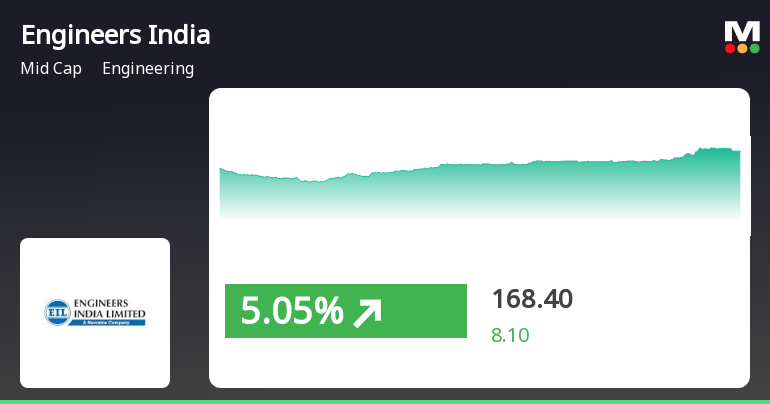

Engineers India Faces Mixed Technical Signals Amidst Market Challenges and Long-Term Resilience

2025-03-25 08:01:31Engineers India, a midcap player in the engineering sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 166.40, showing a slight increase from the previous close of 163.95. Over the past year, the stock has experienced a decline of 15.36%, contrasting with a 7.07% gain in the Sensex, highlighting a challenging performance relative to the broader market. In terms of technical indicators, the weekly MACD suggests a mildly bullish sentiment, while the monthly perspective leans towards a mildly bearish outlook. The Bollinger Bands and moving averages also indicate a mildly bearish trend, suggesting caution among market participants. The KST remains bearish on both weekly and monthly charts, further emphasizing the mixed signals present in the stock's technical landscape. Despite recent fluctuations, Engineers India has shown resilience...

Read More

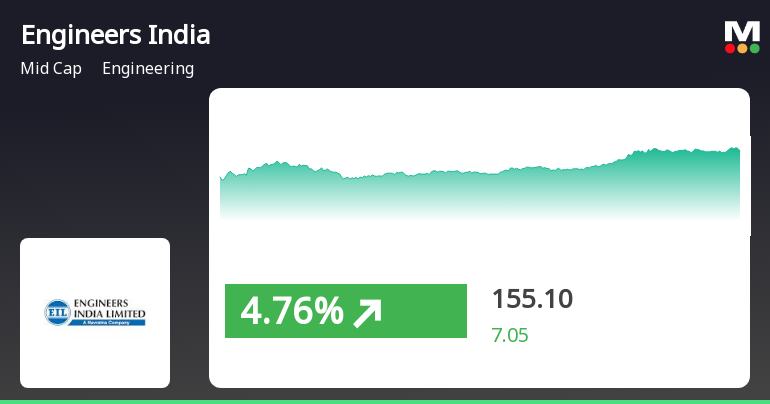

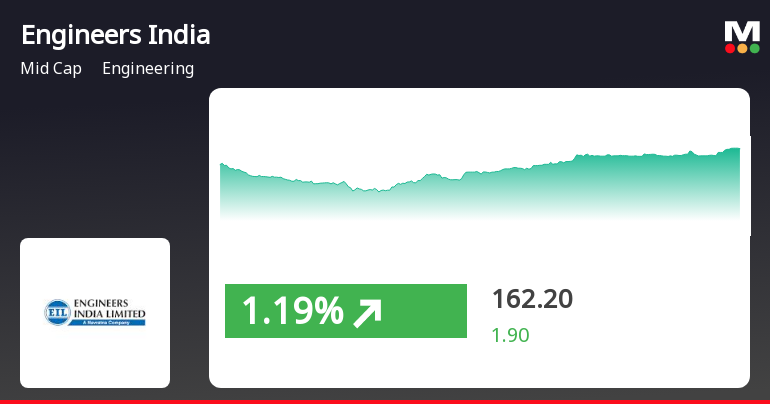

Engineers India Ltd. Shows Short-Term Gains Amid Long-Term Performance Challenges

2025-03-05 13:30:19Engineers India Ltd. experienced significant activity on March 5, 2025, with a notable gain and outperforming its sector. However, it remains below key moving averages and has seen declines over the past week and month. The broader market, including mid-cap stocks, showed positive trends today.

Read More

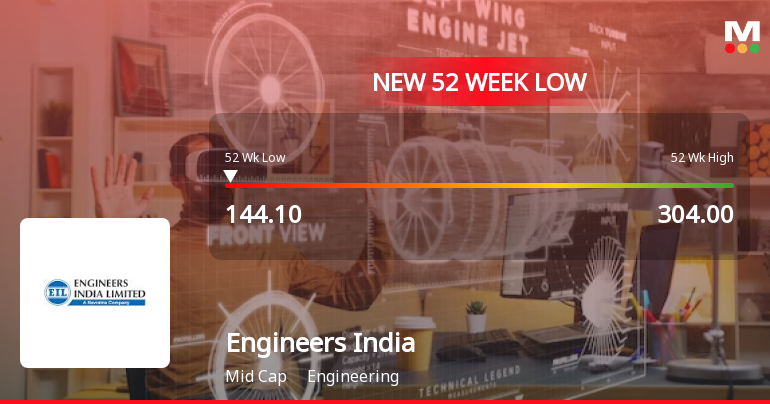

Engineers India Ltd. Hits 52-Week Low Amidst Ongoing Market Challenges

2025-03-03 10:05:55Engineers India Ltd. has reached a new 52-week low, reflecting a significant decline in its stock performance. The company has faced consecutive losses over the past three days, with a notable annual decline compared to the broader market. The stock is currently trading below key moving averages, indicating a bearish trend.

