company's return on capital employed (ROCE) stands at 21.56%, while its return on equity (ROE) is recorded at 11.69%. In comparison to its peers, D P Wires shows a relatively favorable valuation, particularly when contrasted with companies like Beekay Steel Industries and Steel Exchange, which have higher PE ratios and EV t...

Read More

D P Wires Faces Significant Challenges Amidst Declining Sales and Profitability Trends

2025-03-04 16:07:17D P Wires, a microcap in the Steel/Sponge Iron/Pig Iron sector, has faced notable volatility, recently hitting a 52-week low. The company reported a significant year-on-year performance drop, with declining net sales and profit after tax. It is currently trading below key moving averages, indicating a bearish outlook.

Read MoreClosure of Trading Window

24-Mar-2025 | Source : BSECLOSURE OF TRADING WINDOW

Shareholder Meeting / Postal Ballot-Scrutinizers Report

22-Mar-2025 | Source : BSEEGM Scrutinizer Report and Voting Results

Shareholder Meeting / Postal Ballot-Outcome of EGM

21-Mar-2025 | Source : BSEProceedings for EGM held on 20th March 2025

Corporate Actions

No Upcoming Board Meetings

D P Wires Ltd has declared 12% dividend, ex-date: 22 Sep 23

No Splits history available

D P Wires Ltd has announced 1:7 bonus issue, ex-date: 08 Nov 23

No Rights history available