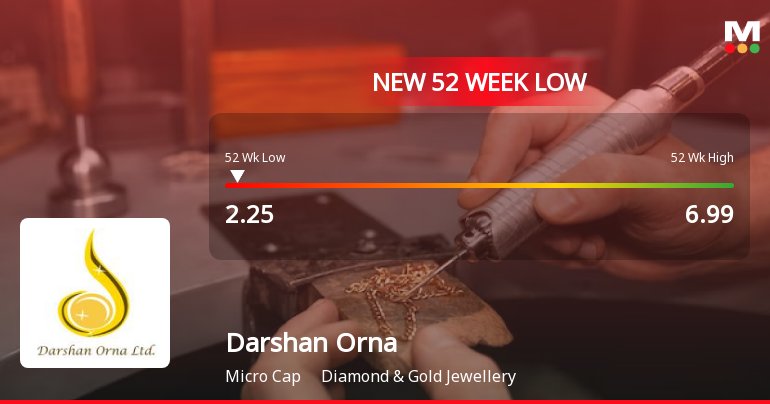

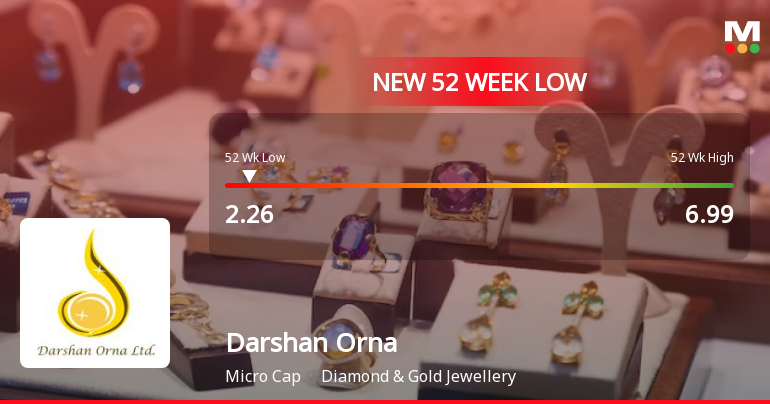

Darshan Orna Faces Challenges Amid Broader Market Downturn and Weak Fundamentals

2025-04-01 11:58:54Darshan Orna, a microcap in the diamond and gold jewellery sector, reached a new 52-week low amid a broader market decline. The company has shown weak long-term fundamentals, with declining operating profits and low profitability. Recent financial results indicate a significant drop in net sales and reduced promoter confidence.

Read More

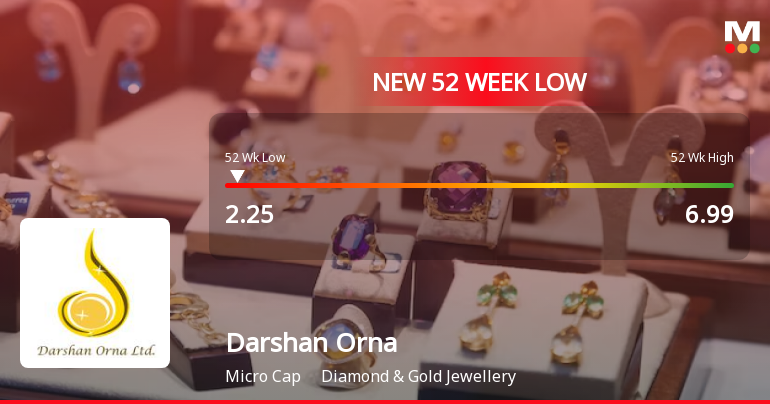

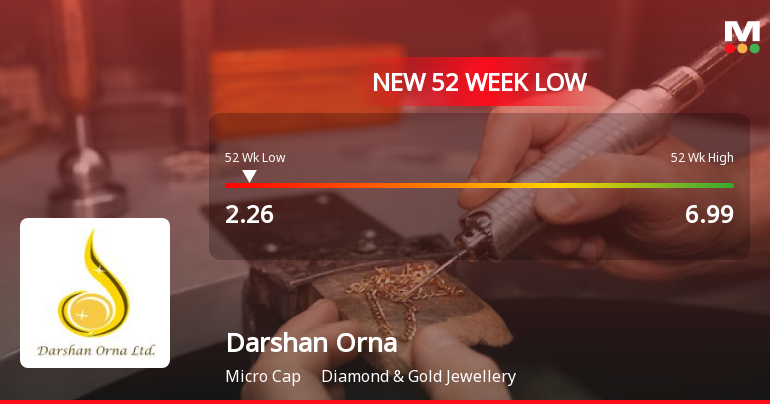

Darshan Orna Faces Challenges Amid Market Volatility and Weak Financial Fundamentals

2025-04-01 11:58:47Darshan Orna, a microcap in the diamond and gold jewellery sector, hit a new 52-week low amid a broader market decline. The company faces challenges with weak long-term fundamentals, declining sales, and reduced promoter confidence, raising concerns about its financial stability and future performance.

