DEE Development Engineers Faces Technical Trend Shifts Amid Market Fluctuations

2025-04-03 08:06:45DEE Development Engineers, a small-cap player in the engineering and industrial equipment sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 243.15, down from a previous close of 249.85, with a notable 52-week high of 400.00 and a low of 166.60. Today's trading saw a high of 246.45 and a low of 242.05. In terms of technical indicators, the MACD shows a bearish trend on a weekly basis, while the Bollinger Bands indicate a mildly bearish sentiment. The Relative Strength Index (RSI) currently presents no signal, and moving averages are not providing clear direction. Additionally, both the On-Balance Volume (OBV) and Dow Theory indicate no significant trends at this time. When comparing the stock's performance to the Sensex, DEE Development Engineers has shown a return of 0.62% over the past week, contrasting with a decline of 0.87% i...

Read MoreDEE Development Engineers Shows Mixed Technical Trends Amid Market Volatility

2025-04-02 08:10:54DEE Development Engineers, a small-cap player in the engineering and industrial equipment sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 249.85, showing a notable increase from the previous close of 238.40. Over the past week, the stock has experienced a high of 253.55 and a low of 240.95, indicating some volatility. In terms of technical indicators, the MACD on a weekly basis suggests a mildly bullish sentiment, while the Bollinger Bands indicate a mildly bearish trend. The Relative Strength Index (RSI) shows no significant signal, and moving averages are neutral. Additionally, both the KST and Dow Theory indicate no clear trend at this time. When comparing the company's performance to the Sensex, DEE Development Engineers has shown varied returns. Over the past month, the stock has returned 26.03%, significantly outperformin...

Read MoreTechnical Indicators Reveal Mixed Signals for DEE Development Engineers Amid Market Volatility

2025-03-25 08:06:43DEE Development Engineers, a small-cap player in the engineering and industrial equipment sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 259.40, showing a slight increase from the previous close of 258.50. Over the past year, the stock has experienced a high of 400.00 and a low of 166.60, indicating significant volatility. In terms of technical indicators, the weekly MACD suggests a bearish trend, while the Bollinger Bands also reflect a mildly bearish sentiment. The Dow Theory indicates a mildly bullish stance on a weekly basis, although the monthly outlook shows no definitive trend. The Relative Strength Index (RSI) and On-Balance Volume (OBV) metrics are currently signaling no clear direction. When comparing the company's performance to the Sensex, DEE Development Engineers has shown notable returns over the past week and m...

Read MoreDEE Development Engineers Shows Mixed Technical Signals Amidst Strong Recent Performance

2025-03-21 08:03:31DEE Development Engineers, a small-cap player in the engineering and industrial equipment sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 254.00, showing a notable increase from the previous close of 244.40. Over the past week, DEE Development has demonstrated a strong performance with a return of 10.92%, significantly outpacing the Sensex, which returned 3.41% in the same period. In terms of technical indicators, the MACD on a weekly basis remains bearish, while the monthly outlook is yet to be determined. The Relative Strength Index (RSI) shows no signal on a weekly basis, indicating a neutral momentum. Bollinger Bands reflect a mildly bearish trend weekly, while moving averages and other indicators like KST and Dow Theory present mixed signals. The company's performance over the past month has been particularly strong, wit...

Read MoreDEE Development Engineers Faces Mixed Technical Trends Amid Market Evaluation Revision

2025-03-17 08:01:41DEE Development Engineers, a small-cap player in the engineering and industrial equipment sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 229.00, slightly down from the previous close of 232.00. Over the past week, DEE Development has shown a stock return of 2.78%, contrasting with a decline of 0.69% in the Sensex, indicating a short-term outperformance. However, the company's performance metrics reveal a mixed picture. The 52-week high stands at 400.00, while the low is recorded at 166.60, highlighting significant volatility. Today's trading saw a high of 239.95 and a low of 226.65, further emphasizing the stock's fluctuating nature. In terms of technical indicators, the MACD and Bollinger Bands suggest bearish trends on a weekly basis, while the Dow Theory indicates a mildly bullish stance. The On-Balance Volume (OBV) also re...

