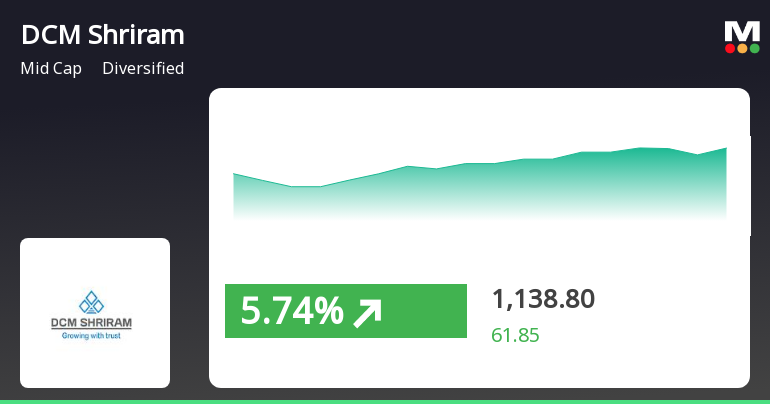

DCM Shriram's Strong Performance Highlights Resilience Amid Broader Market Decline

2025-03-28 09:30:18DCM Shriram has demonstrated strong performance, gaining 5.28% on March 28, 2025, and outperforming its sector. The stock has seen consecutive gains over two days, with notable intraday volatility. It has consistently traded above key moving averages and has achieved significant returns over the past month and year.

Read More

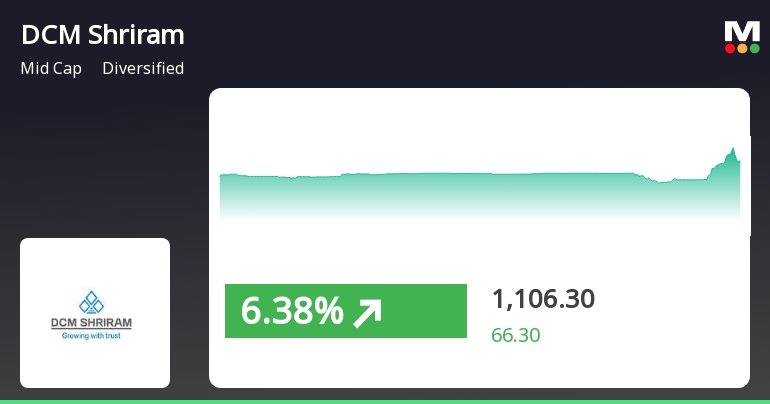

DCM Shriram Faces Market Challenges Amid Broader Sensex Resilience and Small-Cap Gains

2025-03-27 15:15:24DCM Shriram has seen significant trading activity, gaining 5.14% on March 27, 2025, despite recent underperformance and a downward trend over the past four days. The stock is currently below key moving averages, while the broader market, represented by the Sensex, has shown resilience and growth.

Read More

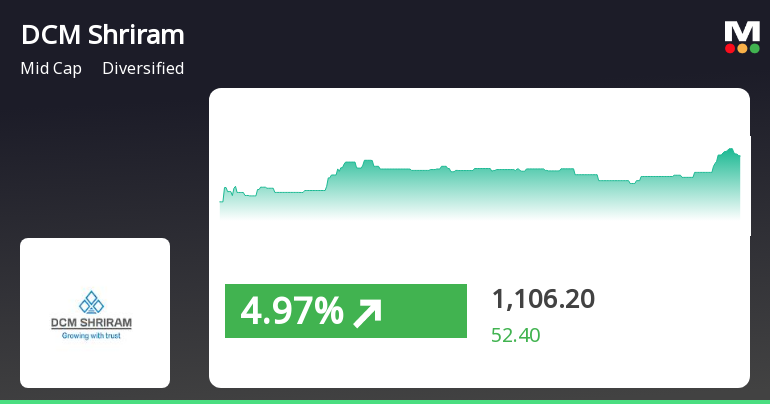

DCM Shriram Shows Strong Performance Amid Broader Market Recovery Trends

2025-03-21 14:45:20DCM Shriram has experienced notable gains, marking its fourth consecutive day of increases and outperforming its sector. The stock is trading above all key moving averages, indicating strong performance. In the broader market, the Sensex has rebounded, with small-cap stocks leading the way.

Read MoreDCM Shriram Faces Mixed Technical Trends Amid Strong Long-Term Performance

2025-03-18 08:00:22DCM Shriram, a midcap player in the diversified industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 981.00, slightly down from its previous close of 988.50. Over the past year, DCM Shriram has shown a return of 12.78%, significantly outperforming the Sensex, which recorded a return of 2.10% in the same period. In terms of technical indicators, the weekly MACD and Bollinger Bands suggest a bearish sentiment, while the monthly metrics indicate a mildly bearish outlook. The Relative Strength Index (RSI) shows no signal on a weekly basis but is bullish on a monthly scale. Additionally, the KST reflects a bearish trend weekly, contrasting with a bullish monthly perspective. The On-Balance Volume (OBV) indicates no trend weekly but is mildly bullish monthly. Notably, DCM Shriram's performance over longer periods has been impressive, wi...

