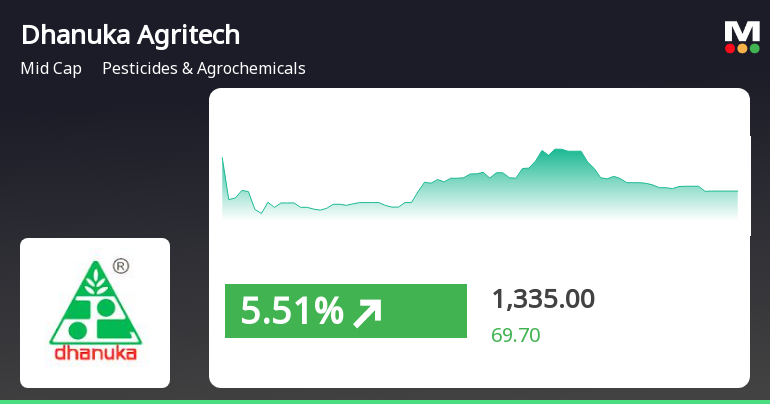

Dhanuka Agritech Shows Mixed Technical Trends Amid Strong Long-Term Performance

2025-04-03 08:04:30Dhanuka Agritech, a midcap player in the pesticides and agrochemicals sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1326.00, showing a notable increase from the previous close of 1248.95. Over the past year, Dhanuka Agritech has demonstrated a robust performance with a return of 26.17%, significantly outperforming the Sensex, which recorded a return of 3.67% in the same period. In terms of technical indicators, the weekly MACD remains bearish, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) shows no signal on both weekly and monthly charts, indicating a neutral momentum. Bollinger Bands suggest a mildly bearish trend on a weekly basis, contrasting with a bullish stance on a monthly basis. Moving averages also reflect a mildly bearish sentiment in the short term. Dhanuka Agritech's performance ov...

Read More

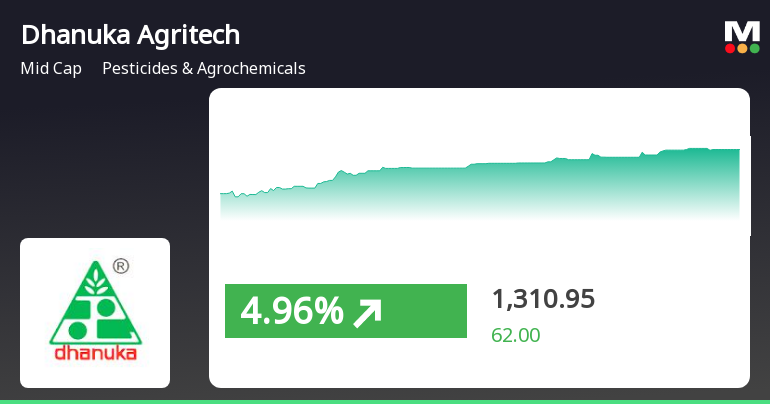

Dhanuka Agritech Shows Signs of Trend Reversal Amid Broader Market Gains

2025-04-02 12:05:25Dhanuka Agritech experienced a notable uptick on April 2, 2025, following a four-day decline, reaching an intraday high of Rs 1,310. The stock outperformed its sector, although its moving averages present a mixed outlook. Over the past year, it has significantly outperformed the Sensex.

Read MoreDhanuka Agritech Faces Technical Trend Shifts Amid Market Volatility and Mixed Indicators

2025-04-01 08:02:30Dhanuka Agritech, a midcap player in the Pesticides & Agrochemicals industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1292.35, down from a previous close of 1315.00, with a notable 52-week high of 1,926.40 and a low of 956.35. Today's trading saw a high of 1370.95 and a low of 1263.75, indicating some volatility. The technical summary indicates a bearish sentiment in various indicators, including MACD and Moving Averages, while the Bollinger Bands and KST show a mix of bearish and mildly bearish trends. The Dow Theory presents a mildly bullish outlook on a weekly basis, contrasting with the overall bearish sentiment. In terms of performance, Dhanuka Agritech has shown varied returns compared to the Sensex. Over the past year, the stock has delivered a return of 26.42%, significantly outperforming the Sensex's 5.11%. However, on...

Read MoreDhanuka Agritech Adjusts Valuation Grade Amid Strong Industry Performance Metrics

2025-04-01 08:00:27Dhanuka Agritech, a midcap player in the Pesticides and Agrochemicals sector, has recently undergone a valuation adjustment. The company's current price stands at 1,292.35, reflecting a slight decline from the previous close of 1,315.00. Over the past year, Dhanuka has demonstrated a stock return of 26.42%, significantly outperforming the Sensex, which recorded a return of 5.11% during the same period. Key financial metrics for Dhanuka Agritech include a PE ratio of 21.00 and an EV to EBITDA ratio of 15.39. The company also boasts a robust return on capital employed (ROCE) of 24.12% and a return on equity (ROE) of 21.30%. In comparison to its peers, Dhanuka's valuation metrics appear more favorable, particularly when contrasted with BASF India, which has a higher PE ratio of 31.58, and Anupam Rasayan, which is noted for its significantly elevated valuation metrics. Overall, Dhanuka Agritech's performance ...

