Dhanalaxmi Roto Spinners Adjusts Valuation Amid Competitive Textile Industry Landscape

2025-03-28 08:00:37Dhanalaxmi Roto Spinners, a microcap player in the textile industry, has recently undergone a valuation adjustment. The company's current price stands at 113.95, reflecting a decline from its previous close of 119.95. Over the past year, Dhanalaxmi Roto has demonstrated a stock return of 37.25%, significantly outperforming the Sensex, which recorded a return of 6.32% during the same period. Key financial metrics for Dhanalaxmi Roto include a PE ratio of 10.56 and an EV to EBITDA ratio of 8.94, indicating a competitive position within its sector. The company also boasts a robust return on capital employed (ROCE) of 68.35% and a return on equity (ROE) of 17.20%. In comparison to its peers, Dhanalaxmi Roto's valuation metrics present a mixed picture. While it maintains a fair valuation, competitors like Sportking India and Faze Three are positioned more attractively based on their respective metrics. This c...

Read More

Dhanalaxmi Roto Spinners Achieves 52-Week High Amid Strong Market Activity

2025-03-25 09:42:36Dhanalaxmi Roto Spinners has achieved a new 52-week high of Rs. 304.8, reflecting a notable increase over the past five days. The stock has consistently outperformed its sector and remains above key moving averages, indicating strong market activity and a significant recovery from its previous low of Rs. 147.

Read More

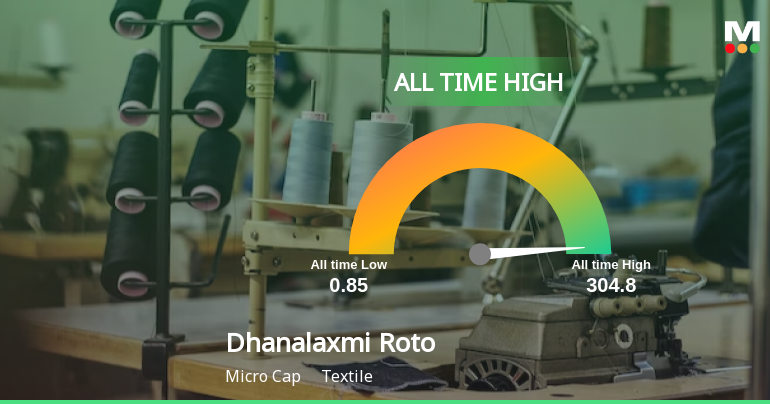

Dhanalaxmi Roto Spinners Achieves All-Time High, Signaling Strong Market Position and Growth Potential

2025-03-25 09:30:42Dhanalaxmi Roto Spinners has achieved an all-time high stock price of Rs. 304.8, reflecting a notable increase during the trading session. The company has outperformed its sector and demonstrated impressive returns over various time frames, indicating a strong upward trend and resilience within the textile industry.

Read More

Dhanalaxmi Roto Spinners Achieves 52-Week High Amid Strong Market Momentum

2025-03-24 09:41:20Dhanalaxmi Roto Spinners has reached a new 52-week high, reflecting a notable performance increase. The stock has gained significantly over the past four days, outperforming its sector. It is currently trading above key moving averages, indicating a strong upward trend, while the broader market shows positive momentum.

Read More

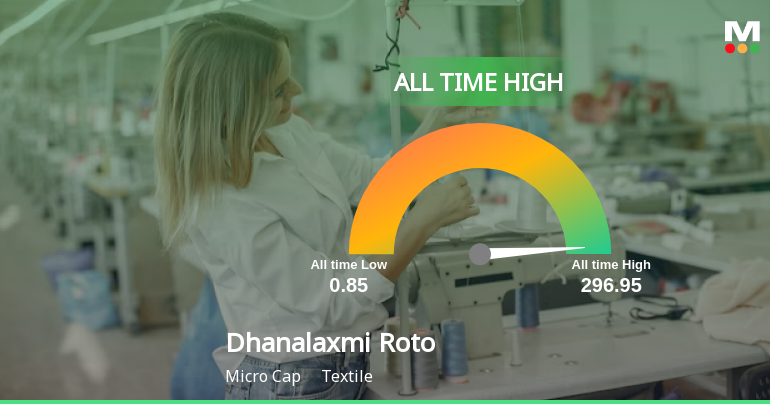

Dhanalaxmi Roto Spinners Achieves All-Time High Amid Strong Market Performance

2025-03-24 09:31:10Dhanalaxmi Roto Spinners, a microcap textile company, reached an all-time high stock price of Rs. 296.95, outperforming its sector significantly. The stock has shown a strong upward trend, with notable returns over various time frames, including a substantial increase over the past year and five years.

