Dixon Technologies Sees Surge in Put Option Activity with 5,241 Contracts at Rs 13,000

2025-04-03 10:00:09Dixon Technologies (India) Ltd has emerged as one of the most active stocks in the market today, particularly in the options segment, with a focus on put options. The company, operating in the Consumer Durables - Electronics industry, has seen significant activity in its put options expiring on April 24, 2025. Notably, 5,241 contracts were traded at a strike price of Rs 13,000, resulting in a turnover of approximately Rs 1,263.39 lakhs. The open interest for these puts stands at 1,869 contracts, indicating ongoing interest among traders. In terms of performance, Dixon Technologies has underperformed its sector by 0.55%, with a one-day return of -0.75%. The stock is currently trading below its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, reflecting a bearish trend. Additionally, investor participation has declined, with delivery volume dropping by 46.54% compared to the 5-day average. Despit...

Read MoreDixon Technologies Faces Mixed Technical Trends Amid Strong Long-Term Performance

2025-04-03 08:05:56Dixon Technologies (India), a prominent player in the Consumer Durables - Electronics sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 13,450.25, showing a notable increase from the previous close of 12,925.40. Over the past year, Dixon has demonstrated a significant return of 70.01%, outperforming the Sensex, which recorded a return of 3.67% during the same period. In terms of technical indicators, the weekly MACD is bearish, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) shows no signals for both weekly and monthly assessments. Bollinger Bands indicate a mildly bearish trend on a weekly basis, contrasting with a bullish monthly perspective. Moving averages reflect a bearish sentiment on a daily basis, while the KST shows a bearish weekly trend but a bullish monthly outlook. Dixon's performance o...

Read MoreDixon Technologies Shows Strong Long-Term Growth Amid Short-Term Market Challenges

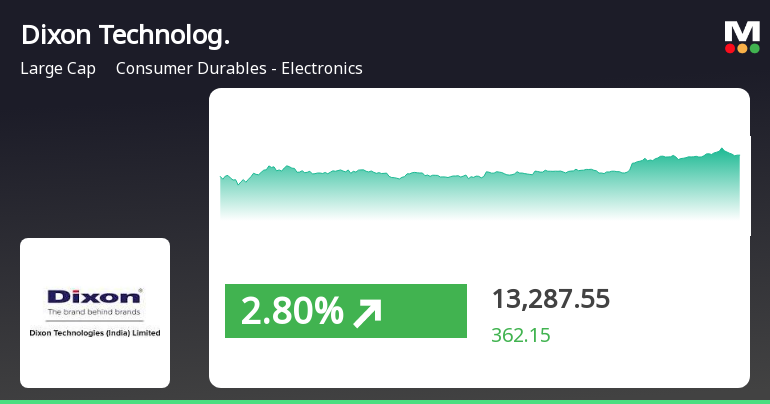

2025-04-02 18:00:35Dixon Technologies (India) Ltd, a prominent player in the Consumer Durables - Electronics sector, has shown significant activity in the stock market today, with a notable increase of 4.06%. This performance stands in contrast to the Sensex, which rose by 0.78%. Over the past year, Dixon Technologies has delivered an impressive return of 70.01%, significantly outperforming the Sensex's 3.67% gain. Despite its strong yearly performance, the stock has faced challenges in the short term, with a decline of 3.59% over the past month and a year-to-date drop of 24.99%. The company's market capitalization is currently at Rs 78,897.00 crore, and it operates with a P/E ratio of 128.94, which is notably higher than the industry average of 86.09. In terms of technical indicators, the weekly MACD suggests a bearish trend, while the monthly outlook appears mildly bullish. The stock's performance over the last three year...

Read More

Dixon Technologies Shows Reversal Amid Broader Market Gains and Mixed Performance Indicators

2025-04-02 12:35:22Dixon Technologies (India) experienced a notable gain today, reversing a two-day decline and reaching an intraday high. While the stock is currently below several moving averages and has seen a decline over the past month and year, it has shown significant long-term growth over three and five years. The broader market also saw positive movement.

Read MoreDixon Technologies has emerged as one of the most active stock puts today amid fluctuating investor interest.