Read More

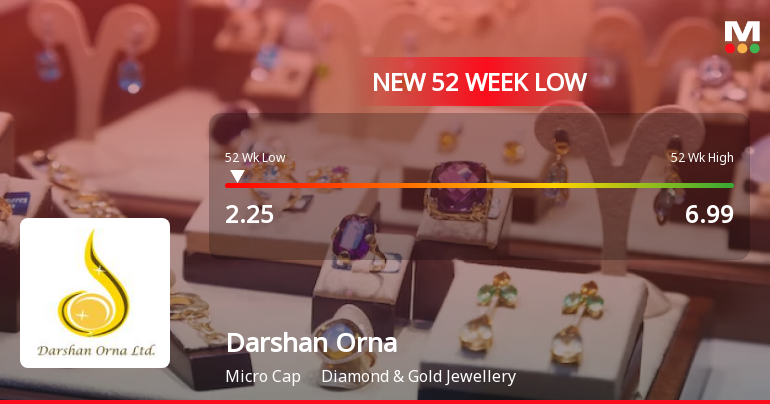

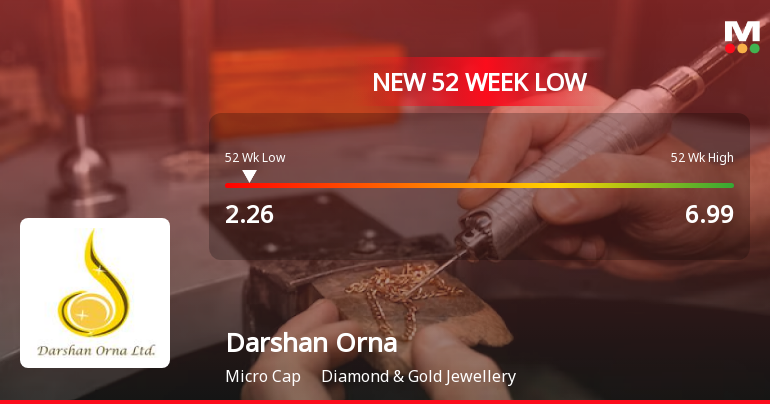

Darshan Orna Faces Significant Challenges Amid Broader Market Volatility and Weak Fundamentals

2025-04-01 11:58:45Darshan Orna, a microcap in the diamond and gold jewellery sector, has faced significant volatility, reaching a new 52-week low amid a broader market decline. The company's long-term fundamentals are weak, with declining sales and concerns over debt servicing, while promoter confidence has diminished with a recent stake reduction.

Read MoreDarshan Orna Ltd Sees Significant Buying Activity Amidst Market Challenges

2025-03-27 10:45:11Darshan Orna Ltd, a microcap player in the diamond and gold jewellery industry, is witnessing significant buying activity today, with a notable gain of 4.64%. This performance stands in stark contrast to the Sensex, which has only increased by 0.43% during the same period. The stock has recently experienced a trend reversal after three consecutive days of decline, indicating a potential shift in market sentiment. Despite today's gains, Darshan Orna's performance over the past week, month, and year remains negative, with declines of 7.12%, 10.47%, and 39.07%, respectively. The stock has also hit a new 52-week and all-time low of Rs. 2.26 today, reflecting ongoing challenges. Over the last three years, the stock has plummeted by 84.29%, while the Sensex has appreciated by 35.32%. Today's trading saw the stock outperform its sector by 3.86%, although it continues to trade below its 5-day, 20-day, 50-day, 100...

Read More

Darshan Orna Faces Significant Challenges Amidst Declining Stock Performance and Weak Fundamentals

2025-03-27 10:05:13Darshan Orna, a microcap in the diamond and gold jewellery sector, has faced notable volatility, reaching a new 52-week low. The stock has declined significantly over the past four days and year, underperforming its sector. Weak long-term fundamentals and reduced promoter stake raise concerns about its future performance.

Read More

Darshan Orna Faces Financial Struggles Amid Declining Sales and Stakeholder Confidence

2025-03-27 10:05:12Darshan Orna, a microcap in the diamond and gold jewellery sector, has reached a new 52-week low, reflecting a significant decline in performance. The company has faced a 43.73% drop in one-year returns and a 36.92% decrease in net sales, alongside weakening promoter confidence and challenging financial metrics.

Read More

Darshan Orna Faces Significant Challenges Amidst Declining Sales and Investor Confidence

2025-03-27 10:05:07Darshan Orna, a microcap in the diamond and gold jewellery sector, has faced notable volatility, reaching a new 52-week low. The stock has declined for four consecutive days and shows a significant year-over-year drop. Financially, the company reports negative sales growth and weak debt servicing capabilities, with reduced promoter stakes indicating declining confidence.