Read MoreEngineers India Adjusts Valuation Grade Amid Competitive Industry Landscape

2025-03-01 08:00:18Engineers India, a midcap player in the engineering sector, has recently undergone a valuation adjustment, reflecting a shift in its financial standing. The company's current price is 150.15, down from a previous close of 161.50, with a 52-week high of 304.00 and a low of 148.50. Key financial metrics reveal a PE ratio of 20.31 and an EV to EBITDA of 24.89, indicating its market valuation relative to earnings and operational performance. The company also boasts a dividend yield of 2.00% and a return on capital employed (ROCE) of 17.89%, alongside a return on equity (ROE) of 15.54%. In comparison to its peers, Engineers India presents a more favorable valuation profile. For instance, Triveni Turbine is noted for its significantly higher PE ratio of 45.31, while Ircon International and Craftsman Auto show attractive valuations with lower PE ratios. This context highlights Engineers India's competitive pos...

Read More

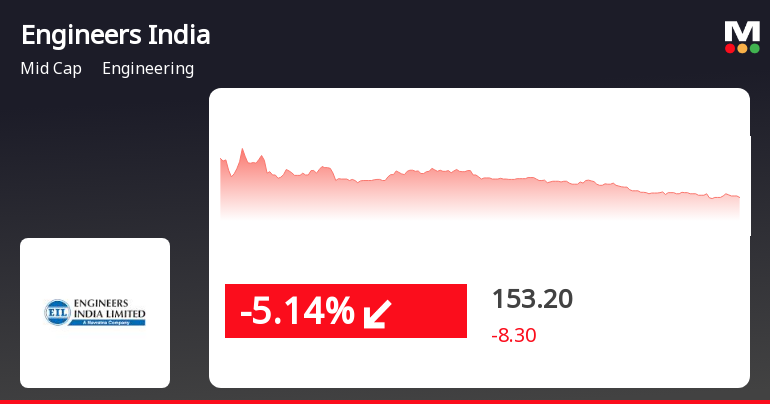

Engineers India Faces Significant Stock Decline Amid Challenging Market Conditions

2025-02-28 12:15:19Engineers India Ltd. has faced a notable decline, with its stock trading just above a 52-week low. The company has experienced consecutive losses and underperformed its sector. Additionally, it is trading below key moving averages, reflecting a bearish trend amid a challenging market environment.

Read More

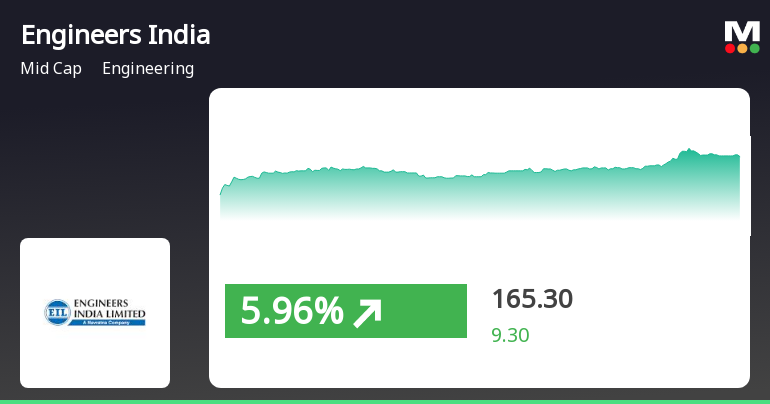

Engineers India Ltd. Shows Signs of Recovery Amid Market Volatility

2025-02-19 13:05:17Engineers India Ltd. experienced a notable uptick on February 19, 2025, following a four-day decline, indicating a potential trend reversal. The stock outperformed its sector and reached an intraday high, although it remains below several key moving averages, reflecting mixed performance signals amid broader market volatility.

Read More

Engineers India Ltd. Experiences High Volatility Amid Broader Market Decline in February 2025

2025-02-12 15:15:17Engineers India Ltd. has shown notable activity, gaining 5.83% on February 12, 2025, despite a slight decline in the broader market. The stock reached a new 52-week low and experienced high volatility during the trading session, trading below multiple moving averages and reflecting a challenging trend.

Read More

Engineers India Ltd. Hits 52-Week Low Amid Broader Engineering Sector Decline

2025-02-12 10:05:40Engineers India Ltd. has reached a new 52-week low, reflecting a significant decline in its stock performance. The company has underperformed its sector and is currently trading below key moving averages. Over the past year, it has experienced a notable drop, contrasting with the overall market's gains.

Read More

Engineers India Ltd. Faces Significant Stock Decline Amid Broader Market Challenges

2025-02-12 10:00:27Engineers India Ltd. has faced notable challenges, with its stock price declining significantly and reaching a new 52-week low. The company has underperformed against its sector and broader market indices, reflecting a troubling trend as it continues to trade below key moving averages over various timeframes.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

03-Apr-2025 | Source : BSECertificate under Regulation 74(5) of SEBI (DP) Regulations 2018

Announcement under Regulation 30 (LODR)-Change in Management

01-Apr-2025 | Source : BSEIntimation regarding change in Senior Management of the Company.

Announcement under Regulation 30 (LODR)-Award_of_Order_Receipt_of_Order

31-Mar-2025 | Source : BSEDisclosure of event/information pursuant to Regulation 30 of SEBI Listing Regulations

Corporate Actions

No Upcoming Board Meetings

Engineers India Ltd. has declared 40% dividend, ex-date: 14 Feb 25

Engineers India Ltd. has announced 5:10 stock split, ex-date: 06 May 10

Engineers India Ltd. has announced 1:1 bonus issue, ex-date: 30 Dec 16

No Rights history available