Decipher Labs Faces Financial Struggles Amid Significant Stock Volatility and Declining Performance

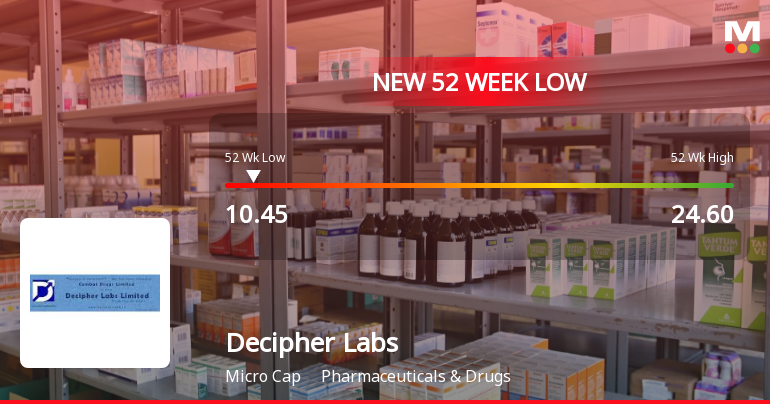

2025-03-27 14:06:58Decipher Labs, a microcap in the Pharmaceuticals & Drugs sector, has reached a new 52-week low amid significant volatility and a four-day decline. The company is trading below key moving averages and has reported operating losses, declining net sales, and reduced cash reserves, indicating ongoing financial challenges.

Read MoreDecipher Labs Adjusts Valuation Grade Amid Competitive Financial Metrics and Market Positioning

2025-03-25 08:00:25Decipher Labs, a microcap player in the Pharmaceuticals & Drugs sector, has recently undergone a valuation adjustment, reflecting a notable shift in its financial standing. The company currently boasts a price-to-earnings (PE) ratio of 12.25 and an EV to EBITDA ratio of 7.48, indicating a competitive position within its industry. Additionally, its price-to-book value stands at 0.57, suggesting that the stock may be undervalued relative to its assets. In comparison to its peers, Decipher Labs demonstrates a more favorable PEG ratio of 0.12, significantly lower than that of companies like Shree Ganesh Rem and Fermenta Biotec, which have PEG ratios of 1.55 and 0.02, respectively. This positions Decipher Labs as a potentially more attractive option in terms of growth relative to its valuation. Despite recent performance challenges, including a year-to-date return of -18.86% and a one-year return of -23.61%, t...

Read MoreDecipher Labs Adjusts Valuation Grade Amidst Competitive Industry Landscape and Performance Challenges

2025-03-13 08:00:27Decipher Labs, a microcap player in the Pharmaceuticals & Drugs sector, has recently undergone a valuation adjustment reflecting its financial metrics and market position. The company currently exhibits a price-to-earnings (P/E) ratio of 11.62 and an enterprise value to EBITDA ratio of 6.85, indicating a competitive stance within its industry. Additionally, its price-to-book value stands at 0.54, suggesting that the stock is trading below its book value. In comparison to its peers, Decipher Labs shows a favorable PEG ratio of 0.11, significantly lower than that of Shree Ganesh Remedies, which is at 1.46, and Anuh Pharma, which has a PEG of 0. This positions Decipher Labs as an attractive option relative to its competitors. However, its return metrics reveal challenges, with a year-to-date decline of 23.08% and a three-year return of -83.48%, contrasting sharply with the broader market performance. Overall...

Read MoreDecipher Labs Adjusts Valuation Grade Amidst Competitive Industry Landscape and Performance Challenges

2025-03-13 08:00:27Decipher Labs, a microcap player in the Pharmaceuticals & Drugs sector, has recently undergone a valuation adjustment reflecting its financial metrics and market position. The company currently exhibits a price-to-earnings (P/E) ratio of 11.62 and an enterprise value to EBITDA ratio of 6.85, indicating a competitive stance within its industry. Additionally, its price-to-book value stands at 0.54, suggesting that the stock is trading below its book value. In comparison to its peers, Decipher Labs shows a favorable PEG ratio of 0.11, significantly lower than that of Shree Ganesh Remedies, which is at 1.46, and Anuh Pharma, which has a PEG of 0. This positions Decipher Labs as an attractive option relative to its competitors. However, its return metrics reveal challenges, with a year-to-date decline of 23.08% and a three-year return of -83.48%, contrasting sharply with the broader market performance. Overall...

Read MoreDecipher Labs Experiences Valuation Grade Change Amidst Competitive Industry Landscape

2025-03-05 08:00:29Decipher Labs, a microcap player in the Pharmaceuticals & Drugs sector, has recently undergone a valuation adjustment, reflecting a notable shift in its financial standing. The company currently exhibits a price-to-earnings (P/E) ratio of 11.40 and an enterprise value to EBITDA ratio of 6.63, indicating a competitive position within its industry. Additionally, its price-to-book value stands at 0.53, suggesting that the stock may be undervalued relative to its assets. Despite these favorable metrics, Decipher Labs has faced challenges in its stock performance, with a year-to-date return of -24.48%, significantly underperforming the Sensex, which has seen a decline of only -6.59% in the same period. Over the past three years, the company's stock has decreased by 83.25%, contrasting sharply with the Sensex's growth of 34.34%. When compared to its peers, Decipher Labs demonstrates a more attractive valuation ...

Read More

Decipher Labs Faces Increased Volatility Amid Significant Stock Decline and Market Underperformance

2025-02-17 09:38:13Decipher Labs, a microcap in the Pharmaceuticals & Drugs sector, is nearing a 52-week low, trading just above its recent low. The stock has declined consecutively over the past six days, with a significant one-year performance drop, underperforming compared to the broader market and trading below key moving averages.

Read More

Decipher Labs Reports Financial Results Indicating Shift in Performance Metrics, February 2025

2025-02-14 12:34:13Decipher Labs has announced its financial results for the quarter ending December 2024, revealing a shift in performance metrics. The company's score has adjusted to -12 from -9 over the past three months, indicating potential challenges in aligning financial trends within the pharmaceuticals sector. Stakeholders will be closely observing these developments.

Read More

Decipher Labs Faces Ongoing Challenges Amidst Sector Underperformance and Volatility in November 2023

2025-02-14 09:35:56Decipher Labs, a microcap in the Pharmaceuticals & Drugs sector, has hit a new 52-week low, continuing a downward trend with a notable decline over the past year. The company's stock performance has lagged behind the sector, raising concerns about its competitive position in the market.

Read More

Decipher Labs Hits 52-Week Low Amid Broader Market Gains and Sector Resilience

2025-02-13 14:05:14Decipher Labs, a microcap in the Pharmaceuticals & Drugs sector, has reached a new 52-week low, reflecting a year of underperformance compared to the broader market. Despite recent declines, the company showed some resilience today, outperforming its sector, though it remains below key moving averages.

Read MoreClosure of Trading Window

27-Mar-2025 | Source : BSEClosure of Trading Window under SEBI (Prohibition of Insider Trading) Regulations 2015

Announcement under Regulation 30 (LODR)-Newspaper Publication

15-Feb-2025 | Source : BSEPublication of Un-audited Financial Results for the Quarter and Nine Months ended 31.12.2024 in Newspaper(s)

Board Meeting Outcome for Outcome Of Board Meeting For The Quarter And Nine Months Ended 31.12.2024 Under Regulation 30 And 33 Of SEBI (Listing Obligations And Disclosure Requirements) Regulations 2015.

13-Feb-2025 | Source : BSEOutcome of the Board Meeting held on 13.02.2025

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available