EPL Limited Faces Mixed Technical Trends Amidst Market Evaluation Revision

2025-03-18 08:02:14EPL Limited, a midcap player in the plastic products industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 196.15, showing a slight increase from the previous close of 190.75. Over the past year, EPL has demonstrated a return of 4.56%, outperforming the Sensex, which returned 2.10% in the same period. However, the stock has faced challenges in shorter time frames, with a year-to-date return of -24.46%, compared to the Sensex's -5.08%. The technical summary indicates a mixed performance across various indicators. The MACD shows bearish signals on a weekly basis, while the monthly perspective leans towards a mildly bearish outlook. The Relative Strength Index (RSI) presents a bullish signal weekly, but lacks a definitive signal on a monthly basis. Additionally, Bollinger Bands and moving averages reflect bearish tendencies, particular...

Read MoreEPL Limited Faces Mixed Technical Trends Amid Market Evaluation Revision

2025-03-13 08:01:17EPL Limited, a midcap player in the plastic products industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 195.15, down from a previous close of 199.95, with a notable 52-week high of 289.70 and a low of 169.85. Today's trading saw a high of 205.95 and a low of 194.10, indicating some volatility. The technical summary reveals a mixed performance across various indicators. The MACD shows a bearish trend on a weekly basis, while the monthly perspective is mildly bearish. The Relative Strength Index (RSI) indicates a bullish signal weekly, but no signal is present on a monthly basis. Bollinger Bands and moving averages both reflect bearish trends, suggesting caution in the short term. In terms of returns, EPL Limited has shown varied performance compared to the Sensex. Over the past week, the stock returned 1.06%, outperforming the S...

Read MoreEPL Limited Faces Mixed Technical Trends Amid Market Evaluation Revision

2025-03-13 08:01:17EPL Limited, a midcap player in the plastic products industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 195.15, down from a previous close of 199.95, with a notable 52-week high of 289.70 and a low of 169.85. Today's trading saw a high of 205.95 and a low of 194.10, indicating some volatility. The technical summary reveals a mixed performance across various indicators. The MACD shows a bearish trend on a weekly basis, while the monthly perspective is mildly bearish. The Relative Strength Index (RSI) indicates a bullish signal weekly, but no signal is present on a monthly basis. Bollinger Bands and moving averages both reflect bearish trends, suggesting caution in the short term. In terms of returns, EPL Limited has shown varied performance compared to the Sensex. Over the past week, the stock returned 1.06%, outperforming the S...

Read More

EPL Limited Shows Strong Financial Metrics Amidst Market Challenges and Growth Concerns

2025-03-11 08:12:06EPL Limited, a midcap plastic products company, has recently adjusted its evaluation, showcasing strong management efficiency with a 15.12% return on capital employed and a low debt to EBITDA ratio of 0.87. The company reported a profit before tax of Rs 87.80 crore, reflecting a 24.36% growth.

Read MoreEPL Limited Shows Mixed Technical Trends Amidst Long-Term Growth Potential

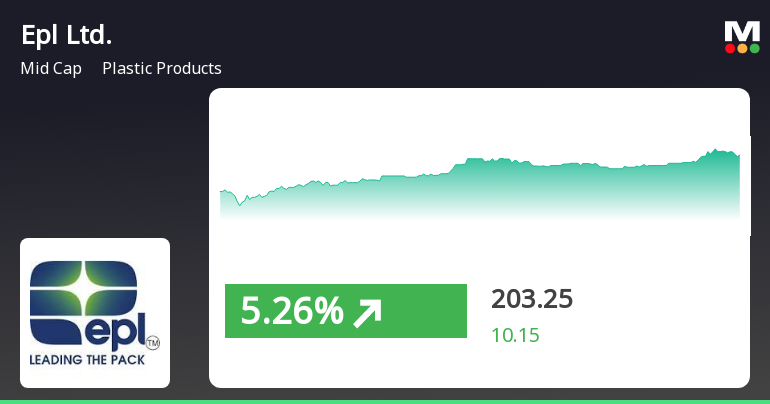

2025-03-07 08:02:24EPL Limited, a midcap player in the plastic products industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 207.00, showing a notable increase from the previous close of 193.10. Over the past year, EPL Limited has demonstrated a return of 13.15%, outperforming the Sensex, which recorded a modest gain of 0.34%. In terms of technical indicators, the company's weekly MACD and KST are bearish, while the monthly readings present a mixed picture with some bullish signals. The Relative Strength Index (RSI) shows no signal on a weekly basis but indicates bullish momentum monthly. Bollinger Bands and moving averages suggest a mildly bearish trend in the short term. EPL Limited's performance over various time frames reveals a complex narrative. While the stock has faced challenges in the short term, with a year-to-date return of -20.28%, it h...

