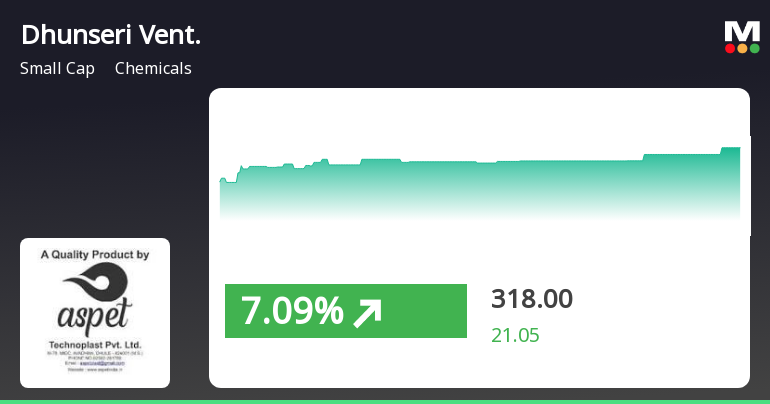

Dhunseri Ventures Opens Strong with 8.78% Gain, Outperforming Sector Amid Market Fluctuations

2025-04-02 15:25:03Dhunseri Ventures, a small-cap player in the chemicals industry, has shown significant activity today, opening with a notable gain of 8.78%. The stock has outperformed its sector by 1.55%, reflecting a strong performance amid market fluctuations. Over the past three days, Dhunseri Ventures has recorded a cumulative return of 5.1%, indicating a positive trend. Today, the stock reached an intraday high of Rs 356.9, showcasing its volatility with an intraday fluctuation of 6.09%. In terms of moving averages, the stock is currently above its 5-day, 20-day, and 50-day averages, although it remains below the 100-day and 200-day averages, suggesting mixed signals in its longer-term performance. In the broader context, Dhunseri Ventures has performed well over the past month, with a return of 10.29%, compared to the Sensex's 4.67%. The stock's beta of 1.35 indicates that it tends to experience larger price moveme...

Read More

Dhunseri Ventures Shows Strong Sales Growth Amid Ongoing Market Caution

2025-04-02 08:02:06Dhunseri Ventures, a small-cap chemicals company, has recently seen a change in its evaluation, reflecting a shift in market sentiment. The firm reported impressive growth in net sales and operating profit, although it has faced challenges with stock performance over the past year, indicating ongoing market caution.

Read MoreDhunseri Ventures Shows Mixed Technical Trends Amidst Market Volatility and Performance Variability

2025-04-02 08:01:08Dhunseri Ventures, a small-cap player in the chemicals industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 328.10, showing a slight increase from the previous close of 322.95. Over the past year, the stock has experienced a high of 542.55 and a low of 294.10, indicating significant volatility. The technical summary reveals a mixed picture. The MACD indicates a bearish trend on a weekly basis, while the monthly perspective shows a mildly bearish stance. Bollinger Bands also reflect a mildly bearish trend for both weekly and monthly evaluations. Meanwhile, the KST presents a mildly bullish outlook on a weekly basis but shifts to mildly bearish on a monthly scale. Notably, the stock's moving averages indicate a bearish trend on a daily basis. In terms of performance, Dhunseri Ventures has shown varied returns compared to the Sensex....

Read More

Dhunseri Ventures Faces Technical Outlook Shift Amid Strong Financial Growth

2025-03-25 08:00:55Dhunseri Ventures, a small-cap chemicals company, has experienced a recent adjustment in its technical outlook, indicating a shift in sentiment. Despite this, the company reported strong financial results for the quarter ending December 2024, with significant growth in net sales and operating profit, alongside a low debt-to-equity ratio.

Read MoreDhunseri Ventures Faces Technical Trend Shifts Amid Market Volatility and Mixed Performance

2025-03-25 08:00:35Dhunseri Ventures, a small-cap player in the chemicals industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 335.00, slightly down from its previous close of 335.80. Over the past year, the stock has experienced a high of 542.55 and a low of 294.10, indicating significant volatility. In terms of technical indicators, the weekly MACD and Bollinger Bands are showing bearish signals, while the monthly metrics reflect a mildly bearish stance. The daily moving averages also align with this trend, suggesting a cautious outlook. Notably, the Relative Strength Index (RSI) shows no signal for both weekly and monthly periods, indicating a lack of momentum in either direction. When comparing the stock's performance to the Sensex, Dhunseri Ventures has shown varied returns. Over the past week, it outperformed the Sensex with a return of 6.35% ...

Read More

Dhunseri Ventures Reports Strong Growth Amidst Mixed Stock Performance and Valuation Adjustments

2025-03-19 08:00:28Dhunseri Ventures, a small-cap chemicals company, has reported strong financial results for Q3 FY24-25, with significant growth in net sales and operating profit. The company also shows a favorable low debt-to-equity ratio and an attractive valuation compared to industry peers, despite recent stock performance challenges.

Read MoreDhunseri Ventures Faces Mixed Technical Trends Amidst Market Evaluation Revision

2025-03-19 08:00:27Dhunseri Ventures, a small-cap player in the chemicals industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 320.10, showing a slight increase from the previous close of 315.00. Over the past year, the stock has experienced a decline of 2.75%, contrasting with a 3.51% gain in the Sensex, indicating a challenging performance relative to the broader market. In terms of technical indicators, the weekly MACD and Bollinger Bands suggest a bearish sentiment, while the monthly metrics show a mildly bearish trend. The Relative Strength Index (RSI) presents a mixed picture, with no signal on a weekly basis but a bullish stance monthly. The On-Balance Volume (OBV) indicates bullish activity weekly, yet shows no trend monthly, reflecting varied investor sentiment. Looking at the company's return compared to the Sensex, Dhunseri Ventures has s...

Read More

Dhunseri Ventures Shows Resilience Amid Broader Market Decline and Small-Cap Gains

2025-03-04 15:00:15Dhunseri Ventures, a small-cap chemicals company, experienced a notable rise today, contrasting with a declining market. After four days of losses, the stock reached an intraday high, although it remains below key moving averages. The broader market, represented by the Sensex, continues to face challenges.

Read More

Dhunseri Ventures Faces Stock Volatility Amidst Broader Market Trends and Challenges

2025-03-03 10:05:23Dhunseri Ventures has faced notable stock volatility, recently hitting a 52-week low and declining nearly 10% over four days. Despite a slight intraday increase, the stock remains below key moving averages and has dropped 22.79% over the past year, contrasting with the Sensex's minor decline.

Read MoreClosure of Trading Window

27-Mar-2025 | Source : BSEClosure of Trading Window

Disclosure Under Regulation 7(2) Of SEBI (Prohibition Of Insider Trading) Regulations 2015

12-Mar-2025 | Source : BSEDisclosure under Regulation 7(2) of SEBI (Prohibition of Insider Trading) Regulations 2015

Disclosure Under Regulation 7(2) Of SEBI (Prohibition Of Insider Trading) Regulations 2015

12-Mar-2025 | Source : BSEDisclosure under Regulation 7(2) of SEBI (Prohibition of Insider Trading) Regulations 2015

Corporate Actions

No Upcoming Board Meetings

Dhunseri Ventures Ltd has declared 50% dividend, ex-date: 13 Aug 24

No Splits history available

No Bonus history available

No Rights history available