Dhoot Industrial Finance Faces Mixed Technical Trends Amid Market Volatility

2025-02-25 10:28:30Dhoot Industrial Finance, a microcap player in the trading industry, has recently undergone an evaluation revision reflecting its current market dynamics. The company's technical indicators present a mixed picture, with the MACD signaling bearish trends on both weekly and monthly bases, while the KST shows a contrasting bullish signal on a monthly scale. The Bollinger Bands and moving averages also indicate bearish conditions, suggesting a cautious outlook. In terms of performance metrics, Dhoot Industrial Finance's current price stands at 235.35, slightly up from the previous close of 235.00. The stock has experienced significant volatility, with a 52-week high of 469.90 and a low of 191.00. Today's trading saw a high of 250.90 and a low matching the current price. When comparing the company's returns to the Sensex, Dhoot Industrial Finance has faced challenges recently. Over the past month, the stock ha...

Read MoreDhoot Industrial Finance Shows Resilience Amid Recent Market Volatility and Declines

2025-02-25 09:56:44Dhoot Industrial Finance Ltd, a microcap player in the trading industry, has shown significant activity today, with a notable increase of 4.26% in its stock price, outperforming the Sensex, which rose by 0.41%. The company's market capitalization stands at Rs 154.79 crore, and it boasts a price-to-earnings (P/E) ratio of 1.81, significantly lower than the industry average of 46.57. Over the past year, Dhoot Industrial Finance has delivered a performance of 12.39%, contrasting sharply with the Sensex's 2.21% gain. However, the stock has faced challenges in the short term, with a decline of 20.71% over the past month and a year-to-date drop of 36.36%. In a longer-term perspective, the company has shown resilience, with a remarkable 208.37% increase over three years and an impressive 1125.00% rise over five years. Technical indicators suggest a bearish trend in the weekly and monthly outlooks, with moving av...

Read More

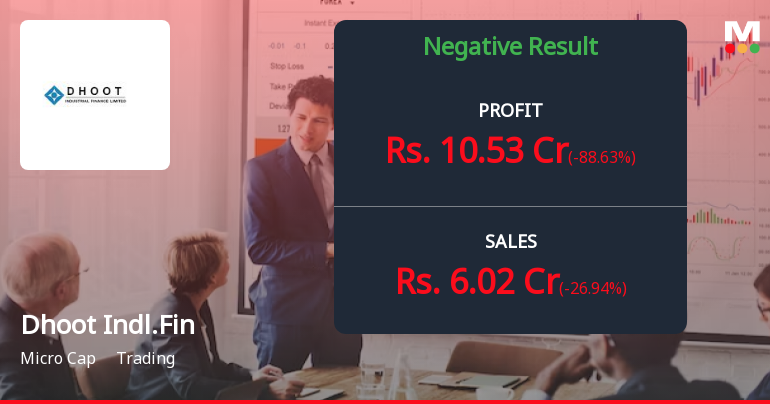

Dhoot Industrial Finance Reports Mixed Financial Results Amidst Notable Efficiency Gains in December 2024

2025-02-12 15:47:45Dhoot Industrial Finance has released its financial results for the quarter ending December 2024, showcasing a strong Debtors Turnover Ratio of 13.22 times, the highest in recent periods. However, the company faces challenges with declines in Profit Before Tax, Profit After Tax, net sales, and Operating Profit, indicating a mixed performance.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

09-Apr-2025 | Source : BSECertificate under Regulation 74(5) of the SEBI (Depositories and Participants) Regulations 2018 is attached herewith.

Announcement Under Regulation 30 Of SEBI (Listing Obligations And Disclosure Requirements) Regulations 2015

04-Apr-2025 | Source : BSEAnnouncement under Regulation 30 of SEBI (LODR) Regulations 2015.

Closure of Trading Window

27-Mar-2025 | Source : BSEIntimation of Closure of Trading Window.

Corporate Actions

No Upcoming Board Meetings

Dhoot Industrial Finance Ltd has declared 15% dividend, ex-date: 20 Sep 24

No Splits history available

No Bonus history available

No Rights history available