Read MoreDhanuka Agritech Shows Mixed Technical Trends Amid Strong Long-Term Performance

2025-03-26 08:03:21Dhanuka Agritech, a midcap player in the Pesticides and Agrochemicals industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1331.75, showing a slight increase from the previous close of 1322.70. Over the past year, Dhanuka Agritech has demonstrated a notable return of 39.05%, significantly outperforming the Sensex, which recorded a return of 7.12% in the same period. In terms of technical indicators, the weekly MACD remains bearish, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) shows no signal for both weekly and monthly assessments. Bollinger Bands indicate a mildly bearish trend on a weekly basis, contrasting with a bullish monthly perspective. Moving averages reflect a bearish sentiment on a daily basis, while the KST shows a bearish trend weekly and mildly bearish monthly. Dhanuka Agritech's per...

Read MoreDhanuka Agritech Adjusts Valuation Amid Strong Performance in Agrochemical Sector

2025-03-25 08:00:37Dhanuka Agritech, a midcap player in the pesticides and agrochemicals sector, has recently undergone a valuation adjustment. The company's current price stands at 1,322.70, reflecting a notable increase from the previous close of 1,265.30. Over the past year, Dhanuka has demonstrated a stock return of 38.10%, significantly outperforming the Sensex, which recorded a return of 7.07% in the same period. Key financial metrics for Dhanuka Agritech include a PE ratio of 21.49 and an EV to EBITDA ratio of 15.75, indicating its market positioning within the industry. The company also boasts a robust return on capital employed (ROCE) of 24.12% and a return on equity (ROE) of 21.30%. In comparison to its peers, Dhanuka's valuation metrics present a mixed picture. While BASF India maintains a fair valuation with a higher PE ratio, Anupam Rasayan is positioned at a significantly higher valuation level. Sharda Cropch...

Read More

Dhanuka Agritech Shows Resilience with Notable Stock Recovery Amid Market Fluctuations

2025-03-24 10:05:26Dhanuka Agritech has experienced a notable rebound, gaining 7.2% after two days of decline. The stock outperformed its sector and has shown a significant increase over the past week. Despite a three-month decline, its one-year performance remains strong, reflecting resilience in a fluctuating market.

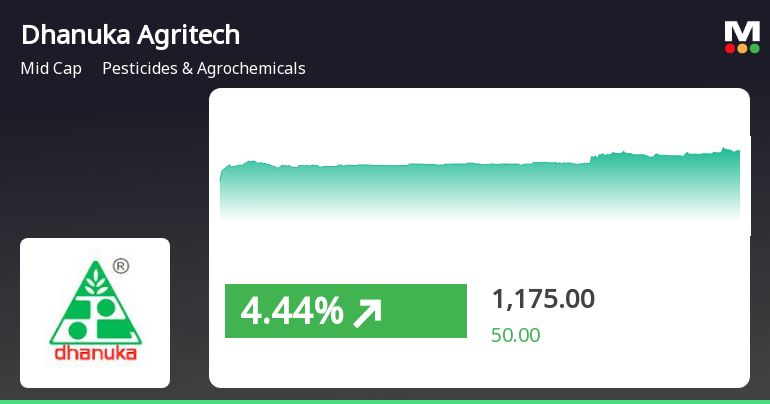

Read MoreDhanuka Agritech Opens Strong with 4.72% Gain, Signaling Potential Trend Reversal

2025-03-24 10:00:20Dhanuka Agritech, a midcap player in the pesticides and agrochemicals industry, has shown significant activity today, opening with a gain of 4.72%. The stock outperformed its sector by 5.42%, marking a notable trend reversal after two consecutive days of decline. It reached an intraday high of Rs 1378.9, reflecting an increase of 8.98% during the trading session. In terms of performance metrics, Dhanuka Agritech's one-day performance stands at 7.20%, significantly surpassing the Sensex's 0.80% gain. However, over the past month, the stock has only increased by 1.60%, while the Sensex has risen by 4.12%. From a technical perspective, the stock's moving averages are currently higher than the 5-day, 20-day, and 50-day averages, but lower than the 100-day and 200-day averages. The stock is classified as a high beta stock, with a beta of 1.20, indicating that it tends to experience larger fluctuations compare...

Read More

Dhanuka Agritech Shows Signs of Recovery Amid Mixed Market Momentum

2025-03-17 13:50:22Dhanuka Agritech, a midcap in the pesticides and agrochemicals sector, experienced a notable rebound on March 17, 2025, after two days of decline. The stock's current price is above its 5-day moving average but below longer-term averages, reflecting mixed momentum. The broader sector also showed positive movement.

Read MoreClosure of Trading Window

25-Mar-2025 | Source : BSEIntimation of Closure of Trading Window in terms of SEBI (Prohibition of Insider Trading) Regulations 2015.

Intimation For Appointment Of Senior Management Personnel

17-Mar-2025 | Source : BSEIntimation for appointment of Senior Management Personnel

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Intimation

24-Feb-2025 | Source : BSEIntimation of schedule of Analyst / Institutional Investors Meet

Corporate Actions

No Upcoming Board Meetings

Dhanuka Agritech Ltd has declared 300% dividend, ex-date: 19 Jul 24

Dhanuka Agritech Ltd has announced 2:10 stock split, ex-date: 02 Sep 10

No Bonus history available

No Rights history available