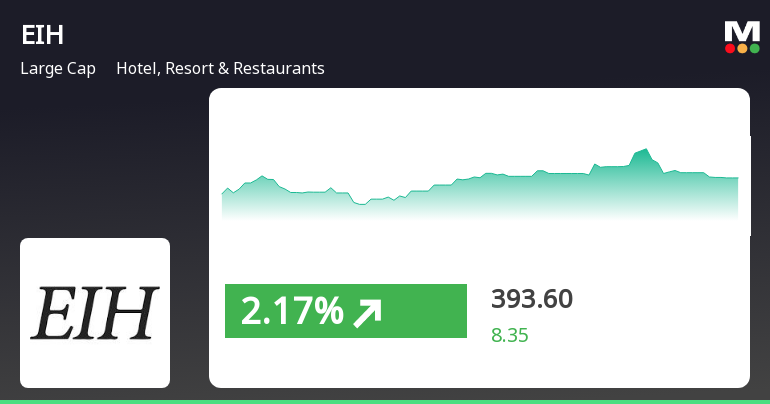

EIH Ltd. Outperforms Sector Amid Broader Market Gains and Positive Momentum

2025-04-02 09:45:16EIH Ltd., a key player in the Hotel, Resort & Restaurants sector, has experienced notable gains, outperforming its sector and achieving a total return of 7.86% over two days. While it remains below its 200-day moving average, EIH has shown strong monthly performance compared to the broader market.

Read MoreEIH Experiences Mixed Technical Trends Amid Market Evaluation Revision

2025-04-02 08:02:33EIH, a prominent player in the Hotel, Resort & Restaurants industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 368.10, showing a notable shift from its previous close of 353.05. Over the past year, EIH has experienced a decline of 22.48%, contrasting with a modest gain of 2.72% in the Sensex during the same period. In terms of technical indicators, the MACD shows a mildly bullish trend on a weekly basis, while the monthly perspective leans mildly bearish. The Bollinger Bands indicate a mildly bearish stance weekly, yet bullish on a monthly scale. Moving averages also reflect a mildly bearish trend, suggesting a mixed technical outlook. EIH's performance over various time frames reveals a significant return of 131.15% over three years and an impressive 460.70% over five years, outpacing the Sensex considerably. This long-term gr...

Read More

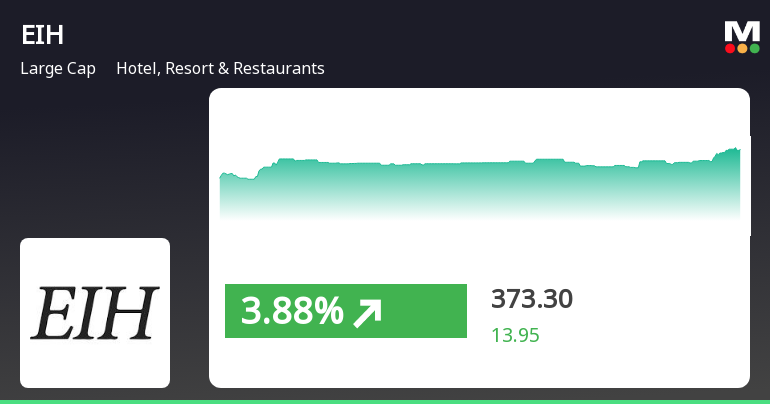

EIH Ltd. Shows Resilience Amid Broader Market Decline, Outperforming Sector Trends

2025-04-01 14:45:17EIH Ltd., a key player in the Hotel, Resort & Restaurants sector, has shown strong performance today, outperforming its sector amid a broader market decline. The stock has risen significantly over the past month, although it has faced challenges over the past year, indicating mixed long-term trends.

