EID Parry's Technical Indicators Show Mixed Signals Amid Market Dynamics

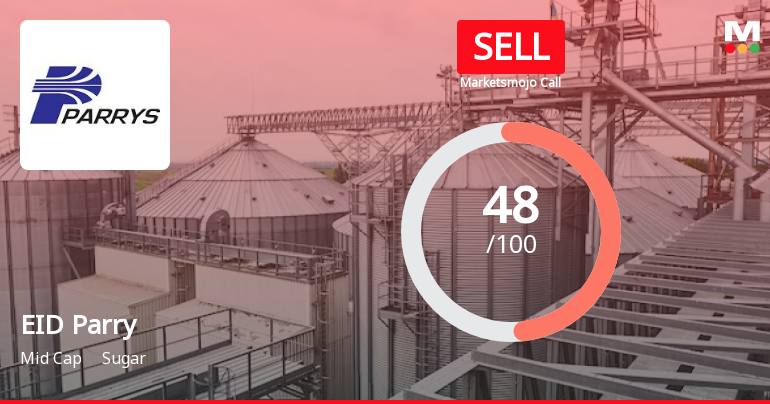

2025-03-10 08:00:18EID Parry (India), a midcap player in the sugar industry, has recently undergone an evaluation revision reflecting its current market dynamics. The company's stock is currently priced at 695.10, slightly down from the previous close of 700.90. Over the past year, EID Parry has demonstrated a return of 14.17%, significantly outperforming the Sensex, which recorded a modest gain of 0.29% during the same period. In terms of technical indicators, the weekly MACD remains bearish, while the monthly outlook shows a mildly bearish trend. The Relative Strength Index (RSI) indicates bullish momentum on a weekly basis, but lacks a clear signal on a monthly scale. Bollinger Bands present a mildly bearish trend weekly, contrasting with a bullish monthly perspective. Moving averages reflect a bearish sentiment on a daily basis, while the KST shows a mixed outlook with bearish weekly and bullish monthly signals. EID Par...

Read MoreEID Parry's Technical Indicators Shift Amid Strong Long-Term Performance in Sugar Sector

2025-03-07 08:00:58EID Parry (India), a midcap player in the sugar industry, has recently undergone an evaluation revision reflecting shifts in its technical indicators. The company's current price stands at 700.90, showing a slight increase from the previous close of 685.60. Over the past year, EID Parry has demonstrated a notable return of 16.42%, significantly outperforming the Sensex, which recorded a mere 0.34% return during the same period. In terms of technical metrics, the weekly MACD indicates a bearish trend, while the monthly perspective shows a mildly bearish stance. The Relative Strength Index (RSI) remains neutral on both weekly and monthly charts, suggesting a lack of strong momentum in either direction. Bollinger Bands present a mildly bearish outlook on a weekly basis, contrasting with a bullish monthly view. Moving averages and KST also reflect bearish tendencies in the short term, while the monthly KST sho...

Read MoreEID Parry Navigates Market Fluctuations Amid Strong Long-Term Growth in Sugar Sector

2025-03-06 18:00:47EID Parry (India) Ltd, a mid-cap player in the sugar industry, has shown notable activity in the stock market today, with a daily performance increase of 2.23%, outperforming the Sensex, which rose by 0.83%. Over the past year, EID Parry has delivered a robust performance of 16.42%, significantly higher than the Sensex's modest gain of 0.34%. Despite recent fluctuations, including a decline of 18.80% over the past month, the company's long-term performance remains impressive. Over three years, EID Parry has achieved a remarkable 72.51% increase, and over five years, it has surged by 284.05%, far surpassing the Sensex's growth of 97.84% in the same period. Currently, EID Parry's market capitalization stands at Rs 12,231.00 crore, with a price-to-earnings (P/E) ratio of 15.34, notably lower than the industry average of 31.73. Technical indicators suggest a mixed outlook, with bearish signals observed in w...

Read MoreEID Parry's Technical Indicators Reflect Mixed Signals Amid Market Dynamics

2025-03-06 08:00:17EID Parry (India), a midcap player in the sugar industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 685.60, showing a notable increase from the previous close of 659.75. Over the past year, EID Parry has demonstrated a return of 10.97%, significantly outperforming the Sensex, which recorded a mere 0.07% return in the same period. The technical summary indicates a mixed performance across various indicators. The MACD shows bearish tendencies on a weekly basis while presenting a mildly bearish outlook monthly. The Relative Strength Index (RSI) is bullish weekly, yet shows no signal monthly, suggesting fluctuating momentum. Bollinger Bands reflect a mildly bearish trend weekly, with a sideways movement monthly. Daily moving averages indicate a mildly bullish stance, while the KST presents a bearish weekly trend but a bullish monthly ...

