Energy Development Company Ltd Sees Strong Buying Activity Amid Broader Market Decline

2025-04-03 14:35:05Energy Development Company Ltd is currently witnessing significant buying activity, with the stock rising by 4.70% today, contrasting sharply with the Sensex, which has declined by 0.42%. Over the past week, the stock has shown a robust performance, gaining 10.17%, while the Sensex has fallen by 1.69%. Notably, Energy Development Company has experienced consecutive gains for the last three days, accumulating a total return of 12.06% during this period. In terms of price summary, the stock opened with a gap up and reached an intraday high, reflecting strong buyer sentiment. The company's performance over the past month shows a 6.28% increase, outperforming the Sensex's 4.39% gain. However, the longer-term view reveals a decline of 30.61% over the past three months and 29.58% over the past year, indicating volatility in its performance relative to the broader market. The power generation and distribution se...

Read MoreEnergy Development Company Ltd Shows Strong Market Momentum Amid Sector Performance Variability

2025-04-03 10:00:12Energy Development Company Ltd, a microcap player in the Power Generation and Distribution industry, has captured attention today as its stock hit the upper circuit limit. The stock reached a high price of 18.08, reflecting a notable change of 0.5, which translates to a 2.9% increase. The last traded price was recorded at 17.72, with a price band of 5%. Throughout the trading session, the stock demonstrated robust activity, with a total traded volume of approximately 0.505 million shares and a turnover of around Rs 0.0896 crore. The stock has shown consistent performance, gaining for three consecutive days and achieving an impressive 8.62% return over this period. In terms of moving averages, the stock is currently above its 5-day and 20-day averages, although it remains below the 50-day, 100-day, and 200-day averages. Notably, the stock outperformed its sector by 1.3%, while the broader market, represe...

Read MoreEnergy Development Company Adjusts Valuation Amidst Competitive Market Challenges

2025-04-03 08:00:05Energy Development Company has recently undergone a valuation adjustment, reflecting its current standing in the power generation and distribution sector. The company's price-to-earnings ratio stands at 85.98, while its price-to-book value is notably low at 0.80. Other financial metrics include an EV to EBIT ratio of 27.89 and an EV to EBITDA ratio of 12.13, indicating a complex financial landscape. In terms of return on capital employed (ROCE), the company reported a figure of 4.17%, with a return on equity (ROE) of 2.41%. These metrics suggest a cautious outlook on profitability and efficiency. When compared to its peers, Energy Development Company presents a stark contrast. For instance, Urja Global is positioned at a significantly higher valuation, while several other competitors are categorized as risky or do not qualify for evaluation due to financial instability. This peer comparison highlights th...

Read MoreEnergy Development Company Ltd Achieves Upper Circuit Limit Amidst Notable Stock Activity

2025-04-02 10:00:09Energy Development Company Ltd, a microcap player in the Power Generation and Distribution industry, has shown significant activity today as its stock hit the upper circuit limit. The stock reached a high price of 17.54, reflecting a change of 0.73, which translates to a 4.37% increase. The last traded price was noted at 17.44, with a price band of 5%. Throughout the trading session, the stock demonstrated robust performance, outperforming its sector by 2.78%. Over the past two days, Energy Development Company has recorded a consecutive gain, accumulating a total return of 5.15%. However, it is important to note that the stock is currently trading below its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages. The total traded volume for the day was approximately 0.2911 lakh, resulting in a turnover of 0.0505 crore. Despite a decline in delivery volume, which fell by 74.05% against the 5-day averag...

Read MoreEnergy Development Company Ltd Experiences Notable Stock Activity Amid Market Dynamics Shift

2025-04-01 12:00:06Energy Development Company Ltd, a microcap player in the Power Generation and Distribution industry, has shown significant activity today as its stock hit the upper circuit limit. The stock reached a high price of 17.54, marking a notable change of 0.64, which translates to a 3.83% increase. The last traded price (LTP) stands at 17.35, reflecting a strong performance compared to its sector, outperforming by 4.47%. Today's trading session saw a total traded volume of approximately 0.14367 lakh shares, with a turnover of around 0.0249 crore. The stock has experienced a trend reversal, gaining after four consecutive days of decline. Despite this positive movement, it is currently trading below its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages. Investor participation has also risen, with a delivery volume of 93.97k on March 28, up by 26.42% compared to the 5-day average. Overall, Energy Developm...

