Electronics Mart India Faces Declining Profits Amidst Market Evaluation Shift

2025-04-02 08:40:55Electronics Mart India has recently experienced a change in its evaluation, reflecting a shift in its stock's technical landscape. The company reported a significant decline in profit metrics for Q3 FY24-25, alongside a low operating profit to interest ratio, indicating tighter margins despite maintaining a reasonable return on capital employed.

Read MoreElectronics Mart Faces Mixed Technical Trends Amid Market Volatility and Declining Performance

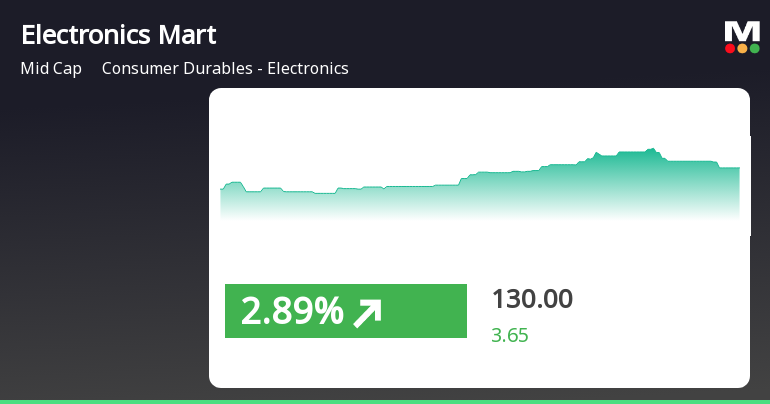

2025-04-02 08:10:10Electronics Mart India, a player in the consumer durables and electronics sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock, currently priced at 125.95, has shown fluctuations with a 52-week high of 261.75 and a low of 112.90. Today's trading saw a high of 129.15 and a low of 121.75, indicating some volatility. The technical summary reveals a mixed picture. The MACD indicates a bearish trend on a weekly basis, while the moving averages also reflect bearish sentiment. Bollinger Bands show a mildly bearish stance, suggesting some caution in the market. The Dow Theory presents a mildly bullish outlook on a weekly basis, contrasting with other indicators that lack clear signals. In terms of performance, Electronics Mart's returns have been underwhelming compared to the Sensex. Over the past week, the stock returned 2.57%, while the Sensex declined by 2.55%...

Read More

Electronics Mart India Faces Significant Volatility Amid Broader Market Resilience

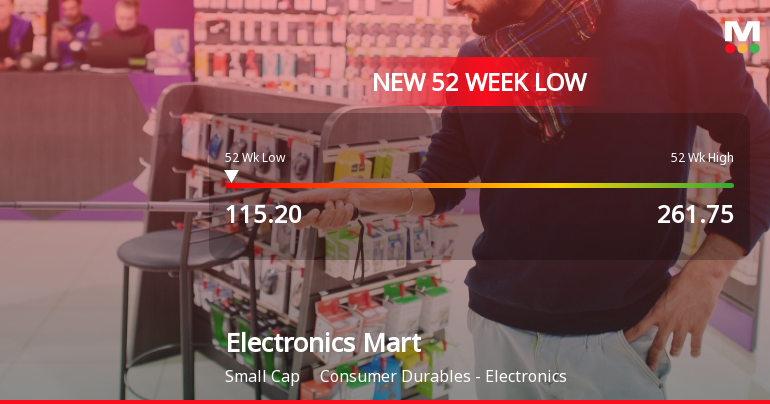

2025-03-17 13:38:23Electronics Mart India has faced notable volatility, hitting a 52-week low and declining 13% over five days. The company's performance has been weak over the past year, with a 36.56% drop, contrasting with the Sensex's slight gain. Financial metrics indicate challenges, yet the company retains a decent valuation and strong institutional holdings.

Read More

Electronics Mart India Faces Significant Stock Volatility Amid Declining Financial Performance

2025-03-13 09:52:11Electronics Mart India has hit a new 52-week low, experiencing notable volatility and a significant decline over the past four days. The stock is trading below all major moving averages and has faced a substantial year-over-year drop, influenced by poor financial results and a low operating profit to interest ratio.

