Edelweiss Financial Services Faces Mixed Technical Trends Amid Strong Long-Term Performance

2025-04-02 08:03:59Edelweiss Financial Services, a midcap player in the Finance/NBFC sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 90.09, showing a slight increase from the previous close of 89.51. Over the past year, Edelweiss has demonstrated notable resilience, with a return of 36.58%, significantly outperforming the Sensex, which recorded a return of 2.72% in the same period. The technical summary indicates a mixed outlook, with the MACD showing bearish tendencies on a weekly basis while being mildly bearish on a monthly scale. The Bollinger Bands present a mildly bearish signal weekly, contrasting with a bullish stance monthly. Moving averages indicate bearish conditions daily, while the KST reflects a similar trend. In terms of performance, Edelweiss has shown a strong return over longer periods, with a remarkable 280.23% return over five...

Read More

Edelweiss Financial Services Shows Resilience Amid Mixed Market Performance Trends

2025-03-27 13:15:17Edelweiss Financial Services saw a notable increase on March 27, 2025, reversing three days of decline and outperforming the broader market. The stock's performance has been mixed, showing significant annual gains but a decline year-to-date, highlighting its complex position in the current market landscape.

Read MoreEdelweiss Financial Services Faces Mixed Technical Trends Amidst Market Evaluation Revision

2025-03-24 08:01:03Edelweiss Financial Services, a midcap player in the Finance/NBFC sector, has recently undergone an evaluation revision reflecting current market dynamics. The company's technical indicators present a mixed picture, with the MACD signaling bearish trends on a weekly basis while showing a mildly bearish stance monthly. The moving averages also indicate bearish conditions, suggesting a cautious outlook. Despite these technical adjustments, Edelweiss has demonstrated notable performance in various timeframes. Over the past week, the stock returned 6.83%, outperforming the Sensex, which returned 4.17%. However, the one-month performance shows a decline of 5.96%, contrasting with the Sensex's modest gain of 2.12%. Year-to-date, Edelweiss has faced challenges, with a return of -24.91%, while the Sensex has remained relatively stable at -1.58%. In the longer term, Edelweiss has shown resilience, with a one-year ...

Read MoreEdelweiss Financial Services Shows Resilience Amid Mixed Market Signals and Short-Term Challenges

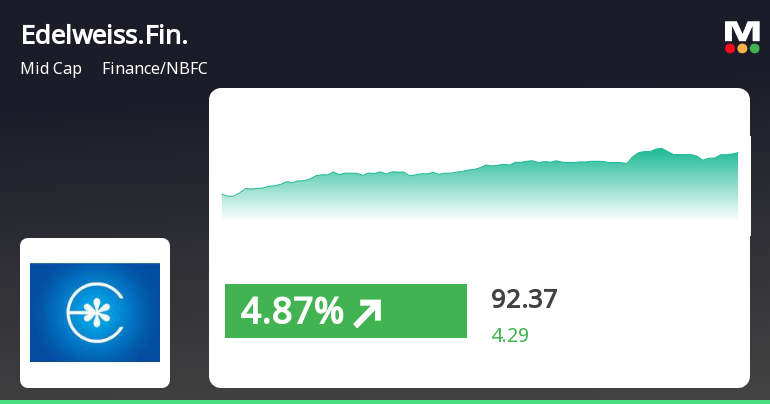

2025-03-21 18:00:26Edelweiss Financial Services Ltd, a mid-cap player in the Finance/NBFC sector, has shown significant activity today, with its stock rising by 5.54%. This performance stands in contrast to the Sensex, which increased by only 0.73%. Over the past year, Edelweiss has outperformed the Sensex with a remarkable gain of 42.18%, compared to the index's 5.87% rise. Despite today's positive movement, the stock has faced challenges in the short term, with a decline of 5.96% over the past month and a year-to-date drop of 24.91%. However, looking at longer-term performance, Edelweiss has demonstrated resilience, boasting a 182.87% increase over three years and an impressive 285.13% rise over five years. The company's market capitalization stands at Rs 8,519.00 crore, with a price-to-earnings (P/E) ratio of 19.01, which is below the industry average of 21.43. Technical indicators suggest a mixed outlook, with bearish s...

Read More

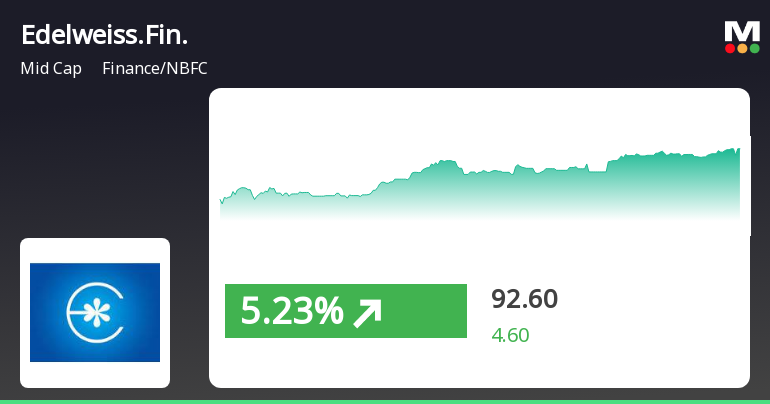

Edelweiss Financial Services Shows Mixed Trends Amid Broader Market Recovery

2025-03-21 10:35:16Edelweiss Financial Services experienced notable activity, gaining 5.0% and reaching an intraday high of Rs 92.5. The stock's performance shows a year-to-date decline of 25.56%, but it has significantly outperformed the Sensex over the past year and three years. The broader market also saw a recovery today.