Read MoreDhanalaxmi Roto Spinners Adjusts Valuation Amidst Competitive Textile Industry Landscape

2025-03-18 08:00:46Dhanalaxmi Roto Spinners, a microcap player in the textile industry, has recently undergone a valuation adjustment. The company currently exhibits a price-to-earnings (PE) ratio of 11.11 and a price-to-book value of 1.91, indicating its market positioning relative to its financial metrics. The enterprise value to EBITDA stands at 9.85, while the EV to EBIT is recorded at 10.46, reflecting its operational efficiency. In terms of returns, Dhanalaxmi Roto has shown notable performance over various periods, with a one-year return of 35.62%, significantly outperforming the Sensex, which returned 2.10% in the same timeframe. Over the last five years, the company has achieved an impressive return of 2041.52%, compared to the Sensex's 142.55%. When compared to its peers, Dhanalaxmi Roto's valuation metrics present a mixed picture. While it has a competitive PE ratio, other companies in the sector, such as Sportki...

Read MoreDhanalaxmi Roto Spinners Adjusts Valuation Amid Strong Financial Performance and Market Position

2025-03-07 08:01:08Dhanalaxmi Roto Spinners, a microcap player in the textile industry, has recently undergone a valuation adjustment, reflecting its financial performance and market position. The company currently boasts a price-to-earnings (PE) ratio of 9.04 and an impressive return on capital employed (ROCE) of 68.35%. Additionally, its return on equity (ROE) stands at 17.20%, indicating effective management of shareholder equity. In comparison to its peers, Dhanalaxmi Roto Spinners demonstrates a competitive edge with a lower PE ratio than several companies in the textile sector, such as Faze Three and GHCL Textiles, which have higher valuations. The company's enterprise value to EBITDA ratio of 6.45 further highlights its operational efficiency relative to others in the industry. Despite some fluctuations in stock performance, Dhanalaxmi Roto has shown resilience, particularly over longer time frames, with a remarkable...

Read More

Dhanalaxmi Roto Spinners Reports Strong Sales Amid Mixed Market Sentiment

2025-02-28 18:24:39Dhanalaxmi Roto Spinners, a microcap textile company, recently adjusted its evaluation following a strong third-quarter performance, reporting net sales of Rs 68.88 crore and a PBDIT of Rs 3.22 crore. The firm demonstrates effective resource management and a solid return on equity, despite facing some bearish market conditions.

Read More

Dhanalaxmi Roto Spinners Shows Recovery Amid Ongoing Market Challenges

2025-02-18 18:30:14Dhanalaxmi Roto Spinners, a microcap textile company, has recently adjusted its evaluation following a positive third-quarter performance for FY24-25, with net sales reaching Rs 68.88 crore. Despite this recovery, the stock has shown bearish trends and underperformed compared to the broader market over the past year.

Read MoreClosure of Trading Window

27-Mar-2025 | Source : BSEClosure of trading window under SEBI(Prohibition of Insider Trading) Regulations 2015

Board Meeting Outcome for Outcome Of The Board Meeting Under Regulation 30 Read With Schedule III Of SEBI(Listing Obligations And Disclosure Requriments) Regulation 2015

27-Mar-2025 | Source : BSEAllotment of 3900300 Equity Shares of Rs.10/- (Rupees Ten) each as fully paid Bonus Shares in the ratio of 1:1 held by the members whose names appears in the Registrar of Members as on the record date i.e. 26.03.2025.

Intimation Of Record Date For Allotment Of Bonus Equity Shares

12-Mar-2025 | Source : BSEIntimation of Record Date for allotment of Bonus Equity Shares

Corporate Actions

No Upcoming Board Meetings

Dhanalaxmi Roto Spinners Ltd has declared 15% dividend, ex-date: 21 Jun 24

No Splits history available

Dhanalaxmi Roto Spinners Ltd has announced 1:1 bonus issue, ex-date: 26 Mar 25

No Rights history available