EMS Stock Evaluation Revision Highlights Technical Trends Amid Market Challenges

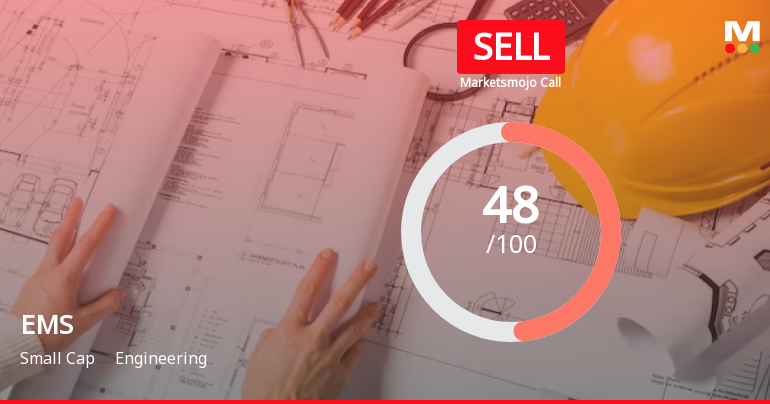

2025-04-02 08:10:26EMS, a small-cap player in the engineering sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 632.60, showing a slight increase from the previous close of 618.00. Over the past year, EMS has demonstrated a notable return of 50.01%, significantly outperforming the Sensex, which recorded a return of 2.72% in the same period. In terms of technical indicators, the MACD and KST suggest a bearish sentiment on a weekly basis, while the moving averages indicate a bearish trend as well. The Bollinger Bands reflect a mildly bearish stance on a weekly basis, with a sideways trend observed monthly. The Dow Theory presents a mildly bullish outlook weekly, although no definitive trend is noted on a monthly basis. When comparing EMS's performance to the Sensex, the stock has shown resilience over the past month with a return of 3.54%, albeit sli...

Read MoreEMS Stock Shows Resilience Amid Mixed Technical Indicators and Market Dynamics

2025-03-20 08:04:20EMS, a small-cap player in the engineering sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 639.45, showing a notable increase from the previous close of 608.00. Over the past year, EMS has demonstrated a significant return of 68.85%, outperforming the Sensex, which recorded a return of 4.77% in the same period. In terms of technical indicators, the weekly MACD is bearish, while the daily moving averages also reflect a bearish sentiment. The Bollinger Bands indicate a mildly bearish trend on a weekly basis, while the KST and Dow Theory metrics present a mixed outlook. The On-Balance Volume (OBV) shows a mildly bullish trend weekly, contrasting with the monthly assessment, which leans mildly bearish. Despite the recent fluctuations, EMS has shown resilience, particularly in the one-week and one-month returns, where it has outperf...

Read MoreEMS Stock Shows Mixed Technical Trends Amid Strong Yearly Performance Against Sensex

2025-03-19 08:05:14EMS, a small-cap player in the engineering sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 608.00, showing a slight increase from the previous close of 598.95. Over the past year, EMS has demonstrated a notable return of 57.82%, significantly outperforming the Sensex, which recorded a return of 3.51% during the same period. In terms of technical indicators, the weekly MACD remains bearish, while the Relative Strength Index (RSI) indicates bullish momentum on a weekly basis, with no signal on the monthly front. The Bollinger Bands suggest a mildly bearish trend weekly, and daily moving averages also reflect bearish sentiment. The KST and Dow Theory metrics present a mixed picture, with the former indicating bearishness and the latter showing mildly bullish signals on a weekly basis. Despite recent challenges, EMS has shown resil...

Read MoreEMS Faces Technical Trend Shifts Amidst Strong Yearly Performance and Market Evaluation Adjustments

2025-03-10 08:02:11EMS, a small-cap player in the engineering sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 639.60, slightly down from the previous close of 640.20. Over the past year, EMS has shown a notable return of 48.55%, significantly outperforming the Sensex, which recorded a mere 0.29% return in the same period. In terms of technical indicators, the weekly MACD is positioned in a bearish trend, while the daily moving averages also reflect a bearish sentiment. The Bollinger Bands indicate a mildly bearish stance on a weekly basis, suggesting some volatility in price movements. The KST and Dow Theory metrics further align with the bearish outlook, while the On-Balance Volume (OBV) shows a mildly bearish trend. Despite recent challenges, EMS has demonstrated resilience, particularly over the past year, where it has outpaced the broader mar...