Read MoreEdelweiss Financial Services Faces Mixed Technical Trends Amid Market Evaluation Revision

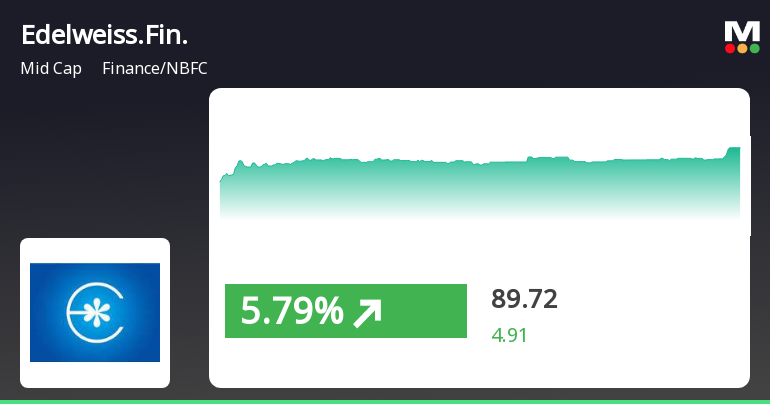

2025-03-21 08:01:16Edelweiss Financial Services, a midcap player in the Finance/NBFC sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 88.08, down from a previous close of 89.80, with a notable 52-week range between 59.40 and 145.50. Today's trading saw a high of 91.35 and a low of 87.80. The technical summary indicates a mixed performance across various indicators. The MACD shows bearish tendencies on both weekly and monthly scales, while the RSI presents a bullish signal on a weekly basis, with no clear signal on the monthly front. Bollinger Bands reflect a mildly bearish outlook weekly, contrasting with a mildly bullish stance monthly. Moving averages indicate a mildly bullish trend on a daily basis, while the KST and Dow Theory both suggest a mildly bearish position. In terms of returns, Edelweiss has shown varied performance compared to the Se...

Read MoreEdelweiss Financial Services Adjusts Valuation Amid Strong Market Performance and Metrics

2025-03-20 08:00:20Edelweiss Financial Services has recently undergone a valuation adjustment, reflecting changes in its financial metrics and market positioning within the finance and non-banking financial company (NBFC) sector. The company's current price stands at 89.80, with a notable 52-week high of 145.50 and a low of 59.40. Key financial indicators reveal a price-to-earnings (PE) ratio of 18.36 and a price-to-book value of 1.68. The enterprise value to EBITDA ratio is recorded at 7.05, while the return on capital employed (ROCE) is at 16.19%. The dividend yield is 1.67%, and the return on equity (ROE) is 9.18%. In comparison to its peers, Edelweiss maintains a competitive stance, with its PE ratio higher than that of Angel One but lower than Aadhar Housing Finance. The enterprise value to EBITDA ratio is also more favorable than several competitors, indicating a solid market position. Over the past year, Edelweiss ...

Read MoreEdelweiss Financial Services Shows Mixed Technical Trends Amid Strong Long-Term Performance

2025-03-19 08:02:03Edelweiss Financial Services, a midcap player in the Finance/NBFC sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 89.06, showing a notable increase from the previous close of 84.81. Over the past year, Edelweiss has demonstrated a strong performance with a return of 31.57%, significantly outperforming the Sensex, which returned 3.51% in the same period. In terms of technical indicators, the weekly MACD remains bearish, while the monthly outlook shows a mildly bearish trend. The Relative Strength Index (RSI) indicates no significant signals for both weekly and monthly assessments. Bollinger Bands present a mixed picture, with a mildly bearish stance weekly and a mildly bullish outlook monthly. Daily moving averages suggest a mildly bullish trend, contrasting with the bearish signals from the KST and Dow Theory on a weekly basis....

Read More

Edelweiss Financial Services Shows Trend Reversal Amid Broader Market Challenges

2025-03-18 14:15:17Edelweiss Financial Services experienced a notable rebound on March 18, 2025, after five days of decline, reaching an intraday high. Despite this, the stock remains below key moving averages, indicating ongoing challenges. Over the past year, it has significantly outperformed the Sensex, though year-to-date performance shows a decline.

Read MoreAnnouncement under Regulation 30 (LODR)-Press Release / Media Release

07-Apr-2025 | Source : BSEPress Release

Public Issue Of Non-Convertible Debentures

28-Mar-2025 | Source : BSEPublic Issue of Non-convertible Debentures

Closure of Trading Window

28-Mar-2025 | Source : BSEClosure of Trading window

Corporate Actions

No Upcoming Board Meetings

Edelweiss Financial Services Ltd has declared 150% dividend, ex-date: 17 Sep 24

Edelweiss Financial Services Ltd has announced 1:5 stock split, ex-date: 10 Aug 10

Edelweiss Financial Services Ltd has announced 1:1 bonus issue, ex-date: 10 Aug 10

No Rights history available