2025-04-02 10:00:08Dixon Technologies (India) Ltd, a prominent player in the Consumer Durables - Electronics sector, has emerged as one of the most active stocks today, particularly in the options market. The company’s put options, set to expire on April 24, 2025, have seen significant trading activity, with 7,446 contracts exchanged at a strike price of Rs 13,000. This activity has generated a turnover of approximately Rs 1,945.75 lakhs, while the open interest stands at 1,527 contracts, indicating a robust interest in these options. In terms of performance, Dixon Technologies is currently trading at an underlying value of Rs 12,924.80, reflecting a one-day return of 1.73%, which is notably higher than the sector's return of 0.75% and the Sensex's return of 0.49%. The stock has shown signs of a trend reversal, gaining after two consecutive days of decline. However, it is trading below its 5-day, 20-day, 50-day, 100-day, and...

Read More

Dixon Technologies Adjusts Evaluation Amid Strong Financial Performance and Market Outperformance

2025-04-02 08:31:11Dixon Technologies (India) has recently experienced a change in its evaluation, reflecting a shift in its technical trend. The company showcases strong long-term fundamentals, with impressive growth in net sales and operating profit, alongside a low Debt to EBITDA ratio, and has consistently outperformed the broader market.

Read MoreDixon Technologies Faces Technical Trend Shifts Amid Market Volatility

2025-04-02 08:09:07Dixon Technologies (India), a prominent player in the consumer durables and electronics sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 12,925.40, showing a notable decline from its previous close of 13,179.55. Over the past year, Dixon has experienced significant volatility, with a 52-week high of 19,149.80 and a low of 7,100.05. In terms of technical indicators, the weekly MACD and KST suggest bearish trends, while the monthly KST indicates a bullish stance. The Bollinger Bands present a mixed picture, with weekly readings showing bearish tendencies and monthly readings leaning mildly bullish. Moving averages on a daily basis reflect a mildly bullish sentiment, although the overall technical summary indicates a shift in trend. When comparing Dixon's performance to the Sensex, the stock has faced challenges in the short term, ...

Read MoreDixon Technologies has emerged as one of the most active stock puts today amid market volatility.

2025-04-01 15:00:05Dixon Technologies (India) Ltd, a prominent player in the Consumer Durables - Electronics sector, has emerged as one of the most active stocks in the market today, particularly in the options space. The company’s put options, set to expire on April 24, 2025, have seen significant trading activity, with 6,594 contracts exchanged at a turnover of approximately Rs 1,691.98 lakhs. The strike price for these puts is set at Rs 13,000, while the underlying stock is currently valued at Rs 12,963.8. Today’s performance reflects a trend reversal, as Dixon Technologies has experienced a consecutive decline over the past two days, resulting in a total return of -4.09%. The stock reached an intraday high of Rs 13,450, marking a 2.05% increase at its peak. However, it is trading below its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, indicating a bearish trend. Investor participation has also waned, with...

Read MoreDixon Technologies Sees Significant Open Interest Surge Amid Market Activity Shift

2025-03-28 15:00:40Dixon Technologies (India) Ltd, a prominent player in the Consumer Durables - Electronics sector, has experienced a significant increase in open interest today. The latest open interest stands at 60,905 contracts, reflecting a rise of 10,379 contracts or 20.54% from the previous open interest of 50,526. This surge coincides with a trading volume of 72,974 contracts, indicating heightened activity in the derivatives market. In terms of price performance, Dixon Technologies underperformed its sector by 0.6%, with the stock reaching an intraday low of Rs 13,009.4, marking a decline of 3.71%. The weighted average price suggests that more volume was traded closer to this low price point. Additionally, the stock is currently trading below its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, indicating a bearish trend in the short to medium term. Despite these challenges, there has been a notable inc...

Read MoreAnnouncement under Regulation 30 (LODR)-Analyst / Investor Meet - Intimation

04-Apr-2025 | Source : BSEPursuant to Regulations 30 and 46 of the SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015 read with Para A and Part A of schedule III of the said regulations please find enclosed herewith the details of scheduled Meeting(s) between the officials of the Company and various Analyst(s)/advisor(s)/investor(s).

Announcement under Regulation 30 (LODR)-Allotment of ESOP / ESPS

28-Mar-2025 | Source : BSEAnnouncement under Regulation 30 (LODR)- Allotment of ESOP

Closure of Trading Window

28-Mar-2025 | Source : BSEClosure of Trading Window w.e.f. 1st April 2025 until 48 hours after the declaration of financial results/ statements of the Company for the quarter and financial year ending as on 31st March 2025.

Corporate Actions

No Upcoming Board Meetings

Dixon Technologies (India) Ltd has declared 250% dividend, ex-date: 17 Sep 24

Dixon Technologies (India) Ltd has announced 2:10 stock split, ex-date: 18 Mar 21

No Bonus history available

No Rights history available