Read MoreDEE Development Engineers Faces Technical Trend Shifts Amid Market Volatility

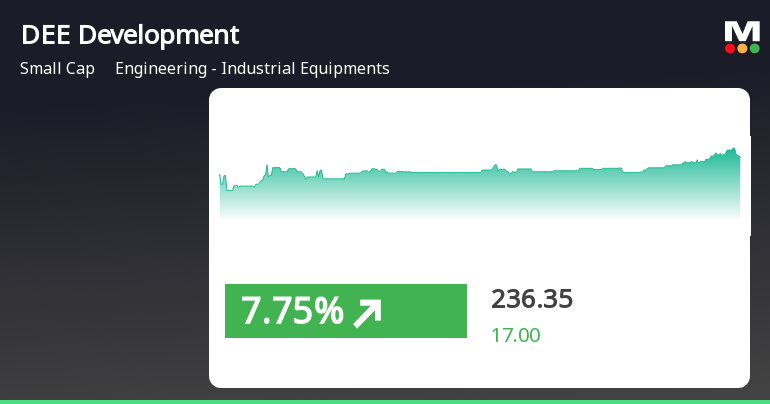

2025-03-13 08:02:56DEE Development Engineers, a small-cap player in the engineering and industrial equipment sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 232.00, down from a previous close of 236.40, with a notable 52-week high of 400.00 and a low of 166.60. Today's trading saw a high of 247.65 and a low of 226.85, indicating some volatility. In terms of technical indicators, the MACD shows a bearish trend on a weekly basis, while the monthly perspective remains unreported. The Relative Strength Index (RSI) currently presents no signal, and Bollinger Bands indicate a mildly bearish stance on a weekly basis. Moving averages and KST data are not specified, but Dow Theory suggests a mildly bullish trend weekly, with no trend observed monthly. The On-Balance Volume (OBV) reflects a mildly bullish sentiment weekly, with no trend on a monthly basis. ...

Read MoreDEE Development Engineers Faces Technical Trend Shifts Amid Market Volatility

2025-03-13 08:02:56DEE Development Engineers, a small-cap player in the engineering and industrial equipment sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 232.00, down from a previous close of 236.40, with a notable 52-week high of 400.00 and a low of 166.60. Today's trading saw a high of 247.65 and a low of 226.85, indicating some volatility. In terms of technical indicators, the MACD shows a bearish trend on a weekly basis, while the monthly perspective remains unreported. The Relative Strength Index (RSI) currently presents no signal, and Bollinger Bands indicate a mildly bearish stance on a weekly basis. Moving averages and KST data are not specified, but Dow Theory suggests a mildly bullish trend weekly, with no trend observed monthly. The On-Balance Volume (OBV) reflects a mildly bullish sentiment weekly, with no trend on a monthly basis. ...

Read More

DEE Development Engineers Surges Amidst Market Volatility, Outperforming Sector Peers

2025-03-11 15:20:27DEE Development Engineers has seen notable trading activity, with a significant intraday gain and outperforming its sector. The stock is currently above its short-term moving averages but below longer-term ones, indicating mixed trends. Despite today's performance, the stock has experienced declines over the past month and year-to-date.

Read MoreDEE Development Engineers Faces Technical Trend Adjustments Amid Market Volatility

2025-03-11 08:05:49DEE Development Engineers, a small-cap player in the engineering and industrial equipment sector, has recently undergone a technical trend adjustment. The company's current stock price stands at 219.35, reflecting a decline from the previous close of 230.60. Over the past year, the stock has experienced significant volatility, with a 52-week high of 400.00 and a low of 166.60. In terms of technical indicators, the MACD shows a bearish signal on a weekly basis, while the Bollinger Bands also indicate bearish conditions. The Relative Strength Index (RSI) currently shows no signal, suggesting a lack of momentum in either direction. Moving averages and other indicators like KST and Dow Theory are indicating no clear trend, which may reflect the stock's recent performance. When comparing the company's returns to the Sensex, DEE Development Engineers has shown a notable performance over the past week, with a re...

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

09-Apr-2025 | Source : BSECertificate under Reg. 74(5) of SEBI (DP) Regulations 2018 for the quarter ended 31st March 2025

Announcement Under Regulation 30 (LODR)- Updates On Order Book Of The Company For The Month Of March 2025

06-Apr-2025 | Source : BSEUpdates on order book of the Company for the month of March 2025

Announcement under Regulation 30 (LODR)-Award_of_Order_Receipt_of_Order

03-Apr-2025 | Source : BSEDisclosure under Regulation 30 of SEBI (LODR) Regulations 2015

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available