Elnet Technologies Faces Cautious Outlook Amid Flat Financial Performance and Bearish Sentiment

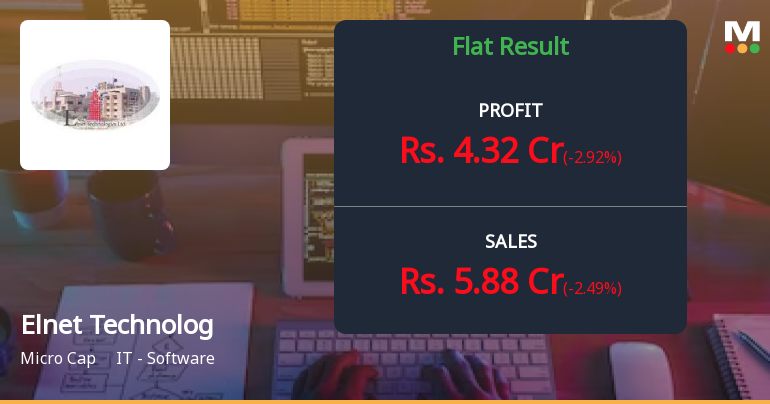

2025-04-02 08:30:12Elnet Technologies, a microcap IT software firm, has recently adjusted its evaluation amid a cautious outlook. The company reported flat financial performance with net sales of Rs 5.88 crore and modest growth in operating profit. Technical indicators suggest bearish sentiment, while its low debt-to-equity ratio remains a positive factor.

Read More

Elnet Technologies Adjusts Financial Outlook Amidst Market Position Changes and Consistent Returns

2025-03-26 08:09:25Elnet Technologies, a microcap IT software firm, has recently adjusted its evaluation, reflecting changes in financial metrics and market position. The company has shown a shift in technical trends and maintains a low debt-to-equity ratio, despite experiencing flat financial performance in recent quarters.

Read MoreElnet Technologies Sees Surge in Buying Activity Amid Strong Price Gains

2025-03-24 12:40:09Elnet Technologies Ltd is currently witnessing significant buying activity, with a remarkable one-day performance increase of 20.06%, substantially outperforming the Sensex, which rose by only 1.28%. Over the past week, Elnet has gained 20.75%, compared to the Sensex's 5.02%. This trend continues over the month, with Elnet up 12.88% against the Sensex's 4.61%. The stock opened with a gap down of 2.74% today but quickly rebounded, reaching an intraday high of Rs 416.6. The stock's volatility has been notable, with an intraday fluctuation of 10.49%. Elnet Technologies has consistently traded above its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, indicating a strong upward trend in its price performance. Several factors may be contributing to the heightened buying pressure, including positive market sentiment towards the IT sector and the company's robust historical performance, which shows ...

Read MoreElnet Technologies Adjusts Valuation Grade Amid Competitive Market Landscape

2025-03-21 08:00:40Elnet Technologies, a microcap player in the IT software industry, has recently undergone a valuation adjustment. The company's current price stands at 357.70, reflecting a slight increase from the previous close of 351.95. Over the past year, Elnet has shown a return of 9.35%, outperforming the Sensex, which returned 5.89% in the same period. However, year-to-date performance indicates a decline of 12.97%, contrasting with the Sensex's modest drop of 2.29%. Key financial metrics for Elnet include a PE ratio of 8.48 and an EV to EBITDA ratio of 2.08, which position it within a competitive landscape. The company's return on capital employed (ROCE) is notably high at 40.63%, while its return on equity (ROE) stands at 11.46%. In comparison to its peers, Elnet's valuation metrics suggest a more favorable position relative to companies like NINtec Systems and Blue Cloud Software, which exhibit significantly h...

Read MoreElnet Technologies Adjusts Valuation Amid Strong Financial Performance in IT Sector

2025-03-07 08:01:13Elnet Technologies, a microcap player in the IT software industry, has recently undergone a valuation adjustment. The company's current price stands at 356.00, reflecting a slight increase from the previous close of 350.00. Over the past year, Elnet has shown a return of 5.20%, outperforming the Sensex, which recorded a modest gain of 0.34%. Key financial metrics for Elnet include a PE ratio of 8.44 and an EV to EBITDA ratio of 2.04, indicating its market positioning relative to its peers. The company also boasts a robust return on capital employed (ROCE) of 40.63% and a return on equity (ROE) of 11.46%. In comparison to its peers, Elnet's valuation metrics reveal a distinct positioning. For instance, Ksolves India has a significantly higher PE ratio of 24.61, while NINtec Systems is noted for its very high valuation metrics. Other competitors like InfoBeans Technologies and Innovana Technologies present...

Read More

Elnet Technologies Reports Flat Sales Amidst Minimal Growth and High Non-Operating Income

2025-02-24 18:34:08Elnet Technologies, a microcap IT software firm, recently adjusted its evaluation amid flat financial performance for Q3 FY24-25, reporting net sales of Rs 5.88 crore. The company has shown minimal growth in net sales over five years, while maintaining a low debt-to-equity ratio and a reliance on non-operating income.

Read More

Elnet Technologies Reports Stable Financial Results and Revised Market Evaluation in December 2024

2025-02-13 18:20:54Elnet Technologies has announced its financial results for the quarter ending December 2024, revealing stable performance with no significant fluctuations. The company's evaluation score has improved from -4 to -2 over the past three months, reflecting its current market standing amid the competitive IT software landscape.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

09-Apr-2025 | Source : BSECertificate under Reg 74(5) of SEBI (DP) Regulations 2018 for the quarter ended March 31 2025

Intimation Regarding Appointment Of Additional Independent Director And Reconstitution Of Board Committees

29-Mar-2025 | Source : BSEIntimation regarding appointment of Additional Independent Director and reconstitution of Board Committees

Intimation Regarding Appointment Of Additional Independent Director And Reconstitution Of Board Committees

29-Mar-2025 | Source : BSEIntimation regarding appointment of Additional Independent Director and reconstitution of Board Committees

Corporate Actions

No Upcoming Board Meetings

Elnet Technologies Ltd has declared 17% dividend, ex-date: 17 Sep 24

No Splits history available

No Bonus history available

No Rights history available