Ecoplast Adjusts Valuation Grade Amid Mixed Industry Comparisons and Strong Stock Performance

2025-03-20 08:00:32Ecoplast, a microcap player in the packaging industry, has recently undergone a valuation adjustment, reflecting its current market standing. The company's price-to-earnings (P/E) ratio stands at 19.68, while its price-to-book value is noted at 4.00. Other key financial metrics include an enterprise value to EBITDA ratio of 14.15 and a return on capital employed (ROCE) of 21.84%. In comparison to its peers, Ecoplast's valuation metrics present a mixed picture. For instance, Sh. Jagdamba Pol is positioned with a higher P/E ratio of 20.1, while Shree TirupatiBa shows a more attractive P/E of 16.22. Notably, Hitech Corp. boasts a significantly lower EV to EBITDA ratio of 6.16, indicating a different market perception within the sector. Ecoplast's stock performance has shown resilience, with a one-year return of 110.25%, significantly outpacing the Sensex's 4.77% return over the same period. Over the last f...

Read MoreEcoplast Adjusts Valuation Grade Amid Competitive Packaging Sector Dynamics

2025-03-12 08:00:20Ecoplast, a microcap player in the packaging industry, has recently undergone a valuation adjustment, reflecting its current financial metrics and market position. The company's price-to-earnings (PE) ratio stands at 19.26, while its price-to-book value is recorded at 3.92. Additionally, Ecoplast's enterprise value to EBITDA ratio is 13.85, and its enterprise value to EBIT is 17.80. The company also shows a robust return on capital employed (ROCE) of 21.84% and a return on equity (ROE) of 19.73%. In terms of market performance, Ecoplast's stock has experienced fluctuations, with a current price of 590.00, slightly up from the previous close of 589.60. Over the past year, the stock has delivered a return of 65.99%, significantly outperforming the Sensex, which recorded a mere 0.82% return during the same period. However, in the year-to-date comparison, Ecoplast's return of -14.49% contrasts with the Sensex'...

Read MoreEcoplast Adjusts Valuation Grade, Highlighting Strong Competitive Position in Packaging Sector

2025-03-05 08:00:38Ecoplast, a microcap player in the packaging industry, has recently undergone a valuation adjustment, reflecting its current financial metrics and market position. The company's price-to-earnings (PE) ratio stands at 20.07, while its price-to-book value is noted at 4.08. Other significant metrics include an enterprise value to EBITDA ratio of 14.44 and a return on capital employed (ROCE) of 21.84%. In terms of performance, Ecoplast has shown notable returns over various periods. Over the past year, the stock has returned 68.86%, significantly outperforming the Sensex, which recorded a mere -1.19% return. Over a three-year span, Ecoplast's return soared to 594.41%, compared to the Sensex's 34.34%. When compared to its peers, Ecoplast's valuation metrics indicate a premium positioning within the industry. For instance, while Ecoplast's PE ratio is higher than that of Sh. Jagdamba Pol and Shree TirupatiBa,...

Read More

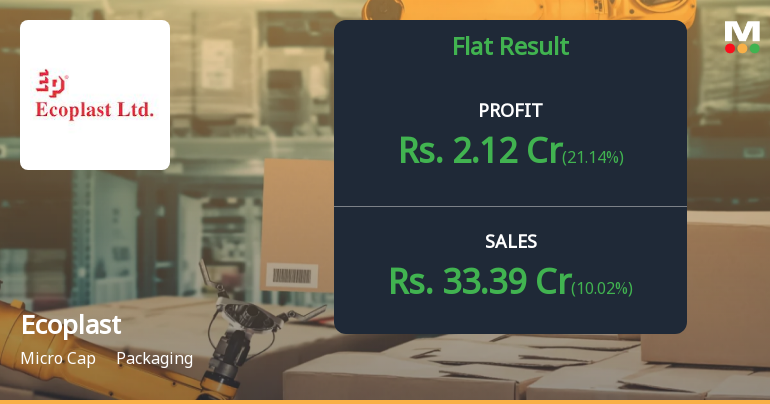

Ecoplast Reports Strong December 2024 Sales Growth and Improved Debtors Turnover Ratio

2025-02-12 21:32:51Ecoplast has announced its financial results for the quarter ending December 2024, reporting its highest quarterly net sales in five quarters at Rs 33.39 crore. The company's Debtors Turnover Ratio also peaked at 11.47 times, reflecting improved efficiency in managing receivables and a positive sales trend.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

04-Apr-2025 | Source : BSECompliance Certificate under Regulation 74(5) of SEBI (DP) Regulations 2018

Closure of Trading Window

17-Mar-2025 | Source : BSEIntimation of Trading Window

Announcement under Regulation 30 (LODR)-Credit Rating

13-Mar-2025 | Source : BSEDisclosure under Regulation 30 of SEBI (LODR) Regulation 2015- Credit Rating.

Corporate Actions

No Upcoming Board Meetings

Ecoplast Ltd has declared 30% dividend, ex-date: 08 Aug 24

No Splits history available

No Bonus history available

No Rights history available