EIH Associated Hotels Shows Mixed Technical Trends Amid Market Volatility

2025-04-03 08:04:32EIH Associated Hotels, a player in the Hotel, Resort & Restaurants industry, has recently undergone an evaluation revision reflecting its current market dynamics. The company's stock is currently priced at 357.60, showing a slight increase from the previous close of 350.40. Over the past year, EIH has experienced a 52-week high of 544.95 and a low of 300.05, indicating notable volatility. In terms of technical indicators, the MACD suggests a bearish stance on a weekly basis, while the monthly view leans mildly bearish. The Bollinger Bands present a mixed picture, with a mildly bearish outlook weekly and a bullish trend monthly. Moving averages also reflect a mildly bearish sentiment on a daily basis. When comparing the company's performance to the Sensex, EIH Associated Hotels has shown a 2.10% return over the past week, contrasting with a -0.87% return for the Sensex. Over the past month, the stock has ...

Read MoreEIH Associated Hotels Adjusts Valuation Grade Amid Competitive Industry Landscape

2025-03-17 08:00:35EIH Associated Hotels has recently undergone a valuation adjustment, reflecting a shift in its financial standing within the hotel, resort, and restaurant industry. The company currently exhibits a price-to-earnings (PE) ratio of 23.73 and a price-to-book value of 4.51, indicating its market valuation relative to its earnings and assets. Additionally, the enterprise value to EBITDA stands at 15.96, while the enterprise value to EBIT is recorded at 18.77. In terms of performance metrics, EIH Associated Hotels boasts a return on capital employed (ROCE) of 35.88% and a return on equity (ROE) of 19.00%, showcasing its efficiency in generating profits from its capital and equity. The company also offers a dividend yield of 1.80%. When compared to its peers, EIH Associated Hotels presents a more favorable valuation profile, particularly against companies like ITDC and Apeejay Surrender, which are positioned at ...

Read MoreEIH Associated Hotels Adjusts Valuation Grade Amid Competitive Industry Landscape

2025-03-07 08:01:03EIH Associated Hotels has recently undergone a valuation adjustment, reflecting a shift in its financial standing within the hotel, resort, and restaurant industry. The company's current price stands at 334.40, showing a slight increase from the previous close of 328.85. Over the past year, EIH has experienced a stock return of -7.95%, contrasting with a modest gain of 0.34% in the Sensex. Key financial metrics for EIH include a PE ratio of 23.83 and an EV to EBITDA ratio of 16.03, indicating its market positioning relative to peers. The company boasts a robust return on capital employed (ROCE) of 35.88% and a return on equity (ROE) of 19.00%, which are noteworthy indicators of operational efficiency. In comparison to its peers, EIH's valuation metrics reveal a more favorable position against companies like ITDC and Samhi Hotels, which are categorized at higher valuation levels. This context highlights EI...

Read More

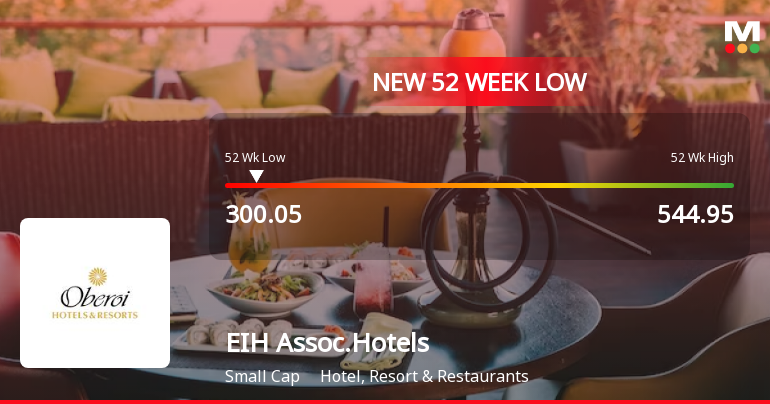

EIH Associated Hotels Hits 52-Week Low Amid Broader Small-Cap Sector Challenges

2025-03-04 10:18:27EIH Associated Hotels has reached a new 52-week low, despite outperforming its sector. The stock has shown signs of a trend reversal after six days of decline, but remains below key moving averages. Financial metrics indicate low debt and strong cash reserves, though long-term growth prospects appear limited.

