DCX Systems Faces Mixed Technical Trends Amid Market Volatility and Underperformance

2025-03-18 08:04:46DCX Systems, a small-cap player in the electronics components industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 219.20, down from a previous close of 227.95, with a notable 52-week high of 451.90 and a low of 214.25. Today's trading saw a high of 229.65 and a low of 218.60, indicating some volatility. The technical summary reveals a mixed picture. The MACD indicates bearish momentum on a weekly basis, while the RSI shows bullish signals in the short term. However, Bollinger Bands and moving averages suggest bearish trends, particularly on the daily chart. The Dow Theory presents a mildly bullish outlook weekly, contrasting with a mildly bearish monthly perspective. Additionally, the On-Balance Volume (OBV) reflects no trend in the short term but shows bullishness over the monthly period. In terms of performance, DCX Systems has...

Read MoreDCX Systems Faces Technical Challenges Amidst Broader Market Trends

2025-03-17 08:01:37DCX Systems, a small-cap player in the electronics components industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 227.95, showing a slight increase from the previous close of 227.00. Over the past year, DCX Systems has experienced a 7.17% decline, contrasting with a 1.47% gain in the Sensex, highlighting a notable underperformance relative to the broader market. The technical summary indicates a bearish sentiment across several indicators. The MACD and Bollinger Bands are both signaling bearish trends on a weekly basis, while the daily moving averages also reflect a bearish outlook. The Relative Strength Index (RSI) shows a bullish signal on a weekly basis, but lacks a clear direction on a monthly scale. Meanwhile, the On-Balance Volume (OBV) presents a mildly bearish trend weekly, with a bullish stance monthly. In terms of retur...

Read MoreDCX Systems Experiences Valuation Grade Change Amidst Challenging Market Conditions

2025-03-12 08:00:53DCX Systems, a small-cap player in the electronics components sector, has recently undergone a valuation adjustment. The company's current price stands at 232.35, slightly down from the previous close of 234.20. Over the past year, DCX Systems has faced challenges, with a return of -21.6%, contrasting sharply with a modest gain of 0.82% in the Sensex during the same period. Key financial metrics for DCX Systems include a PE ratio of 50.63 and an EV to EBITDA ratio of 52.13, indicating a premium valuation relative to some peers. For instance, Apollo Micro Systems shows a higher PE ratio of 63.9, while Cyient DLM maintains a PE of 49.99. In terms of return on capital employed (ROCE), DCX Systems reported 7.80%, which is lower than some competitors, highlighting the need for improved operational efficiency. The company's performance has been under scrutiny, particularly as it navigates a challenging market e...

Read MoreDCX Systems Faces Mixed Technical Trends Amidst Market Underperformance

2025-03-05 08:03:42DCX Systems, a small-cap player in the electronics components industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 233.50, showing a notable shift from its previous close of 225.80. Over the past year, DCX Systems has faced challenges, with a return of -28%, significantly underperforming compared to the Sensex, which recorded a mere -1.19% during the same period. The technical summary indicates a mixed performance across various indicators. The MACD shows a bearish trend on a weekly basis, while the Relative Strength Index (RSI) is bullish weekly but shows no signal monthly. Bollinger Bands and Dow Theory reflect a mildly bearish stance on both weekly and monthly assessments. Additionally, the On-Balance Volume (OBV) presents a mildly bearish outlook weekly, contrasting with a bullish monthly trend. In terms of price movement, DCX...

Read More

DCX Systems Faces Sustained Downward Trend Amid Significant Stock Volatility

2025-03-03 10:08:28DCX Systems has faced notable volatility, reaching a new 52-week low amid a six-day decline totaling 15.93%. Despite a brief intraday high, the stock has struggled over the past year, down 31.35%, and is trading below multiple moving averages, indicating a persistent downward trend.