Read MoreEID Parry's Technical Indicators Show Mixed Signals Amid Market Volatility

2025-03-04 08:01:51EID Parry (India), a midcap player in the sugar industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 659.60, down from a previous close of 674.25, with a notable 52-week high of 997.60 and a low of 540.00. Today's trading saw a high of 674.25 and a low of 639.30, indicating some volatility. The technical summary reveals a mixed picture. The MACD indicates bearish trends on both weekly and monthly scales, while the Bollinger Bands also reflect bearish conditions. Moving averages show a mildly bullish stance on a daily basis, suggesting some short-term resilience. The KST presents a bearish outlook weekly but is bullish monthly, adding to the complexity of the stock's technical profile. In terms of performance, EID Parry's returns have varied significantly over different periods. Over the past week, the stock has returned -5.28%, co...

Read MoreEID Parry Faces Mixed Technical Trends Amid Recent Market Volatility

2025-03-03 08:00:41EID Parry (India), a midcap player in the sugar industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 674.25, down from a previous close of 683.45, with a 52-week high of 997.60 and a low of 540.00. Today's trading saw a high of 698.60 and a low of 657.80, indicating some volatility. The technical summary reveals a mixed picture. The MACD indicates bearish trends on a weekly basis, while the monthly outlook shows a mildly bearish stance. The Relative Strength Index (RSI) shows no signals for both weekly and monthly periods, suggesting a lack of momentum. Bollinger Bands reflect a bearish trend weekly and sideways monthly, while moving averages indicate a mildly bullish trend on a daily basis. The KST shows bearish weekly and bullish monthly trends, and the Dow Theory aligns with a mildly bearish outlook for both weekly and monthly a...

Read MoreEID Parry Experiences Mixed Technical Trends Amid Market Fluctuations in Sugar Sector

2025-03-02 08:00:40EID Parry (India), a midcap player in the sugar industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 674.25, down from a previous close of 683.45, with a notable 52-week high of 997.60 and a low of 540.00. Today's trading saw fluctuations, reaching a high of 698.60 and a low of 657.80. The technical summary indicates a mixed performance across various indicators. The MACD shows bearish signals on a weekly basis, while the monthly perspective is mildly bearish. The Relative Strength Index (RSI) presents no clear signals for both weekly and monthly evaluations. Bollinger Bands reflect bearish trends weekly, with a sideways movement monthly. Daily moving averages suggest a mildly bullish stance, while the KST indicates bearish weekly trends but bullish monthly signals. The On-Balance Volume (OBV) also shows a mildly bearish trend week...

Read MoreEID Parry's Technical Indicators Show Mixed Signals Amid Market Dynamics

2025-03-01 08:00:39EID Parry (India), a midcap player in the sugar industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 674.25, having closed at 683.45 previously. Over the past year, EID Parry has shown a return of 8.44%, outperforming the Sensex, which recorded a return of 1.24% in the same period. However, the year-to-date performance indicates a decline of 24.36%, compared to the Sensex's 6.32% drop. The technical summary reveals a mixed outlook, with various indicators suggesting different trends. The MACD shows bearish signals on a weekly basis, while the monthly perspective is mildly bearish. The Relative Strength Index (RSI) indicates no significant signals for both weekly and monthly assessments. Bollinger Bands reflect a bearish trend weekly, but a sideways movement monthly. Daily moving averages are mildly bullish, contrasting with the KST...

Read More

EID Parry Faces Market Dynamics Amid Flat Performance and Declining Stakeholder Confidence

2025-02-28 18:24:53EID Parry (India), a key player in the sugar industry, recently experienced an evaluation adjustment amid flat financial performance in Q3 FY24-25. The company reported annual sales of Rs 30,354.53 crore, while its return on capital employed and debtors turnover ratio declined, indicating challenges in the current market environment.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

04-Apr-2025 | Source : BSECompliances-Certificate under Reg. 74(5) of SEBI (DP) Regulations 2018

Amendment To The Code Of Practices And Procedures For Fair Disclosure Of Unpublished Price Sensitive Information.

28-Mar-2025 | Source : BSEEnclosed amended code of practices and procedures for Fair Disclosure of Unpublished Price Sensitive Information

Board Meeting Outcome for Outcome Of The Board Meeting Held On March 28 2025

28-Mar-2025 | Source : BSEOutcome of the Board Meeting held on March 28 2025

Corporate Actions

No Upcoming Board Meetings

EID Parry (India) Ltd has declared 400% dividend, ex-date: 21 Nov 23

EID Parry (India) Ltd has announced 1:2 stock split, ex-date: 23 Dec 10

No Bonus history available

No Rights history available