DCW Stock Shows Mixed Technical Signals Amid Strong Long-Term Performance

2025-03-28 08:03:18DCW, a small-cap player in the chemicals industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 78.84, showing a slight increase from the previous close of 77.05. Over the past year, DCW has demonstrated a notable performance, with a return of 51.27%, significantly outperforming the Sensex, which recorded a return of 6.32% in the same period. The technical summary indicates mixed signals across various indicators. The MACD shows a bearish trend on a weekly basis while maintaining a bullish stance monthly. Similarly, Bollinger Bands reflect a bearish outlook weekly but are bullish monthly. The moving averages suggest a mildly bearish trend, while the On-Balance Volume (OBV) indicates a consistent mildly bearish sentiment across both weekly and monthly assessments. In terms of stock performance, DCW has shown resilience over longer pe...

Read MoreDCW Experiences Technical Trend Shifts Amidst Market Volatility in Chemicals Sector

2025-03-27 08:03:14DCW, a small-cap player in the chemicals industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 77.05, down from a previous close of 79.65, with a notable 52-week high of 113.00 and a low of 48.65. Today's trading saw a high of 80.81 and a low of 76.50, indicating some volatility. The technical summary reveals a mixed picture. The MACD indicates bearish conditions on a weekly basis, while the monthly perspective shows a mildly bearish trend. The Bollinger Bands present a bearish outlook weekly, contrasting with a bullish stance monthly. Moving averages also reflect bearish sentiment, and the KST shows bearish trends weekly, although it is bullish monthly. The On-Balance Volume (OBV) suggests a mildly bearish trend over both weekly and monthly periods. In terms of performance, DCW's returns have varied significantly over different ti...

Read MoreDCW Experiences Technical Trend Shifts Amidst Strong Long-Term Performance

2025-03-18 08:03:31DCW, a small-cap player in the chemicals industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 71.28, slightly down from the previous close of 72.31. Over the past year, DCW has shown a notable return of 40.23%, significantly outperforming the Sensex, which recorded a return of 2.10% during the same period. In terms of technical indicators, the weekly MACD remains bearish, while the monthly outlook shows a mildly bearish trend. The Relative Strength Index (RSI) indicates no signal for both weekly and monthly assessments. Bollinger Bands present a mixed picture, with a bearish stance on the weekly chart and a mildly bullish outlook monthly. Moving averages reflect a bearish trend on a daily basis, while the KST shows a bearish weekly trend but a bullish monthly perspective. The company's performance over various time frames highli...

Read MoreDCW Experiences Mixed Technical Trends Amidst Market Evaluation Revision

2025-03-11 08:04:24DCW, a small-cap player in the chemicals industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 74.76, down from a previous close of 77.83, with a notable 52-week range between 46.90 and 113.00. Today's trading saw a high of 79.00 and a low of 74.20. The technical summary indicates a bearish sentiment in the weekly MACD and moving averages, while the monthly indicators show a mix of mildly bearish and bullish signals. The Bollinger Bands present a bearish outlook on a weekly basis, contrasting with a bullish stance on a monthly scale. The KST also reflects bearish conditions weekly, while the monthly trend appears more favorable. In terms of performance, DCW has shown varied returns compared to the Sensex. Over the past week, the stock returned 3.30%, outperforming the Sensex's 1.41%. However, on a year-to-date basis, DCW has faced ...

Read MoreDCW Shows Mixed Technical Indicators Amid Strong Long-Term Performance in Chemicals Sector

2025-03-10 08:01:40DCW, a small-cap player in the chemicals industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 77.83, showing a slight increase from the previous close of 76.54. Over the past year, DCW has demonstrated a notable return of 37.75%, significantly outperforming the Sensex, which recorded a mere 0.29% return in the same period. In terms of technical indicators, the weekly MACD and KST are bearish, while the monthly indicators show a bullish trend. The Relative Strength Index (RSI) remains neutral on both weekly and monthly scales, indicating a lack of strong momentum in either direction. Additionally, Bollinger Bands and On-Balance Volume (OBV) reflect a mildly bearish sentiment on a weekly basis, while moving averages indicate a bearish trend. DCW's performance over various time frames highlights its resilience, particularly over the ...

