Eiko Lifesciences Adjusts Valuation Grade Amid Competitive Market Landscape Insights

2025-04-02 08:02:41Eiko Lifesciences, a microcap player in the finance/NBFC sector, has recently undergone a valuation adjustment, reflecting its current financial metrics and market position. The company's price-to-earnings ratio stands at 57.37, while its price-to-book value is recorded at 1.30. Other notable metrics include an EV to EBIT ratio of 49.65 and an EV to EBITDA ratio of 30.60, indicating a significant valuation relative to its earnings and cash flow. In terms of returns, Eiko Lifesciences has experienced a decline of 15.54% year-to-date, contrasting with a slight increase in the Sensex of 2.71% over the same period. However, the company has shown resilience over a five-year horizon, boasting a remarkable return of 432.56%, significantly outpacing the Sensex's 168.97% return. When compared to its peers, Eiko Lifesciences presents a more favorable valuation profile, particularly in terms of its PEG ratio of 8.57...

Read MoreEiko Lifesciences Adjusts Valuation Amidst Competitive Finance/NBFC Sector Dynamics

2025-03-17 08:00:53Eiko Lifesciences, a microcap player in the Finance/NBFC sector, has recently undergone a valuation adjustment. The company's current price stands at 48.82, reflecting a decline from its previous close of 50.98. Over the past year, Eiko Lifesciences has experienced a stock return of -4.41%, contrasting with a modest gain of 1.47% in the Sensex. Key financial metrics reveal a PE ratio of 52.85 and an EV to EBITDA ratio of 27.58, indicating a premium valuation compared to its peers. The company's return on capital employed (ROCE) is reported at 2.84%, while the return on equity (ROE) is at 2.27%. These figures suggest that Eiko Lifesciences is positioned differently within the market landscape. In comparison to its peers, Eiko Lifesciences exhibits a higher PE ratio than companies like Fedders Holding and Dhunseri Investments, which have lower valuations. Conversely, Abans Holdings stands out with a signifi...

Read MoreEiko Lifesciences Adjusts Valuation Amidst Competitive Finance Sector Dynamics

2025-03-05 08:00:58Eiko Lifesciences, a microcap company in the finance/NBFC sector, has recently undergone a valuation adjustment. The company's current price stands at 47.90, reflecting a notable shift from its previous close of 45.34. Over the past year, Eiko Lifesciences has experienced a stock return of -18.79%, contrasting with a modest -1.19% return from the Sensex during the same period. Key financial metrics for Eiko Lifesciences reveal a PE ratio of 51.86 and an EV to EBITDA ratio of 26.91, indicating a premium valuation relative to its peers. In comparison, Nisus Finance, categorized as very expensive, has a PE ratio of 40, while Vardhman Holdings, rated as attractive, shows a significantly lower PE of 4.01. This highlights the varying valuation landscapes within the sector. Eiko's return on capital employed (ROCE) is recorded at 2.84%, and its return on equity (ROE) is at 2.27%, both of which are relatively low ...

Read More

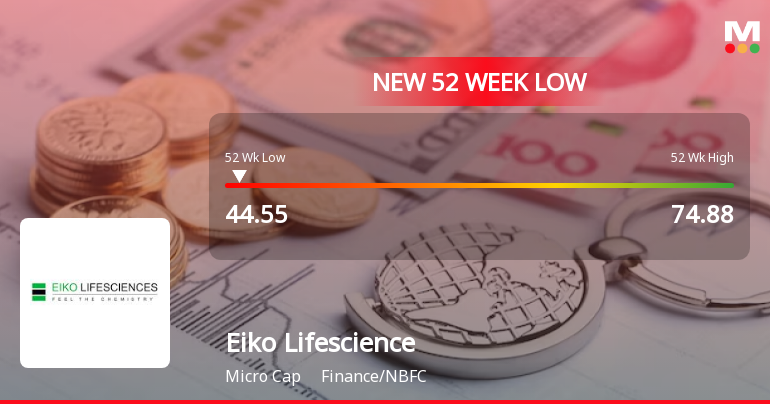

Eiko Lifesciences Hits 52-Week Low Amid Broader Market Weakness and Declining Trends

2025-03-04 10:48:02Eiko Lifesciences, a microcap in the finance/NBFC sector, reached a new 52-week low today, reflecting a one-year decline of nearly 20%. The stock has consistently traded below key moving averages and faces challenges, including a low average Return on Equity, amid a broader market downturn.