Read MoreEMS Ltd Shows Resilience Amid Market Volatility and Declining Trends

2025-03-07 18:00:40EMS Ltd, a small-cap player in the engineering sector, has shown notable activity in the stock market today. With a market capitalization of Rs 3,560.00 crore, EMS has a price-to-earnings (P/E) ratio of 19.23, which is significantly lower than the industry average of 28.95. Over the past year, EMS Ltd has delivered a robust performance, gaining 48.55%, in stark contrast to the Sensex, which has only increased by 0.29%. However, the stock has faced some challenges recently, with a slight decline of 0.09% today, while the Sensex dipped by 0.01%. In the short term, EMS has shown resilience, with a weekly performance of 4.68%, outperforming the Sensex's 1.55%. Yet, the stock has struggled over the past month and quarter, with declines of 14.95% and 28.45%, respectively. Year-to-date, EMS Ltd is down 24.75%, compared to the Sensex's decline of 4.87%. Technical indicators suggest a bearish trend in the week...

Read MoreEMS Stock Faces Mixed Technical Signals Amid Market Evaluation Revision

2025-03-03 08:01:12EMS, a small-cap player in the engineering sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 611.00, slightly down from its previous close of 615.75. Over the past year, EMS has shown a notable return of 21.81%, significantly outperforming the Sensex, which recorded a return of 1.24% in the same period. However, the stock has faced challenges in the shorter term, with a decline of 28.12% year-to-date, compared to the Sensex's drop of 6.32%. In terms of technical indicators, the weekly MACD and Bollinger Bands suggest a bearish sentiment, while the daily moving averages indicate a mildly bullish trend. The On-Balance Volume (OBV) shows a bullish stance on a monthly basis, although the weekly trend remains neutral. The Relative Strength Index (RSI) currently presents no signals, indicating a lack of momentum in either direction. Th...

Read MoreEMS Faces Mixed Technical Indicators Amidst Recent Market Evaluation Adjustments

2025-03-02 08:01:11EMS, a small-cap player in the engineering sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 611.00, slightly down from its previous close of 615.75. Over the past year, EMS has shown a notable return of 21.81%, significantly outperforming the Sensex, which recorded a return of just 1.24% in the same period. However, the recent performance metrics indicate some challenges. The stock has experienced a decline of 28.12% year-to-date, while the Sensex has only dipped by 6.32%. In the short term, EMS has faced a 5.91% drop over the past week, compared to a 2.81% decline in the Sensex. This trend suggests that while EMS has had a strong yearly performance, recent months have been more difficult. Technical indicators present a mixed picture. The MACD and Bollinger Bands are showing bearish signals on a weekly basis, while the On-Balanc...

Read MoreEMS Stock Evaluation Revision Highlights Mixed Technical Trends Amid Market Dynamics

2025-03-01 08:01:10EMS, a small-cap player in the engineering sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 611.00, slightly down from its previous close of 615.75. Over the past year, EMS has shown a notable return of 21.81%, significantly outperforming the Sensex, which recorded a return of 1.24% in the same period. In terms of technical indicators, the weekly MACD and Bollinger Bands suggest a bearish sentiment, while the daily moving averages indicate a mildly bullish trend. The On-Balance Volume (OBV) shows no trend on a weekly basis but is bullish on a monthly scale. The Relative Strength Index (RSI) remains neutral, indicating a lack of strong momentum in either direction. Looking at the stock's performance over various time frames, EMS has faced challenges recently, with a 1-month return of -19.96% compared to the Sensex's -3.56%. Howev...

Read More

EMS Reports Strong Sales Growth Amid Elevated Valuation and Declining Institutional Interest

2025-02-28 18:34:09EMS, a small-cap engineering firm, recently adjusted its evaluation following a strong third-quarter performance, reporting a 46% annual growth in net sales and achieving record quarterly net sales of Rs 245.29 crore. However, the stock's valuation appears high, and institutional investor participation has slightly declined.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

05-Apr-2025 | Source : BSEEMS Limited has informed the exchange about compliance certificate under Regulation 74(5) of SEBI (Depositories and Participants) Regulation 2018

Closure of Trading Window

29-Mar-2025 | Source : BSEEMS Limited has informed the exchange regarding the Trading window closure pursuant to SEBI (Prohibition of Insider Trading) Regulations 2015

Announcement under Regulation 30 (LODR)-Updates on Acquisition

27-Mar-2025 | Source : BSEEMS Limited informed the exchange about update on the Acquisition of shares of Brijbihari Pulp and Paper private Limited

Corporate Actions

No Upcoming Board Meetings

EMS Ltd has declared 10% dividend, ex-date: 20 Sep 24

No Splits history available

No Bonus history available

No Rights history available