Damodar Industries Adjusts Valuation Grade Amid Competitive Textile Sector Landscape

2025-03-06 08:00:25Damodar Industries, a microcap player in the textile industry, has recently undergone a valuation adjustment, reflecting a shift in its financial standing. The company's current price is 32.55, slightly above its previous close of 32.50, with a 52-week high of 57.90 and a low of 28.07. Key financial metrics reveal a PE ratio of 19.50 and an EV to EBITDA of 9.50, indicating a competitive position within its sector. The company's price to book value stands at 0.55, while the PEG ratio is noted at 0.75. However, the return on capital employed (ROCE) and return on equity (ROE) are relatively low at 1.08% and 2.82%, respectively. In comparison to its peers, Damodar Industries shows a more favorable valuation profile, particularly when looking at the PE and EV to EBITDA ratios. For instance, Sportking India and Mafatlal Industries, both categorized as attractive, have lower PE ratios, while Faze Three and GHCL...

Read More

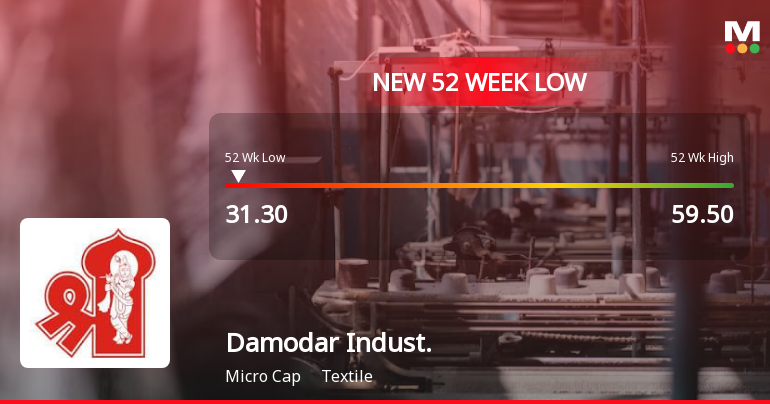

Damodar Industries Faces Persistent Downward Trend Amid High Market Volatility

2025-03-03 10:35:27Damodar Industries, a microcap textile firm, faced significant volatility, hitting a 52-week low of Rs. 29 after an initial gain. The stock has declined consecutively over four days, with a yearly drop of over 50%. It is trading below key moving averages, indicating a persistent downward trend.

Read More

Damodar Industries Faces Significant Volatility Amidst Broader Textile Sector Challenges

2025-02-28 12:35:15Damodar Industries, a microcap textile firm, is nearing its 52-week low amid significant volatility, underperforming its sector. The stock has declined 11.76% over three days and 44.23% over the past year, contrasting with a slight gain in the Sensex, reflecting ongoing challenges in the market.

Read More

Damodar Industries Faces Significant Volatility Amidst Challenging Market Conditions

2025-02-27 13:35:14Damodar Industries, a microcap textile firm, is facing significant volatility, nearing its 52-week low. The stock has declined consecutively over two days, underperforming its sector and trading below key moving averages. Over the past year, it has experienced a notable decline, contrasting with broader market gains.

Read MoreDamodar Industries Adjusts Valuation Grade Amidst Competitive Textile Industry Landscape

2025-02-24 12:56:47Damodar Industries, a microcap player in the textile industry, has recently undergone a valuation adjustment, reflecting its current financial standing. The company's price-to-earnings ratio stands at 20.08, while its price-to-book value is notably low at 0.57. The enterprise value to EBITDA ratio is recorded at 9.58, indicating a favorable valuation relative to earnings before interest, taxes, depreciation, and amortization. In terms of performance metrics, Damodar Industries shows a return on capital employed (ROCE) of 1.08% and a return on equity (ROE) of 2.82%. The PEG ratio, which assesses growth relative to earnings, is at 0.78, suggesting a potentially attractive growth profile. When compared to its peers, Damodar Industries presents a competitive edge with a lower PEG ratio than several companies in the sector, such as Sportking India and Mafatlal Industries. However, it faces challenges in terms ...

Read More

Damodar Industries Faces Volatility Amid Stock Price Reversal and Sector Challenges

2025-02-18 14:55:12Damodar Industries, a microcap textile firm, reached a 52-week low but has shown signs of recovery after two days of decline. Despite outperforming its sector, the stock remains below key moving averages and has seen a significant year-over-year decline, contrasting with the broader market's positive performance.

Read More

Damodar Industries Faces Significant Volatility Amid Ongoing Market Challenges

2025-02-17 10:05:29Damodar Industries, a microcap textile firm, has faced significant volatility, hitting a new 52-week low of Rs. 33.6. The stock has underperformed its sector and has seen a cumulative loss of 9.19% over two days, reflecting ongoing challenges in the market.

Read More

Damodar Industries Faces Significant Volatility Amid Broader Textile Sector Challenges

2025-02-11 15:35:13Damodar Industries, a microcap textile firm, has faced significant volatility, recently hitting a 52-week low. The stock has dropped 12.13% over three days and 41.72% over the past year, underperforming its sector. It is currently trading below multiple moving averages, reflecting ongoing market challenges.

Read More

Damodar Industries Reports Mixed Q2 Results Amid Profit Growth and Sales Decline

2025-02-05 18:46:15Damodar Industries has released its financial results for the quarter ending December 2024, showing a mixed performance. The company reported a year-on-year increase in Profit After Tax and achieved its highest Operating Profit to Interest ratio in five quarters, while facing challenges with declining net sales and reliance on non-operating income.

Read MoreDisclosures under Reg. 29(2) of SEBI (SAST) Regulations 2011

01-Apr-2025 | Source : BSEThe Exchange has received the disclosure under Regulation 29(2) of SEBI (Substantial Acquisition of Shares & Takeovers) Regulations 2011 for Manju Biyani & Others

Disclosure Under Regulation 10(6) Of SEBI (Substantial Acquisition Of Share And Takeover) Regulations 2011.

01-Apr-2025 | Source : BSEDear Sir/Madam Please find the attachment herewith

Disclosures under Reg. 29(2) of SEBI (SAST) Regulations 2011

01-Apr-2025 | Source : BSEThe Exchange has received the disclosure under Regulation 29(2) of SEBI (Substantial Acquisition of Shares & Takeovers) Regulations 2011 for Ajay Biyani & Others

Corporate Actions

No Upcoming Board Meetings

Damodar Industries Ltd has declared 10% dividend, ex-date: 15 Jul 22

Damodar Industries Ltd has announced 5:10 stock split, ex-date: 25 Oct 18

Damodar Industries Ltd has announced 1:4 bonus issue, ex-date: 02 Sep 15

Damodar Industries Ltd has announced 8:5 rights issue, ex-date: 01 Sep 08