Read More

Eiko Lifesciences Faces Significant Volatility Amidst Declining Stock Performance

2025-03-03 15:53:15Eiko Lifesciences has faced notable volatility, reaching a new 52-week low and experiencing a significant decline over the past four days. The company's annual performance shows a substantial drop, contrasting with broader market trends, and its financial metrics indicate weak long-term fundamentals and high valuation concerns.

Read More

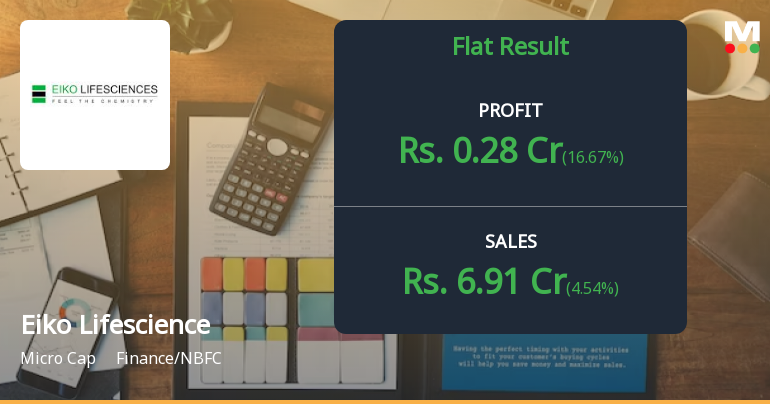

Eiko Lifesciences Reports Stable December 2024 Results Amid Stock Evaluation Shift

2025-02-13 10:07:50Eiko Lifesciences has announced its financial results for the quarter ending December 2024, reporting net sales of Rs 25.40 crore, a year-on-year growth of 30.06%. The Profit After Tax for the nine-month period is Rs 0.84 crore, surpassing the previous year's figures.

Read More

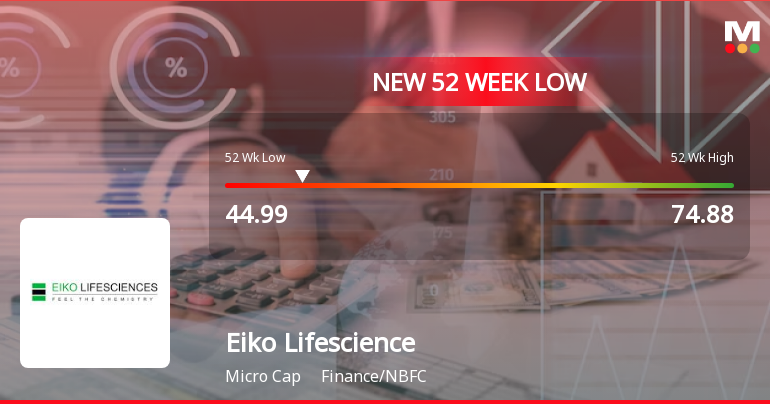

Eiko Lifesciences Faces Continued Decline Amid Broader Finance/NBFC Sector Challenges

2025-02-12 10:36:14Eiko Lifesciences has faced notable volatility, hitting a new 52-week low and continuing a downward trend with a significant decline over the past four days. The stock is trading below all major moving averages and has underperformed over the past year compared to the broader market and sector.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

07-Apr-2025 | Source : BSECompliance Certificate under Reg 74(5) of SEBI (DP) Regulations 2018

Disclosures under Reg. 29(1) of SEBI (SAST) Regulations 2011

28-Mar-2025 | Source : BSEThe Exchange has received the disclosure under Regulation 29(1) of SEBI (Substantial Acquisition of Shares & Takeovers) Regulations 2011 for Siddhant Kabra

Disclosures under Reg. 29(2) of SEBI (SAST) Regulations 2011

28-Mar-2025 | Source : BSEThe Exchange has received the disclosure under Regulation 29(2) of SEBI (Substantial Acquisition of Shares & Takeovers) Regulations 2011 for 2B Black Bio LLP

Corporate Actions

No Upcoming Board Meetings

Eiko Lifesciences Ltd has declared 2% dividend, ex-date: 20 Sep 17

No Splits history available

No Bonus history available

Eiko Lifesciences Ltd has announced 2:3 rights issue, ex-date: 07 Jul 23