Read More

EPL Limited's Recent Gains Highlight Resilience Amid Broader Market Trends

2025-03-06 12:45:21EPL LIMITED, a midcap in the plastic products sector, has seen significant activity, outperforming its sector recently. The stock has gained over the past two days and opened higher today. Despite a monthly decline, it has achieved an annual gain, contrasting with the broader market's performance.

Read MoreEPL Limited Faces Short-Term Challenges Amid Long-Term Growth Potential in Plastic Industry

2025-03-04 11:07:57EPL Limited, a mid-cap player in the plastic products industry, has experienced notable fluctuations in its stock performance recently. With a market capitalization of Rs 6,152.01 crore, the company currently holds a price-to-earnings (P/E) ratio of 20.83, significantly lower than the industry average of 39.64. Over the past year, EPL Limited has shown a modest gain of 1.74%, outperforming the Sensex, which has declined by 1.18%. However, the stock has faced challenges in the short term, with a 1-day decline of 0.62% compared to the Sensex's 0.11% drop. The 1-week performance reflects a more significant downturn, with EPL Limited down 9.38%, while the Sensex fell 2.14%. In terms of longer-term performance, EPL Limited has seen a 22.70% increase over three years, although this lags behind the Sensex's 34.36% rise. The company's performance over five years stands at 11.07%, compared to the Sensex's impressi...

Read More

EPL Limited Faces Market Challenges Despite Strong Operational Performance and Management Efficiency

2025-03-03 18:44:50EPL Limited, a midcap in the plastic products sector, has experienced a recent evaluation adjustment influenced by various financial metrics and market conditions. The company shows solid management efficiency and a strong ability to handle debt, while its valuation remains competitive compared to peers, with significant institutional investor confidence.

Read More

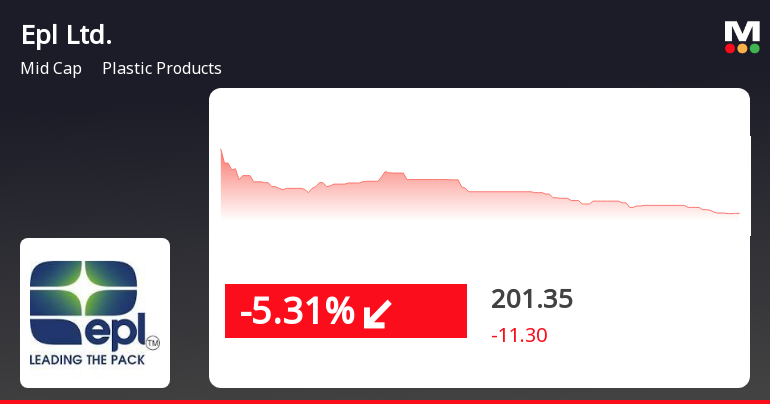

EPL Limited Faces Ongoing Challenges Amid Sustained Stock Decline and Underperformance

2025-02-27 11:35:17EPL LIMITED, a midcap company in the plastic products sector, has faced a notable decline in its stock price for three consecutive days, totaling a 14.73% drop. The stock is currently trading below multiple moving averages, indicating ongoing challenges in the market environment.

Read MoreIntimation With Respect To Dispatch Of The Letter In Terms Of The Provisions Of IEPF Authority (Accounting Audit Transfer And Refund) Rules 2016

02-Apr-2025 | Source : BSEIntimation with respect to dispatch of the letter in terms of the provisions of IEPF Authority (Accounting Audit Transfer and Refund) Rules 2016 is enclosed herewith.

Closure of Trading Window

27-Mar-2025 | Source : BSEIntimation regarding closure of trading window for dealing in securities of the Company is enclosed herewith.

Announcement under Regulation 30 (LODR)-Newspaper Publication

27-Mar-2025 | Source : BSENewspaper advertisement(s) with respect to notice issued to the equity shareholders pursuant to IEPF Rules is enclosed herewith.

Corporate Actions

No Upcoming Board Meetings

EPL Ltd has declared 125% dividend, ex-date: 25 Nov 24

EPL Ltd has announced 2:10 stock split, ex-date: 08 Jun 06

EPL Ltd has announced 1:1 bonus issue, ex-date: 20 Jun 18

No Rights history available