Read MoreDCW Stock Shows Mixed Technical Trends Amid Strong Long-Term Performance

2025-03-07 08:03:10DCW, a small-cap player in the chemicals industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 76.54, showing a notable increase from the previous close of 74.35. Over the past year, DCW has demonstrated a strong performance with a return of 35.33%, significantly outperforming the Sensex, which recorded a mere 0.34% return in the same period. In terms of technical indicators, the weekly MACD is bearish, while the monthly outlook shows a mildly bearish trend. The Relative Strength Index (RSI) indicates no signal for both weekly and monthly assessments. Bollinger Bands present a mildly bearish trend on a weekly basis, contrasting with a bullish monthly perspective. Daily moving averages also reflect a bearish sentiment, while the KST shows a bearish weekly trend alongside a bullish monthly outlook. DCW's performance over various time...

Read MoreDCW Ltd's Trading Activity Highlights Short-Term Volatility Amid Long-Term Growth Potential

2025-03-06 18:01:06DCW Ltd, a small-cap player in the chemicals industry, has shown notable activity in today's trading session, with a rise of 2.95%. This performance stands in contrast to the Sensex, which increased by 0.83% on the same day. Over the past year, DCW has delivered a robust return of 35.33%, significantly outperforming the Sensex's modest gain of 0.34%. Despite its strong annual performance, DCW has faced challenges in the short term, with a decline of 9.11% over the past month and a more pronounced drop of 26.70% over the last three months. Year-to-date, the stock is down 16.45%, while the Sensex has decreased by 4.86%. However, looking at a longer horizon, DCW has demonstrated impressive growth, with a 99.32% increase over the past three years and an extraordinary 488.77% rise over the last five years. The company's current market capitalization stands at Rs 2,256.00 crore, with a price-to-earnings ratio o...

Read More

DCW Reports Strong Profit Growth Amid Debt Servicing Concerns and Limited Long-Term Prospects

2025-03-03 18:50:53DCW, a small-cap chemicals company, recently adjusted its evaluation following a positive Q3 FY24-25 performance, with significant growth in profits. However, concerns about debt servicing and limited long-term growth prospects persist, despite the stock outperforming the market with a notable annual return. Current trends indicate sideways price movement.

Read More

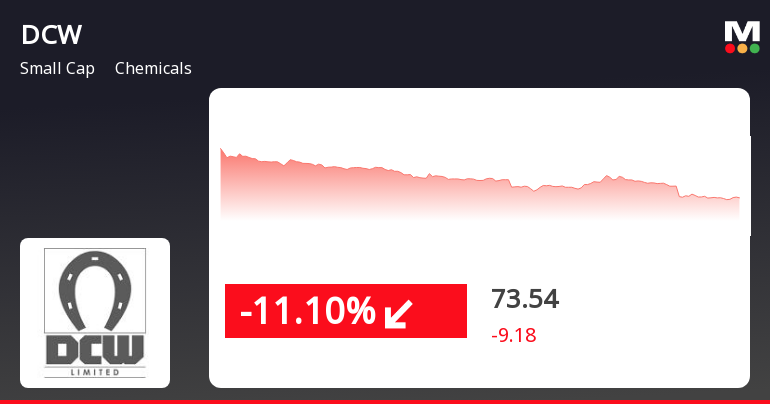

DCW Faces Significant Stock Decline Amid Broader Market Stability in February 2025

2025-02-14 10:35:19DCW, a small-cap chemicals company, has seen a notable decline in its stock performance, dropping significantly today and over the past two days. The stock is trading below its moving averages and has underperformed compared to the broader market, reflecting ongoing challenges in the current environment.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

07-Apr-2025 | Source : BSEIntimation/Certificate under Reg 74(5) of SEBI (DP) Reg 2018

Regulation 30 Of The Securities And Exchange Board Of India (Listing Obligations And Disclosure Requirements) Regulations 2015 - Update On Commission Of Captive Solar Plant Located In Tamil Nadu

03-Apr-2025 | Source : BSEIntimation under Regulation 30 of the SEBI (LODR) Regulations 2015

Announcement under Regulation 30 (LODR)-Credit Rating

02-Apr-2025 | Source : BSEIntimation of Credit Ratings

Corporate Actions

No Upcoming Board Meetings

DCW Ltd has declared 15% dividend, ex-date: 22 Sep 23

No Splits history available

No Bonus history available

No Rights history available