Embassy Office Parks REIT Faces Technical Trend Challenges Amid Market Dynamics

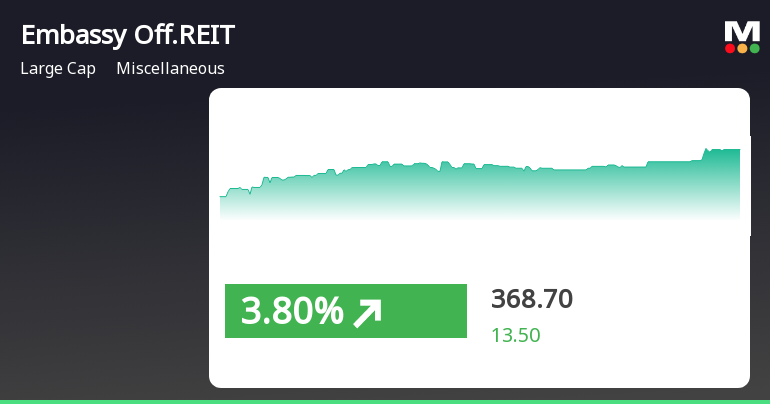

2025-03-25 08:05:59Embassy Office Parks REIT, a prominent player in the miscellaneous sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 356.38, showing a slight increase from the previous close of 355.91. Over the past year, the stock has faced challenges, with a return of -5.21%, contrasting sharply with the Sensex's gain of 7.07% during the same period. In terms of technical indicators, the MACD suggests a bearish trend on a weekly basis, while the monthly perspective leans towards a mildly bearish outlook. The Relative Strength Index (RSI) shows no significant signals for both weekly and monthly assessments. Bollinger Bands indicate a mildly bearish trend weekly, while the monthly view remains sideways. Moving averages reflect a bearish sentiment on a daily basis, and the On-Balance Volume (OBV) shows a mildly bearish trend monthly. Despite thes...

Read MoreEmbassy Office Parks REIT Faces Bearish Technical Trends Amid Market Challenges

2025-03-24 08:02:52Embassy Office Parks REIT, a prominent player in the miscellaneous industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 355.91, down from a previous close of 362.50, with a 52-week high of 432.52 and a low of 335.10. Today's trading saw a high of 364.30 and a low of 355.11. The technical summary indicates a bearish sentiment in various indicators. The MACD shows a bearish trend on a weekly basis, while the monthly outlook is mildly bearish. The Bollinger Bands also reflect a bearish stance weekly, with a sideways trend monthly. Daily moving averages confirm a bearish trend, and the KST presents a mixed picture with a bearish weekly outlook and a bullish monthly perspective. In terms of performance, Embassy Office Parks REIT has faced challenges compared to the Sensex. Over the past week, the stock has returned -3.06%, while the Se...

Read MoreEmbassy Office Parks REIT Faces Mixed Technical Trends Amid Market Challenges

2025-03-20 08:03:54Embassy Office Parks REIT, a prominent player in the miscellaneous sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 362.50, slightly down from its previous close of 362.79. Over the past year, the stock has experienced a decline of 5.26%, contrasting with a 4.77% gain in the Sensex, highlighting a challenging performance relative to the broader market. In terms of technical indicators, the weekly MACD and KST suggest a bearish sentiment, while the monthly KST indicates a bullish trend. The Bollinger Bands show a mixed outlook, with weekly readings leaning bearish and monthly readings mildly bullish. The moving averages and Dow Theory also reflect a bearish stance on a daily and weekly basis, respectively. Despite these technical signals, the company has shown resilience over longer periods, with a slight gain of 0.3% over three ...

Read MoreEmbassy Office Parks REIT Faces Mixed Technical Trends Amid Market Evaluation Revision

2025-03-18 08:04:24Embassy Office Parks REIT, a prominent player in the miscellaneous industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 364.25, slightly down from the previous close of 367.15. Over the past year, the stock has experienced a decline of 7.87%, contrasting with a modest gain of 2.10% in the Sensex during the same period. The technical summary indicates a bearish sentiment in the weekly MACD and moving averages, while the monthly indicators show a mix of mildly bearish and bullish trends. Notably, the Bollinger Bands reflect a bearish stance on a weekly basis, suggesting potential volatility in the near term. The KST presents a bearish outlook weekly, while maintaining a bullish position monthly, indicating mixed signals in the longer timeframe. In terms of performance, Embassy Office Parks REIT has shown resilience over shorter peri...

