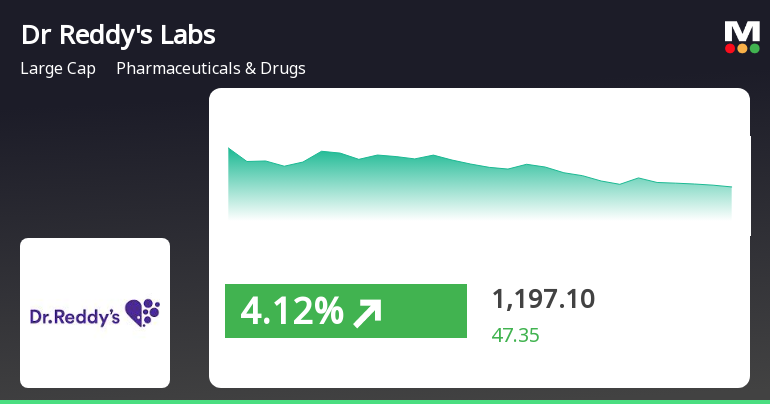

Dr Reddys Laboratories Surges Amid Market Volatility and Sector Outperformance

2025-04-03 09:30:34Dr Reddys Laboratories has shown notable stock activity, outperforming its sector amid high volatility. The stock opened significantly higher and reached an intraday peak, while the broader market, represented by the Sensex, has experienced fluctuations, with small-cap stocks leading the gains today.

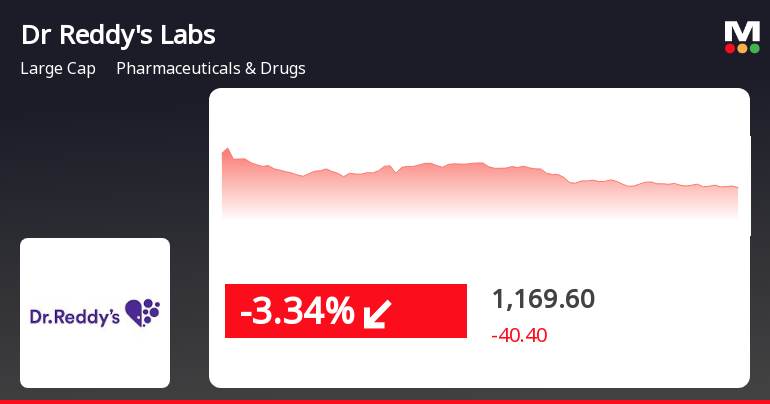

Read MoreDr. Reddy's Laboratories Faces Market Challenges Amid Valuation Discrepancies and Declining Performance

2025-03-28 09:20:49Dr. Reddy's Laboratories, a prominent player in the Pharmaceuticals & Drugs sector, is experiencing notable activity in the market today. The stock has been on a downward trend, marking its fourth consecutive day of losses, with a decline of 4.13% over this period. Currently, the stock's performance aligns with the sector, reflecting a slight decrease of 0.38% today, compared to a marginal drop of 0.05% in the Sensex. With a market capitalization of Rs 96,433.83 crore, Dr. Reddy's Laboratories holds a P/E ratio of 18.02, significantly lower than the industry average of 37.32. This indicates a potential valuation discrepancy within the sector. In terms of moving averages, the stock is currently above its 20-day moving average but below the 5-day, 50-day, 100-day, and 200-day averages, suggesting mixed short-term momentum. Over the past year, Dr. Reddy's Laboratories has seen a decline of 6.12%, contrastin...

Read MoreDr. Reddy's Laboratories Faces Consecutive Declines Amid Sector Trends and Valuation Discrepancies

2025-03-27 09:20:22Dr. Reddy's Laboratories, a prominent player in the Pharmaceuticals & Drugs sector, has experienced notable activity today, aligning its performance with the broader sector trends. The stock has faced a consecutive decline over the past three days, recording a total drop of 4.05%. Today, it opened at Rs 1161 and has maintained this price throughout the trading session. In terms of financial metrics, Dr. Reddy's Laboratories holds a market capitalization of Rs 96,337.87 crore, categorizing it as a large-cap company. The stock's price-to-earnings (P/E) ratio stands at 18.08, significantly lower than the industry average of 37.39, indicating a potential valuation discrepancy within the sector. Over the past year, the stock has declined by 4.55%, contrasting with the Sensex's positive performance of 5.76%. In the short term, Dr. Reddy's has also underperformed, with a 1-day decline of 0.80% compared to the Se...

Read MoreDr. Reddy's Laboratories Faces Bearish Technical Trends Amid Market Evaluation Revision

2025-03-26 08:03:09Dr. Reddy's Laboratories, a prominent player in the Pharmaceuticals & Drugs sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1180.55, down from a previous close of 1210.00, with a 52-week high of 1,420.20 and a low of 1,093.00. Today's trading saw a high of 1217.95 and a low of 1168.50. The technical summary indicates a bearish sentiment across various indicators. The MACD shows a bearish trend on a weekly basis, while the monthly perspective is mildly bearish. Similarly, Bollinger Bands and Moving Averages also reflect bearish conditions. The KST aligns with this trend, indicating bearishness on a weekly basis and mildly bearish on a monthly basis. The Dow Theory presents a mixed view, with a mildly bullish weekly trend contrasted by a mildly bearish monthly outlook. In terms of performance, Dr. Reddy's has experienced varied r...

