DLF Faces Technical Trend Shifts Amid Mixed Market Sentiment and Performance Challenges

2025-04-03 08:01:34DLF, a prominent player in the construction and real estate sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 683.10, showing a notable fluctuation with a 52-week high of 967.00 and a low of 622.15. Today's trading session saw the stock reach a high of 684.95 and a low of 658.40. In terms of technical indicators, the MACD and KST suggest a bearish sentiment on a weekly basis, while the monthly outlook shows a mildly bearish trend. The Relative Strength Index (RSI) indicates no signal on a weekly basis but leans bullish monthly. Bollinger Bands and moving averages also reflect a mildly bearish stance, indicating a cautious market environment. When comparing DLF's performance to the Sensex, the company has shown varied returns over different periods. Notably, over the past three years, DLF has outperformed the Sensex with a return ...

Read More

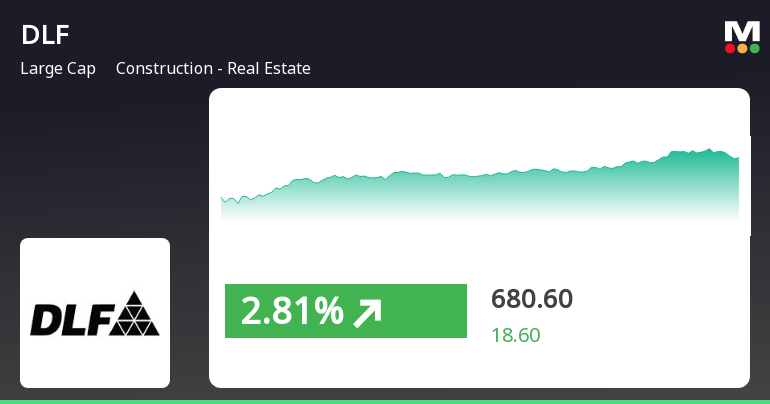

DLF Ltd. Stock Shows Potential Trend Reversal Amid Broader Market Gains

2025-04-02 11:15:16DLF Ltd. experienced a notable stock price increase on April 2, 2025, following two days of decline, suggesting a potential trend reversal. The stock outperformed the broader market, reaching an intraday high while showing mixed signals in its moving averages and a complex longer-term performance.

Read More

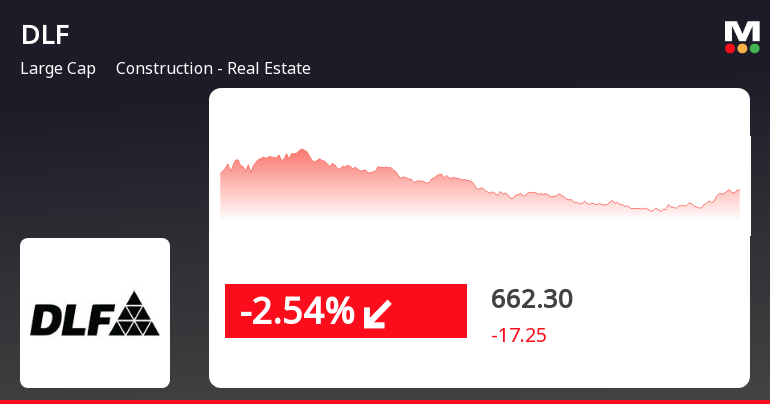

DLF Ltd. Faces Challenges Amid Broader Market Decline and Underperformance Trends

2025-04-01 11:45:16DLF Ltd., a key player in the construction and real estate sector, has faced a significant decline, underperforming its sector. The stock has dropped over the past two days and is trading below multiple moving averages, indicating a bearish trend. In contrast, the broader market has also experienced notable pressure.

Read MoreDLF Ltd. Sees Surge in Open Interest Amidst Challenging Price Environment

2025-03-26 15:00:14DLF Ltd., a prominent player in the construction and real estate sector, has experienced a significant increase in open interest today, reflecting heightened activity in its futures market. The latest open interest stands at 93,400 contracts, up from the previous figure of 83,785, marking a change of 9,615 contracts or an 11.48% increase. The trading volume for the day reached 60,218 contracts, indicating robust engagement from market participants. In terms of price performance, DLF Ltd. has underperformed its sector by 0.54%, with a 1-day return of -2.04%. The stock has been on a downward trend, recording a decline of 3.44% over the past two days. The weighted average price suggests that more volume was traded closer to the low price for the day. While the stock remains above its 20-day moving averages, it is trading below its 5-day, 50-day, 100-day, and 200-day moving averages. Additionally, the deliver...