Read MoreEmbassy Office Parks REIT Experiences Technical Trend Adjustments Amid Market Challenges

2025-03-10 08:01:59Embassy Office Parks REIT, a prominent player in the miscellaneous sector, has recently undergone a technical trend adjustment. The evaluation revision reflects a nuanced view of the stock's performance, particularly in light of various technical indicators. The MACD readings indicate a bearish stance on a weekly basis, while the monthly perspective shows a mildly bearish outlook. Additionally, the Bollinger Bands present a mixed picture, with weekly indicators leaning bearish and monthly indicators suggesting a mildly bullish trend. The stock's current price stands at 360.73, slightly above the previous close of 358.12. Over the past year, Embassy Office Parks REIT has experienced a decline of 4.08%, contrasting with a modest gain of 0.29% in the Sensex during the same period. This performance is further highlighted by the stock's year-to-date return of -2.58%, while the Sensex has also faced challenges, ...

Read MoreEmbassy Office Parks REIT Faces Bearish Technical Trends Amid Market Evaluation Revision

2025-03-07 08:03:52Embassy Office Parks REIT, a prominent player in the miscellaneous sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 358.12, down from a previous close of 361.50. Over the past year, the stock has experienced a decline of 4.75%, contrasting with a slight gain of 0.34% in the Sensex during the same period. The technical summary indicates a bearish sentiment in various indicators. The MACD shows a bearish trend on a weekly basis, while the monthly outlook is mildly bearish. The Bollinger Bands also reflect a bearish stance weekly, with a sideways trend monthly. Moving averages on a daily basis further support this bearish sentiment. The KST presents a mixed picture, being bearish weekly but bullish monthly, while the On-Balance Volume (OBV) indicates a mildly bearish trend. In terms of returns, Embassy Office Parks REIT has faced c...

Read More

Embassy Office Parks REIT Shows Resilience Amid Broader Market Challenges

2025-02-27 13:35:24Embassy Office Parks REIT experienced a notable increase in its stock price today, marking a turnaround after previous declines. The stock outperformed its sector and showed positive performance over the past month, despite mixed signals from moving averages, indicating resilience in a challenging market environment.

Read More

Embassy Office Parks REIT Reports Record Quarterly Sales Amid Profitability Challenges

2025-01-30 10:04:12Embassy Office Parks REIT reported its financial results for the quarter ending December 2024, showcasing strong quarterly net sales of Rs 1,032.62 crore. However, the company faces challenges with declining operating profit to interest ratio, reduced profit after tax, and an increased debt-equity ratio, indicating potential liquidity concerns.

Read More

Embassy Office Parks REIT Reports Record Quarterly Sales Amid Profitability Challenges

2025-01-30 10:04:12Embassy Office Parks REIT reported its financial results for the quarter ending December 2024, showcasing strong quarterly net sales of Rs 1,032.62 crore. However, the company faces challenges with declining operating profit to interest ratio, reduced profit after tax, and an increased debt-equity ratio, indicating potential liquidity concerns.

Read MoreReg 23(5)(i): Disclosure of material issue

29-Mar-2025 | Source : BSEEmbassy Office Parks REIT has informed the Exchange regarding Disclosure of material issue

Reg 23(5)(i): Disclosure of material issue

28-Mar-2025 | Source : BSEEmbassy Office Parks REIT has informed the Exchange regarding Disclosure of material issue

Reg 23(5)(i): Disclosure of material issue

26-Mar-2025 | Source : BSEEmbassy Office Parks REIT has informed the Exchange regarding Disclosure of material issue

Corporate Actions

No Upcoming Board Meetings

Embassy Office Parks REIT has declared 1% dividend, ex-date: 31 Jan 25

No Splits history available

No Bonus history available

No Rights history available