Dilip Buildcon Faces Evaluation Shift Amid Long-Term Financial Challenges and Recent Growth

2025-04-03 08:10:44Dilip Buildcon, a midcap player in the Capital Goods sector, has undergone a recent evaluation adjustment. While the company has shown positive results over the last ten quarters, it faces challenges with long-term fundamentals, including a declining operating profit growth rate and high debt levels, despite recent quarterly profit growth.

Read MoreDilip Buildcon Shows Mixed Technical Trends Amid Strong Long-Term Performance

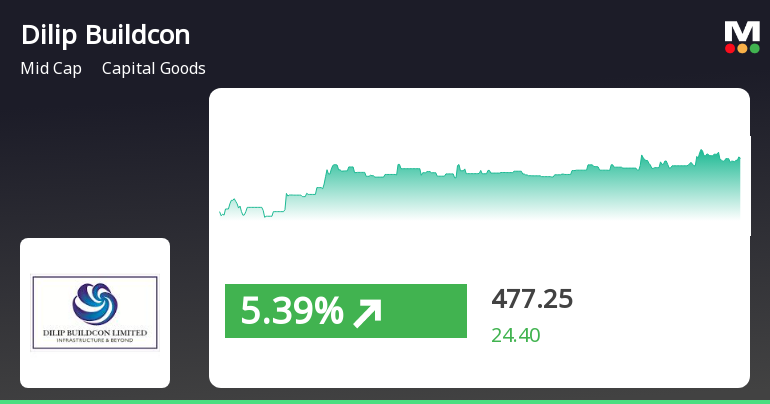

2025-04-02 08:08:53Dilip Buildcon, a midcap player in the capital goods sector, has recently undergone an evaluation revision reflecting shifts in its technical indicators. The company's current stock price stands at 478.55, slightly above the previous close of 475.50. Over the past year, Dilip Buildcon has experienced a stock return of 4.44%, outperforming the Sensex, which recorded a return of 2.72% during the same period. In terms of technical metrics, the MACD indicates a mildly bullish trend on a weekly basis, while the monthly perspective shows a mildly bearish stance. The Relative Strength Index (RSI) remains neutral for both weekly and monthly evaluations. Bollinger Bands suggest a bullish outlook weekly, contrasting with a sideways trend monthly. Daily moving averages reflect a mildly bearish sentiment, while the KST shows mixed signals with a mildly bullish weekly trend and a mildly bearish monthly trend. Notably,...

Read MoreDilip Buildcon Shows Technical Trend Divergence Amid Market Volatility and Resilience

2025-04-01 08:03:18Dilip Buildcon, a midcap player in the capital goods sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 475.50, slightly down from its previous close of 478.20. Over the past year, the stock has experienced a high of 588.40 and a low of 341.65, indicating significant volatility. In terms of technical indicators, the weekly MACD shows a mildly bullish trend, while the monthly perspective leans mildly bearish. The Bollinger Bands are bullish on both weekly and monthly charts, suggesting a potential for upward movement. The On-Balance Volume (OBV) also indicates a bullish sentiment in the weekly timeframe, contrasting with the mildly bearish signals from the daily moving averages. When comparing Dilip Buildcon's performance to the Sensex, the company has shown notable resilience. Over the past month, it recorded a return of 15.09%, s...

Read MoreDilip Buildcon's Technical Indicators Reflect Mixed Signals Amid Strong Market Performance

2025-03-28 08:03:34Dilip Buildcon, a midcap player in the capital goods sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 478.20, showing a notable increase from the previous close of 452.85. Over the past year, Dilip Buildcon has demonstrated a return of 12.48%, outperforming the Sensex, which recorded a return of 6.32% in the same period. The technical summary indicates a mixed performance across various indicators. The MACD shows a mildly bullish trend on a weekly basis, while the monthly perspective leans mildly bearish. Bollinger Bands are bullish on both weekly and monthly charts, suggesting potential volatility. The moving averages present a mildly bearish outlook on a daily basis, contrasting with the overall bullish sentiment reflected in the KST and OBV metrics. In terms of stock performance relative to the Sensex, Dilip Buildcon has show...

Read More

Dilip Buildcon Shows Signs of Trend Reversal Amid Broader Market Recovery

2025-03-27 15:05:26Dilip Buildcon Ltd. has experienced notable activity, rebounding after three days of decline. The stock has outperformed its sector and shown strong performance over the past month and year-to-date. Currently, it is trading above several moving averages, reflecting a positive trend amid broader market recovery.