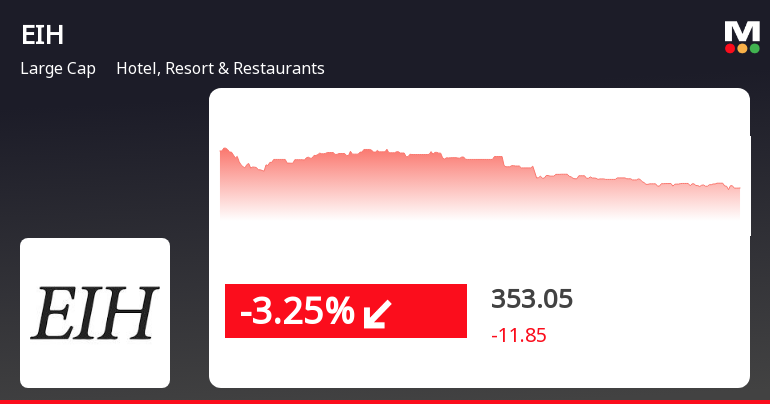

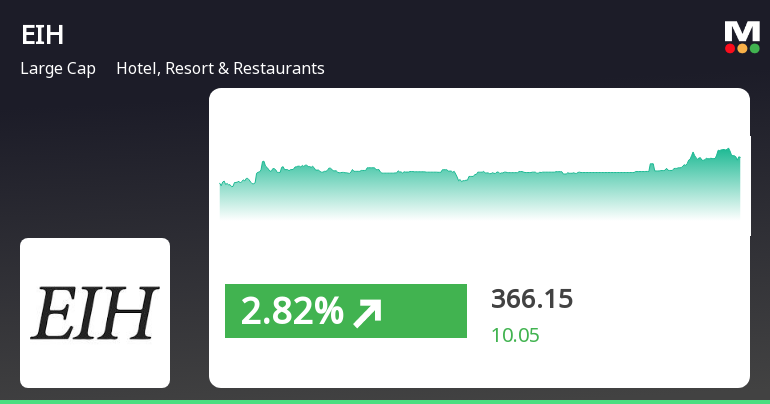

Read MoreEIH Faces Bearish Technical Trends Amid Recent Market Volatility

2025-04-01 08:00:54EIH, a prominent player in the Hotel, Resort & Restaurants industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 353.05, down from a previous close of 364.90, with a notable 52-week high of 566.00 and a low of 293.45. Today's trading saw a high of 369.95 and a low of 350.65, indicating some volatility in its performance. The technical summary for EIH reveals a bearish sentiment across various indicators. The MACD shows a bearish trend on a weekly basis, while the monthly perspective is mildly bearish. Similarly, Bollinger Bands and moving averages also reflect bearish tendencies. The KST indicator aligns with this sentiment, indicating bearish conditions on a weekly basis and mildly bearish on a monthly basis. In terms of performance, EIH's stock return has shown mixed results compared to the Sensex. Over the past week, the stock ...

Read More

EIH Ltd. Faces Mixed Trends Amid Broader Market Volatility and Fluctuating Performance

2025-03-28 13:45:18EIH Ltd., a key player in the hospitality sector, saw a decline on March 28, 2025, underperforming its sector. The stock's moving averages indicate mixed trends, while the broader market, represented by the Sensex, is experiencing volatility. EIH Ltd. has shown significant fluctuations over various time frames.

Read More

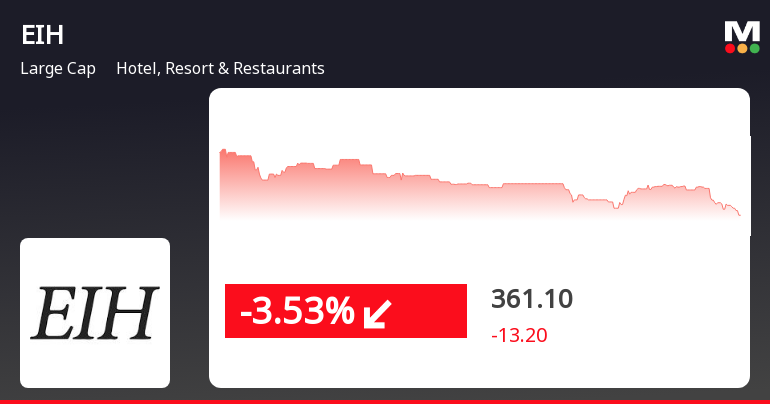

EIH Ltd. Faces Continued Stock Decline Amid Mixed Performance Trends and Market Volatility

2025-03-26 15:15:18EIH Ltd., a key player in the hospitality sector, has faced a decline, marking its third consecutive day of losses. The stock's performance shows mixed trends against various moving averages. In the broader market, the Sensex has experienced a recent downturn but has gained over the past three weeks.

