EFC (I) Experiences Mixed Technical Trends Amidst Strong Yearly Performance

2025-04-01 08:02:09EFC (I), a small-cap player in the trading industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 247.65, showing a notable increase from the previous close of 219.45. Over the past year, EFC (I) has demonstrated a strong performance with a return of 49.95%, significantly outpacing the Sensex, which returned 5.11% in the same period. The technical summary indicates a mixed outlook, with the MACD showing bearish signals on a weekly basis while presenting a mildly bearish trend monthly. The Bollinger Bands reflect a mildly bearish stance weekly, contrasting with a bullish monthly perspective. Additionally, the moving averages indicate a mildly bearish trend on a daily basis, while the Dow Theory suggests a mildly bullish outlook weekly. In terms of recent performance, EFC (I) has shown resilience, particularly over the past week with ...

Read More

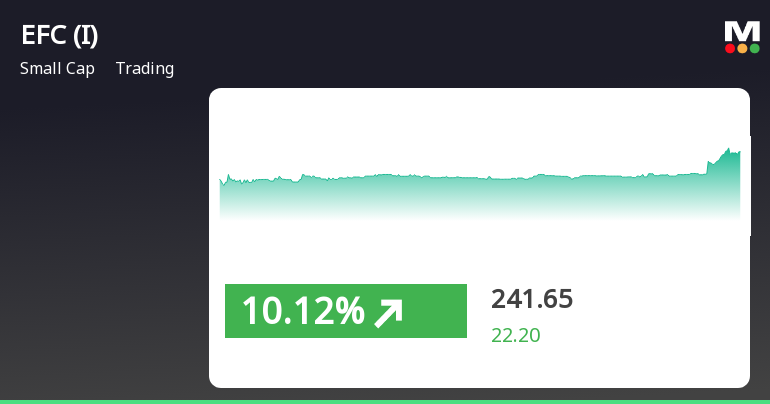

EFC (I) Shows Strong Rebound Amid Broader Market Decline and Mixed Moving Averages

2025-03-28 15:05:24EFC (I) experienced a notable rebound on March 28, 2025, reversing a three-day decline with a significant intraday gain. The stock outperformed its sector and has shown strong annual returns, contrasting with a slight dip in the broader market represented by the Sensex.

Read More

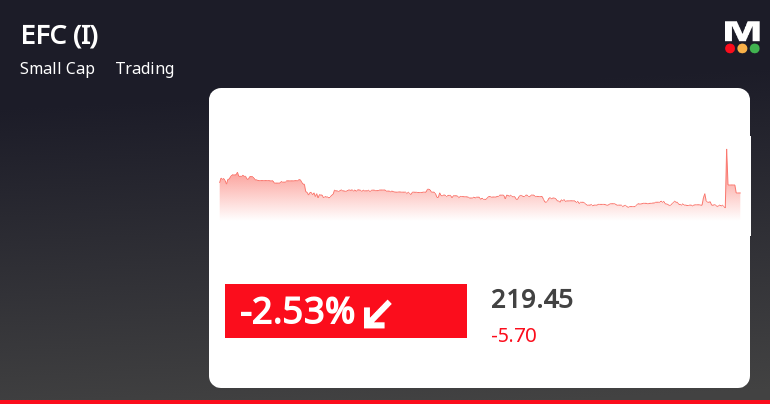

EFC (I) Faces Continued Volatility Amid Broader Market Resilience

2025-03-27 15:35:27EFC (I) faced notable volatility on March 27, 2025, declining for the third consecutive day and underperforming its sector. Despite reaching a high of Rs 233.95 intraday, it ultimately settled lower. The stock is trading below all key moving averages, indicating a bearish trend amidst a recovering broader market.

Read More

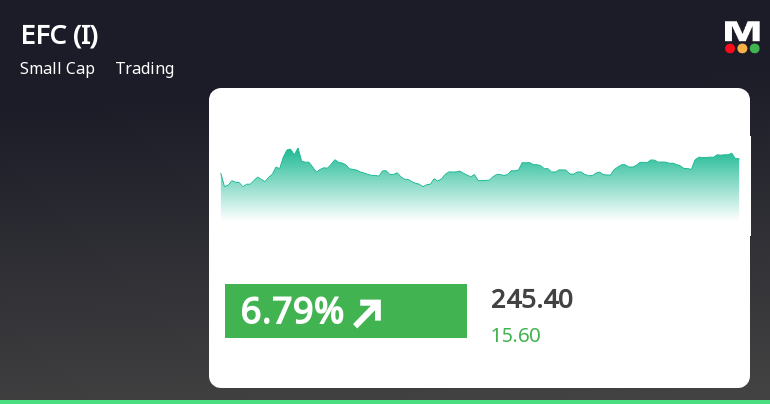

EFC (I) Exhibits Strong Performance Amid Broader Market Gains and Trends

2025-03-20 11:35:22EFC (I) has demonstrated strong performance, gaining 7.01% on March 20, 2025, and outperforming its sector. The stock has seen a total return of 29.08% over three days and a 52.05% increase over the past year, significantly surpassing the Sensex's growth.

