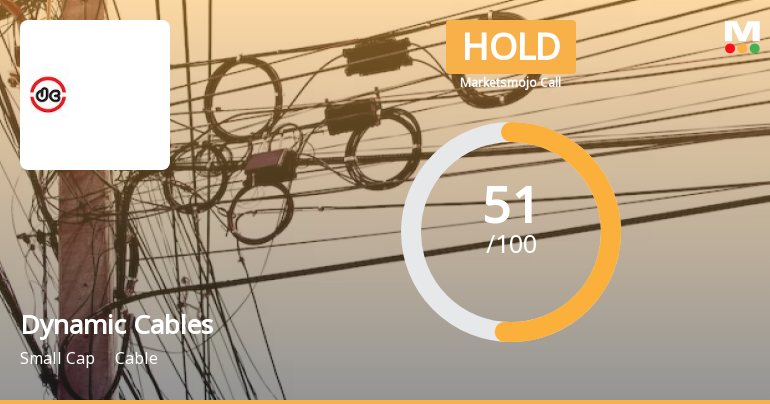

Dynamic Cables' Valuation Upgrade Reflects Strong Financial Performance and Market Confidence

2025-04-02 08:37:47Dynamic Cables has recently adjusted its evaluation, reflecting improvements in financial metrics and market position. The company reported a 110.11% increase in net profit for the last quarter and demonstrated strong financial stability, attracting increased institutional investor interest and outperforming broader market indices over the past year.

Read MoreDynamic Cables Adjusts Valuation Grade Amid Strong Financial Metrics and Market Position

2025-04-02 08:02:52Dynamic Cables has recently undergone a valuation adjustment, reflecting its strong financial metrics and market position within the cable industry. The company currently exhibits a price-to-earnings (PE) ratio of 24.96 and a price-to-book value of 4.10, indicating a solid valuation relative to its earnings and assets. Additionally, its enterprise value to EBITDA stands at 14.32, while the enterprise value to sales ratio is 1.48, showcasing effective revenue generation. Dynamic Cables also demonstrates robust profitability, with a return on capital employed (ROCE) of 22.86% and a return on equity (ROE) of 16.44%. The PEG ratio of 0.53 suggests favorable growth prospects relative to its valuation. In comparison to its peers, Dynamic Cables stands out with a more favorable valuation profile. For instance, while Diamond Power is categorized as risky with a significantly higher PE ratio of 122.87, other comp...

Read More

Dynamic Cables Faces Technical Shift Amid Strong Financial Performance and Investor Interest

2025-03-28 08:07:51Dynamic Cables has recently experienced a change in its technical outlook, moving to a more bearish position. Despite this, the company reported a substantial 110.11% growth in net profit for the last quarter and maintains strong financial fundamentals, including favorable debt ratios and consistent stock performance.

Read MoreDynamic Cables Faces Bearish Technical Trends Amidst Mixed Performance Indicators

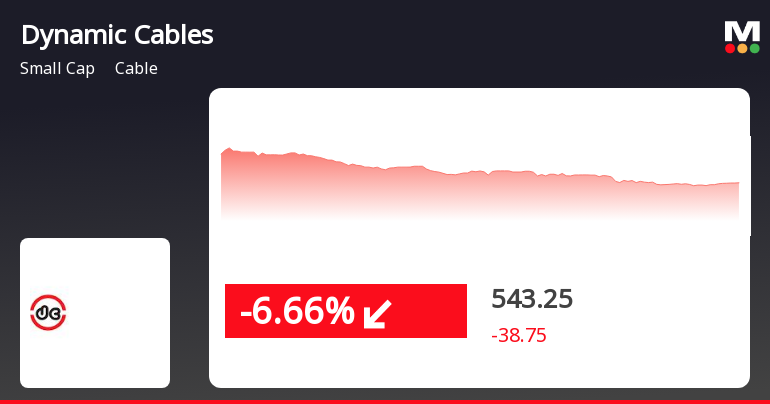

2025-03-28 08:03:52Dynamic Cables, a small-cap player in the cable industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 551.25, showing a slight increase from the previous close of 541.70. Over the past year, Dynamic Cables has demonstrated significant volatility, with a 52-week high of 1,092.85 and a low of 368.85. The technical summary indicates a bearish sentiment across various indicators. The MACD shows a bearish trend on a weekly basis, while the monthly outlook is mildly bearish. Similarly, Bollinger Bands and moving averages also reflect bearish conditions. The KST and OBV metrics present a mixed picture, with weekly readings leaning towards bearishness. In terms of performance, Dynamic Cables has had a mixed return profile compared to the Sensex. Over the past week, the stock returned 2.06%, outperforming the Sensex's 1.65%. However, over t...