Read More

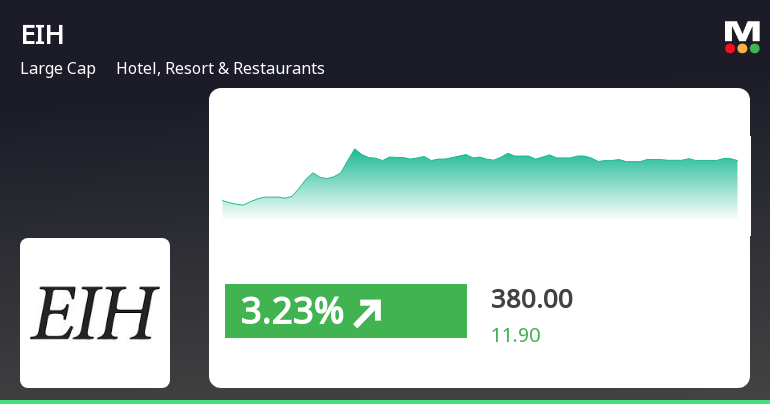

EIH Ltd. Shows Strong Stock Performance Amid Broader Market Gains

2025-03-24 10:30:17EIH Ltd., a key player in the Hotel, Resort & Restaurants sector, has experienced notable gains, outperforming its industry. The stock has shown a strong upward trend recently, trading above multiple moving averages. In the broader market, the Sensex has also seen positive movement, marking a three-week rise.

Read More

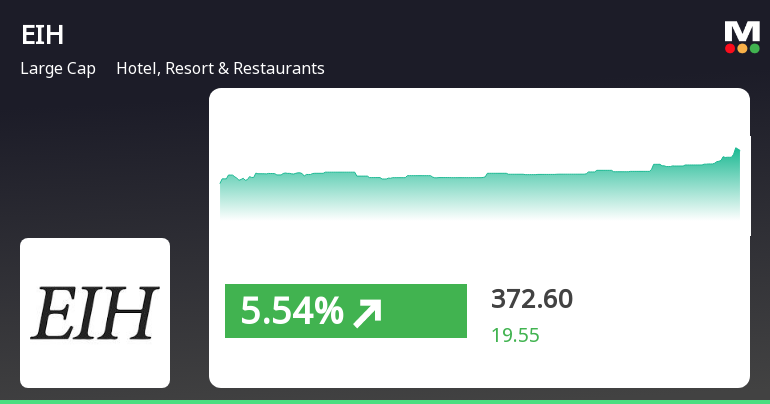

EIH Ltd. Shows Strong Recovery Amid Broader Market Rebound and Small-Cap Gains

2025-03-21 14:45:17EIH Ltd., a key player in the Hotel, Resort & Restaurants sector, has shown notable recovery after two days of decline, outperforming the Sensex. The stock reached an intraday high of Rs 372, while the broader market, led by small-cap stocks, has also rebounded positively.

Read More

EIH Ltd. Shows Strong Short-Term Gains Amid Mixed Long-Term Momentum

2025-03-17 15:00:20EIH Ltd., a key player in the Hotel, Resort & Restaurants sector, experienced notable gains on March 17, 2025, outperforming the Sensex. The stock has risen for three consecutive days, achieving a total return of 7.77%. However, its year-over-year performance remains negative compared to the broader market.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

09-Apr-2025 | Source : BSECertificate for the quarter ended 31st March 2025

Disclosure Under Regulation 30 Of The Securities And Exchange Board Of India (Listing Obligations And Disclosure Requirements) Regulations 2015

02-Apr-2025 | Source : BSEDisclosure under Regulation 30 of SEBI (LODR ) Regulations 2015

Closure of Trading Window

25-Mar-2025 | Source : BSEClosure of Trading window

Corporate Actions

No Upcoming Board Meetings

EIH Ltd. has declared 60% dividend, ex-date: 31 Jul 24

EIH Ltd. has announced 2:10 stock split, ex-date: 12 Sep 06

EIH Ltd. has announced 1:2 bonus issue, ex-date: 12 Sep 06

EIH Ltd. has announced 8:85 rights issue, ex-date: 22 Sep 20