Read More

EIH Associated Hotels Faces Ongoing Challenges Amid Significant Stock Volatility

2025-03-03 14:20:59EIH Associated Hotels has faced significant volatility, hitting a new 52-week low of Rs. 304.75 and underperforming its sector. The stock has seen consecutive losses over the past six days, reflecting a challenging market position as it trades below multiple moving averages and has declined over the past year.

Read MoreEIH Associated Hotels Adjusts Valuation Grade Amid Strong Financial Performance and Market Position

2025-03-01 08:00:29EIH Associated Hotels has recently undergone a valuation adjustment, reflecting its current financial metrics and market position within the hotel, resort, and restaurant industry. The company reports a price-to-earnings (P/E) ratio of 22.70 and a price-to-book value of 4.31, indicating its valuation relative to its earnings and assets. Additionally, its enterprise value to EBITDA stands at 15.20, while the enterprise value to EBIT is recorded at 17.88. The company also showcases a robust return on capital employed (ROCE) of 35.88% and a return on equity (ROE) of 19.00%, highlighting its efficiency in generating profits from its capital and equity. EIH Associated Hotels offers a dividend yield of 1.88%, which may appeal to income-focused investors. In comparison to its peers, EIH Associated Hotels presents a more favorable valuation profile. For instance, competitors like ITDC and Apeejay Surrendra have s...

Read More

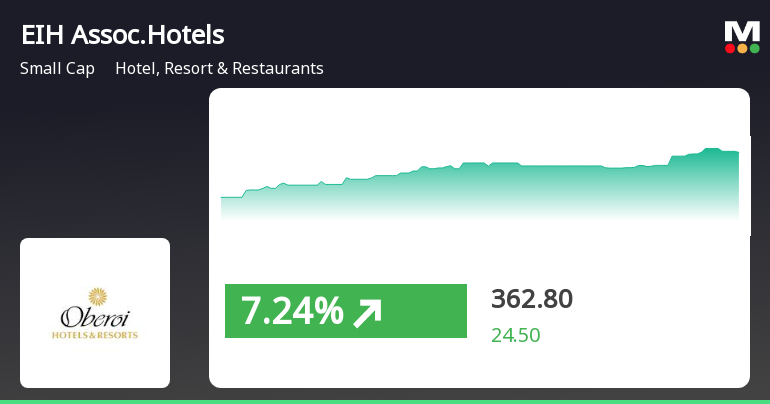

EIH Associated Hotels Shows Strong Short-Term Gains Amid Broader Market Challenges

2025-02-20 11:20:23EIH Associated Hotels experienced notable trading activity, achieving a significant gain on February 20, 2025, and outperforming its sector. The stock has shown consecutive gains over two days, although it remains below several longer-term moving averages. In the broader market context, it has outperformed the Sensex today.

Read More

EIH Associated Hotels Reports Strong Q4 Results with Significant Profit Growth and Improved Liquidity

2025-02-10 16:20:39EIH Associated Hotels has announced its financial results for the quarter ending December 2024, highlighting significant growth in profit before tax, profit after tax, and net sales. The company also reported improved operating profit, earnings per share, and liquidity, alongside efficient management of receivables.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

09-Apr-2025 | Source : BSECertificate for the quarter ended 31st March 2025

Closure of Trading Window

25-Mar-2025 | Source : BSEClosure of Trading window

Announcement under Regulation 30 (LODR)-Investor Presentation

04-Mar-2025 | Source : BSEInvestor Presentation for Quarter ended 31st December 2024

Corporate Actions

No Upcoming Board Meetings

EIH Associated Hotels Ltd has declared 60% dividend, ex-date: 13 Aug 24

No Splits history available

EIH Associated Hotels Ltd has announced 1:1 bonus issue, ex-date: 13 Aug 24

EIH Associated Hotels Ltd has announced 5:9 rights issue, ex-date: 11 Sep 12