Read MoreDilip Buildcon Faces Mixed Technical Signals Amid Market Volatility and Performance Variability

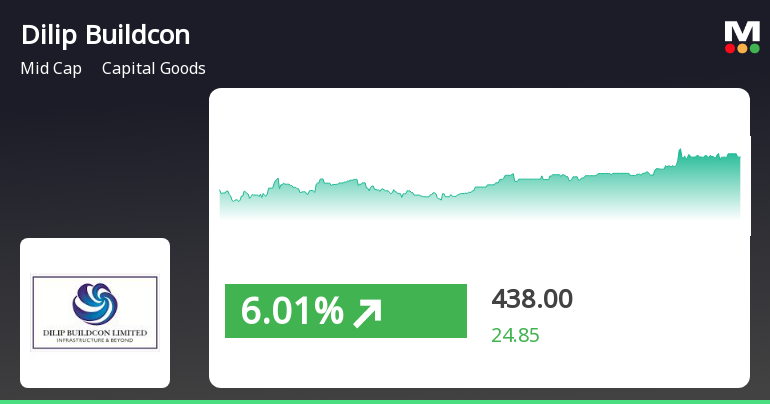

2025-03-27 08:03:28Dilip Buildcon, a midcap player in the capital goods sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 452.85, down from a previous close of 462.25, with a notable 52-week high of 588.40 and a low of 341.65. Today's trading saw a high of 466.40 and a low of 452.05, indicating some volatility in its performance. The technical summary reveals mixed signals across various indicators. The MACD shows a mildly bullish trend on a weekly basis, while the monthly perspective leans mildly bearish. The Relative Strength Index (RSI) remains neutral for both weekly and monthly evaluations. Bollinger Bands indicate a mildly bullish trend weekly, contrasting with a sideways movement monthly. Moving averages suggest a mildly bearish outlook on a daily basis, while the KST reflects a similar mildly bearish sentiment monthly. In terms of performan...

Read MoreDilip Buildcon Shows Mixed Technical Trends Amid Strong Long-Term Performance

2025-03-19 08:04:27Dilip Buildcon, a midcap player in the capital goods industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 449.65, showing a notable increase from the previous close of 435.60. Over the past year, Dilip Buildcon has demonstrated a stock return of 9.2%, outperforming the Sensex, which recorded a return of 3.51% in the same period. The technical summary indicates a mixed performance across various indicators. The MACD shows a mildly bullish trend on a weekly basis, while the monthly perspective leans mildly bearish. The Relative Strength Index (RSI) remains neutral, indicating no significant momentum in either direction. Bollinger Bands suggest a bullish stance weekly, contrasting with a sideways trend monthly. Moving averages present a mildly bearish outlook on a daily basis, while the On-Balance Volume (OBV) reflects a mildly bullis...

Read MoreDilip Buildcon Adjusts Valuation Grade Amidst Competitive Capital Goods Landscape

2025-03-11 08:00:39Dilip Buildcon, a midcap player in the capital goods sector, has recently undergone a valuation adjustment, reflecting its current market standing. The company's price-to-earnings ratio stands at 25.19, while its price-to-book value is recorded at 1.45. Key performance indicators include an EV to EBITDA ratio of 8.25 and an EV to EBIT ratio of 10.22, which provide insights into its operational efficiency. In terms of returns, Dilip Buildcon has shown resilience with a one-week stock return of 4.49%, outperforming the Sensex, which returned 1.41% in the same period. Over the past month, the company has achieved a return of 5.63%, contrasting with a decline in the Sensex by 4.13%. However, its longer-term performance reveals a mixed picture, with a year-to-date return of 1.99% compared to a 5.15% drop in the Sensex. When compared to its peers, Dilip Buildcon's valuation metrics indicate a competitive positi...

Read More

Dilip Buildcon Shows Resilience Amid Broader Market Challenges and Bearish Trends

2025-03-03 18:00:34Dilip Buildcon Ltd., a midcap capital goods company, experienced a notable increase in stock performance, outperforming its sector. The stock has shown consecutive gains over two days and is currently positioned above several short-term moving averages, indicating resilience amid a broader market downturn.

Read MoreAnnouncement under Regulation 30 (LODR)-Award_of_Order_Receipt_of_Order

27-Mar-2025 | Source : BSEIn continuation to our disclosure dated 12.11.2024 we are pleased to inform you that DBL-STL Consortium has received the Advance Work Order (AWO) for Design Supply Construction Installation Upgradation Operation and Maintenance of middle mile network for BSNL Bharat Net Phase - III Broadband Connectivity Project funded by USOF and the value of the project is Rs. 2631.14 cr. (including CAPEX OPEX and GST) to provide Middle mile and Last mile connectivity in Jammu & Kashmir and Ladakh regions wherein the DBL portion for Project Execution is 70.23%.

Closure of Trading Window

25-Mar-2025 | Source : BSEIntimation of closure of Trading Window

Shareholder Meeting / Postal Ballot-Outcome of EGM

21-Mar-2025 | Source : BSEPursuant to regulation 44 of the SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015 please find enclosed herewith Voting Results in respect of the business conducted at the Extra Ordinary General Meeting (1/2024-25) held through Video Conferencing/Other Audio-Visual Means on Thursday March 20 2025. The same will also be made available on the Company website at www.dilipbuildcon.com

Corporate Actions

No Upcoming Board Meetings

Dilip Buildcon Ltd. has declared 10% dividend, ex-date: 17 Sep 24

No Splits history available

No Bonus history available

No Rights history available