Read MoreDynamic Cables Shows Long-Term Growth Amid Short-Term Market Challenges

2025-03-27 18:00:43Dynamic Cables, a small-cap player in the cable industry, has shown notable activity today, with its stock rising by 1.76%. This performance stands in contrast to the Sensex, which increased by 0.41%. Over the past year, Dynamic Cables has delivered a robust return of 48.15%, significantly outperforming the Sensex's 6.32% gain during the same period. Despite this strong yearly performance, the stock has faced challenges in the short term, with a decline of 8.94% over the past month and a year-to-date drop of 42.76%. In the three-month view, the stock has decreased by 43.46%, while it has shown impressive growth over the longer term, with a three-year increase of 333.54% and a five-year surge of 2440.32%. The company's current market capitalization stands at Rs 1,313.00 crore, with a price-to-earnings ratio of 24.28, notably lower than the industry average of 46.23. Technical indicators suggest a bearish t...

Read MoreDynamic Cables Faces Mixed Technical Trends Amid Market Volatility and Historical Resilience

2025-03-26 08:04:35Dynamic Cables, a small-cap player in the cable industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 553.90, down from a previous close of 576.30, with a notable 52-week high of 1,092.85 and a low of 368.85. Today's trading saw a high of 585.90 and a low of 541.85, indicating some volatility. The technical summary reveals a mixed picture, with the MACD showing bearish trends on both weekly and monthly scales, while moving averages indicate a mildly bullish stance on a daily basis. The Bollinger Bands and KST metrics also reflect bearish tendencies, suggesting caution in the current market environment. In terms of performance, Dynamic Cables has faced challenges recently, with a year-to-date return of -42.48%, contrasting sharply with the Sensex's slight decline of -0.16%. However, over a longer horizon, the company has shown resi...

Read MoreDynamic Cables Shows Mixed Technical Indicators Amid Strong Long-Term Performance

2025-03-25 08:05:51Dynamic Cables, a small-cap player in the cable industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 576.30, slightly up from the previous close of 574.45. Over the past year, Dynamic Cables has shown a notable return of 51.34%, significantly outperforming the Sensex, which recorded a return of 7.07% in the same period. In terms of technical indicators, the company presents a mixed picture. The MACD shows bearish tendencies on a weekly basis, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) indicates no clear signal for both weekly and monthly assessments. Bollinger Bands suggest a mildly bearish trend weekly, contrasting with a bullish stance monthly. Daily moving averages lean mildly bullish, indicating some short-term strength. Dynamic Cables has experienced fluctuations in its stock price, with a ...

Read MoreDynamic Cables Faces Mixed Technical Trends Amid Market Volatility and Declining Returns

2025-03-21 08:02:57Dynamic Cables, a small-cap player in the cable industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 540.10, down from a previous close of 582.00, with a notable 52-week high of 1,092.85 and a low of 365.00. Today's trading saw a high of 583.95 and a low of 526.20, indicating some volatility. The technical summary reveals a mixed picture. The MACD indicates bearish trends on both weekly and monthly scales, while the Bollinger Bands also reflect bearish conditions. Moving averages present a mildly bullish outlook on a daily basis, contrasting with the overall bearish sentiment in other indicators such as KST and Dow Theory. The On-Balance Volume (OBV) shows a mildly bullish trend on a weekly basis but leans towards bearish on a monthly basis. In terms of performance, Dynamic Cables has faced challenges recently, with a significant ...

Read More

Dynamic Cables Faces Market Challenges Amid Broader Sector Declines and Trend Reversal

2025-03-20 11:20:27Dynamic Cables has faced a notable decline, with the stock down significantly after two days of gains. It is currently trading below key moving averages and has underperformed compared to its sector. Year-to-date, the stock has seen a substantial drop, despite a strong three-year performance.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

07-Apr-2025 | Source : BSECertificate under Regulation 74(5) of SEBI (Depositories and Participants) Regulations 2018

Disclosure Under Regulation 30 Of The SEBI (Listing Obligations And Disclosure Requirements) Regulations 2015

31-Mar-2025 | Source : BSEIntimation regarding the Income Tax Order

Disclosure Under Regulation 30 Of The SEBI (Listing Obligations And Disclosure Requirements) Regulations 2015

28-Mar-2025 | Source : BSEIntimation under Regulation 30 of the SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015

Corporate Actions

No Upcoming Board Meetings

Dynamic Cables Ltd has declared 5% dividend, ex-date: 24 Jul 24

No Splits history available

No Bonus history available

No Rights history available