Read More

Dr Reddys Laboratories Faces Reversal Amid Mixed Performance and Sector Underperformance

2025-03-25 10:35:23Dr Reddys Laboratories saw a decline on March 25, 2025, ending a seven-day gain streak. The stock's performance lagged behind its sector, with mixed moving average indicators. Over the past three years, it has increased significantly, though it underperformed compared to the broader Sensex index.

Read MoreDr. Reddy's Laboratories Faces Mixed Technical Trends Amid Market Evaluation Revision

2025-03-25 08:03:52Dr. Reddy's Laboratories, a prominent player in the Pharmaceuticals & Drugs sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1210.00, showing a slight increase from the previous close of 1201.10. Over the past year, the stock has experienced a high of 1,420.20 and a low of 1,093.00, indicating a degree of volatility. In terms of technical indicators, the MACD suggests a bearish trend on a weekly basis, while the monthly outlook is mildly bearish. The Bollinger Bands also reflect a mildly bearish sentiment, consistent with the moving averages observed on a daily basis. Notably, the Dow Theory presents a mildly bullish perspective on a weekly timeframe, contrasting with the monthly bearish outlook. When comparing the company's performance to the Sensex, Dr. Reddy's has shown varied returns. Over the past week, the stock returned 5...

Read MoreDr. Reddy's Laboratories Faces Market Challenges Amid Recent Performance Shift

2025-03-24 09:31:06Dr. Reddy's Laboratories, a prominent player in the Pharmaceuticals & Drugs sector, has experienced notable activity today, underperforming the sector by 0.87%. This marks a trend reversal as the stock has declined after six consecutive days of gains. Currently, Dr. Reddy's stock is positioned higher than its 5-day and 20-day moving averages but remains below the 50-day, 100-day, and 200-day moving averages. With a market capitalization of Rs 1,00,226.00 crore, Dr. Reddy's Laboratories has a price-to-earnings (P/E) ratio of 18.66, significantly lower than the industry average of 26.76. Over the past year, the stock has seen a decline of 3.41%, contrasting with the Sensex's performance of 6.32%. In terms of recent performance, Dr. Reddy's has shown a 4.21% increase over the past week, although it lags behind the Sensex's 4.40% gain. Year-to-date, the stock is down 13.70%, while the Sensex has only decreas...

Read MoreDr. Reddy's Laboratories Shows Resilience Amidst Sector Trends and Valuation Disparities

2025-03-21 09:20:32Dr. Reddy's Laboratories, a prominent player in the Pharmaceuticals & Drugs sector, has shown notable activity today, outperforming its sector by 0.65%. The stock has been on a positive trajectory, gaining for the last six consecutive days, with a total return of 8.45% during this period. Today, it opened at Rs 1198.6 and has maintained this price throughout the trading session. In terms of financial metrics, Dr. Reddy's Laboratories has a market capitalization of Rs 98,632.62 crore, categorizing it as a large-cap company. The stock's price-to-earnings (P/E) ratio stands at 18.44, significantly lower than the industry average of 37.36, indicating a potential valuation disparity within the sector. Despite its recent gains, the company's one-year performance reflects a decline of 3.58%, contrasting with the Sensex's increase of 4.98% over the same period. However, Dr. Reddy's has shown resilience in the sho...

Read MoreDr. Reddy's Laboratories Shows Strong Short-Term Gains Amid Sector Performance Variability

2025-03-20 09:20:38Dr. Reddy's Laboratories, a prominent player in the Pharmaceuticals & Drugs sector, has shown notable activity today, outperforming its sector by 0.83%. The stock has been on a positive trajectory, gaining for the last five consecutive days, with a total return of 7.47% during this period. Today, the stock opened at Rs 1,187.8 and has maintained this price throughout the trading session. In terms of moving averages, Dr. Reddy's stock is currently above its 5-day and 20-day moving averages, although it remains below the 50-day, 100-day, and 200-day moving averages. With a market capitalization of Rs 97,593.73 crore, Dr. Reddy's Laboratories has a price-to-earnings (P/E) ratio of 18.21, significantly lower than the industry average of 36.93. In the broader context of the Pharmaceuticals & Drugs sector, 170 stocks have reported results, with 75 showing positive outcomes. Over the past year, Dr. Reddy's La...

Read MoreDisclosure Under Regulation 30 Of SEBI (LODR) Regulations 2015

05-Apr-2025 | Source : BSEDisclosure under Regulation 30 of SEBI (LODR) Regulations 2015

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

01-Apr-2025 | Source : BSECertificate under Regulation 74(5) of SEBI (Depositories and Participants) Regulations 2018

Announcement under Regulation 30 (LODR)-Updates on Acquisition

22-Mar-2025 | Source : BSEDisclosure under Regulation 30 of SEBI (LODR) Regulations 2015

Corporate Actions

09 May 2025

Dr Reddys Laboratories Ltd has declared 800% dividend, ex-date: 16 Jul 24

Dr Reddys Laboratories Ltd has announced 1:5 stock split, ex-date: 28 Oct 24

Dr Reddys Laboratories Ltd has announced 1:1 bonus issue, ex-date: 28 Aug 06

No Rights history available