Read More

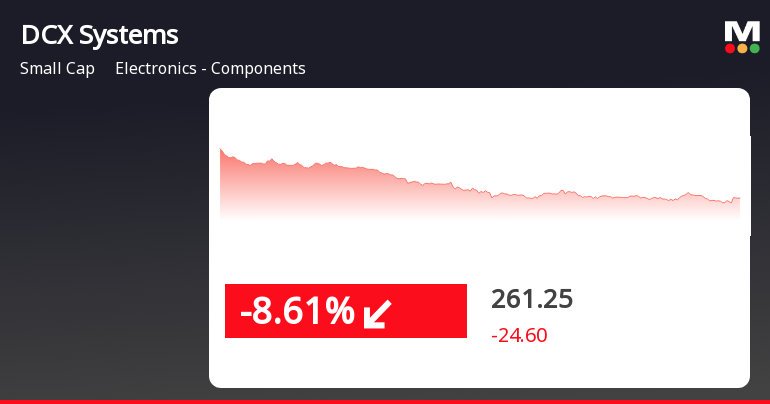

DCX Systems Hits 52-Week Low Amid Broader Electronics Sector Challenges

2025-02-28 12:05:31DCX Systems, a small-cap electronics components company, has hit a new 52-week low amid significant volatility, reflecting a 14.02% decline over the past five days. The stock is trading below key moving averages, while the broader sector has also faced challenges, indicating ongoing struggles in a competitive market.

Read More

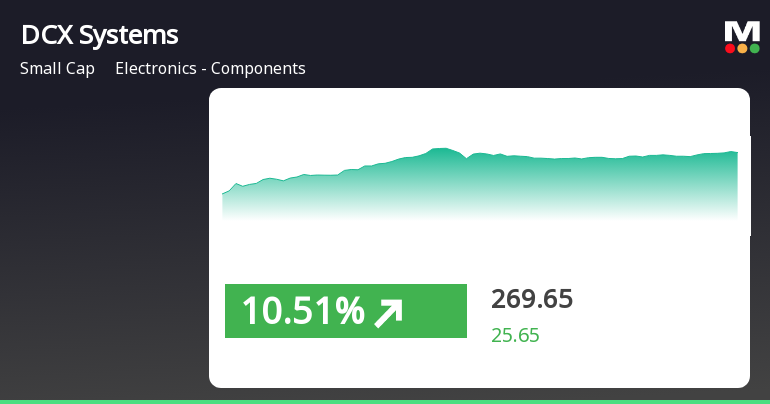

DCX Systems Shows Resilience Amid Market Volatility with Significant Stock Price Rebound

2025-02-19 09:50:38DCX Systems, a small-cap electronics components company, saw a significant stock price increase on February 19, 2025, reversing a six-day decline. Despite outperforming its sector, the stock remains below key moving averages and has experienced a notable decline over the past month, indicating ongoing market challenges.

Read More

DCX Systems Faces Sustained Decline Amid Broader Electronics Sector Challenges in February 2025

2025-02-14 11:20:26DCX Systems has faced a notable decline in its stock price, experiencing a 14.28% drop over four consecutive days. The company is trading below key moving averages and has underperformed the broader Electronics - Components sector, which has also seen a downturn in recent weeks.

Read More

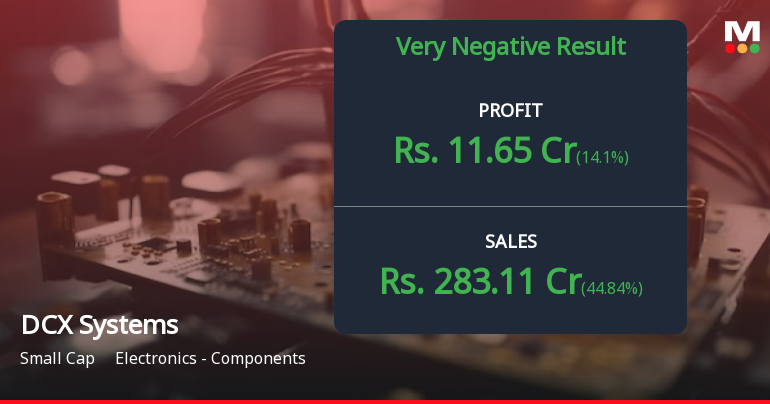

DCX Systems Reports Challenging Q3 FY24-25 Financial Results Amid Competitive Pressures

2025-02-07 10:05:55DCX Systems has announced its financial results for the quarter ending February 2025, revealing significant challenges in its performance. The company's evaluation score has been revised to -21, indicating ongoing difficulties as it navigates a competitive landscape within the small-cap electronics sector.

Read MoreClosure of Trading Window

26-Mar-2025 | Source : BSEClosure of Trading Window for the quarter and financial year ended March 31 2025.

Intimation Of Approval Of 2025 Share Option Plan Of Wholly Owned Subsidiary Company.

21-Mar-2025 | Source : BSEIntimation of approval of 2025 Share Option Plan of Wholly Owned Subsidiary Company.

Shareholder Meeting / Postal Ballot-Outcome of Postal_Ballot

18-Mar-2025 | Source : BSEPostal Ballot Voting Results as per Regulation 44(3) of SEBI(LODR) Regulations 2015.

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available