Enkei Wheels India Experiences Valuation Grade Change Amidst Competitive Market Dynamics

2025-03-27 08:00:46Enkei Wheels India, a microcap player in the auto ancillary sector, has recently undergone a valuation adjustment. The company's current price stands at 495.05, reflecting a notable decline from its previous close of 528.00. Over the past year, Enkei Wheels has experienced a stock return of -7.88%, contrasting with a 6.65% return from the Sensex, indicating a lag in performance relative to the broader market. Key financial metrics reveal a PE ratio of 335.79 and an EV to EBITDA ratio of 15.75, which positions the company within a competitive landscape. The return on capital employed (ROCE) is reported at 8.06%, while the return on equity (ROE) is at 1.09%. These figures provide insight into the company's operational efficiency and profitability. When compared to its peers, Enkei Wheels shows a diverse range of valuations. For instance, Sar Auto Products is categorized as risky with a significantly higher ...

Read More

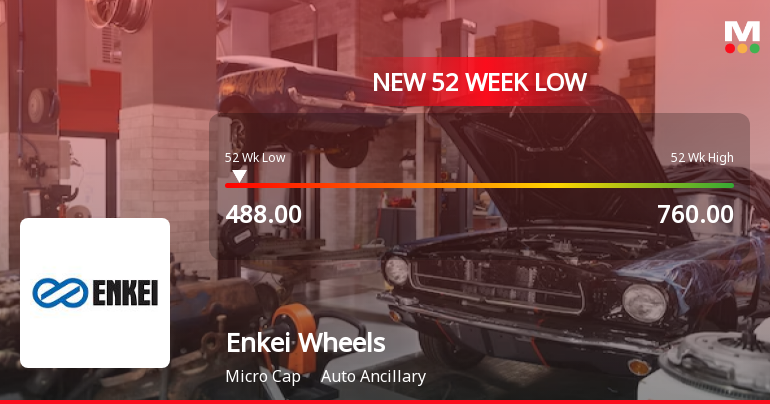

Enkei Wheels India Faces Financial Struggles Amid Broader Market Volatility

2025-03-26 15:39:40Enkei Wheels India has faced notable volatility, hitting a new 52-week low and underperforming its sector. The company's financial metrics reveal challenges, including a low return on capital employed and a high debt-to-EBITDA ratio. Recent results showed a significant decline in profit, contrasting with broader market trends.

Read MoreEnkei Wheels India Opens Strong with 6.74% Gain Amid Market Trends

2025-03-06 09:40:24Enkei Wheels India, a small-cap player in the auto ancillary sector, has shown significant activity today, opening with a gain of 6.74%. The stock has outperformed its sector by 3.89%, marking a notable performance amidst a broader market trend. Over the past three days, Enkei Wheels has recorded a cumulative return of 8.74%, indicating a positive momentum. Today, the stock reached an intraday high of Rs 586, reflecting strong trading interest. However, despite this short-term gain, the stock's one-month performance shows a decline of 7.35%, compared to a 5.62% drop in the Sensex. From a technical perspective, Enkei Wheels is currently positioned higher than its 5-day moving averages but remains below the 20-day, 50-day, 100-day, and 200-day moving averages. The stock is classified as a high beta stock, with a beta of 1.50, suggesting it tends to experience larger fluctuations than the overall market. ...

Read More

Enkei Wheels India Reports Financial Struggles Amid Declining Sales and Profitability in December 2024

2025-02-27 08:17:39Enkei Wheels India has reported challenging financial results for the quarter ending December 2024, with significant declines in Profit Before Tax and Profit After Tax. The company also experienced its lowest net sales in five quarters and a reduced operating profit margin, indicating operational difficulties and the need for strategic adjustments.

Read More

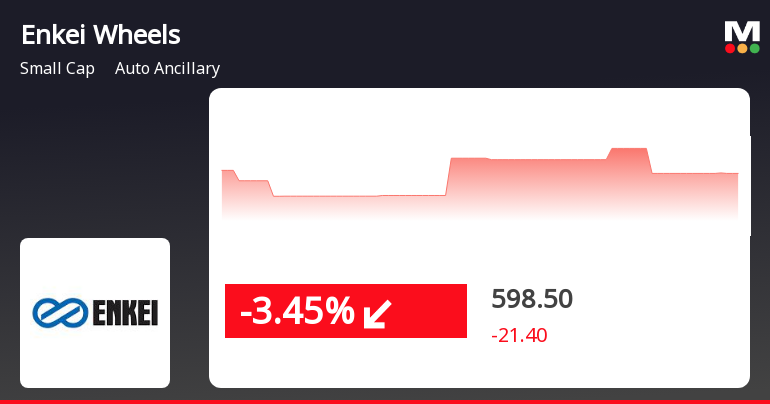

Enkei Wheels India Faces Continued Stock Decline Amid Broader Market Challenges

2025-02-12 10:15:39Enkei Wheels India has faced a notable decline in its stock price, losing 7.19% on February 12, 2025, and marking three consecutive days of losses. The stock is trading below all key moving averages and has dropped 10.39% over the past month, underperforming its sector and the Sensex.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

05-Apr-2025 | Source : BSEDisclosure under Reg 74(5) of SEBI (DP) Regulations 2018

Closure of Trading Window

28-Mar-2025 | Source : BSEClosure of Trading Window

Compliances-Reg.24(A)-Annual Secretarial Compliance

01-Mar-2025 | Source : BSEPlease find the attached Annual Secretarial Compliance Report for the Financial year ended on 31st December 2024.

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available