Read More

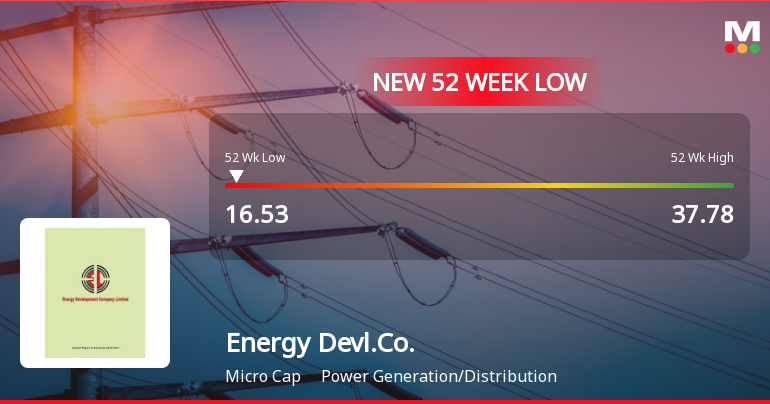

Energy Development Company Faces Significant Challenges Amidst Market Volatility and Declining Performance

2025-03-28 10:06:00Energy Development Company has faced notable volatility, reaching a new 52-week low and underperforming its sector. The company reports a one-year return of -23.08% and struggles with low profitability and high debt levels. Despite these challenges, it trades at a discount relative to its peers.

Read MoreEnergy Development Company Faces Increased Trading Activity Amid Market Challenges

2025-03-28 10:00:09Energy Development Company Ltd, a microcap player in the Power Generation and Distribution industry, experienced significant trading activity today as its stock hit the lower circuit limit. The last traded price was Rs 16.97, reflecting a decline of Rs 0.89 or 4.98% from the previous close. The stock reached an intraday low of Rs 16.96, just 3.45% above its 52-week low of Rs 16.5. Today's trading volume was notable, with a total of 1.04835 lakh shares exchanged, resulting in a turnover of approximately Rs 0.1804 crore. Despite the downturn, the stock outperformed its sector by 0.4%, although it has been trading below its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages. Investor participation appears to be rising, with delivery volume increasing by 63.87% compared to the 5-day average. Overall, Energy Development Company Ltd's performance today highlights the challenges it faces in the current ...

Read MoreEnergy Development Company Adjusts Valuation Grade Amidst Sector Challenges and Comparisons

2025-03-28 08:00:07Energy Development Company has recently undergone a valuation adjustment, reflecting its current standing in the power generation and distribution sector. The company's price-to-earnings ratio stands at 81.70, while its price-to-book value is noted at 0.76. Additionally, the enterprise value to EBITDA ratio is recorded at 11.89, and the EV to sales ratio is 6.39. In terms of return on capital employed (ROCE) and return on equity (ROE), the company reports figures of 4.17% and 2.41%, respectively. These metrics provide insight into the company's operational efficiency and profitability relative to its equity base. When compared to its peers, Energy Development Company presents a more favorable valuation profile. For instance, Urja Global is categorized as very expensive with a significantly higher PE ratio of 378.85, while other competitors like GVK Power Infra and Indowind Energy are classified as risky ...

Read MoreEnergy Development Company Faces Intense Selling Pressure Amid Significant Price Declines

2025-03-27 14:35:04Energy Development Company Ltd is currently facing significant selling pressure, with the stock showing only sellers today. The company has experienced a consecutive decline over the past three days, resulting in a total loss of 9.28% during this period. Today, the stock fell by 4.97%, underperforming the Sensex, which gained 0.43%. Over the past week, Energy Development Company has seen a decline of 5.49%, while the Sensex rose by 1.67%. The stock's performance has been consistently negative, with a one-month loss of 10.65% compared to the Sensex's gain of 4.03%. Year-to-date, the stock is down 37.88%, contrasting sharply with the Sensex's slight decline of 0.66%. The stock is currently trading close to its 52-week low, just 3.78% away from Rs 16.55. Additionally, it is trading below its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, indicating a bearish trend. The persistent selling pres...

Read MoreClosure of Trading Window

26-Mar-2025 | Source : BSEPursuant to SEBI (PIT) Regulations 2015 the trading window will remain closed for all designated employees and their immediate relatives Directors and Promoters w.e.f. 01st April 2025 till 48 hours after the announcement of Audited Standalone and Consolidated Financial Results for the quarter and year ended 31st March 2025.

Integrated Filing (Financial)

14-Feb-2025 | Source : BSEPlease find attached the Integrated Filling (Financials) for the quarter and nine months ended 31.12.2024.

Board Meeting Outcome for Outcome Of Board Meeting: Un-Audited Financial Results For The Quarter And Nine Months Ended On 31St December 2024

10-Feb-2025 | Source : BSEPlease be informed that the Board of Directors of the Company in its Board meeting held today i.e. 10th February 2025 has inter-alia approved and taken on record the Un-audited Standalone and Consolidated Financial Results of the Company for the quarter and nine months ended on 31st December 2024.

Corporate Actions

No Upcoming Board Meetings

Energy Development Company Ltd has declared 5% dividend, ex-date: 18 Dec 20

No Splits history available

No Bonus history available

No Rights history available