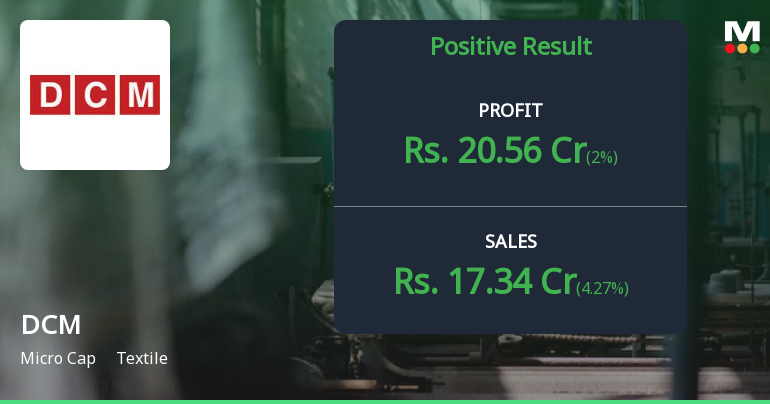

DCM Reports Strong Profit Growth Amid Challenges in Debtor Management for December 2024

2025-02-13 22:49:51DCM, a microcap textile company, reported its financial results for the quarter ending December 2024, revealing significant profit growth. Profit before tax reached Rs 16.26 crore, while profit after tax hit Rs 20.56 crore, both marking the highest levels in five quarters. However, the debtors turnover ratio declined to 4.03 times.

Read More

DCM Faces Financial Challenges Amidst Flat Quarterly Performance and Declining Sales

2025-02-11 18:51:19DCM, a microcap textile company, has experienced a recent evaluation adjustment amid flat financial performance for the quarter ending September 2024. Despite a notable annual return of 22.55%, challenges persist, including declining net sales, low operating cash flow, and concerns regarding debt servicing and long-term growth prospects.

Read More

DCM Faces Financial Challenges Amid Flat Q2 Performance and Declining Sales Trends

2025-01-27 18:28:50DCM, a microcap textile company, has adjusted its evaluation amid a flat financial performance for Q2 FY24-25, reporting net sales of Rs 16.63 crore. The firm faces challenges with debt management, negative EBIT to Interest ratio, and declining net sales over five years, despite a recent stock return of 15.69%.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

07-Apr-2025 | Source : BSECertificate under Regulation 74(5) of SEBI (DP) Regulations 2018 is enclosed.

Announcement under Regulation 30 (LODR)-Acquisition

05-Apr-2025 | Source : BSEDisclosure under Regulation 30 of SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015 is enclosed.

Closure of Trading Window

26-Mar-2025 | Source : BSEIntimation of closure of Trading Window in terms of Companys Code of Conduct to Regulate Monitor and Report Trading in Securities is attached.

Corporate Actions

No Upcoming Board Meetings

DCM Ltd has declared 15% dividend, ex-date: 20 Nov 15

No Splits history available

No Bonus history available

No Rights history available