Read MoreDCM Shriram Adjusts Valuation Amidst Mixed Performance Against Market and Peers

2025-03-18 08:00:06DCM Shriram, a midcap player in the diversified industry, has recently undergone a valuation adjustment. The company's current price stands at 981.00, reflecting a slight decline from the previous close of 988.50. Over the past year, DCM Shriram has shown a return of 12.78%, outperforming the Sensex, which recorded a return of 2.10% in the same period. However, the company's year-to-date performance indicates a decline of 14.99%, contrasting with the Sensex's drop of 5.08%. Key financial metrics for DCM Shriram include a PE ratio of 28.16 and an EV to EBITDA ratio of 13.23. The company also reports a return on capital employed (ROCE) of 11.22% and a return on equity (ROE) of 7.85%. In comparison to its peers, such as A B Real Estate, which is positioned at a significantly higher valuation level, DCM Shriram's metrics suggest a more moderate financial standing. This evaluation revision highlights the compan...

Read MoreDCM Shriram Faces Technical Trend Shifts Amid Market Volatility and Bearish Indicators

2025-03-17 08:00:12DCM Shriram, a midcap player in the diversified industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 988.50, down from a previous close of 1020.95. Over the past year, DCM Shriram has experienced a notable fluctuation, with a 52-week high of 1,370.00 and a low of 840.15. Today's trading saw a high of 1022.50 and a low of 951.10, indicating volatility in its price movements. The technical summary reveals a bearish sentiment in various indicators. The MACD shows a bearish trend on a weekly basis, while the monthly perspective is mildly bearish. Similarly, Bollinger Bands and moving averages also reflect bearish tendencies. The KST presents a mixed view, being bearish weekly but bullish monthly, while the On-Balance Volume indicates no significant trend on a weekly basis but is mildly bullish monthly. In terms of performance, DCM Shr...

Read MoreDCM Shriram Experiences Technical Trend Adjustments Amid Mixed Market Signals

2025-03-13 08:00:18DCM Shriram, a midcap player in the diversified industry, has recently undergone a technical trend adjustment. The company's current price stands at 1020.95, reflecting a slight increase from the previous close of 1011.90. Over the past year, DCM Shriram has shown a notable return of 12.48%, significantly outperforming the Sensex, which recorded a mere 0.49% return in the same period. In terms of technical indicators, the weekly MACD and Bollinger Bands suggest a bearish sentiment, while the monthly MACD indicates a mildly bearish outlook. The Relative Strength Index (RSI) shows no signal for both weekly and monthly assessments, indicating a lack of momentum in either direction. Moving averages also reflect a bearish trend on a daily basis, while the KST presents a mixed picture with a bullish monthly reading. When examining the company's performance against the Sensex, DCM Shriram has faced challenges in...

Read MoreDCM Shriram Experiences Technical Trend Adjustments Amid Mixed Market Signals

2025-03-13 08:00:18DCM Shriram, a midcap player in the diversified industry, has recently undergone a technical trend adjustment. The company's current price stands at 1020.95, reflecting a slight increase from the previous close of 1011.90. Over the past year, DCM Shriram has shown a notable return of 12.48%, significantly outperforming the Sensex, which recorded a mere 0.49% return in the same period. In terms of technical indicators, the weekly MACD and Bollinger Bands suggest a bearish sentiment, while the monthly MACD indicates a mildly bearish outlook. The Relative Strength Index (RSI) shows no signal for both weekly and monthly assessments, indicating a lack of momentum in either direction. Moving averages also reflect a bearish trend on a daily basis, while the KST presents a mixed picture with a bullish monthly reading. When examining the company's performance against the Sensex, DCM Shriram has faced challenges in...

Read MoreDCM Shriram Faces Technical Trend Shifts Amid Mixed Market Performance Indicators

2025-03-12 08:00:20DCM Shriram, a midcap player in the diversified industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1011.90, down from a previous close of 1023.45. Over the past year, DCM Shriram has shown a return of 10.20%, significantly outperforming the Sensex, which recorded a return of 0.82% in the same period. However, the year-to-date performance indicates a decline of 12.31%, while the Sensex has decreased by 5.17%. The technical summary for DCM Shriram reveals a bearish sentiment in various indicators. The MACD shows a bearish trend on a weekly basis, while the monthly outlook is mildly bearish. Bollinger Bands also reflect a bearish stance, and moving averages indicate a bearish trend on a daily basis. The KST presents a mixed picture, being bearish weekly but bullish monthly. In terms of stock performance, DCM Shriram has experienced...

Read MoreCommissioning Of 2Nd 300 TPD Flexi-Fuel Flaker Plant At Jhagadia Bharuch District Today I.E. 31St March 2025.

31-Mar-2025 | Source : BSECommissioning of 2nd 300 TPD Flexi-fuel Flaker Plant at Jhagadia Bharuch district today.

Disclosure Under Regulation 30 Of Sebl Listing Regulations - Commissioning Of 12TPD Compressed Biogas Capacity Plant At Ajbapur Unit.

27-Mar-2025 | Source : BSECommissioning of 12TPD Compressed Biogas capacity plant at Ajbapur Unit.

Closure of Trading Window

26-Mar-2025 | Source : BSEIntimation for Closure of Trading Window for quarter and year ending March 31 2025

Corporate Actions

No Upcoming Board Meetings

DCM Shriram Ltd. has declared 180% dividend, ex-date: 24 Jan 25

No Splits history available

No Bonus history available

No Rights history available