Read More

Electronics Mart India Faces Significant Volatility Amid Declining Stock Performance

2025-03-13 09:52:10Electronics Mart India has faced notable volatility, reaching a 52-week low and trailing its sector significantly. The stock has declined consecutively over four days, with a year-over-year drop of 35.84%. Recent financial results show a substantial decrease in profits, contributing to a bearish outlook amid unfavorable technical indicators.

Read More

Electronics Mart India Faces Significant Stock Volatility Amid Declining Financial Performance

2025-03-13 09:52:08Electronics Mart India has faced notable volatility, hitting a 52-week low and experiencing a significant decline over the past four days. The stock is trading below all major moving averages and has seen a substantial year-over-year drop, influenced by poor financial results and a low operating profit to interest ratio.

Read MoreElectronics Mart India Adjusts Valuation Grade Amidst Market Challenges and Peer Comparisons

2025-03-12 08:00:53Electronics Mart India, a small-cap player in the consumer durables and electronics sector, has recently undergone a valuation adjustment. The company's current price stands at 118.40, reflecting a notable decline from its previous close of 126.25. Over the past year, Electronics Mart has experienced a significant drop in stock value, with a return of -39.53%, contrasting sharply with a modest gain of 0.82% in the Sensex. Key financial metrics for Electronics Mart include a PE ratio of 26.93 and an EV to EBITDA ratio of 13.50, which position the company within a competitive landscape. The company's return on capital employed (ROCE) is reported at 11.81%, while the return on equity (ROE) stands at 12.48%. In comparison to its peers, Electronics Mart's valuation metrics appear more favorable. For instance, companies like Orient Electric and Avalon Tech are categorized with significantly higher PE ratios an...

Read More

Electronics Mart India Outperforms Sector Amid Mixed Market Trends and Volatility

2025-03-07 11:45:58Electronics Mart India has experienced notable trading activity, with a significant rise in stock price and increased trading volume. While it outperformed its sector, its moving averages indicate a mixed performance. In the broader market, small-cap stocks are leading, while the Sensex shows a bearish trend.

Read MoreElectronics Mart India Experiences Valuation Grade Change Amidst Declining Stock Performance

2025-03-04 08:00:13Electronics Mart India, a small-cap player in the consumer durables and electronics sector, has recently undergone a valuation adjustment. The company's current price stands at 119.80, reflecting a notable decline from its previous close of 126.25. Over the past year, Electronics Mart has experienced a significant drop in stock performance, with a return of -45.11%, contrasting sharply with the Sensex's modest decline of -0.98% during the same period. Key financial metrics for Electronics Mart include a PE ratio of 27.25 and an EV to EBITDA ratio of 13.62, which position the company favorably compared to its peers. Notably, while Electronics Mart's valuation has been revised, several competitors in the market, such as Avalon Tech and Orient Electric, are categorized at higher valuation levels, indicating a more expensive market position. The company's return on capital employed (ROCE) is reported at 11.8...

Read MoreCommencement Of Commercial Operation

04-Apr-2025 | Source : BSEPursuant to reg 30 (4) of SEBI LODR 2015 this is to inform you that Electronics Mart India Limited has commenced the commercial operations of a new multi-brand store under the brand name BAJAJ ELECTRONICS in Kalyanadurgam Andhra Pradesh.

Closure of Trading Window

31-Mar-2025 | Source : BSEElectronics Mart India Limited has informed the exchange about the closure of the trading window effective from 01st April 2025.

Closure Of One Of The Retail Store

17-Mar-2025 | Source : BSEPursuant to reg 30(4) of SEBI LODR Regulations 2015 this is to inform you that Electronics Mart India Limited has decided to close one of its retail stores under the brand name SAMSUNG situated at Dwarakapuri Colony Punjagutta Hyderabad effective from 17th March 2025.

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available