Read More

Darshan Orna Faces Significant Challenges Amidst Declining Stock Performance and Weak Fundamentals

2025-03-27 10:05:03Darshan Orna, a microcap in the diamond and gold jewellery sector, has faced notable volatility, reaching a new 52-week low. The stock has declined significantly over the past year and shows weak long-term fundamentals, including a negative growth rate in operating profits and concerns over debt servicing. Promoter confidence is also diminishing.

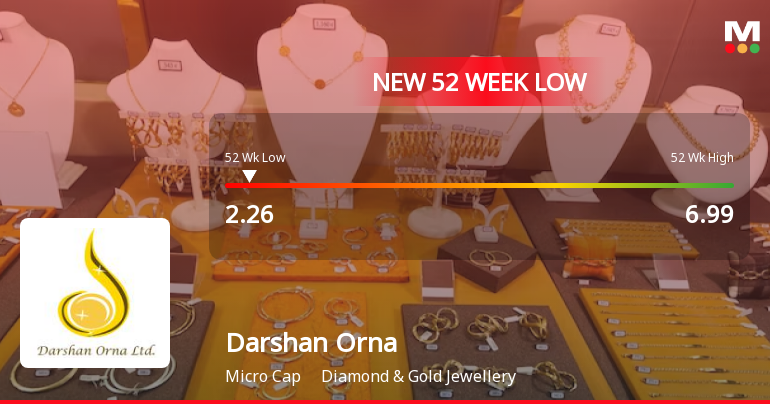

Read MoreDarshan Orna Faces Intense Selling Pressure Amid Significant Price Declines

2025-03-27 09:50:15Darshan Orna Ltd is currently facing significant selling pressure, with today's trading session showing only sellers in the market. The stock has experienced a notable decline of 4.64% today, contrasting sharply with the Sensex, which has gained 0.20%. This marks the fourth consecutive day of losses for Darshan Orna, resulting in a total drop of 16.91% over this period. Over the past week, the stock has fallen by 15.36%, while the Sensex has risen by 1.44%. The longer-term performance is equally concerning, with Darshan Orna down 18.41% over the past month and a staggering 50.55% over the last three months. Year-to-date, the stock has declined by 31.10%, compared to a slight decrease of 0.89% in the Sensex. Today, Darshan Orna hit a new 52-week and all-time low of Rs. 2.26, underperforming its sector by 5.23%. The stock is currently trading below its 5-day, 20-day, 50-day, 100-day, and 200-day moving aver...

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

08-Apr-2025 | Source : BSEIn compliance with Regulation 74(5) of the SEBI(DP) Regulations 2018 copy of certificate received from the registrar of the company is attached herewith.

Annual Disclosure Under Regulation 31(4) Of SEBI (Substantial Acquisition Of Shares & Takeovers) Regulations 2011

07-Apr-2025 | Source : BSEPursuant to Regulation 31(4)of SEBI(SAST) Regulations 2011 as amended please find the enclosed yearly disclosure received from the Promoter of the company for the Financial year ended March 31st 2025.

Format of the Initial Disclosure to be made by an entity identified as a Large Corporate : Annexure A

07-Apr-2025 | Source : BSEFormat of Initial Disclosure to be made by an entity identified as a Large Corporate.

| Sr. No. | Particulars | Details |

| 1 | Name of Company | Darshan Orna Ltd |

| 2 | CIN NO. | L36910GJ2011PLC063745 |

| 3 | Outstanding borrowing of company as on 31st March / 31st December as applicable (in Rs cr) | 3.68 |

| 4 | Highest Credit Rating during the previous FY | NA |

| 4a | Name of the Credit Rating Agency issuing the Credit Rating mentioned in (4) | Not Applicable |

| 5 | Name of Stock Exchange# in which the fine shall be paid in case of shortfall in the required borrowing under the framework | BSE |

Designation: Company Secretary

EmailId: compliancingdarshan@gmail.com

Designation: Chief Financial Officer and MD

EmailId: compliancingdarshan@gmail.com

Date: 07/04/2025

Note: In terms para of 3.2(ii) of the circular beginning F.Y 2022 in the event of shortfall in the mandatory borrowing through debt securities a fine of 0.2% of the shortfall shall be levied by Stock Exchanges at the end of the two-year block period. Therefore an entity identified as LC shall provide in its initial disclosure for a financial year the name of Stock Exchange to which it would pay the fine in case of shortfall in the mandatory borrowing through debt markets.

Corporate Actions

No Upcoming Board Meetings

Darshan Orna Ltd has declared 2% dividend, ex-date: 20 Aug 18

Darshan Orna Ltd has announced 2:10 stock split, ex-date: 13 Jun 22

Darshan Orna Ltd has announced 11:10 bonus issue, ex-date: 19 Sep 18

No Rights history available