Endurance Technologies Faces Market Sentiment Shift Despite Strong Financial Performance

2025-04-03 08:08:27Endurance Technologies, a key player in the auto ancillary sector, has experienced a recent evaluation adjustment influenced by changes in technical indicators. Despite this, the company reported strong financial results, including growth in profits and a favorable debt-to-equity ratio, while maintaining a solid return on capital employed.

Read MoreEndurance Technologies Faces Mixed Technical Trends Amid Market Evaluation Revision

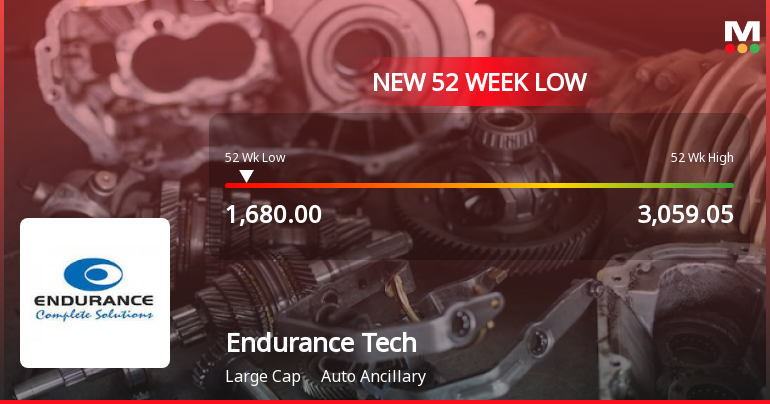

2025-04-03 08:01:59Endurance Technologies, a prominent player in the auto ancillary sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1909.30, down from a previous close of 1927.85, with a notable 52-week high of 3,059.05 and a low of 1,680.00. Today's trading saw a high of 1999.95 and a low matching the current price. The technical summary indicates a mixed performance across various indicators. The MACD shows a mildly bullish trend on a weekly basis, while the monthly perspective leans towards a mildly bearish outlook. The Relative Strength Index (RSI) presents a bearish signal on a monthly basis, with no signal on the weekly chart. Bollinger Bands and moving averages reflect bearish trends, suggesting caution in the short term. In terms of performance, Endurance Technologies has experienced varied returns compared to the Sensex. Over the past we...

Read More

Endurance Technologies Adjusts Evaluation Score Amid Strong Financial Performance and Bearish Signals

2025-03-20 08:06:06Endurance Technologies, a key player in the auto ancillary sector, has recently seen a change in its evaluation score, influenced by technical indicators and market performance. The company has shown consistent financial growth, with strong returns and a low debt-to-equity ratio, despite some bearish technical signals.

Read MoreEndurance Technologies Shows Mixed Technical Trends Amid Strong Performance Metrics

2025-03-20 08:01:12Endurance Technologies, a prominent player in the auto ancillary sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1965.00, showing a notable increase from the previous close of 1918.10. Over the past week, the stock has demonstrated a return of 3.18%, outperforming the Sensex, which returned 1.92% in the same period. In terms of technical indicators, the weekly MACD and KST are positioned in a bearish trend, while the monthly indicators suggest a mildly bearish stance. The Bollinger Bands also reflect a mildly bearish outlook on both weekly and monthly bases. However, the On-Balance Volume (OBV) indicates a mildly bullish trend on both timeframes, suggesting some underlying strength in trading volume. Looking at the company's performance over various periods, Endurance Technologies has delivered a 10.3% return over the past year...

Read More

Endurance Technologies Outperforms Sector Amid Broader Market Gains and Mixed Trends

2025-03-18 11:15:22Endurance Technologies has experienced significant activity, gaining 3.46% on March 18, 2025, and outperforming its sector. The stock has risen consistently over four days, achieving a total return of 6.01%. It is currently above its shorter-term moving averages, indicating a mixed performance trend.

Read More

Endurance Technologies Outperforms Sector Amid Broader Market Decline and Mixed Performance Metrics

2025-03-07 09:45:52Endurance Technologies has demonstrated significant activity, achieving a notable gain and outperforming its sector. The stock has seen consecutive gains over four days, while its performance metrics reveal a mixed outlook year-to-date compared to the broader market. Small-cap stocks are currently leading in market performance.

Read More

Endurance Technologies Displays Resilience Amid Mixed Market Trends and Small-Cap Gains

2025-03-06 10:30:21Endurance Technologies has experienced significant activity, gaining 3.08% on March 6, 2025, and outperforming its sector. The stock has shown a consistent upward trend over three days, with a total return of 7.61%. Despite mixed short-term momentum, it has demonstrated resilience in a challenging market.

Read More

Endurance Technologies Shows Signs of Trend Reversal Amid Broader Market Decline

2025-03-04 15:00:25Endurance Technologies Ltd. experienced a notable increase in stock price today, breaking a six-day decline. Despite this uptick, the stock remains below key moving averages, indicating ongoing market challenges. Meanwhile, the broader market, represented by the Sensex, is facing a slight decline and nearing its 52-week low.

Read More

Endurance Technologies Hits 52-Week Low Amidst Ongoing Downward Trend and Strong Fundamentals

2025-03-04 09:46:42Endurance Technologies, a key player in the auto ancillary sector, has reached a new 52-week low, continuing a seven-day decline. Despite this, the company has shown strong financial health with a low debt-to-equity ratio, consistent quarterly profits, and significant institutional interest, indicating solid fundamentals.

Read MoreRegulation 30 Read With Part C Of Schedule III Of The SEBI (Listing Obligations And Disclosure Requirements) Regulations 2015 - Industrial Promotion Subsidy - Eligibility Certificate Received Under Package Scheme Of Incentives - 2019

04-Apr-2025 | Source : BSEThis is to inform you that the Directorate of Industries Government of Maharashtra has issued an Eligibility Certificate to the Company for expansion under Mega Projects - Investment Based under the Package Scheme of Incentives - 2019.

Announcement under Regulation 30 (LODR)-Updates on Acquisition

02-Apr-2025 | Source : BSEIn continuation to the intimation given by the Company on 12th December 2024 regarding signing of the Share Purchase Agreement (SPA) by Endurance Overseas SpA subsidiary of the Company to inter alia acquire 60% stake in Stoferle GmbH and Stoferle Automotive GmbH Germany ( Target Companies) respectively we further inform pursuant to Regulation 30 of the Listing Regulations that the last approval of Antitrust authorities for abovementioned acquisition has been received by Endurance Overseas SpA. Accordingly Endurance Overseas SpA has today i.e. 2nd April 2025 completed the formalities for acquisition of 60% stake in the Target Companies as per SPA and paid the agreed consideration of 37.74 million Euros. With this the Target Companies have now become direct subsidiaries of the Company.

Closure of Trading Window

25-Mar-2025 | Source : BSEEndurance Technologies Limited has informed that in terms of the SEBI (Prohibition of Insider Trading) Regulations 2015 and the Companys Code of Conduct for Prevention of Insider Trading (PIT Code) the trading window shall remain closed from Tuesday 1st April 2025 up to 48 hours after the announcement of the financial results i.e. Saturday 17th May 2025 (both days inclusive).

Corporate Actions

15 May 2025

Endurance Technologies Ltd. has declared 85% dividend, ex-date: 09 Aug 24

No Splits history available

No Bonus history available

No Rights history available