Read MoreEFC (I) Adjusts Valuation Grade Amid Strong Operational Performance Metrics

2025-03-20 08:00:33EFC (I), a small-cap player in the trading industry, has recently undergone a valuation adjustment, reflecting a shift in its financial standing. The company's price-to-earnings (PE) ratio stands at 20.81, while its price-to-book value is noted at 4.78. Other key metrics include an EV to EBIT of 15.59 and an EV to EBITDA of 10.44, indicating a robust operational performance. In terms of return on capital employed (ROCE) and return on equity (ROE), EFC (I) reports figures of 15.33% and 18.49%, respectively, showcasing effective management of resources and shareholder equity. The company's stock price recently closed at 229.80, up from a previous close of 207.75, with a 52-week high of 358.48 and a low of 155.00. When compared to its peers, EFC (I) exhibits a higher valuation in several metrics, particularly in PE and EV to EBITDA ratios. For instance, PTC India, categorized as very attractive, has a signif...

Read More

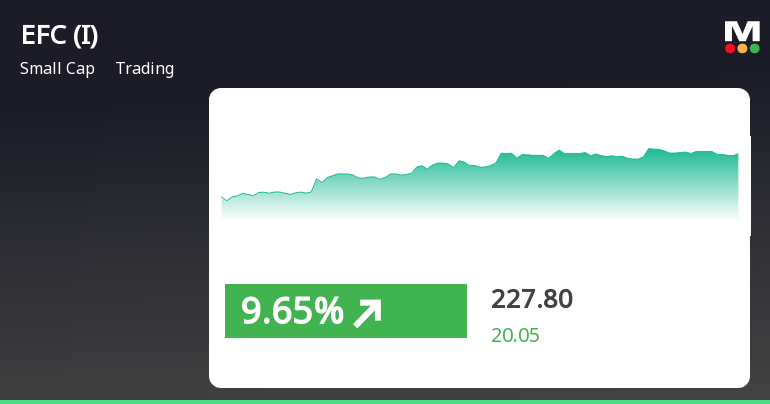

EFC (I) Shows Strong Short-Term Gains Amid Mixed Long-Term Performance Trends

2025-03-19 10:05:25EFC (I) has experienced notable gains, outperforming its sector and achieving consecutive increases over two days. The stock's performance is mixed in relation to various moving averages. Meanwhile, the broader market shows small-cap stocks leading, despite the Sensex trading below key moving averages. Year-to-date, EFC (I) has declined, but it has seen significant growth over the past year.

Read More

EFC (I) Shows High Volatility Amid Broader Market Gains and Sector Outperformance

2025-03-18 13:35:21EFC (I) saw significant intraday volatility on March 18, 2025, with a notable rise and a marked decline during the session. Despite trading below key moving averages, the stock has outperformed the Sensex over the past year, although it has faced a decline year-to-date.

Read More

EFC (I) Faces Significant Decline Amid Broader Market Challenges and Mixed Trends

2025-03-17 12:15:24EFC (I) faced a notable decline on March 17, 2025, underperforming its sector amid broader market challenges. The stock traded below key moving averages, reflecting a bearish trend. Despite recent losses, it has shown positive annual returns, contrasting with the Sensex's modest gains.

Read MoreEFC (I) Shows Mixed Technical Trends Amidst Market Evaluation Revision

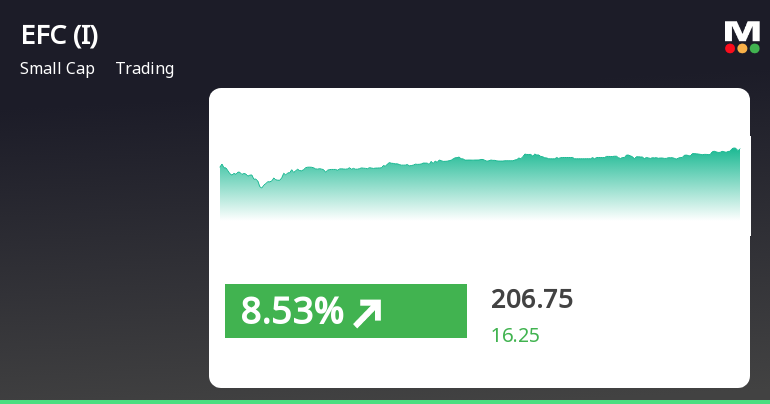

2025-03-11 08:02:56EFC (I), a small-cap player in the trading industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 218.00, showing a slight increase from the previous close of 216.65. Over the past year, EFC (I) has experienced a return of 8.96%, contrasting with a negligible change in the Sensex, which recorded a return of -0.01%. In terms of technical indicators, the weekly MACD is bearish, while the monthly MACD shows a mildly bearish trend. The Relative Strength Index (RSI) indicates no signal for both weekly and monthly assessments. Bollinger Bands present a mildly bearish outlook on a weekly basis, while the monthly perspective is mildly bullish. Daily moving averages reflect a bearish sentiment, and the KST shows a bearish trend weekly and mildly bearish monthly. The company's performance over various time frames highlights a significant decl...

Read MoreClosure of Trading Window

26-Mar-2025 | Source : BSETrading Window Closure as per attached Letter.

Intimation Of Approval Received From BSE Limited On Reclassification Of Promoter.

17-Mar-2025 | Source : BSEDetails as per attached Letter.

Announcement under Regulation 30 (LODR)-Press Release / Media Release

17-Mar-2025 | Source : BSEEFC Group expended its portfolio with the purchase of a 26500 square feet commercial office space at prime location in Pune.

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

EFC (I) Ltd has announced 2:10 stock split, ex-date: 18 Aug 23

EFC (I) Ltd has announced 1:1 bonus issue, ex-date: 11 Feb 25

No Rights history available