Read MoreDLF Experiences Technical Trend Shift Amid Mixed Market Performance Indicators

2025-03-26 08:01:18DLF, a prominent player in the construction and real estate sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 694.40, down from a previous close of 705.85, with a notable 52-week high of 967.00 and a low of 622.15. Today's trading saw a high of 713.50 and a low of 692.00, indicating some volatility in its performance. The technical summary for DLF reveals a bearish sentiment across various indicators. The MACD shows a bearish trend on a weekly basis, while the monthly perspective is mildly bearish. Similarly, the Bollinger Bands and KST also indicate bearish conditions, with moving averages reflecting a bearish stance on daily metrics. The On-Balance Volume (OBV) presents a mildly bullish outlook on a weekly basis but shows no trend on a monthly scale. In terms of returns, DLF's performance has been mixed compared to the Sensex. ...

Read MoreDLF Ltd. Sees Significant Open Interest Surge Amid Active Market Participation

2025-03-25 15:00:20DLF Ltd., a prominent player in the construction and real estate sector, has experienced a significant increase in open interest today. The latest open interest stands at 92,745 contracts, reflecting a rise of 8,824 contracts or 10.51% from the previous open interest of 83,921. This uptick coincides with a trading volume of 70,168 contracts, indicating active participation in the market. In terms of price performance, DLF's stock has shown a 1D return of -1.18%, slightly outperforming the sector's return of -1.45%. The stock's current price is positioned at an underlying value of Rs 698. Notably, DLF's moving averages indicate that it is trading above the 5-day and 20-day averages but below the 50-day, 100-day, and 200-day averages, suggesting a mixed trend in its short to long-term performance. Additionally, the stock has seen a rise in delivery volume, with 24.56 lakh shares delivered on March 24, marki...

Read MoreDLF Faces Mixed Technical Trends Amidst Market Challenges and Long-Term Resilience

2025-03-25 08:01:39DLF, a prominent player in the construction and real estate sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 705.85, showing a slight increase from the previous close of 696.75. Over the past year, DLF has experienced a decline of 18.47%, contrasting with a 7.07% gain in the Sensex, highlighting the challenges faced by the company in the broader market context. In terms of technical indicators, the weekly and monthly assessments present a mixed picture. The MACD and KST indicators are bearish on a weekly basis, while the monthly outlook remains mildly bearish. The Bollinger Bands also indicate a mildly bearish trend, suggesting some volatility in price movements. Notably, the stock's performance over various time frames reveals a significant return of 484.80% over the past five years, compared to the Sensex's 192.36% return, show...

Read MoreDLF Ltd. Sees Significant Open Interest Surge Amid Increased Trading Activity

2025-03-24 15:00:18DLF Ltd., a prominent player in the construction and real estate sector, has experienced a significant increase in open interest today. The latest open interest stands at 94,084 contracts, reflecting a rise of 10,797 contracts or 12.96% from the previous open interest of 83,287. This uptick in open interest coincides with a trading volume of 103,271 contracts, indicating heightened activity in the stock. In terms of price performance, DLF Ltd. has outperformed its sector by 0.26%, with the stock gaining 2.12% over the last two days. Today, it opened with a gain of 2.03% and reached an intraday high of Rs 714, marking a 2.6% increase. The stock is currently trading above its 5-day, 20-day, and 50-day moving averages, although it remains below the 100-day and 200-day moving averages. Additionally, the delivery volume has surged to 37 lakh shares, representing a 130.97% increase compared to the 5-day average...

Read MoreDLF Ltd. Sees Surge in Open Interest Amid Increased Trading Activity

2025-03-24 14:00:11DLF Ltd., a prominent player in the Construction - Real Estate sector, has experienced a significant increase in open interest today, reflecting heightened trading activity. The latest open interest stands at 93,585 contracts, marking a rise of 10,298 contracts or 12.36% from the previous open interest of 83,287. The trading volume for the day reached 96,451 contracts, indicating robust market engagement. In terms of price performance, DLF Ltd. opened with a gain of 2.03% and touched an intraday high of Rs 712.8, representing a 2.43% increase. The stock has shown a positive trend, gaining 2.6% over the last two days and outperforming its sector by 0.66%. Notably, the stock's delivery volume surged to 37 lakh shares on March 21, reflecting a 130.97% increase compared to the five-day average delivery volume, suggesting rising investor participation. DLF Ltd. currently holds a market capitalization of Rs 1,7...

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

03-Apr-2025 | Source : BSECertificate under Reg. 74(5) of SEBI (DP) Regulations 2018

Intimation Under Regulation 30 Of The SEBI (LODR) Regulations 2015

27-Mar-2025 | Source : BSETranscript of Analysts/ Investors meet held on Friday 21st March 2025

Credit Rating Update - DLF Cyber City Developers Limited A Material Subsidiary

27-Mar-2025 | Source : BSECredit Rating Update - DLF Cyber City Developers Limited a material subsidiary

Corporate Actions

No Upcoming Board Meetings

DLF Ltd. has declared 250% dividend, ex-date: 31 Jul 24

No Splits history available

No Bonus history available

No Rights history available